Summary:

- Royal Caribbean is undervalued and poised for double-digit growth due to strong EBITDA growth and favorable balance sheet management.

- The company is expected to benefit from double-digit growth in the cruise industry and higher net yields compared to competitors.

- Management’s efficient debt management and plans for capacity expansion contribute to a positive investment thesis for Royal Caribbean.

dan_prat/iStock Unreleased via Getty Images

Investment Thesis

Lately, I have been covering cruise operators because I believe, within the travel segment, cruise companies are among the most underappreciated travel complexes of stocks. Cruise companies still carry a pessimistic image among a section of investors, despite overall travel demand remaining strong as we move through the summer months. I had recently covered Norwegian Cruise Lines (NCLH) as well as Carnival Corp. (CCL), where I assessed the earnings growth of both companies versus their respective debt ratios.

This note will be focusing on Royal Caribbean (NYSE:RCL), and I believe that of the Big Three in the cruise industry, Royal Caribbean has the best risk/reward plays for two main reasons. First, the company has found incredible appeal with its target customer by offering experiences that find strong relevance with its end customer. This is also balanced by extremely efficient management that is able to work its balance sheets towards a highly favorable capital structure on a relative basis.

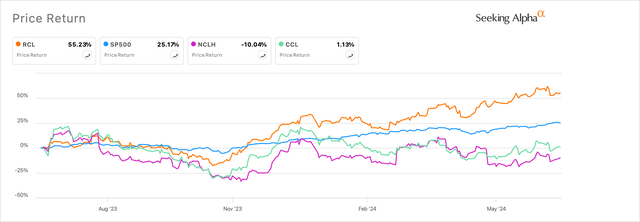

Royal Caribbean’s stock performance this year versus markets and its competitors (SA)

I feel very encouraged by the growth that Royal Caribbean has demonstrated so far and believe this name is clearly a Buy, in my opinion.

Royal Caribbean: The biggest beneficiary in a strong cruise market

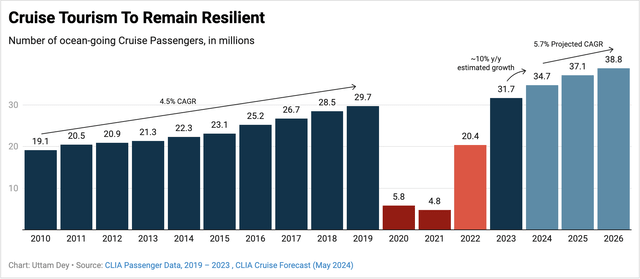

First, the entire cruise industry is expected to post double-digit growth in 2024, continuing the strong momentum from the past few years. According to Cruise Lines Association research, 2024 is still expected to post ~10% growth in the number of ocean-going cruise passengers versus last year, after which growth will normalize to pre-pandemic levels but stay marginally elevated on a relative basis. Here is the chart below, based on the last-known estimates from the Cruise Lines Association.

Exhibit B: Cruise industry sees upbeat tourism volume in 2024 and beyond. (CLIA)

Therefore, at an end-user market level, Royal Caribbean, like its peers, is selling into a strong market, which is encouraging. But unlike its competitors, Royal Caribbean is seeing comparatively higher favorable demand as it sees net yields growing to 9.5% y/y in 2024. Compared to that, Carnival also expects net yields in the same range, whereas Norwegian is guiding for lower net yields of ~7.2%.

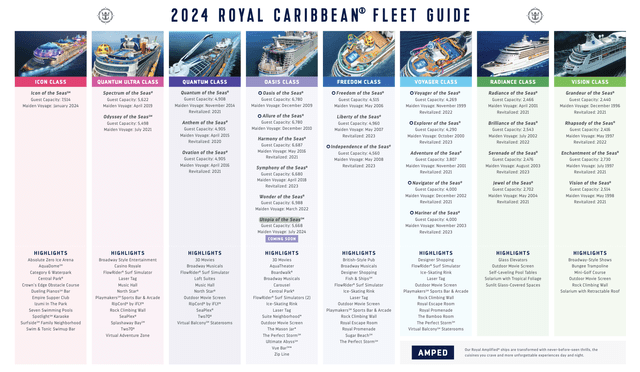

But I believe that in Royal Caribbean’s case, the eventual revenue growth can be far higher since the company has plans to deploy at least one ship (Utopia of the Seas) this year, according to its roadmap. Through 2026, Royal Caribbean plans to introduce three ships that should increase its overall capacity by ~17,000. At the same time, Royal Caribbean remains the only operator who has paced up their hiring plans as it enters a crucial summer travel season.

Exhibit C: Royal Caribbean’s planned cruise fleet for 2024 season. (Company sources)

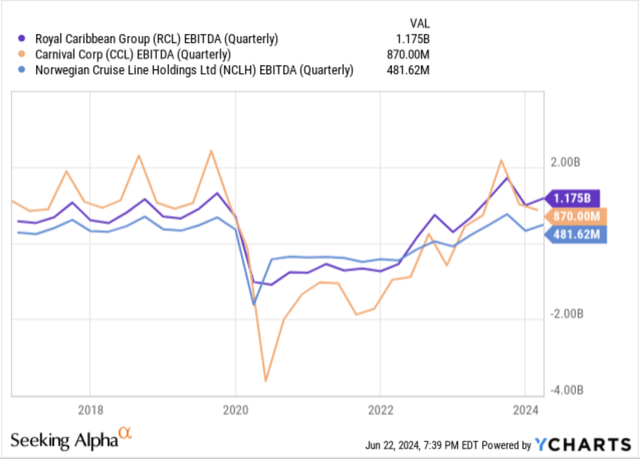

More impressively, management has been navigating the company relatively smoothly as it emerged through the pandemic once lockdown restrictions eased. The company was the first cruise operator to deliver profitable EBITDA on an adjusted basis in 2022, as can be seen in Exhibit D below, and continues to guide for even stronger EBITDA margins this year as it expects to achieve its three-year Trifecta goals that it had set in 2022, this year itself, one year ahead of its 2025 horizons.

Exhibit D: Royal Caribbean’s grows EBITDA faster than its peers (YCharts)

This reflects the strong efficiency with which management is operating. Add to this the significantly lower interest expenses of $1.2 billion that management now expects in 2024. I believe this compresses the valuation multiples by far less than the compression levels that I observed when I valued Norwegian and Carnival Corp. in my recent coverages of them.

Favorable capital structure with efficient management of debt levels

As I mentioned earlier, observing the debt levels of companies is crucial to understanding the implications of debt on the company’s balance sheet from the perspective of servicing and/or retiring it entirely, especially when most cruise operators acquired large volumes of debt during the pandemic to keep their operations alive with significantly heightened uncertainty during those periods of lockdown. I have been underscoring this importance in all my previous coverages of cruise companies, and will continue to do so with Royal Caribbean as well.

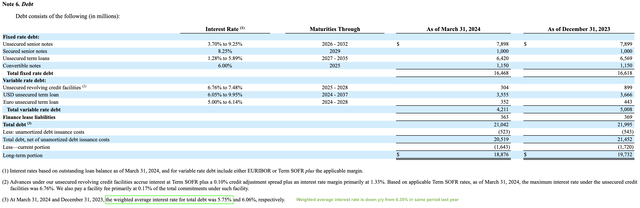

In Royal Caribbean’s case, management appears to be managing their debt levels in a manner that is fairly consistent with its performance as well as my expectations. Per its last known 10-Q filing, Royal Caribbean carries ~$18.8 billion in long-term debt, as seen in Exhibit E below. This has been reduced by ~4.5% since the start of the year and ~12% since 2022, the year that saw peak volume in Royal Caribbean’s debt levels.

Exhibit E: Royal Caribbean’s debt levels per its latest company filings (Company filings)

Management has been using its cash to retire debt since its cash and equivalents dropped every single year since the $3.7 billion it held in 2020, when the pandemic uncertainty was at its height, to the most recent quarter, where it holds $437 million in cash.

Management has also been refinancing debt at more favorable rates, as I have noted in Exhibit E above, where its effective serviceable interest rates dropped to 5.8% from 6.1% at the start of the year and from 6.4% a year ago. This points to some shrewd, opportunistic refinancing opportunities that management has been pursuing, in my opinion. On the earnings call, management mentioned they “expect to further reduce leverage to just below mid 3x by the end of 2024.”

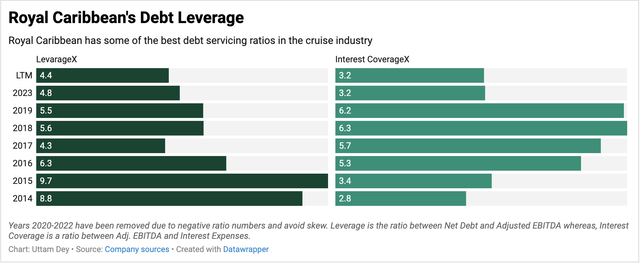

If management expects to reduce leverage to just below 3x by the end of the year, I expect higher volumes of debt to be paid down, obviously combined with the strong EBITDA growth management has been posting and will continue to post in 2024 with the demand they are seeing. As can be seen in Exhibit E below, the company’s leverage ratios are looking far better than they were before the pandemic, currently at 4.4x on an LTM basis.

Exhibit F: Royal Caribbean’s debt servicing ratios are one of the best in the industry. (Company filings)

Even the company interest coverage ratios look healthy at 3.2x, in contrast to both Norwegian Cruise Lines and Carnival Corp., which are still under 1x at the time of writing.

Valuation shows upside in RCL

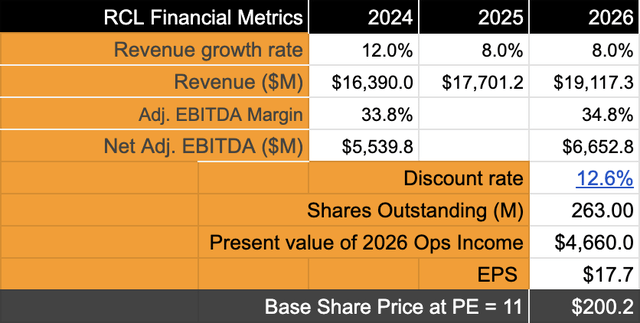

I expect Royal Caribbean to grow at ~11–12% growth on a compounded basis through FY26, which includes the faster-than-market growth rates this year and at market rates over the next two years.

I also expect the company to deliver between 13–14% CAGR growth in adjusted EBITDA over the same investment horizon, which actually implies a forward valuation multiple that rests in the low twenties. However, after I account for ~1.2 billion in annual interest expenses required to service debt, I believe a forward multiple of ~11x would be warranted. I have used discount rates of 12.6% based on assumptions here, but with a higher cost of debt applied. I also assume that the company has cycled through their share dilution requirements as they moved through the pandemic and would need to dilute shares by more than 1% of their base since the company has demonstrated the ability to manage debt and grow earnings.

Exhibit G: Valuation model for Royal Caribbean (Author)

Based on my model above, I note that Royal Caribbean is quite undervalued and see strong double-digit growth in its stock from here on.

Risks & other factors to consider

If the larger market does slow down due to economic reasons or due to geopolitical tensions, Royal Caribbean could see weakness in upcoming bookings as well as heightened levels of cancellations, which could cause headwinds. Plus, geopolitical tensions could also raise fuel prices, causing the company to source fuel today at forward contracts, which may be more expensive.

Note: Carnival Cruise will be reporting their Q2 earnings on Tuesday morning, June 25th, before markets open.

Takeaway

Of all the three cruise operators, I prefer Royal Caribbean the most due to the strong growth in its EBITDA that the company has delivered so far and continues to navigate the company in a high-demand environment for its cruise packages. The company’s management has also been doubling down on its priority to maintain a favorable balance sheet, which is compressing the valuation multiples far less than what I had expected, allowing more room for the stock to run.

In my view, I rate Royal Caribbean as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NCLH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.