Summary:

- Salesforce is set to report earnings on May 31.

- Investors will be interested in SBC and GAAP profitability, as the company has expressed the desire to shift towards higher levels of profitability.

- The stock has run up a lot on investor enthusiasm but the company has so far only shown a modest improvement in operating profitability.

- Conservative investors can wait until the company shows higher levels of GAAP profitability before taking a position here.

Bjorn Bakstad

Thesis

Salesforce (NYSE:CRM) stock has seen a massive rally YTD on investor enthusiasm for cost controls, but the company has so far shown only modest progress in improving GAAP operating profitability. While Salesforce is still growing at a reasonable rate for such a mature company, the stock remains richly valued until the company can get SBC and their operating expenses under control.

YTD Rally

Salesforce stock has rallied 58.65% YTD on the back of investor enthusiasm for cost controls at the company. Salesforce said that these cost cuts were going to come primarily in the form of layoffs and scaling down their real estate footprint. It will take time for the benefits of these cost cuts to take shape and feed through into their financial results.

Most Recent Quarter

In order to gain insight into Salesforce’s future, we need to take a look at where they are coming from. The company is seeking to cut costs and improve operational efficiency, and investors can use their most recent quarter as a baseline to evaluate their future progress in these areas.

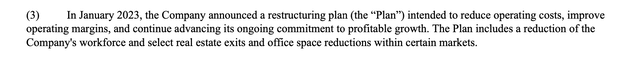

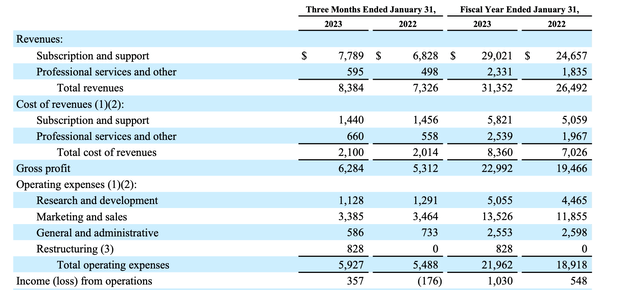

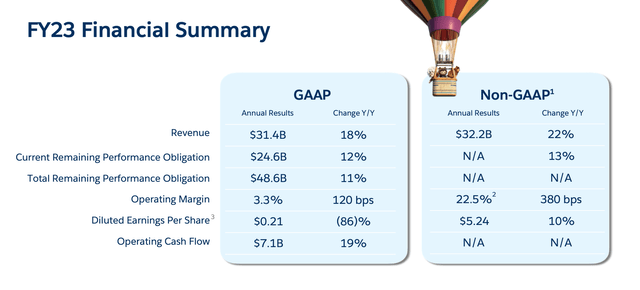

In their most recent quarter Salesforce reported operating income of $357 million, compared to an operating loss of $176 million in the year ago period. For the full year Salesforce earned operating income of $1,030 million compared to the previous year’s operating income of $548.

Due to losses on strategic investments and income taxes Salesforce ended up with a GAAP loss in their most recent quarter, however investors can usually overlook one-time items such as investment gains/losses as they are not necessarily indicative of the company’s operating performance.

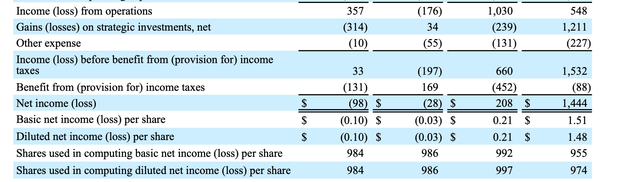

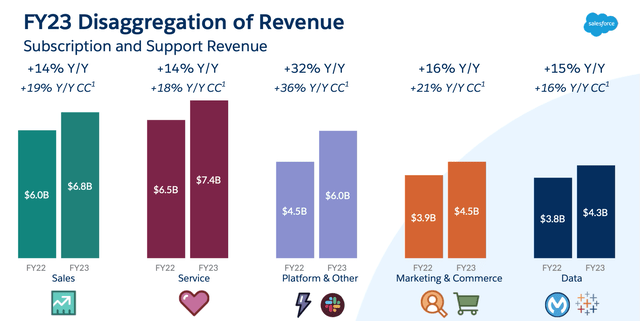

On a top-line basis the company is still showing growth in all of their core business segments. Salesforce bulls can point to this strength in the face of a weakening economy as proof of the stickiness of Salesforce’s customer base and the quality of their product offerings.

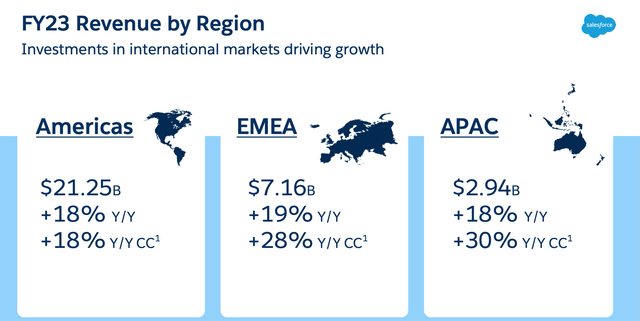

The company is showing higher growth in the APAC and EMEA region than their mature Americas market. If Salesforce is able to continue to tap into under-penetrated markets they can continue to grow at a double digit rate despite their large size.

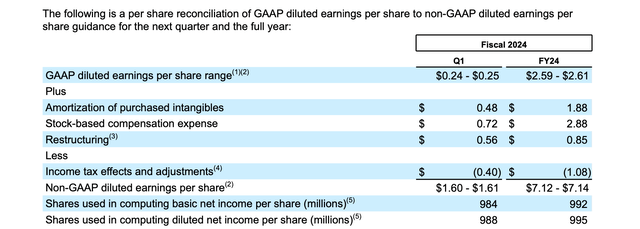

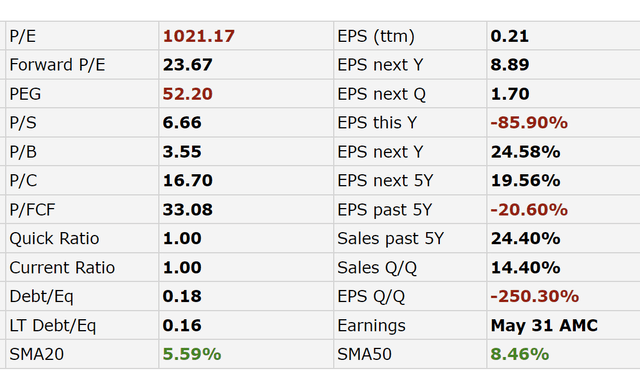

The fundamental issue is that Salesforce is a $208 billion market cap company. With this context it seems that TTM operating income of $1,030 million is rather low for such a high market cap, especially given their moderating revenue growth rate. The company typically refers to their earnings on a non-GAAP basis and investors have been willing to use this metric to value Salesforce for the time being.

SBC and Adjusted Earnings

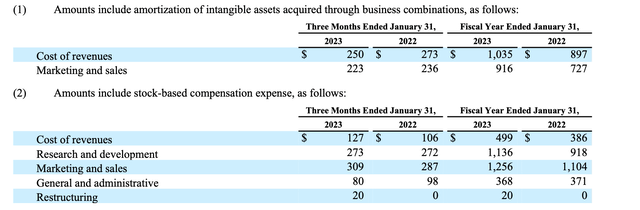

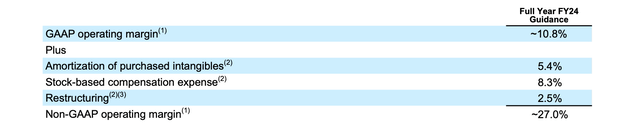

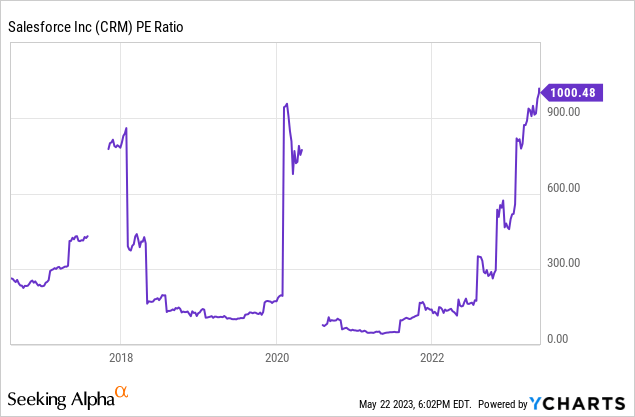

Salesforce highlights their non-GAAP earnings and details their amortization and SBC expenses in their earnings releases.

Looking at the GAAP vs. Non-GAAP figures below it seems like Salesforce is a completely different business. This is where a large part of the bull/bear debate stems from regarding Salesforce. Where an investor lies in that debate has a lot to do with their regard for non-GAAP earnings. I think the debate is a little more nuanced than some value investors make it out to be. In my mind it is perfectly fine for investors to largely disregard expenses related to the large goodwill balance on Salesforce’s balance sheet, as these expenses are not directly related to the current operations of their business. On the other hand, it seems difficult to ignore SBC as employees would likely demand other forms of compensation if the company stopped giving them stock as part of their compensation package. Of course, not all investors view SBC as being a “real” expense, and that’s what makes a market.

On a GAAP basis Salesforce appears to be overvalued at these prices, but the company could get their costs under control enough to justify their current valuation.

The AI Opportunity and FY 24 Guidance

There are a few things that investors should watch in Salesforce’s upcoming quarters. The first is Salesforce’s progress in scaling back their real estate footprint and rightsizing their workforce. The second is their growth in the EMEA and APAC regions. The third is progress on integrating AI tools into their enterprise product suite.

Ever since ChatGPT took the world by storm, enterprises are beginning to demand AI productivity tools be integrated into the enterprise software they use. Salesforce has a perfect opportunity to meaningfully differentiate themselves in the marketplace by adding AI powered tools to their enterprise software offerings. Investors should watch for management commentary on this topic. If the company does not take advantage of this opportunity investors may begin to question their read on market trends and ability to compete over the long-term. Salesforce may have become too large and bureaucratic over time and are no longer operating with an innovation-first mentality.

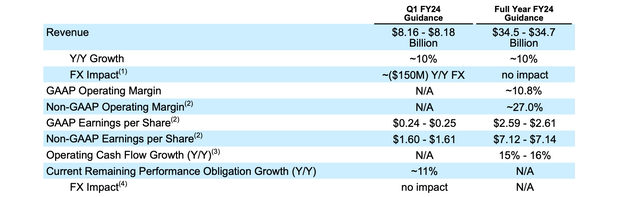

As far as the financial side of things is concerned, Salesforce has given guidance for both their Q1 and full fiscal year. Investors should watch for whether or not the company can exceed their guidance. We would like to see them meaningfully beat on GAAP EPS, but given their history of not seeming to care about GAAP EPS this is unlikely.

It is possible that the company has given a soft guide and will be able to beat and raise over the coming quarters in our view.

Price Action

Salesforce has rallied 58.65% YTD off of investor enthusiasm over Salesforce’s stated goal of cutting costs. If Salesforce can continue to grow earnings and revenue investors will likely be rewarded accordingly.

Valuation

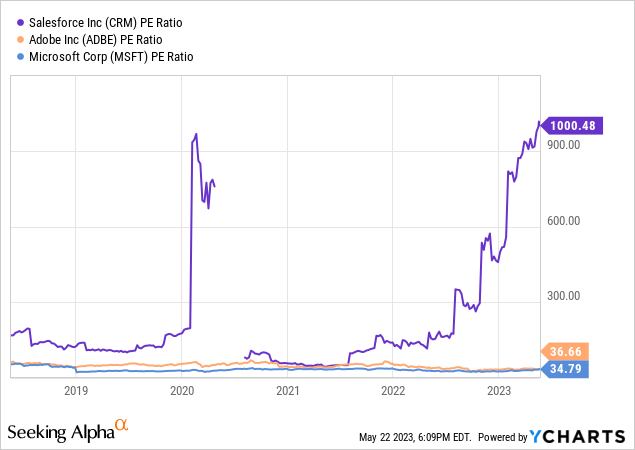

Salesforce is trading at a high PE multiple relative to its own history.

The closest comparable software companies in the market are Microsoft (MSFT) and Adobe (ADBE). Both of these companies also give their employees large amounts of SBC, yet they trade at much lower GAAP PE multiples than Salesforce. This is part of what causes some investors to take a poor view on Salesforce. The company seems to be lagging behind their public market peers when it comes to cost controls, but management seems to be interested in improving profitability. If they can get their valuation in line with Microsoft and Adobe it would likely attract a new cohort of GAAP focused investors to the stock.

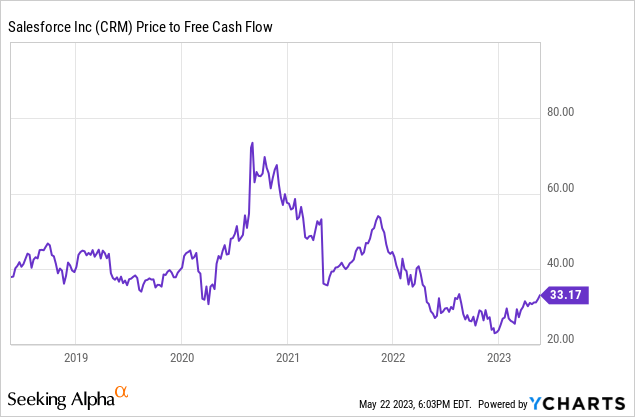

While their PE remains high, their price to free cash flow is at a multiyear low. This discrepancy is caused by costs such as amortization, SBC, and restructuring charges. While some investors care more about cash flow than GAAP profits, we would caution against ignoring SBC. SBC is a legitimate expense and for a mature company such as Salesforce it is part of normal employee compensation. If they stopped giving out SBC those employees would likely demand higher cash compensation to make up the shortfall. For this reason the nearly multiyear low in price to free cash flow isn’t that attractive to us, but for cash flow oriented investors willing to overlook SBC now could represent a buying opportunity.

The valuation of Salesforce seems stretched on a PE basis and reasonable on a free cash flow basis. It is up to investors to determine which side of the fence they are on. As stated earlier, we believe some adjustment to earnings is justified, but do not see the adjustment for SBC as being justified.

We believe that Salesforce remains overvalued until they can show far higher levels of GAAP profitability or accelerate their revenue growth. They can certainly do this if they take advantage of the AI opportunity ahead of them in our view.

Risks

The main risk to this bearish thesis is if Salesforce is able to cut far more expenses than they initially guided for. This would flow directly to the bottom line and rapidly improve their operating income.

Another risk is if Salesforce is able to increase their growth rates in the APAC and EMEA regions. This would represent a new phase for the company and could fuel 20%+ revenue growth for years to come.

We view the overall risk/reward as being unfavorable, not because Salesforce is a “risky” company, but because investors may be overpaying for their fundamental earnings power.

Key Takeaway

All in all Salesforce is a solid company that let their expenses get out of control as they grew. We would stay on the sidelines here until the fundamental picture improves.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.