Summary:

- Activist investors are circling Salesforce.

- First it was Starboard Value, then most recently Elliott Management has joined the party.

- Salesforce continues to sustain double-digit growth in spite of a tough macro environment.

- The company maintains net cash on its balance sheet, is generating cash, and trades at compelling valuations.

Justin Sullivan

Amidst the rubble in the tech stock crash, Salesforce (NYSE:CRM) has garnered investor attention in large part due to the presence of activist investors. As one of the more mature tech companies that still retains secular growth, it is understandable why some view CRM to be an attractive investment. The company has a strong balance sheet and has recently begun to repurchase shares. While CRM has already done a round of layoffs, the activist investors might convince the company to take more drastic actions to realize shareholder value. With the valuation as compelling as ever, a sentiment shift may be all that’s needed to turn things around.

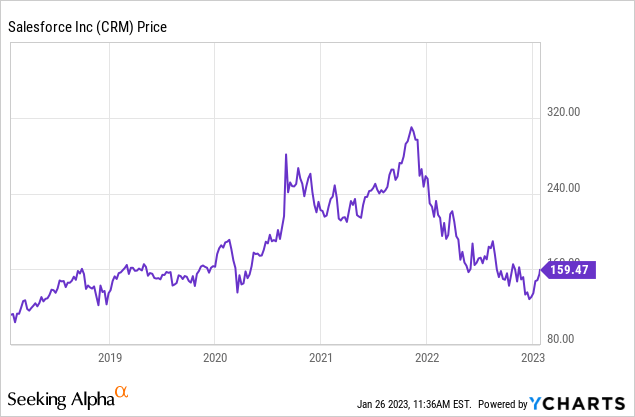

CRM Stock Price

Like most tech stocks, CRM has been crushed amidst the broader crash, but CRM’s stock has performed strongly over the past few weeks.

I last covered CRM in November where I explained why I was buying before earnings. The stock has since returned nearly 8% as tech stocks have recovered some of their brutal losses over the past year.

CRM Stock Key Metrics

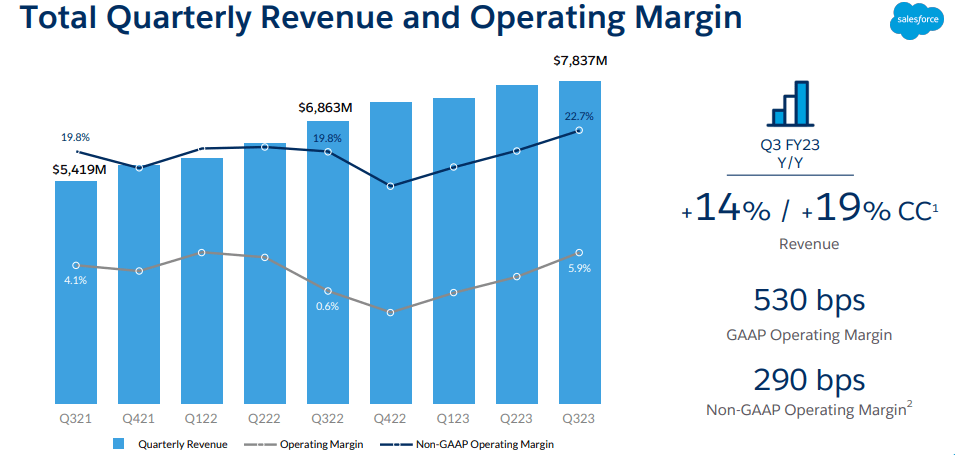

In its most recent quarter, CRM generated solid results in spite of currency fluctuation headwinds. Revenue grew 14% YOY to $7.8 billion while non-GAAP operating margins grew 290 bps to 22.7%.

FY23 Q3 Presentation

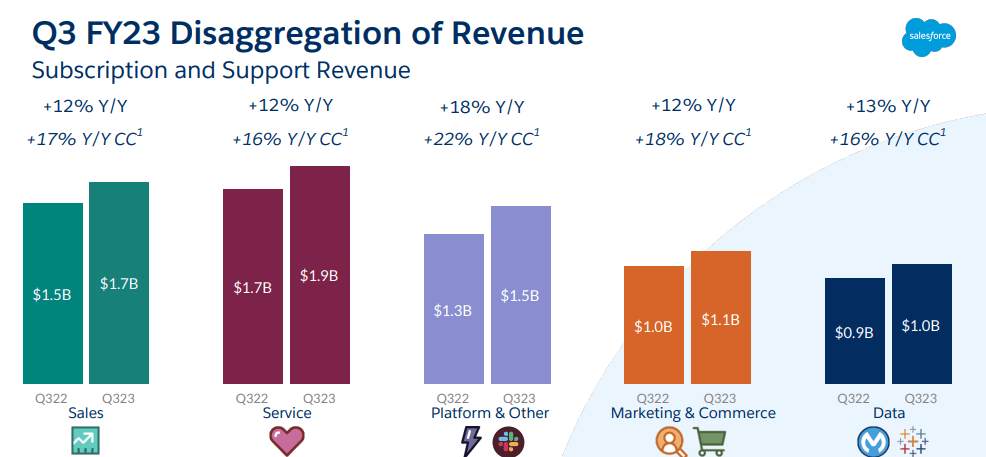

Over the years, CRM has assembled a deep product portfolio – we can see a breakdown of growth rates below. As usual, Slack was the fast grower at 46% YOY.

FY23 Q3 Presentation

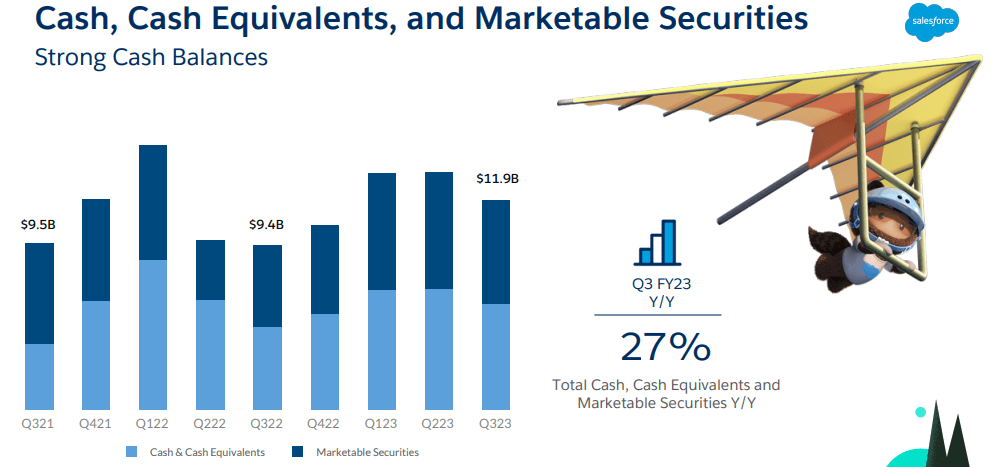

CRM ended the quarter with $11.98 billion in cash versus $10.6 billion of debt.

FY23 Q3 Presentation

I would not be surprised to see CRM take on net leverage at some point considering that it is generating ample free cash flow (and as discussed below, the activist investors may inspire such a development).

For the first time, CRM began returning cash to shareholders as it repurchased $1.7 billion in stock in the quarter.

On the conference call, management reiterated long term guidance for at least 25% in non-GAAP operating margins by fiscal 2026, but stopped short of providing guidance for next year.

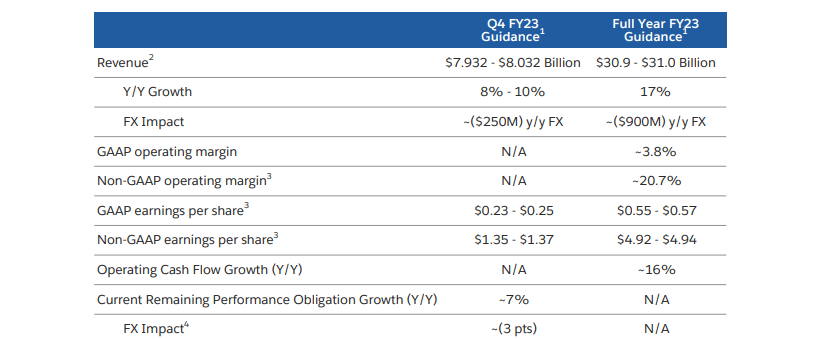

CRM did reiterate full-year guidance for up to $31 billion in revenue, representing 17% YOY growth.

FY23 Q3 Presentation

As valuations have come down, it is impressive to see CRM sustaining solid growth and margins in spite of a tough macro backdrop.

Did Salesforce Do Layoffs in 2023?

Earlier this month, CRM announced that it would layoff approximately 10% of its workforce, a process that is expected to lead to as much as $2.1 billion in charges. Anyone covering the tech sector knows that many tech companies have lots of room for margin expansion through layoffs and cost reduction, but the question is how much? Some activist investors might be thinking that there’s a lot more than 10%.

Activist Investors Circle Salesforce

CRM first gained attention from an activist point of view when Starboard Value took a stake in October. An exact number has not yet been disclosed but has been described as “significant.”

What is an activist investor? In short, an activist investor is one which seeks to not only take an equity stake in a company but to also have a say in the company’s direction.

Things became even more interesting when Elliott Management announced a multi-billion dollar stake in the company in late January. Elliott Management stated the following in regards to its investment:

Salesforce is one of the preeminent software companies in the world, and having followed the company for nearly two decades, we have developed a deep respect for [Co-Chief Executive] Marc Benioff and what he has built.

Why did Starboard Value and Elliott Management invest in Salesforce?

My guess is that the tech crash has gotten so severe that renowned value investors are now licking their chops. While there is some speculation that the activist investors may want CRM to do some asset sales, I find such a move to be highly unlikely considering valuations today. Instead, it may be more simple than that: more layoffs. Valuations in the sector and at CRM have become curiously low in spite of the attractive unit-level economics. Each incremental customer in theory comes at minimal cost because they are sharing the same product – CRM merely needs to pay for the cloud computing costs. Perhaps these activist investors think that Wall Street simply needs to be reminded that these tech companies could show large margins if they wanted to, and more aggressive layoffs may accomplish that goal.

There is also the possibility that these activist investors want CRM to lever up their balance sheet and either aggressively repurchase stock or conduct M&A. CRM is no stranger to the latter but I’d expect share repurchases to be the preferred approach due to the immediate financial impact.

Salesforce’s Stock Forecast

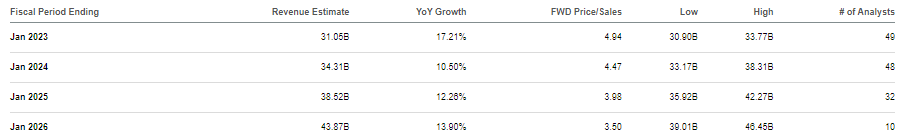

The weak macro backdrop is expected to lead to material deceleration in growth rates in the next year before accelerating again thereafter.

Seeking Alpha

Yet at these valuations, perhaps a better take is that CRM might still sustain double-digit growth in spite of macro. What is driving the strength? On the conference call, management attributed their strength due to the “mission-critical” nature of the product because difficult times only increase the importance of customer relationships.

Is CRM Stock A Buy, Sell, or Hold?

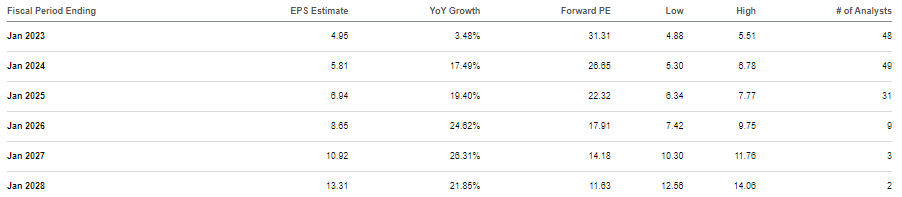

At recent prices, CRM was trading at around 5x sales. Yet the stock has fallen so much that we can even value it on the basis of non-GAAP earnings. CRM was trading at around 27x forward earnings.

Seeking Alpha

While that might not sound obviously cheap at first, it is important to realize that there is great potential for operating leverage in this business, which should in theory lead to earnings eventually growing far faster than revenue growth over time. I continue to see CRM generating at least 30% net margins over the long term. Based on 13% projected growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at 5.9x sales or around $208 per share over the next 12 months.

What are the key risks?

One can make the argument that CRM was able to sustain strong growth rates only due to its voracious M&A activity. That M&A activity sometimes occurred with seemingly little caution for valuations. The company’s acquisition of Slack occurred at around 27x sales for a company that was growing at a mid-30’s clip. Even prior to this recent tech crash, such a valuation can only be considered nosebleed. It is possible that growth decelerates much quicker than anticipated as it is not clear if the company has its eyes set on a large target. I also note that CRM is not necessarily cheap relative to tech peers – that might be due to its profitability and the presence of activist investors. The relative premium might lead to greater volatility over the coming quarters. There is no guarantee that CRM will work with these activist investors – a poor outcome would be for the activist investors to exit their stakes without any influenced actions. As discussed with subscribers to Best of Breed Growth stocks, a wide basket of undervalued quality tech stocks may be a top strategy to take advantage of the tech stock crash. CRM can fit in such a basket as a higher quality allocation.

Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!