Summary:

- Royal Caribbean has rebounded from bankruptcy fears during Covid to record profits, with stock prices soaring to all-time highs, now over $100 above pre-Covid levels.

- The cruise line continues to ride industry growth, with passengers growing at a nearly 10% clip in 2024, far above 2019 levels.

- The stock only trades at 17x ’25 EPS targets of $14+ while industry growth supports the bog targets.

Philip Thurston

For a long period, the market thought Royal Caribbean Cruises Ltd. (NYSE:RCL) might end up bankrupt, with the cruise sector forced to shut down during Covid. The cruise line has made a huge recovery, leading to record profits in the process of the stock soaring to all-time highs. My investment thesis is still Bullish on Royal Caribbean, even after big gains.

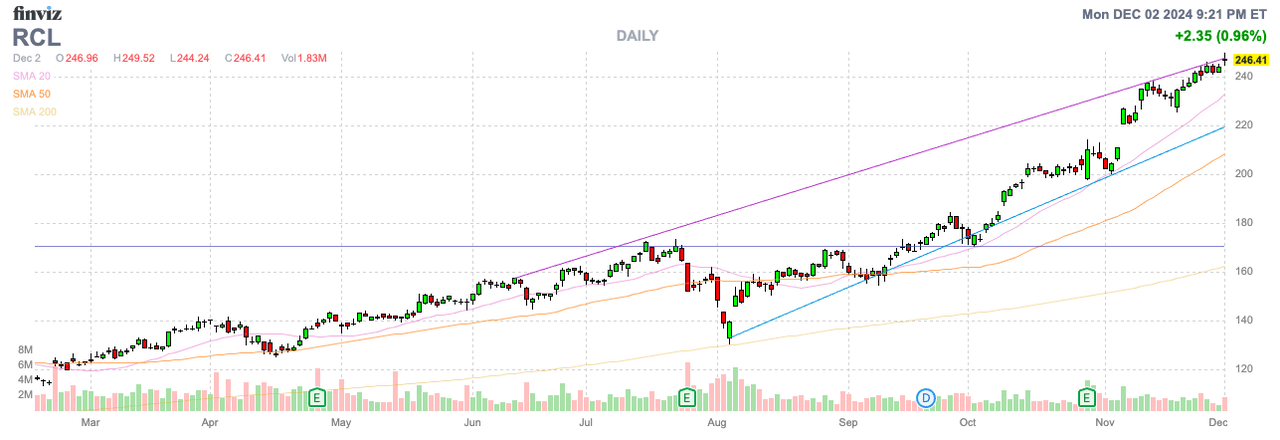

Zooming Higher

After another strong quarter, Royal Caribbean zoomed to nearly $250. The stock is already over $100 above pre-Covid highs.

The amazing part is that investors could’ve bought Royal Caribbean for $40 to $60 back in 2022 when the cruise sector reached an inflection point. The company came out with the Trifecta plan to reach record financial metrics, yet the stock still didn’t reflect the big financial goals.

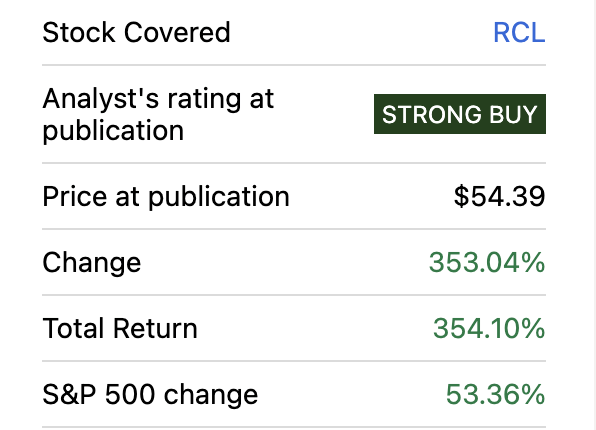

The market generally ignored the forecasts from the sector of a return to previous levels. Royal Caribbean is up over 350% since our initial bullish call on May 24, 2022, in an article titled “Royal Caribbean: Inflection Point”.

Seeking Alpha

As with the past couple of years, Royal Caribbean has guided to continued yield growth in the year ahead on the back of strong bookings. The cruise line continues to see a scenario of higher rates, pushing up pricing and yields on future bookings.

The company even took a hit with the recent hurricanes in Florida. The Q3 EPS soared to $5.20 for 35% growth YoY despite the higher operating expenses.

Royal Caribbean even guided to Q4 EPS of $1.40 to $1.45, up from just $1.25 last year. The company is facing a negative impact from Hurricane Milton back in October and still producing solid numbers in the December quarter.

Not Done Yet

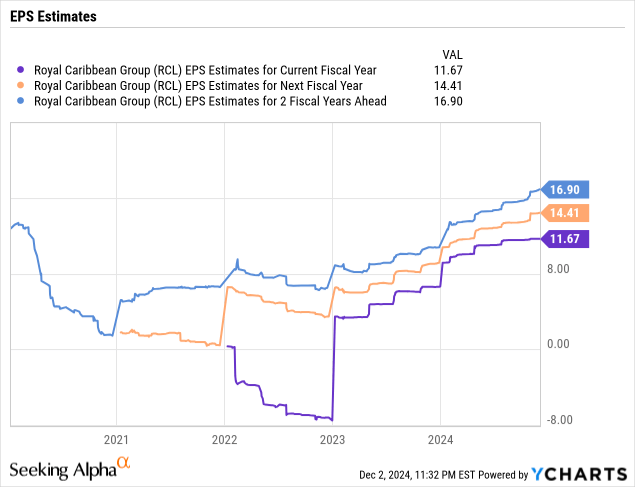

Only 2 years ago, Royal Caribbean introduced the Trifecta concept with a $10+ EPS goal for 2025. On the Q3’24 earnings call, CEO Jason Liberty introduced a 2025 EPS target of $14+ as follows:

The last two years saw unprecedented yield growth and although that created a high bar for comparables, our proven formula for success, a moderate capacity growth, moderate yield growth, and strong cost control while continue to drive topline growth, margin expansion, and substantial cash flow, while still very early in the planning process, we anticipate earnings in 2025 to start with a $14 handle.

The cruise line stock definitely is no longer exceptionally cheap at 17x the consensus analyst EPS estimates for $14.41 in 2025. The market now believes the targets of management versus prior estimates, where the consensus EPS target didn’t even match the $10 Trifecta EPS goal of management.

So in this sense, Royal Caribbean doesn’t have the same upside to estimates with the analyst community in line with management. The analysts are forecasting sales to grow at a 10% clip annually in 2025/26 leading to EPS growing in the 20% range annually providing an indication the stock has more upside.

The market now targets a $16.90 EPS for 2026, which is why the stock probably isn’t done running. Royal Caribbean only trades at 14x 2026 EPS targets.

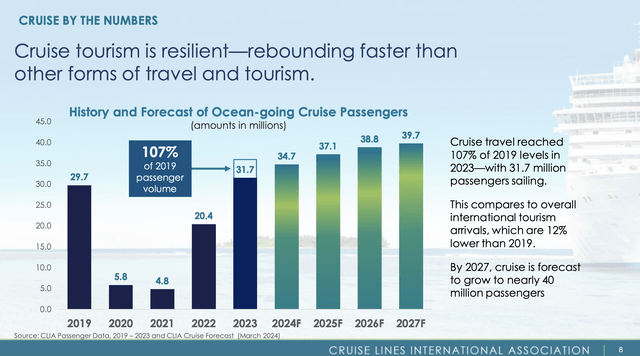

The cruise sector remains strong, with the industry forecast to still see strong demand in the years ahead. After nearly 10% passenger growth in 2024, the CLIA is forecasting the cruise sector to grow passengers a combined 12% over the next 2 years to reach 38.8 million passengers in 2026.

The stock is no longer exceptionally cheap on fears the cruise line sector might never rebound. So those risks don’t exist now, but Royal Caribbean appears to still have years of growth ahead.

The cruise line has vastly improved the balance sheet over the last couple of years, but the company still has net debt topping $20 billion. Royal Caribbean spent the last quarter refinancing debt at lower interest rates to further reduce interest expenses going forward.

Takeaway

The key investor takeaway is that Royal Caribbean hasn’t seen the stock peak just yet. The company is in the process of another year of strong EPS growth, further fueling upside in the stock.

Investors probably don’t want to rush in and buy more shares right now after the rally from $170 to nearly $250 in just a couple of months, but Royal Caribbean is still worth buying for more upside after the stock settles down.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start December, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.