Summary:

- I prefer to overlook the recent weakness in Salesforce’s stock price, as fundamental analysis indicates strong growth potential.

- The company’s profitability and cash flow are soaring, and the management’s commitment to creating more value for customers and shareholders remains intact.

- My valuation analysis suggests that the current stock price presents a rare buying opportunity with substantial upside potential.

wdstock

Introduction

I shared a thesis about Salesforce, Inc. (NYSE:CRM) in May 2024 with a “Strong Buy” rating. My optimism did not age well because the stock price has declined by 12% since then, while the S&P 500 (SP500) declined by 1%. Today I want to update my analysis and explain that CRM’s weak stock performance over the last three months is due to sentiment and not fundamental reasons.

The post-earnings selloff looks unfair because the revenue miss was almost invisible, and I did not find anything disastrous in the Q2 guidance downgrade as long as the management maintained its full-year outlook. The company’s profitability is soaring and is expected to deliver double-digit EPS growth over the next several quarters. That said, CRM’s operating cash flow is poised to expand notably as well, helping to accumulate more financial resources to invest in further growth. CRM’s commitment to innovation with its $5 billion R&D budget and a stellar record of acquisitions means that the management will highly likely allocate the company’s notable cash pile into new ventures and projects. My optimism that this growth will be profitable is backed by the company’s unparalleled profitability. Valuation has become extremely attractive after the post-earnings dip with a 37% upside potential. All these favorable factors mean that I am inclined to confirm my “Strong Buy” rating for CRM.

Fundamental Analysis

According to CRM’s historical stock prices, the stock plunged by 19.74% on May 30 after the company released its FQ1 2025 earnings. I consider such aggressive post-earnings sell-off as unfair because CRM’s Q2 report was not bad. A $20 million revenue miss against consensus estimates looks like nothing considering that quarterly revenue was above $9 billion.

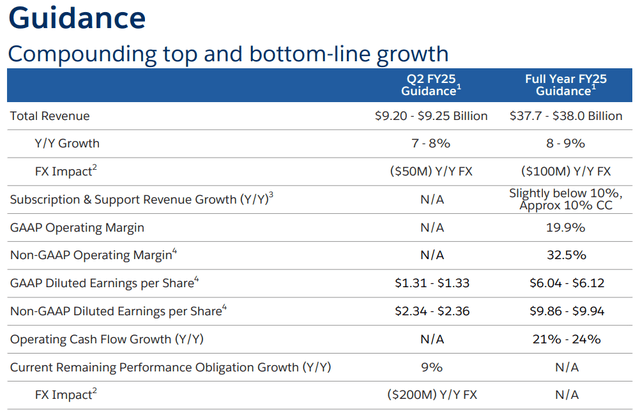

The Q2 guidance was slightly below consensus expectations, but the management maintained its consolidated full-year guidance of around $38 billion. The management also maintained its guidance for the operating cash flow growth, which is expected to be around a solid 21-24%.

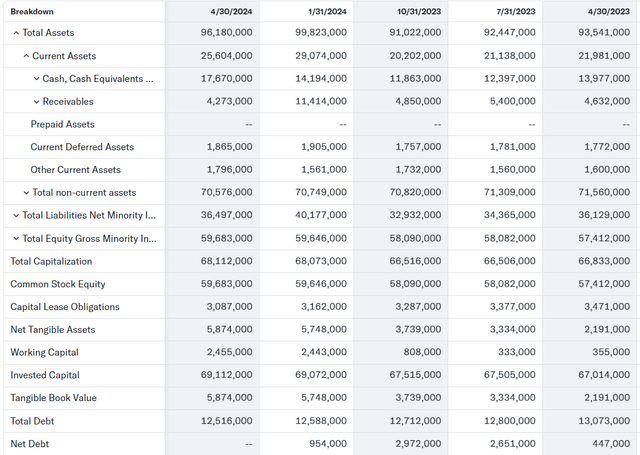

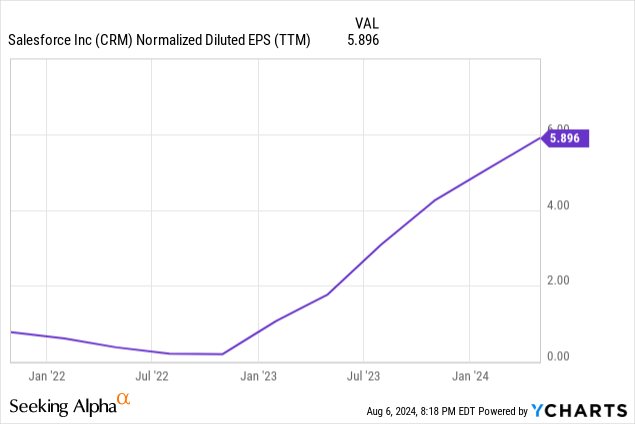

Moreover, CRM’s profitability continues growing aggressively and the TTM chart of the adjusted EPS looks like a straight line over the last few years. The company generated a $6.25 billion operating cash flow in FQ1, up 39% YoY. CRM’s FQ1 free cash flow was 43% higher YoY at $6.08 billion. The company ended the quarter with a formidable $17.7 billion cash balance, more than $5 billion higher than the total debt. With such a fortress balance sheet CRM has vast potential to invest in growth and innovation.

A few weeks ago it was announced that CRM is working on a new artificial intelligence-powered assistant together with Workday, Inc. (WDAY). This joint project is expected to improve users’ experience and streamline workflows across Salesforce’s new Agentforce platform and Einstein AI with the Workday platform and Workday AI. This information underscores CRM’s commitment to constantly improve value for its customers and to innovate.

The company also recently signed a definitive agreement to acquire a cloud-based point-of-sale (‘PoS’) software vendor PredictSpring. After the deal completion CRM will be able to augment the start-up’s capabilities in an attempt to get a stronger hold in the retail industry. This deal looks intriguing as CRM plans to expand it in a brand-new field, though the success of this story is quite uncertain at the moment. The most important to me is that the management continues to strive to create more value for customers and shareholders.

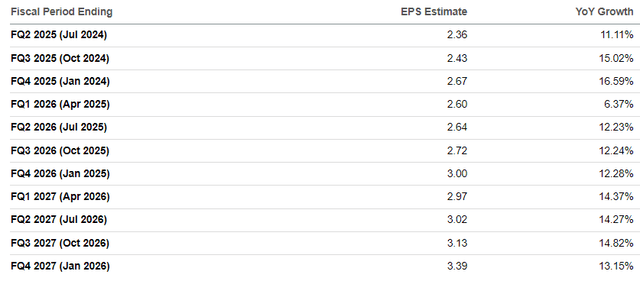

The company’s foreseeable future looks very bright as consensus projects double-digit EPS growth for almost every single quarter for the next couple of years. With such an EPS dynamic projection it is extremely likely that the company’s operating cash flow will also demonstrate consistent growth, providing CRM with even more opportunities to reinvest. CRM’s stellar profitability record means that the probability of reinvesting in profitable projects is substantial. Moreover, the management is not only focused on driving revenue growth, but on cost control as well. Recent reports suggest that the company continues its headcount optimization.

Another positive catalyst for CRM is industry tailwinds. CRM benefits from the global digital transformation trend. Global digital transformation spending is expected to grow from $2.15 trillion to $2.49 trillion in calendar 2024, indicating a 15% growth. This is notably higher than CRM’s projected revenue growth, implying that the full-year guidance is quite conservative and the probability of outperforming it is considerable.

To summarize, my stance is extremely bullish. CRM is an undisputed leader in its industry, and the management has a strong dedication to sustain its leadership for as long as possible through continuous innovation and commitment to customer satisfaction.

Valuation Analysis

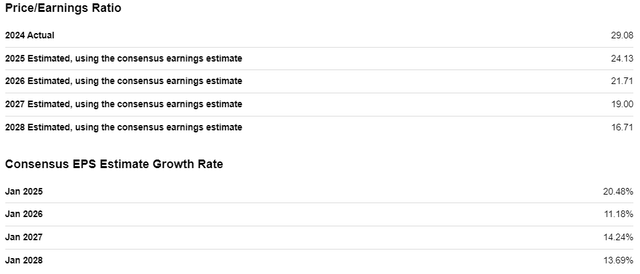

I find the projected by consensus forward dynamic of CRM’s P/E ratio to be quite attractive. The EPS growth incorporated by consensus appears realistic considering the company’s fundamental strength and secular tailwinds. A below 25 FY 2025 P/E ratio appears to be attractive for a company like CRM.

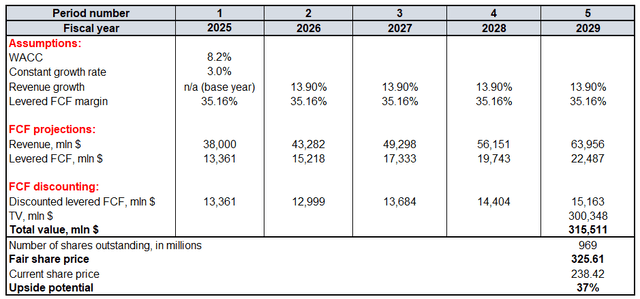

To cross-check my conclusions obtained from looking at CRM’s forward P/E ratio, I must run a discounted cash flow (‘DCF’) model. Future cash flows will be discounted using an 8.2% WACC. A $38 billion FY 2025 revenue for my model is the management’s guidance from one of the above screenshots. The revenue growth rate for the next five years is 13.9%. Levered FCF margin is 35.16% which is already high, and I will be conservative and incorporate a flat level between FY 2025 and 2029. According to Seeking Alpha, there are 969 million CRM shares outstanding. Constant growth rate for the terminal value (‘TV’) calculation is likely to be the most controversial assumption for all growth companies. I incorporate a 3% constant growth rate, approximately in line with the current inflation levels.

The fair share price is $326, 37% higher than the current market price. The valuation looks extremely attractive after the recent pullback after the latest post-earnings sell-off.

Mitigating Factors

CRM’s market cap is $232 billion, and it is challenging to categorize the company as a small player competing with industry giants. However, Microsoft, CRM’s direct competitor in the enterprise team collaboration niche, with a market cap of close to $3 trillion, operates on an entirely different scale of financial power. This means that the significant competition risk is obvious.

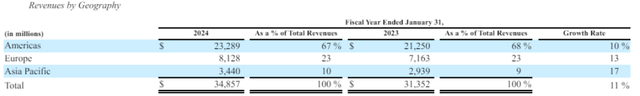

Due to facing larger comparatives and increased market penetration in the U.S., CRM’s domestic market growth will inevitably decelerate. Due to CRM’s already notable international footprint with impressive revenue growth, I think that further international expansion is a realistic strong future growth driver.

However, operating internationally is riskier than domestically due to numerous reasons, including geopolitical risks, a complex web of international taxation and regulations, compliance risks, and substantial foreign exchange risks. Therefore, the larger the share of international revenue becomes, the more risks the company faces.

Conclusion

CRM’s 37% upside potential is an absolute “Strong Buy” because such a deep discount for a company that has dominated its niche for over a decade is an extremely rare buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.