Summary:

- Salesforce’s Q3 earnings are expected to show growth in revenue and earnings, with estimates of 11% and 47% YoY growth, respectively.

- I see concerns relating to slowing deal activity, increasing competition, and negative customer reactions to price increases.

- The stock is trading at a high forward P/E multiple of 28x for projected 2024 earnings, which should spark valuation concerns.

- I remain Hold rated on Salesforce stock going into Q3.

Stephen Lam

Salesforce (NYSE:CRM) is scheduled to publish its Q3 2023 earnings on November 29th, after the market closes. Despite the persisting macroeconomic pressures and ongoing IT budget optimization cycle, analysts are quite bullish on the upcoming data release, expecting an 11% and 47% YoY growth in sales and earnings, respectively. Personally, however, I warn against excessive optimism on CRM pre-Q3 reporting. Specifically, I am concerned about intensifying competitive dynamics, slowing deal activity on prolonged sales cycles, as well as a slower-than-expected and less successful pass-through of price increases. All this brings the potential for a disappointing guidance going into Q4.

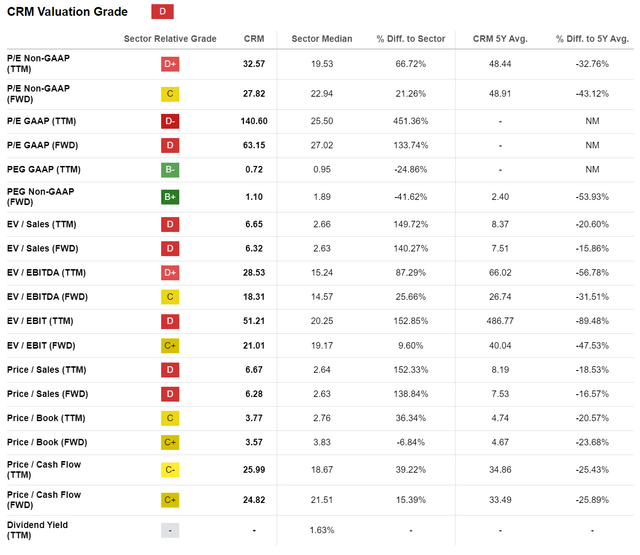

Overall, as we approach the Q3 earnings report, I stand by my belief that Salesforce stock is presently overvalued at ~28x P/E for projected FY 2024 earnings.

For context, Salesforce has shown strong momentum YTD, boasting YTD gains of approximately 54%, compared to 19% return for the S&P 500 (SP500).

Seeking Alpha

Likely Little Upside On Bullish Q3 Consensus

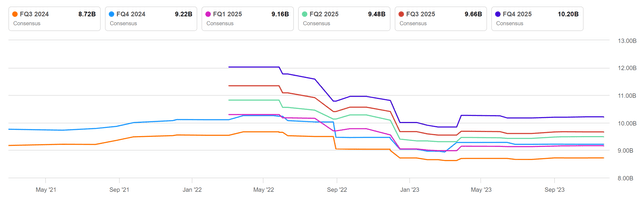

According to data compiled by Seeking Alpha as of November 25th, a total of 41 analysts have shared their estimates for Salesforce’s Q3 results. Their collective forecasts indicate that Salesforce’s top line for the September quarter may fall between $8.67 and $8.82 billion, with $8.72 billion at mid-point. Taking the mid-point as a reference benchmark, it is suggested that Salesforce revenues may expand about 11.25% YoY. While a double-digit sales growth is notable, I point out that on a time-indexed view, consensus revisions on Salesforce topline growth still remain depressed.

Seeking Alpha

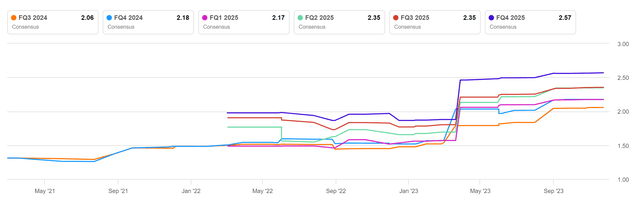

With regard to earnings, analysts are quite bullish: For Q3 2023, analysts now expect a 47% YoY jump in EPS, anchored on a $2.06 EPS consensus estimate (range is $1.84 to $2.12).

Seeking Alpha

I See A Number Of Arguments For Concern

While Salesforce Q3 results will likely show good top line momentum and a strong earnings expansion, I am concerned that the company’s performance may fail to satisfy bullish expectations, with the potential for disappointment also extending to the Q4 outlook. Specifically, I believe investors may underestimate the headwinds that Salesforce is facing due to a challenging market for sales booking on IT budget optimization, paired with increasing industry competition in CRM coming from Microsoft, ServiceNow, SAP, Adobe, and Zendesk.

On deal activity, I point out that during Q3 the broader IT landscape has likely continued to face challenges, with customers pushing for prolonged sales cycles and smaller deal sizes—a trend seen already in Q1 and Q2. In that context, Salesforce’s aggressive price hike this year of 9% across its product portfolio and customer base certainly has not help build deal traction with either existing or new customers. In fact, there have been reports that Salesforce price increases provoked some very negative customer responses (understandably), with Business Insider reporting that some customers even considered “switching to Microsoft or HubSpot” as a consequence of the price adjustments. Such a negative customer reaction sparks a debate about whether Salesforce is able to deliver on further price-driven upside in Q4 and through 2024.

Relating to competitive dynamics more broadly, I am also concerned about Microsoft’s latest release of the Sales Copilot, which brings a likely transformational, new offering to Salesforce’s core CRM market. In that context, it doesn’t help that Microsoft is playing the game slowly, allowing Copilot’s integration with Salesforce CRM, which eliminates the need for a complete switch to Microsoft Dynamics. Because eventually, the dynamic between Microsoft and Salesforce will shift more and more towards competition rather than collaboration.

Valuation: Not Buying These Multiples

As a long-term investor, I am more bullish than bearish on Salesforce, as I believe the YTD operating margin improvement of more than 700 basis points looks sustainable. Additionally, I see the combination of generative AI suggests with Salesforce’s business model as a key leverage point that may rekindle a top line growth trajectory of around 20% CAGR in revenue over the next 3 to 5 years.

That said, however, I am not buying Salesforce at current valuation multiples, especially as I also see the potential for short-term business headwinds (as discussed earlier in the article). Investors should consider that CRM stock is currently trading at a 28x P/E forward multiple for consensus 2024 earrings — this is a materially higher multiple than seen in other tech stocks, e.g., Meta Platforms (24x) and Google (24x).

Overall, I continue to believe that my previous estimate about Salesforce’s fair implied share price remains sound, having calculated a $168.39 per share target price based on a residual earnings model.

Seeking Alpha

Investor Takeaway

Salesforce’s upcoming Q3 2023 earnings report on November 29th is expected with optimism among analysts, who project an 11% YoY revenue growth and a 47% surge in earnings per share. However, I remain cautious going into Q3 reporting, as I am concerned about sluggish deal activities, intensifying competitive dynamics, and customer backlash on the recent price hikes. Going into Q3 earnings, I also reiterate my thesis regarding Salesforce valuation concerns, with CRM stock trading a forward P/E of 28x for projected 2024 earnings. I advise to stay on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

no financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.