Summary:

- I reiterate my “Buy” rating on Salesforce due to its robust financials, AI integration, and international expansion, despite a recent 14% price increase since my 1st call.

- Salesforce’s Q2 FY2025 results show 8% revenue growth and 15.5% non-GAAP operating income increase, highlighting its ability to exceed expectations amid economic challenges.

- The company’s AI initiatives, like Agentforce and Einstein Copilot, position it as a leader in AI-powered enterprise solutions, promising significant future growth.

- Despite some analyst downgrades, Salesforce’s strategic focus on AI and strong financial health justify a medium-term target price of $311 per share.

John M. Chase

My Thesis Update

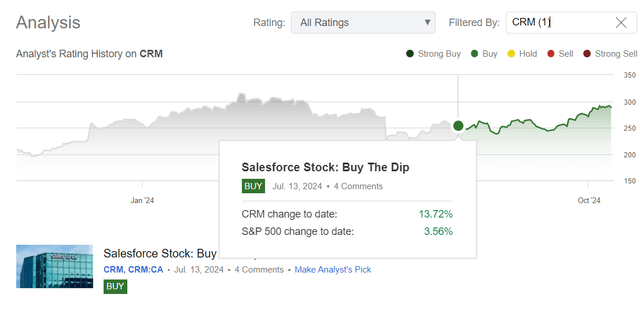

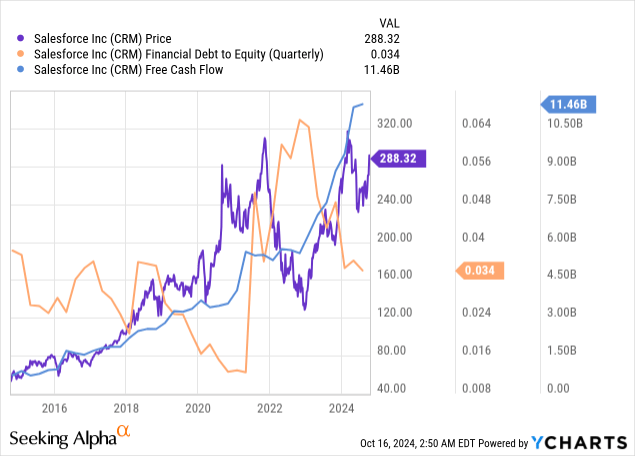

I initiated my coverage of Salesforce, Inc. (NYSE:CRM) stock here on Seeking Alpha about 3 months ago (in mid-July 2024) with a “Buy” rating, calling to buy the dip in CRM’s dip at the time as the firm’s revenue growth and margins looked stable, with “potential for future growth through AI integration and international expansion.” As history has shown, my call has aged quite well on both a relative and absolute basis:

Seeking Alpha, Oakoff’s coverage of CRM stock

However, I believe that this price increase of almost 14% is still a long way from what CRM is really capable of. In my view, the recovery should continue as the company continues to grow – as a leading provider of cloud-based customer relationship management solutions (hence the ticker name – CRM), Salesforce should continue to rapidly grow both its revenue and key margins, relying on strong industry tailwinds. I reiterate my “Buy” rating again this time.

My Reasoning

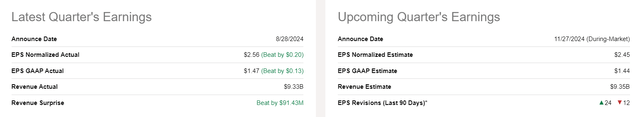

Salesforce reported great results for its fiscal Q2 FY2025 with revenues coming in at $9.33 billion, an increase of 8% YoY; this increase, though marginally lower than the 11% that was seen last year, was trimmed by a negative FX pressure of about one percentage point. Service Cloud was the fastest growing segment with 10% growth and Marketing and Commerce had 6% growth. Anyway, the company topped revenue guidance by $75 million and consensus expectations by $91.4 million, demonstrating its capacity to beat expectations amid a tough economy. Non-GAAP operating income increased a stunning 15.5% to $3.14 billion, and so the EBIT margin improved by 210 basis points YoY to 33.7%. That’s due to Salesforce’s “constant re-engineering and pricing initiatives”, an indicator of a strategic focus on improving profitability in the midst of weakening revenue growth rates. As a result, CRM’s non-GAAP diluted EPS increased 21% from the previous year to $2.56, beating the consensus quite meaningfully and underscoring the focus on cost efficiency at the company.

The company’s results were undeniably strong, yet the market’s reaction has been somewhat ambiguous: A significant portion of analysts – approximately one-third – have collectively lowered their forecasts for the next quarter (Q3 FY2025, set to be released in late November 2024).

It’s not that hard to say what caused those negative revisions. As I can see, Salesforce’s remaining performance obligation (RPO), which predicts future revenues, increased 10% YoY, reaching $26.5 billion – that was slightly higher than expected, according to Argus Research’s note (proprietary source, September 2024). On the other hand, this rate of growth has slowed from 12% last year and shows the slowed pace of the sales pipeline growth. The company’s fiscal Q3 FY2025 guidance expects a further decline in cRPO growth to 9% from 14% in the same quarter last year, indicating cautious optimism about future revenue prospects. I think this is the key to understanding the negative revisions.

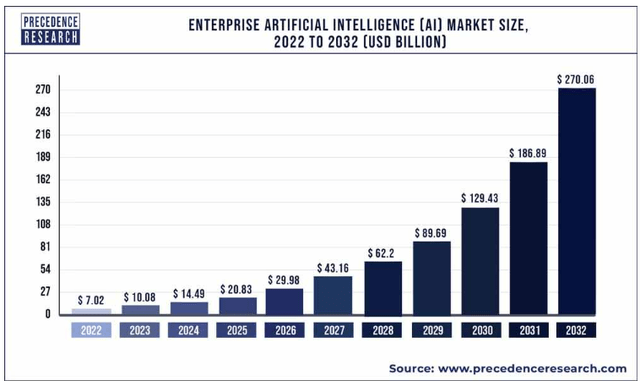

However, CRM’s management seems to be gleeful for the future, as it is energized by AI’s potential to revolutionize everything. The CEO Marc Benioff announced Agentforce – a new solution for adding autonomous AI agents to Salesforce, that should “enhance productivity and drive revenue growth by automating workflows and augmenting human capabilities”. The company is positioning itself as a pioneer in AI-based enterprise solutions and intends to expand Agentforce to various industries. I think they can ride this AI tailwind for quite some time, as the overall enterprise AI market is expected to grow at a CAGR of 44.1% over the next ten years, according to Precedence Research.

At the recent Deutsche Bank investor conference (proprietary source, October 2024), Salesforce’s executives discussed Agentforce’s pricing, with the goal of delivering customer usage and predictable spending through a mix of subscription and consumption. This is the way Salesforce operates — we can already see that in their Data and Commerce cloud deals. By the way, the Data Cloud remains Salesforce’s fastest-growing organic product and holds many opportunities, especially when paired with external unstructured data. This is not necessary for Agentforce but adds features such as mapping service agents to external knowledge bases. The CEO said there will be meaningful financial benefits more likely in FY2027 (in 2 years), and I think CRM will indeed see a boost to its growth because the customer data and metadata, which are part of the Atlas reasoning engine, add to its strengths and make the firm able to interact with its users and rationalize faster than other AI products.

The strategic AI focus of Salesforce is also on full display with the public launch of Einstein Copilot, an artificially intelligent assistant based on in-house data and tailored to customers’ requirements. This product along with Slack AI and Einstein GPT is part of Salesforce’s vision of deepening its AI capabilities and diversifying partnerships with the top AI companies such as Cohere, Hugging Face, and Anthropic.

At the same time, the last quarter showed that CRM stays well-financed on a balance sheet and cash flows; its operating cash flow was $892 million (up 10% YoY). I think this cash-flow growth is evidence that Salesforce is keeping its financial house in order, and has been able to create cash from operations, which helps with future expansions and to keep the company in a solid financial position.

Amy Weaver’s departure as CFO at the end of fiscal year 2025 is a significant leadership transition (she has led Salesforce’s financial revolution, leading to record margins and operational excellence). A new CFO search is underway, and the board is looking for a new addition who will “continue to build on Weaver’s work and fuel Salesforce’s long-term growth plans.” I see minimal risk here – it’s just a regular corporate action, nothing to worry about, in my opinion.

Salesforce’s roadmap is focused on leveraging AI for innovation and customer success. For the near future, Salesforce forecasts revenue between $37.7 and $38 billion in FY2025 (this calendar year), and subscription and support revenue growth rates of about 10-20% in constant currency over the prior year. The company also increased its non-GAAP operating margin guidance to 32.8%, which is up 230 basis points from last year, and its operating cash flow guidance to 23-25% over the previous year. They’re also going to scale their Agentforce platform to allow companies to rethink their operations and incorporate AI agents in their processes – I think this step should provide more growth to the top-line figure.

Overall, I like CRM’s AI strategy: Coupled with a robust financial picture, and an emphasis on customer trust and innovation, it makes Salesforce well-positioned for continued success and market dominance in the enterprise software space.

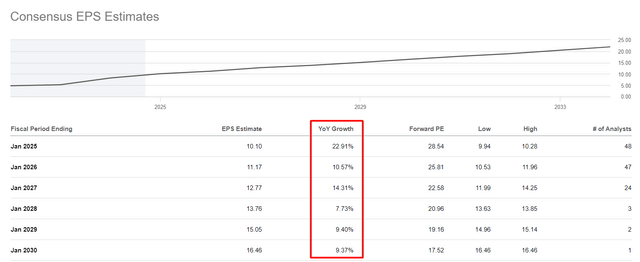

I believe the market might be underestimating the company’s growth prospects by projecting only an 8.5% long-term growth in its EPS over the next 6 years:

Seeking Alpha, CRM, Oakoff’s notes

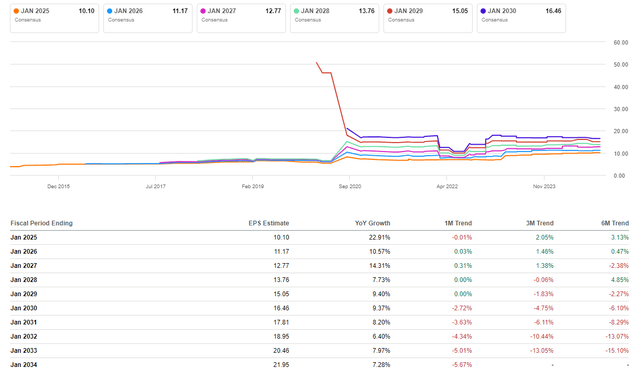

Perhaps the market forecasts back in 2020 were too optimistic in terms of long-term earnings growth rates. Nevertheless, I believe that the stagnation of estimates in recent months is not in line with Salesforce’s actual growth rates, especially in terms of margin expansion. In other words, the company is actually quite actively improving its profitability, yet Wall Street continues to adjust its long-term net earnings per share forecasts downward – this seems completely logical to me.

Seeking Alpha, CRM’s earnings revisions

It’s clear that the growth rates of 20-30% expected 5-6 years ago are no longer realistic. However, this doesn’t mean that the company won’t be able to achieve profit growth over the next six years, which exceeds the current forecast of around 8.5%. In fact, I believe that the growth rate is likely to be significantly higher given the initiatives that management has put in place – these include both cost control measures and the development of new sales services and products.

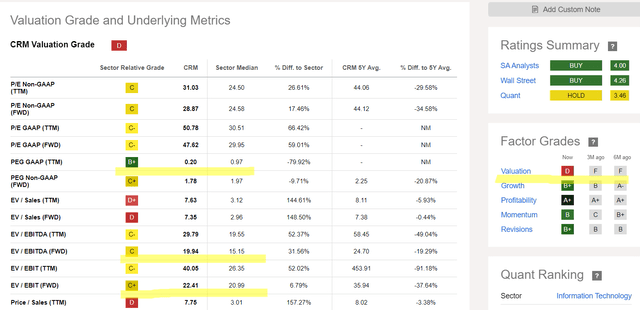

Regarding the company’s valuation, I’ve noticed a significant improvement over the past three months. According to Seeking Alpha Premium data, CRM’s Valuation grade was at an “F” level 3 months ago, but it has now improved to a “D”. The PEG TTM ratio of 0.20x is considerably lower than the industry average of 0.97x. While this indicator is expected to increase in the future (based on the FWD ratio), I believe it might not fully capture the company’s potential, especially given how frequently Salesforce exceeds analysts’ forecasts. Looking ahead to next year, the company is projected to align more closely with industry medians based on EV/EBITDA and EV/EBIT. However, CRM’s Growth grade relative to the sector is at a “B+” level, so the small valuation premium the company holds today seems more than justified by its accelerated business growth.

If the company beats the consensus expectations by 5% in terms of EPS for FY2025, then following Peter Lynch’s formula of finding the fair value of a stock (EPS growth over EPS figure), CRM should be worth $311/share by the end of this year (8% higher than today’s price, but it’s a great upside on an annualized basis). So let this be my medium-term target price for CRM stock.

Risks To My Thesis

As always, there are some areas where it might be problematic for my bullish thesis to age well.

First, the market’s reticent view of Salesforce’s prospects (in particular, its RPO) tells us that analysts are clinging to the sales pipeline. The company’s expectation that cRPO growth will be further flattened to 9% for the coming quarter means that revenue growth could slow somewhat – if Salesforce fails to reverse this trend, it may impact the business’s ability to deliver on or surpass long-term growth targets and will potentially see its price drop from here.

Second, Salesforce is aggressively marketing itself as an AI-enabled enterprise platform provider, but major monetary benefits from these efforts are not expected to occur before FY2027. This long-term outlook may result in investor patience if the growth projections are not sooner.

Third, AI is constantly changing and Salesforce needs to evolve continually to stay ahead of the curve. So any missed or delayed adoption of AI products will slow down the revenue and profit improvement promised.

Fourth, the change of management following the departure of the CFO Amy Weaver could be unpredictable. Any departure like this can’t help but impact investor confidence.

Furthermore, while Salesforce is now worth a higher price due to expectations of solid growth, valuation remains a problem. The price target I’ve arrived at today may be insufficient for many aggressive investors (although I must say it doesn’t take into account some out-of-consensus factors that could drive the stock much higher than we might imagine).

Your Takeaway

Despite the risk factors mentioned above, I believe Salesforce remains a compelling investment opportunity, driven by its strategic focus on AI integration and international expansion. The recent 14% price increase is far from all CRM can show shortly: I believe it has significant room to keep growing, supported by stable revenue growth and improving margins. Salesforce’s strong Q2 FY2025 results – including 8% higher revenue and 15.5% higher non-GAAP operating income – show that the company can continue to exceed its goals despite a volatile economic backdrop. Its projects – including Agentforce and Einstein Copilot – establish CRM as a market-beating AI-powered enterprise solution provider ready to capitalize on the explosive AI market. Some Wall Street analysts have cut estimates but, to me, this is a temporary divergence from Salesforce’s actual progress and promise.

Salesforce’s financial picture, along with an explicit plan to adopt AI, is strong and well-equipped to maintain growth and market leadership – justifying my “Buy” rating and my conservative medium-term target price of $311 per share.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.