Summary:

- Salesforce stock has silenced its doubters as it has outperformed the market markedly since June 2024.

- Agentforce’s rollout and its focus on practical AI applications have improved the market’s confidence in Salesforce’s ability to monetize AI.

- Salesforce’s data cloud offers the company proprietary advantages against its smaller AI peers.

- However, the surge has also lifted its valuations markedly higher, leaving less room for disappointment.

- I explain why it’s timely for me to step back into the sidelines as we await another more attractive buying opportunity.

John M. Chase

Salesforce: Brushed Aside The Market’s Worries

Salesforce (NYSE:CRM) investors who braved the market’s pessimism in June 2024 have been rewarded. The stock of the leading enterprise SaaS company has outperformed the market significantly since then. As a result, it has also vindicated my upgrade in my previous CRM article, even as investors were concerned with the potential AI monetization risks.

Accordingly, the market’s attention has also turned to software stocks over the past six months. Therefore, the market has “quietly” reallocated from semiconductor stocks (SMH) (SOXX), helping peers represented in the iShares Expanded Tech-Software Sector ETF (IGV) to outperform significantly. Hence, it’s increasingly clear that the market seems more optimistic about the monetization growth prospects of the leading SaaS companies as investors seek to benefit from the next growth wave in AI.

As a leading enterprise software leader, Salesforce is well primed to leverage its scale and market leadership across its multi-cloud strategy. Hence, CRM’s market outperformance didn’t surprise me. Coupled with its solidly profitable business model and ability to benefit from its highly scalable data cloud, CRM deserves the valuation re-rating as the stock surged to a new high in November 2024.

Salesforce’s Confident Move Into AI Agents

Salesforce will deliver its Q3FY2025 earnings release on Dec. 3. Investors are likely excited by the recent rollout of its Agentforce platform, underlining Salesforce’s strategy in deploying autonomous AI agents. CEO Marc Benioff indicated that the company is focused on pursuing “practical applications” in leveraging the power of Generative AI. It has also recognized the limitations of depending on customers building their AI applications or models, affecting the adoption of Gen AI. As a result, Agentforce represents Salesforce’s critical push to accelerate the rollout of “useful” AI agents across several industry verticals, allowing the company to capture market share rapidly. Given the robust results ServiceNow (NOW) posted in October 2024, I assess that the market has likely lifted its optimism on CRM as we head into its pivotal fiscal third quarter earnings release.

I’m confident that the resurgence in CRM is likely justified as investors have turned more sanguine about the opportunities for Salesforce to benefit from the next phase in the AI growth inflection. Existing enterprise customers are expected to move from experimentation to deployment with CRM, underscoring Salesforce’s proprietary advantage underpinned by its data cloud. Moreover, Salesforce highlighted it could adopt consumption-based pricing models to mitigate the challenges affecting its typical per-seat pricing limitations. Salesforce’s holistic ecosystem of solutions is also expected to help companies leverage Gen AI more effectively. Hence, the thesis of losing market share to pure-play Gen AI businesses without the robust enterprise base of CRM seems overstated.

Salesforce: Margins Accretion Expected

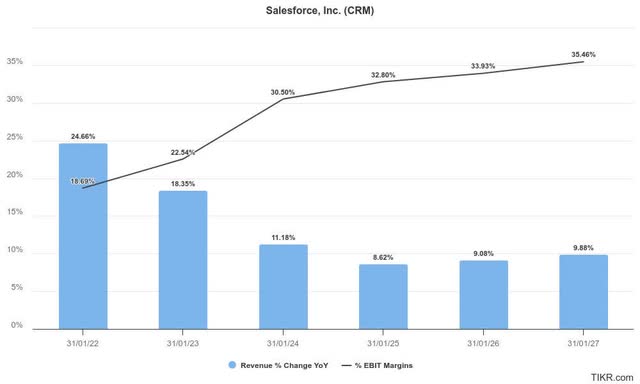

Salesforce estimates (TIKR)

Salesforce’s ability to improve operating leverage hasn’t been lost on analysts. Accordingly, Wall Street’s estimates on CRM have been upgraded, bolstering its confidence in the software leader’s ability to drive earnings accretion. Therefore, the market hasn’t been too concerned with the anticipated slowdown in topline growth as Gen AI is expected to help bolster the growth in its underlying profitability.

I assess that Wall Street’s optimism is apt as demonstrated by the company’s confidence in adjusting its pricing models to reflect the value of its AI solutions. Moreover, its proprietary data advantage should provide the company with an opportunity to demonstrate the efficacy of Agentic AI. Despite that, investors are urged to consider the impact of companies potentially diverting more spending to pure-play AI companies, affecting the growth prospects of Salesforce’s non-Gen AI products and services. Furthermore, the threat from Microsoft (MSFT) and ServiceNow could intensify, given the rapidly evolving Agentic AI landscape. However, the observed limitations of AI scaling have likely bolstered the prospects of Salesforce as leading LLM companies face more costly requirements to scale their AI models while facing the increasing prospects of diminishing returns in model training.

CRM Stock: No Longer That Attractive

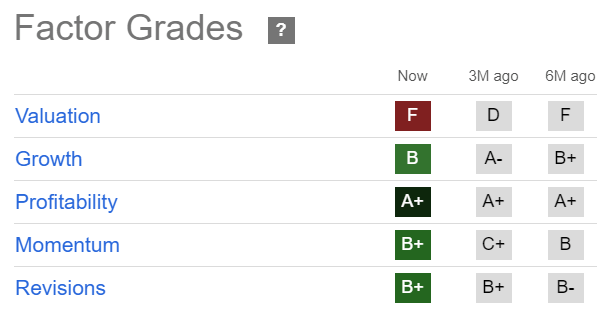

CRM Quant Grades (Seeking Alpha)

CRM’s “F” valuation grade corroborates the valuation re-rating thesis that has occurred over the past three months. In addition, the upgrade of its momentum grade (from “C+” to “B+”) highlights the market’s optimism in its bullish thesis.

CRM’s forward adjusted PEG ratio of 2.11 is more than 10% over its tech sector (XLK) median. Hence, the stock is far from overvalued, suggesting it remains a potential buy-on-pullback prospect. Despite that, it’s also clear that its valuation is much less attractive as compared to my previous update.

Is CRM Stock A Buy, Sell, Or Hold?

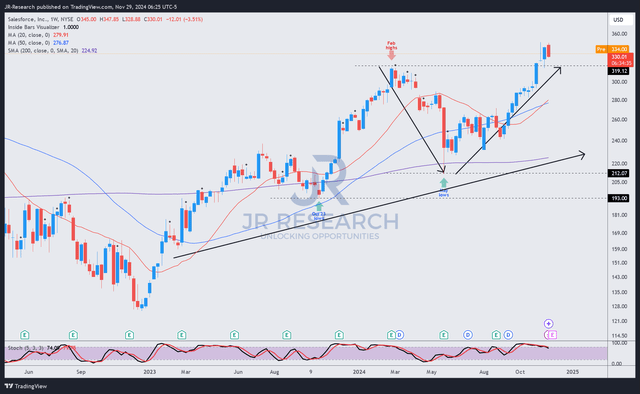

CRM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

CRM’s price action remains in a secular uptrend, corroborating its bullish thesis. The robust bottom at its October 2023 and June 2024 lows indicate the market’s confidence in buying CRM’s steep pullbacks. Members in my Investing Group (Ultimate Growth Investing) also capitalized in June 2024, as we loaded up at highly attractive levels.

The stock’s ability to take out new highs in November 2024 marks a significant turnaround from its June lows, although its momentum seems to be consolidating. While I’ve not assessed bearish signals on the stock, I believe it’s timely to turn more cautious, as the stock is also no longer assessed as undervalued. With the stock reaching overbought zones, investors should await another dip-buying opportunity before considering adding more aggressively.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM, SMH, MSFT, NOW, IGV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!