Summary:

- The software-as-a-service business model, which has seen high valuations in recent years, is facing challenges and industry growth will slow.

- The rise of artificial intelligence is disrupting the software industry, making software development cheaper and leading to increased competition.

- Adobe, a leading software company, is facing competition from AI-powered image generators and other basic photo editing programs, and its growth is slowing.

- This will lead to Wall Street revaluing the stock at a lower valuation.

Justin Sullivan/Getty Images News

Every bull market has a hot new business model. In the 1860s it was miles of railroads laid. The 1920s saw a rise in factories producing items like radios, electrical appliances, and automobiles.

The 1960s saw the Nifty 50 and the popularity of conglomerates. The 90s brought about the internet and valuations based on eyeballs on a page and miles of fiberoptic cable laid. I could on, but we get the point.

Each of these led to insanely high valuation levels. Levels that any sane person could have realized was unsustainable. And eventually these valuations led to a long period of underperformance.

In the 2010s this business model was the software-as-a-service (SaaS) model. Just like webpages stuck around after the 90s, SaaS businesses will still exist. But they will never have the kind of valuations they had in the previous bull market… Their growth will be forever dampened.

“Software Is Eating the World”

12 years ago, famed venture capitalist Marc Andreesen coined this phrase. And it turned out to be quite prescient. His argument was that the new internet and software companies were “building real, high-growth, high-margin, highly defensible businesses.” And that these companies would eat the profits of other companies.

This was a not a widely accepted opinion at the time. Investors believed that companies like Facebook and Twitter were overvalued at their $1 billion valuations. Many a financial guru claimed that these valuations were part of a dangerous new bubble… It was the tech wreck 2.0.

But as it turned out, software was one of the biggest investing trends of the 2010s. Since the article was penned, Facebook has gained about 80,000% and Twitter about 18,000% – even at today’s lowered valuation. And other software companies like Microsoft (MSFT), Adobe (NASDAQ:ADBE), and Salesforce (CRM) all returned over 650%.

And companies that supported software such as the semiconductor companies did great as well. Companies like Nvidia (NVDA), Monolithic Power (MPWR), and Broadcom (AVGO) all gained more than 1,000% as their chips were needed to run the calculations to run the software.

Every business had to buy more and more software if they wanted to remain competitive. They needed to upgrade their payroll functionality, online presence, cybersecurity, customer relationship management software, etc…

Can you imagine a business operating efficiently with paper ledgers, a rolodex, and a typewriter? Of course not. Now they use Excel, Outlook, and Word for each respective task.

And software companies figured out the best way to make money from these clients. It wasn’t to sell a product and collect all the revenue up front. It was to charge users a subscription. This led to a new business model called software-as-a-service (SaaS).

Investors loved these SaaS companies. They sold their products as subscriptions. The best were high growth companies with consistent, recurring revenue and 30% profit margins. Because this subscription revenue was reliable, analysts could accurately predict how much these companies would make over the coming years. So SaaS companies frequently trade at high multiples – quite often over 10x sales.

SaaS companies make up some of the most loved companies today.

But all that is beginning to change… With the expansion of artificial intelligence (AI) and the advent of large language models (LLMs) creating useful software is becoming a lot easier.

Artificial Intelligence Will Disrupt the Industry

We’ve seen a lot of talk about how AI will disrupt the world in the coming years. And despite the overwhelming coverage, the effects of AI are still understated.

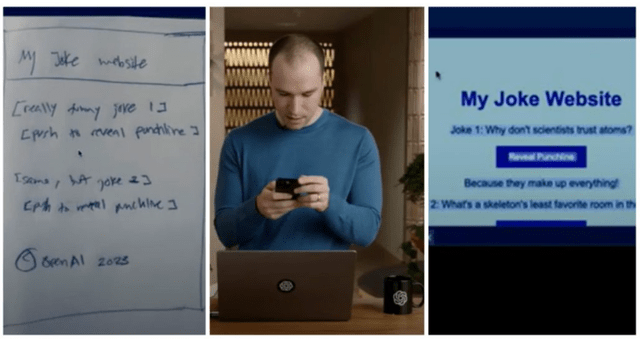

AI creates a website from a sketch (OpenAI)

The website on the right is nothing special, but it was created in a minute just from looking at the sketch on the left. It even came up with the joke.

Another guy took a drawing of a simple app gathering user info and turned it into a web app in no time. If you’re interested, a two minute demo can be found here.

I have a friend who has developed websites for nearly twenty years. He’s scared. He knows he’s about to be disrupted. He’s racing to learn AI as fast as possible to create an app to help novice programmers create a website with the assistance of AI. It’s the only way to future proof his business.

This is just one example of a software business that is going to suffer as AI gets better.

And programmers of more complex applications are getting AI assistance. Using an AI copilot to help write code saves coders tons of time. 88% of developers claim to be more productive when using the tool.

Another study found that a group of developers using the GitHub Copilot could complete a task in 1 hour and 11 minutes, which took others 2 and 41 minutes without AI. Put another way, the average coder is now over twice as productive as before.

We can just look at how quickly Elon Musk created and released his new AI called Grok. It took him just four months to build it from the ground up. In comparison it took Google two years to train Bard and OpenAI took several years to train ChatGPT.

Software Profit Margins Will Go Much Lower

All of the above makes software less expensive to develop. This will lead to more competition in the software market. The 40% profit margins many of these software companies like Adobe and Microsoft have will get competed away.

Fat profit margins like that may stick around for a while, but eventually a competitor like Jeff Bezos comes in and says, “your margin is my opportunity.” And he comes in and destroys the profitability of the market.

What will happen is that these software applications will become more commoditized. Some companies may even decide the costs to build their own software internally will be worth it.

For those remaining companies selling software applications, they will differentiate themselves the way everyone else has to – through lower prices or marketing.

Lower prices obviously destroy margins. But for those marketers who try to push a premium offering will see profits margins contract. They will have to increase their market spend and drive up their cost of acquisition (CAC).

Game theory tells us that these companies will spend all their gross margin on ads. Because if they don’t a competitor will outspend them and gain those incremental customers.

Some companies may even spend more than that hoping the life-time value of the customer will drive profits in the future. This thinking will lead to bankruptcies.

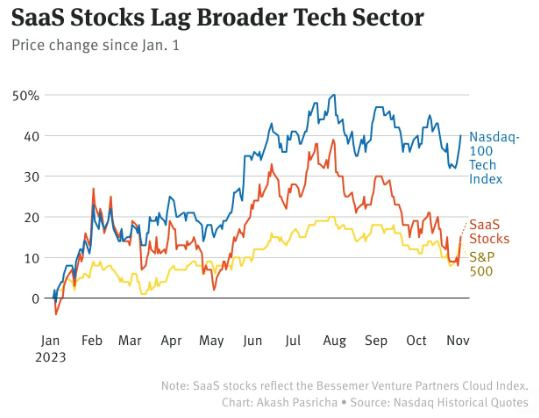

The smart money is already beginning to realize this. This year we’ve seen SaaS companies underperform the Nasdaq Tech Index. (The chart is a month old, but the ratio still stands)

Nasdaq

The barrier of entry and protective moats around SaaS companies will dwindle. Just like software ate the profits of the rest of the market in the 2010s, AI will now eat software’s profits.

Competition Comes for Adobe

Adobe has long fended off competition against its flagship Photoshop product. This is the heart of their Creative Suite segment.

Competitors like Corel Paintshop, Affinity Photo, and GIMP just couldn’t ever quite match the power of the Adobe suite. So they were insulated. People would struggle through the high learning curve to use the power of Photoshop.

But, with generative AI they face the biggest competition yet. And yes, I realize they are incorporating AI into their offerings. But that is now tablestakes for the industry. That is necessary just to remain competitive. Without it, they’d surely lose even more market share.

Right now, image generators like DALL-E and MidJourney can pump out professional looking images with just a few words in a prompt. And image editors like deep-image.ai or Leonardo.ai can make changes to the photo with just a couple clicks or prompts.

Yes, Adobe has Firefly. But I’m not convinced that this is profitable. So far all the companies releasing AI integrations just talk about user or revenue growth. None of them talk about profitability. This tells me the AI compute costs is likely more than the revenue these programs generate.

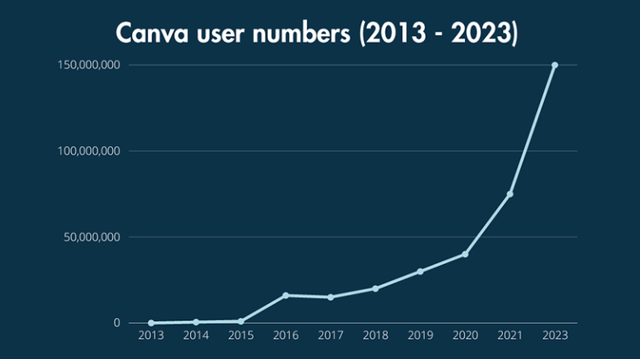

Adobe doesn’t just face competition from image generators. Other basic photo editing programs like Canva are proving to be formidable competitors. Just look at the user growth of Canva to show how people are flocking to this new product.

Canva doesn’t do complex photo edits like Photoshop, but this is assuredly taking away potential users from Adobe.

Competition is coming from all angles. And Adobe doesn’t have the best track record of innovation.

Just look at how they inexplicably missed the boat on e-signatures. Adobe created the PDF document. And they have a dominant market position on the creation of pdfs through their Acrobat offering. But somehow, DocuSign (DOCU) came out of nowhere to control the e-signature market on pdfs.

And Adobe has been slow on releasing collaborative tools for working with images. They were so far behind that they wanted to buy their competitor Figma for $20 billion.

Adobe was so desperate to get rid of that competitor that it offered to pay 50x ARR (annual recurring revenue).

But this deal was recently abandoned as antitrust laws looked to get in the way of the acquisition. Now Adobe will remain behind in collaborative features… Making it harder for teams to use the Adobe Suite.

And anecdotally, I’ve heard from a couple graphics designers and UX specialists that Adobe is a pain to work with. They feared that Adobe would ruin Figma if they were to acquire it. So Adobe’s reputation has taken a hit in recent years.

This is starting to show up in Adobe’s numbers as well.

Growth is Strong, but Slowing

Adobe is no doubt a strong company with strong growth. But the crux of my thesis on Adobe is that as growth slows, the market will revalue it to a lower valuation.

And growth trends are moderating.

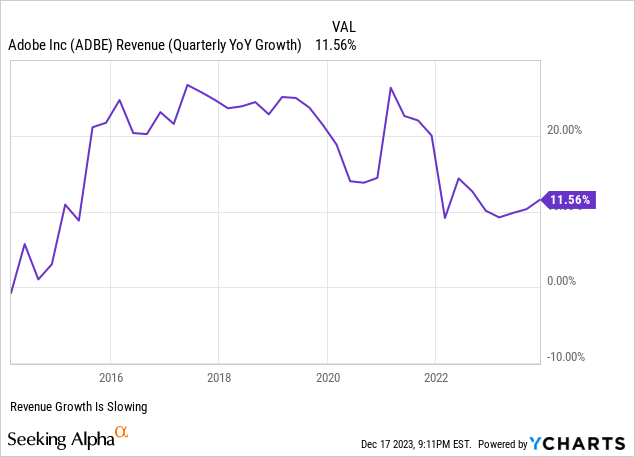

Let’s start by taking a look at revenue growth.

YCharts

The chart shows annual revenue growth surpassed 20% in several years. But now it’s down to 11.6%… And despite the recent uptick this past quarter, management guided next year’s revenue to grow only 10%.

10% revenue growth is still strong, don’t get me wrong. But, Wall Street doesn’t look at the raw growth numbers. They look at the change of growth. And the change shows the company is slowing down.

This tells me management is starting to see pressure mount on their larger sales. And that will make it more difficult for them to pass on the price increases they mentioned in the quarterly call.

This is likely due to a fact of slowing paid user growth. Now, I have read through Adobe’s Investor Day transcript, 10-Ks, 10-Qs, presentation transcripts… And in none of these could I find the growth of paid users. That worries me.

Management is pointing our attention towards free user growth – the wrong metric. For instance, in Adobe’s October Investor Day, they talked up their 20% user growth in Adobe Express – which is a free service with a premium add-on.

Often what management doesn’t say is more important than what they do say. And they didn’t give the numbers of paid users. This should give all Adobe bulls a bit of hesitation.

What they did say is that paid users increased their usage of Express by 65%. While that sounds good, it’s not. Adobe must pay additional compute costs on this extra usage – which ties into my theory that their AI offerings aren’t profitable.

If paid user growth was healthy, they would have touted that number instead of a usage stat.

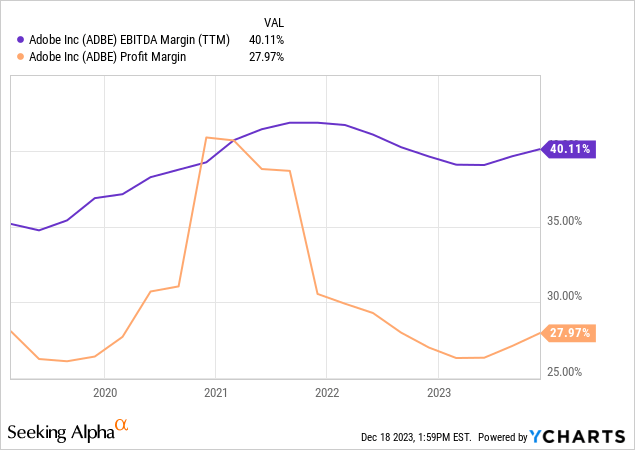

Admittedly, Adobe has great EBITDA and profit margins. But we can see that these margins peaked in the past couple of years and starting to decline.

YCharts

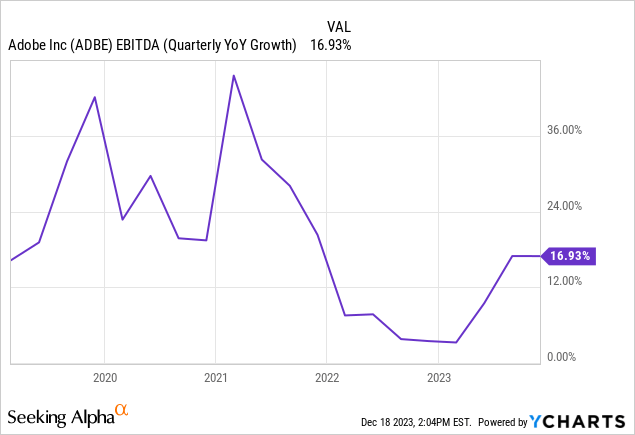

These shrinking margins are leading to a slowing of profit growth as well. Look at the chart of EBITDA growth and you’ll see that EBITDA growth is down from prior years and sits below where it was pre-pandemic.

Ycharts

Another sign that Adobe’s growth is likely slowing in the face of competition.

The Bull Case

I’m well aware of the bull case for Adobe. It’s well documented here on Seeking Alpha.

And perhaps Adobe will see reemergence of profitable growth as they incorporate AI into their offerings. And maybe that will get their current customers to purchase more expensive subscriptions.

And maybe the free user growth will turn into paid customer growth.

This in turn will cause Wall Street to value Adobe at increasingly higher levels.

I just don’t see it happening.

Valuation

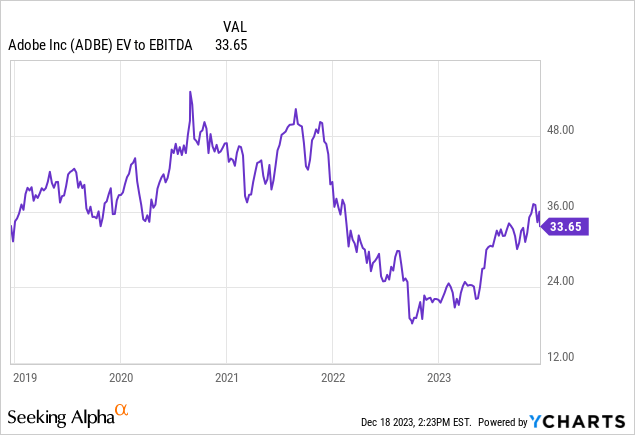

So let’s get into my price target. To keep things simple, I’m going to use an EV/EBITDA calculation – a complex discounted cash flow model gets similar results.

The chart below shows Adobe’s historical EV to EBITDA ratio.

YCharts

Trading at a multiple of 33.7 is a very rich multiple. I’ve found that stocks are fairly valued on an EV/EBITDA ratio that is similar to their annual EBITDA growth. So we’ll round up the EBITDA growth rate to 17%, putting Adobe at a EV/EBITDA multiple of 17.

YCharts estimates next year’s EBITDA to be $12 billion. Tacking a 17x multiple on that gives us an enterprise value of $204 billion at the end of next year.

At a current EV around $265 billion, that means I expect shares to drop about 23% over the coming year.

This is my base case and is why I am initiating coverage on Adobe with a sell rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.