Summary:

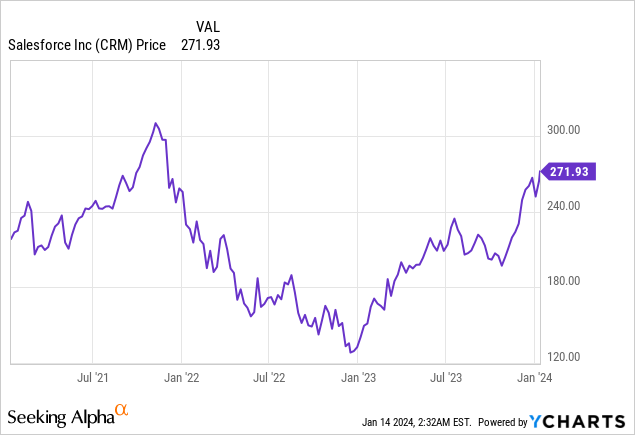

- Salesforce’s stock price nearly doubled in 2023, and some now consider it overvalued based on traditional valuation ratios.

- Some Wall Street analysts have upgraded or recommended the stock for 2024 based on thematic investing ideas.

- Salesforce’s increased focus on profitability, potential for steady revenue growth, and benefits from AI make it an attractive long-term investment opportunity.

Sundry Photography

Salesforce (NYSE:CRM) nearly doubled in 2023 after the stock price bottomed from its terrible 2022 decline. After its magnificent run in 2023, the stock’s valuation has climbed to the point where, based on many traditional valuation ratios, some might consider the stock overvalued.

Yet, at the beginning of 2024, the company received numerous upgrades or stock picks from analysts, primarily based on thematic investing ideas for 2024. Some analysts like Macquarie Equity have included the company in a generative AI stock basket. Other analysts like Oppenheimer have picked Salesforce because they believe 2024 is the year of software-as-a-service (“SAAS”) stocks.

So, is the third largest software company in the world, Salesforce, a buy after its magnificent 2023 run? I believe so. In this article, I will make the case that this $263 billion market cap company’s increased focus on profitability makes it attractive; it still has plenty of room to grow in its addressable market and should be a beneficiary of the growth of Artificial Intelligence (“AI”). Salesforce remains one of the best long-term software investment opportunities in the market.

Einstein AI

Since one of the most exciting theses for investing in Salesforce is the work it is doing in bringing AI plus Customer Relationship Management (“CRM”) software together, let’s start there. The company’s first attempt at bringing AI into the CRM world was when it introduced Einstein in 2016 — gaining significant attention. However, the company has gained even more mainstream recognition after unveiling the evolution and expansion of its AI platform and reintroducing it as Einstein 1 at 2023 Dreamforce.

The idea behind Einstein 1 is building a trusted AI platform for customer companies, the key word being trust. Benioff has a long history of criticizing companies like Meta Platforms (META) and Alphabet (GOOGL) (GOOG) over privacy and other issues. It is little wonder that Salesforce puts privacy and trust at the front of the line regarding AI. Einstein 1 is integrated deeply into Salesforce’s platform and integrates with every app; it is a predictive and generative AI. During 2023 Dreamforce, when introducing Einstein 1, Benioff also said it would soon be “autonomous with agents,” meaning that the AI potentially has decision-making capabilities and could have the ability to take some actions independently.

The Salesforce platform with Einstein will also enable users to build new apps using low code/no code tools. The best part is that the apps that users create will be able to run on other platforms through Salesforce’s Mulesoft application — a build-once, run-everywhere functionality. Benioff also claimed Einstein to “soon be AGI (Artificial General Intelligence),” which is a bold claim since AGI is when an AI has human-level thinking abilities and can learn and perform any intellectual task that a human can. The word “soon” is relative since the Godfather of AI, Geoffrey Hinton, believes it could take as long as 20 years before AGI makes an appearance. Other AI researchers believe AGI capability is speculative and will take significantly more work and time to achieve that capability. However, whether it can achieve AGI soon is inconsequential at this point. If Einstein 1 can help Salesforce’s platform accomplish the rest of the capabilities Benioff highlighted in 2023 Dreamforce, it could become a significant revenue growth driver and is a valid thesis for investing in the company.

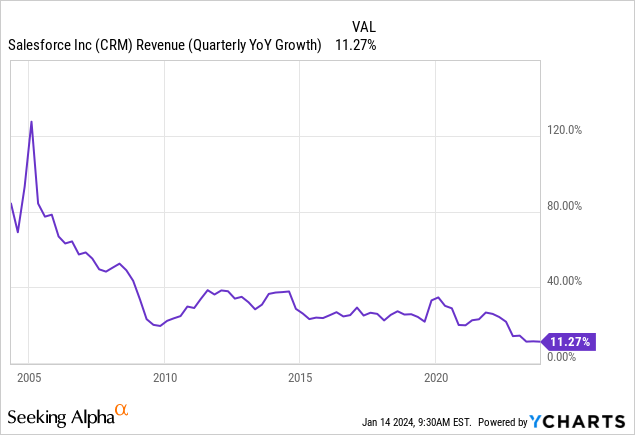

Plenty of room to grow

You might think that a company that just generated $8.7 billion in the third quarter of FY 2024 might be running into the “Law of Large Numbers,” meaning the company is finding it hard to achieve solid growth due to market saturation or the company finding it more challenging to find meaningful things left to invest its cash in. You would be partially correct. The company’s growth rate has consistently dropped since its triple-digit growth days in the mid-2000s to reach revenue of 11.27% in the third quarter of FY 2024.

Although revenue growth has slowed over the years, the company still has large markets to conquer. During the company’s 2022 Investor Day, the company said that its Total Addressable Market (“TAM”) should grow to at least $290 billion by calendar year (“CY”) 2026. At the end of Salesforce’s third quarter FY 2024, it generated $33.95 billion in trailing 12-month (“TTM”) revenue, meaning it has only penetrated 11.70% of its CY 2026 TAM.

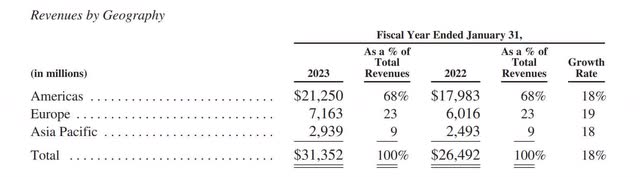

Salesforce is attacking several areas of its market that are ripe for growth. For instance, the company has significant room to grow in Asia and Europe. The image below comes from its FY 2023 Annual report, showing that as of January 31, 2023, the Americas made up 68% of its revenue, and Asia’s penetration was still in the single digits.

Salesforce FY 2023 Annual Report

One of Salesforce’s most significant Asian markets is Japan, which it first entered in 2001. Chief Executive Officer (“CEO”) Mark Benioff said about the Japanese market on the company’s third-quarter earnings call:

I literally just got off the plane from Tokyo. You probably all saw me yesterday at Salesforce World Tour. Tokyo was incredible. Everyone is very excited about Salesforce in Japan, now the second largest software company in Japan. Incredible what has happened over there in the market. I met with hundreds of customers while I was there. I spoke to some of the CEOs of the largest companies in Japan. It was an incredible week. It was the Momiji season, which is the fall season with incredible fall leaves, beautiful over there. And I’ll tell you, everyone wants to talk about Data Cloud. And that is really exciting to have an incredible driver for future [revenue] growth.

Source: Salesforce Third Quarter FY 2024 Earnings Call.

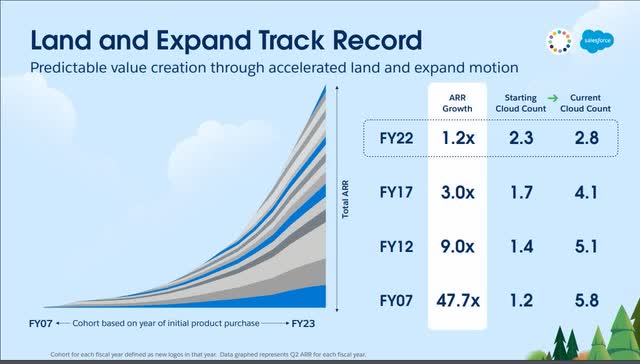

Salesforce also has a significant opportunity to grow within its customer base. The chart below shows that as customer cohorts age, the number of clouds customers adopt and the Annual Recurring Revenue (“ARR”) increases.

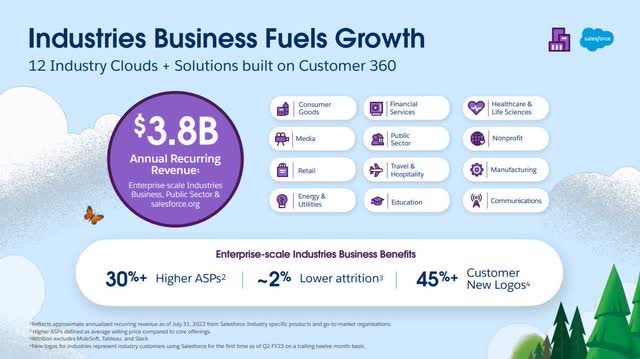

Salesforce offers clients the following six core clouds: Sales Cloud, Service Cloud, Marketing Cloud, Experience Cloud, Analytics Cloud, and Commerce Cloud. Additionally, it has 16 industry clouds that include the Financial Services Cloud, Energy and Utilities Cloud, Healthcare and Life Sciences Cloud, and Media Cloud, to name a few. The industry clouds are pre-built industry-specific solutions that make it easier for businesses in a particular industry to adopt Salesforce’s platform and often result in increased customer satisfaction. These industry clouds can also lead to upsell opportunities for additional features specific to each sector. Management considers the industry clouds a key driver of revenue growth.

Salesforce 2022 Investor Presentation

Salesforce can confuse some people because it has many different services. Some of those services are its cloud offerings; other services are relatively recent acquisitions within the last five years, like Mulesoft, Tableau, and Slack, and older acquisitions like Heroku. It is still possible to use Mulesoft, Tableau, and Slack as standalone services without using the Salesforce platform, but not Heroku, as the company integrated it within the platform.

How does Salesforce bring all these disparate parts of the company together? The Data Cloud acts as a secure central hub, storing and managing structured and unstructured data from all Salesforce products and external sources, securely connecting and synchronizing the data across all the company’s products in real-time. The company integrated Data Cloud within the platform. Customer 360 builds upon this foundation by combining the Data Cloud with CRM data and Einstein AI. This combination goes beyond a traditional Customer Data Platform by giving users a holistic view of the customer with real-time insights, AI-powered personalization, and access to a broader data scope that includes external sources. Customer 360 also connects to all of Salesforce’s other apps like Slack, Mulesoft, Tableau, Heroku, Canvas, and Google products and Microsoft’s (MSFT) products. Benioff’s focus on Customer 360 as a crucial growth driver stems from its ability to elevate customer engagement and drive better business outcomes. It is also one of the company’s primary revenue growth drivers.

The following image depicts Customer 360 connecting the company’s many services and how each new cloud a customer adopts significantly increases average ARR versus a single customer. Also, notice that with each new cloud a customer purchases, the attrition rate or the rate at which customers leave the platforms decreases. This attrition rate reduction demonstrates that Salesforce has a switching costs moat that grows stronger with each new cloud its customers buy. Since Customer 360 makes buying additional clouds more valuable, it is vital in helping Salesforce build up a moat against competitors.

Salesforce 2022 Investor Presentation.

The above revenue growth drivers might be one factor why analysts project Salesforce to produce steady double-digit revenue growth over the next eight fiscal years instead of revenue declining to its terminal growth rate. The chart below shows the company’s revenue projections out to FY 2033.

Although Salesforce may be on the edge of finding it more difficult to find large markets in which to invest where it can get a bang for its buck, there is still more juice it can wring out of its existing opportunities.

A focus on increased profitability

Salesforce’s management seems to understand approximately where the company is in its growth cycle, so it has shifted its strategy from pure growth to growth and profitability. The company first introduced the idea of increasing efficiency and profitability at its Investor Day 2022. In their Investor Day presentation, management highlighted significant opportunities to drive leverage in Sales and G&A (General and Administrative) by FY 2026 (calendar year 2025). The following image lists the operating leverage drivers in Sales.

Salesforce 2022 Investor Presentation

As the above image shows, management planned to drive sales efficiency by diversifying its sales channels, relying more on partner-led sales, and using self-serve. This move could reduce the need for a direct sales force, lower customer acquisition costs, and increase productivity. Salesforce also intends to improve sales rep productivity by improving its “Land & Expand” sales model. A “Land & Expand” is when a salesperson “lands” an initial deal with a customer to get their foot in the door, delivers excellent post-sales service, and forms a positive relationship with the customer, making it easier to upsell or cross-sell additional products to the customer. The theory behind this sales model is that it takes less effort and costs less to upsell or cross-sell to existing customers than to make the original sale to a new customer. The most successful software-as-a-service companies successfully sell to existing clients, resulting in lower customer acquisition costs, increased average revenue per user, improved operational efficiency, and higher margins.

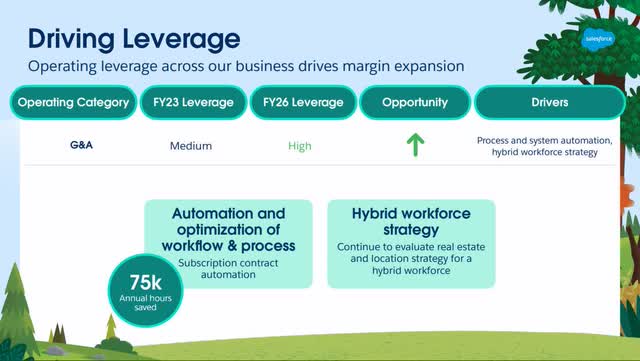

The image below outlines some of Salesforce’s key strategies for driving operational efficiency and cost savings within G&A. Through automation, management plans to reclaim 75,000 annual work hours, reduce labor and administrative costs, streamline processes, and boost overall productivity. Additionally, by adopting a hybrid work model, management can potentially reduce the need for office space, minimize travel expenses, increase the talent pool beyond geographical boundaries, and foster a more engaged and productive workforce.

Salesforce 2022 Investor Day Presentation

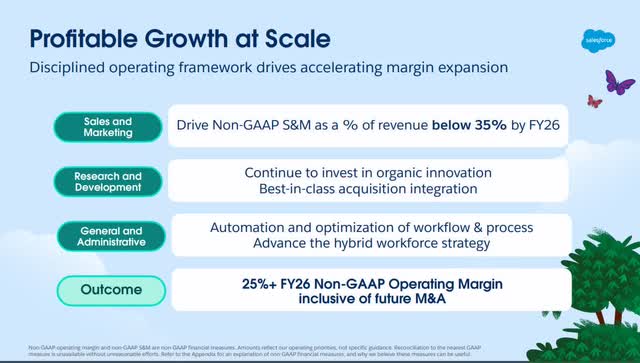

The company’s numerical goals were to achieve non-GAAP (Generally Accepted Accounting Principles) S&M (Sales and marketing) as a percentage of revenue of 35% and a non-GAAP operating margin of +25% by the end of FY 2026. At least that was management’s goal as of Sep 21, 2022, the date of the Investor Day Presentation. Management subsequently moved up the timeline for achieving the goals in the image below.

Salesforce 2022 Investor Day Presentation

Only six months later, on the company’s fourth quarter FY 2023 earnings call held on March 1, 2023, CEO Benioff said:

Six months ago, in September at our Dreamforce Investor Day, we shared with you our comprehensive transformation plan, the new day for profitable growth. But things have changed. As we entered our fourth quarter, we recognized that we needed to radically accelerate the transformation plan timeframe. We needed to press the hyperspace button and bring the 2-year goals forward quickly and exceed them.

Source: Fourth Quarter FY 2023 Earnings Call

The company appears to be serious about transforming. Management went outside the company and hired a consultancy company named Bain & Company to assess its internal operations and sales approach objectively. Salesforce’s board also established a business transformation committee, and the company has disbanded its mergers and acquisition committee, signaling that it may be far more selective in pursuing large strategic acquisitions and focus more on organic growth. The company’s board has also established a stock buyback program, which could support the stock price in the future. Part of the company restructuring also included laying off 10% or more than 7,000 workers in January 2023.

The acceleration of the company’s transformation has also resulted in sweeping changes to how it manages its sales teams. On the fourth quarter FY 2023 earnings call, Chief Operating Officer (“COO”) Brian Millham spoke on a few specific changes that had already occurred by the beginning of calendar year 2023, which included the layoffs comprising some of the sales team, changing the onboarding procedures of new salespeople, changing compensation structure toward profitability incentives instead of revenue or sales growth incentives, and more face-to-face interaction with potential customers. COO Millham said on the third quarter earnings call, “We’re inspecting every part of our business to find opportunities to drive efficiencies and reduce cost of sales, marketing, and G&A.“

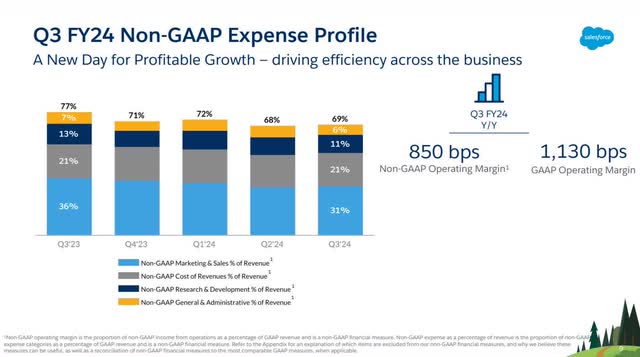

So, has the company’s focus on driving operating leverage resulted in more profitability? The chart below shows that management reduced all of the company’s operating expenses (OpEx) year-over-year, with S&M (Sales and Marketing) dropping 500 basis points, the largest OpEx reduction which dropped non-GAAP S&M as a percentage of revenue to 31%, below its target of 35% by FY 2026. Salesforce’s third quarter FY 2024 non-GAAP operating margin was 31.2%, up 850 basis points (“bps”) year-over-year. This number is already above its profitability goal of +25% by FY 2026. The company has already achieved some of its FY 2026 numerical goals. If the changes work as intended, Salesforce should gain many benefits, including becoming a leaner and more agile company with much more productivity, especially among its sales teams.

Salesforce Third Quarter FY 2024 Earnings Presentation.

You can also see the improvements in the GAAP operating margin, which was a record 17.21%, up 1,130 bps year-over-year. For years, Salesforce’s GAAP operating margin was in the single digits, occasionally drifting into unprofitability. The company also delivered GAAP diluted earnings-per-share of $1.25, up from $0.21 in the previous year. The company generated a third-quarter operating cash flow of $1.5 billion, up 389% over the prior year’s comparable quarter. Free cash flow (“FCF”) was $1.4 billion, up 1,088% over the previous year’s comparable quarter. The FCF margin on a trailing 12-month (“TTM”) basis was around 26%.

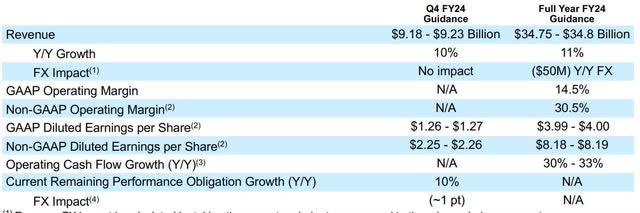

The following image is Salesforce forecasts for the fourth quarter and full year of FY 2024, which shows an FY 2024 non-GAAP operating margin of 30.5% while generating revenue growth of 11% year-over-year. So, the company has gotten off to a great start with its newfound focus on profitable growth.

Salesforce Third Quarter FY 2024 Earnings Release

However, before you go out and buy the stock, you should understand what could throw a monkey wrench into the company’s plans.

There are a few risks

Sometimes, when a management team reduces OpEx, it can result in a noticeable decline in revenue growth rate if they cut too much fat away from the bones. In Salesforce’s zeal to speed up its profitability plans, it may have cut back too far and quickly reversed itself. For instance, after laying off over 7,000 workers in January 2023, Salesforce hired 3,300 people in mid-September, with 40% of those people reportedly being part of the 7,000 previously laid off. If you decide to invest in this company, you need to continue to monitor whether Salesforce can maintain its cost reductions in a competitive market without revenue growth tailing off.

Monitoring the changes Salesforce has made to its sales team is also essential. Management’s decision to lay off salespeople, change the compensation structure, and change other aspects of the job could potentially lower employee morale and negatively impact the sales team reaching their sales targets if the company fails to implement mitigating countermeasures like improving training, support systems, and communication strategies.

Although the company produced stellar results in the last several quarters, it may be too early to assess the long-term success of its transformational changes. A prudent investor should continue to monitor and analyze Salesforce’s sales performance, employee morale, and overall organizational efficiency to determine whether the long-term impact of the company’s transformational changes is favorable.

Salesforce also has integration risk. The company has acquired over 60 companies, with many acquisitions occurring over the last decade. Creating a unified and intuitive user experience across multiple products and technologies while ensuring seamless data flow could make the ongoing integration task complex. Additionally, some Salesforce deals, like Slack, have critics saying that the company overpays for its acquisitions while chasing Benioff’s dream of $50 billion in revenue by fiscal 2026. Although the company has stated as part of its transformation that it is focusing more on organic growth, some are still concerned that it might pull the trigger on an ill-conceived deal.

Competition

According to IDC’s (International Data Corporation’s) Worldwide Semiannual Software Tracker at the end of 2022, Salesforce completely dominates the CRM industry with 22.1% market share compared to Microsoft with only 5.7% share and Oracle (ORCL) with only 4.7% share.

Although Salesforce may not be in danger of Microsoft or other players catching up in market share soon, the collective competition could potentially reduce the company’s revenue growth below analysts’ expectations. Since analysts generally use revenue growth forecasts as one tool to assess a company’s future earnings potential and stock price, maintaining high and steady growth may be needed to justify today’s valuation for Salesforce. Failing to meet expectations could negatively impact investor sentiment, and the stock price could fall.

Why it’s a buy

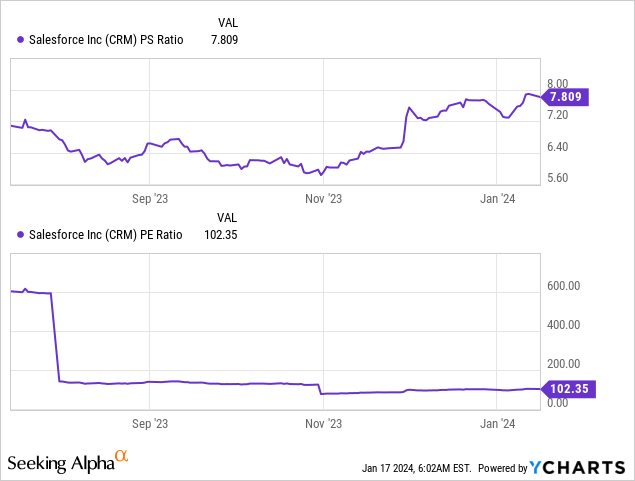

Salesforce trades at a price-to-sales ratio of 7.8 and a price-to-earnings ratio of 102. Based upon many traditional valuation ratios, the market may be overvaluing the stock; Seeking Alpha’s quant rates the stock’s valuation at a D+.

One traditional valuation ratio where Salesforce shines is the price/earnings-to-growth (“PEG”) ratio, which comes in at 0.12, compared to the sector median of 1.11. The forward PEG ratio is 1.33 compared to a sector median of 2.02. Analysts expect the company’s earnings to grow at 26.77% over the next five years. Another ratio to look at is price-to-FCF, which is 30.07 as of January 16, 2023, well below historical averages for the last 10 years. Considering that the company has raised FCF margins from around 22% in calendar year 2019 to a 26% TTM FCF margin today and has only started its margin improvement campaign, the market may be undervaluing the stock, especially if it continues improving FCF margins.

Let’s do a reverse discounted cash flow (“DCF”) to see what FCF growth rates the market assumes at the current stock price.

Reverse DCF

|

The third quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$8,812 |

| Terminal growth rate | 2% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 13.6% |

| Current Stock Price (January 16, 2024, closing price) | $269.19 |

| Terminal FCF value | $32.171 billion |

| Discounted Terminal Value | $155.029 billion |

If Salesforce can maintain low double-digit revenue growth, an FCF growth rate of 13.6% at a TTM FCF margin of 26% should be achievable.

Microsoft, which has other components to its business besides its software, currently has a TTM FCF margin of 28.96%. Adobe (ADBE), a pure software company, has a TTM FCF margin of 35.75%. Assuming that Salesforce can increase its FCF margin to 30% within the next few years, my fair value for the stock is $311.26.

Watch Salesforce revenue growth rates and FCF margin if you decide to invest. If it can maintain steady, low double-digit revenue growth and continue growing FCF margins, it could surprise the market, followed by an increasing stock price. Considering that the overall economy and the market for cloud services should improve over the next several years, I rate Salesforce as a Buy for growth investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.