Summary:

- Salesforce stock remains well below where it traded just 2 years ago.

- Amidst a tough macro environment, management is guiding for 450 bps of margin improvement this upcoming year and 30% operating margins in 2 years.

- The company maintains a net cash balance sheet.

- After a valuation reset, the stock can finally be valued on the basis of earnings.

Steve Jennings/Getty Images Entertainment

To understand why tech stocks have seen a resurgence as of late, perhaps there is no better stock to study than Salesforce (NYSE:CRM). Amidst a tough macro environment which has pressured top-line growth rates, CRM has aggressively accelerated margin expansion plans with more gains in profitability expected moving forward. Management has paired such improvements with share repurchases in efforts to change the stock’s image towards one of profitable growth. Judging by the stock’s strong recent performance, it appears that these efforts are working. I reiterate my buy rating for the stock as the current strong fundamental performance may lead to long term multiple expansion.

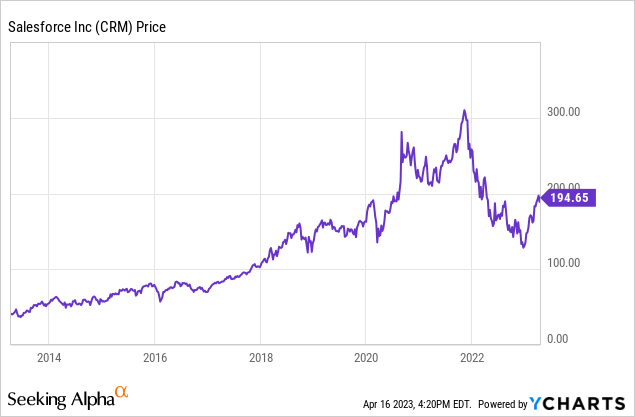

CRM Stock Price

CRM briefly dropped to 2018 levels before the latest rally helped it earn back some of those losses.

I last covered the stock in January where I rated the stock a buy due the activist involvement. The stock is up double-digits since then as the company undertook several shareholder-friendly actions.

CRM Stock Key Metrics

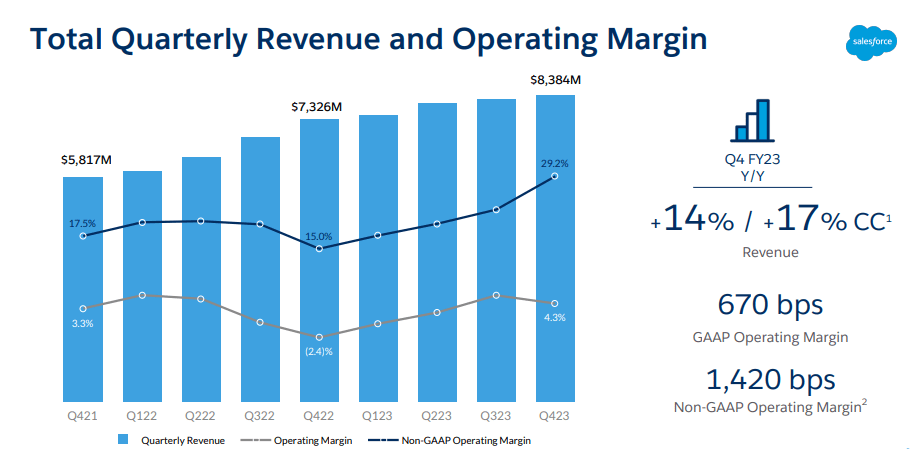

In its most recent quarter, CRM delivered 14% YOY revenue growth (17% constant currency), representing a sizable beat over management’s guidance for $8.032 billion in revenue.

FY23 Q4 Presentation

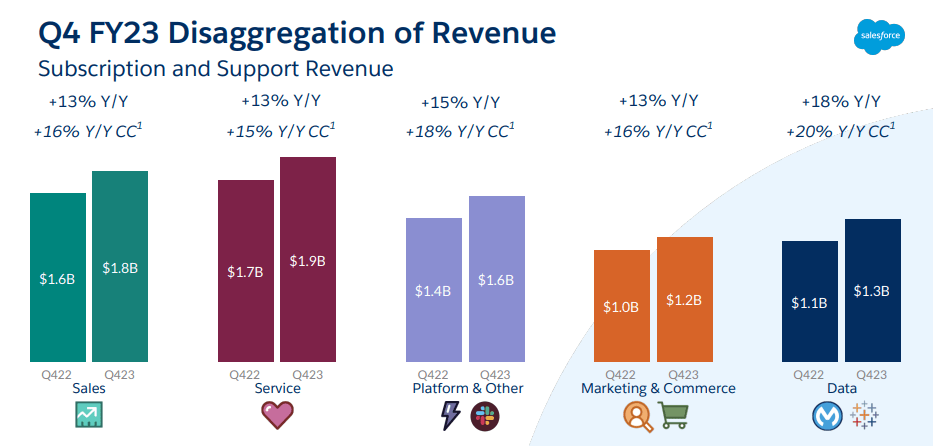

Slack did not help boost the company’s growth this quarter as growth in that segment decelerated meaningfully to 15% YOY, but the company saw improved fundamentals in MuleSoft and Tableau.

FY23 Q4 Presentation

With a 29.2% non-GAAP operating margin in the fourth quarter, CRM ended the year with a non-GAAP operating margin of 22.5%, significantly exceeding the most recent guidance of 20.7%. That 29.2% margin represented an astounding 1,420 bps of improvement year over year. Remember that this is supposed to be a tough macro environment?

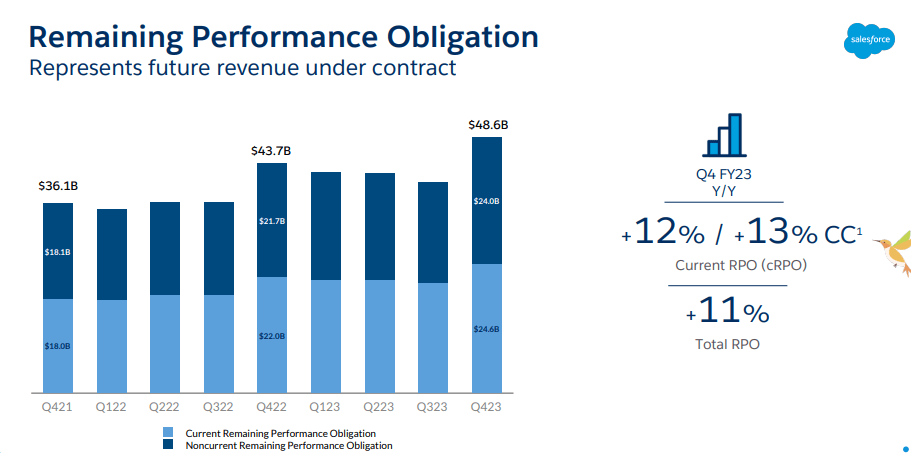

CRM grew remaining performance obligations (‘RPOs’) by 12%, suggesting that forward revenue growth rates should still hover in the low double-digits.

FY23 Q4 Presentation

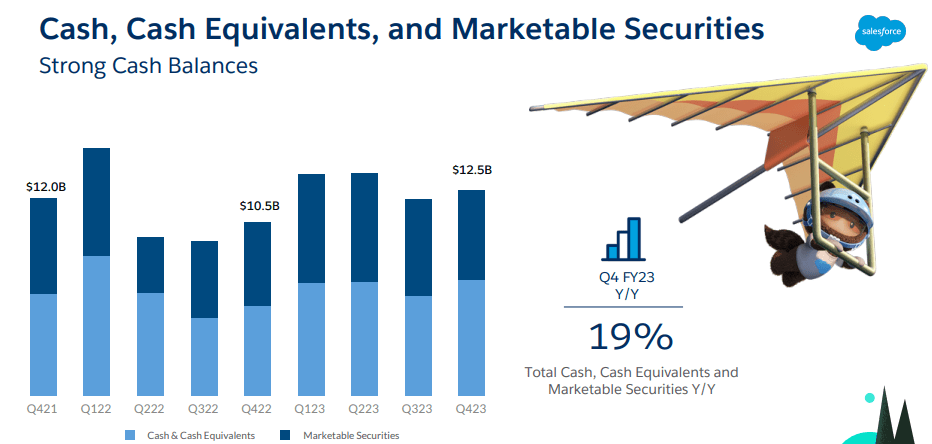

CRM ended the quarter with $12.5 billion in cash and marketable securities versus $10.6 billion in debt.

FY23 Q4 Presentation

The company repurchased $2.3 billion of stock in the quarter and managed increased their share repurchase authorization to $20 billion.

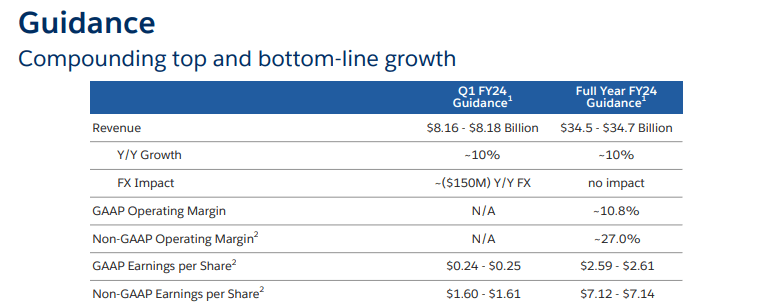

Looking ahead, management is guiding for 10% YOY revenue growth but the more shocking piece was the guidance for 27% non-GAAP operating margins, representing 450 bps of improvement.

FY23 Q4 Presentation

On the conference call, management noted that they had previously been guiding towards 25% margins by fiscal 2026, meaning that they are surpassing those targets 2 years early. Management is now targeting at least 30% non-GAAP operating margins for the first quarter of fiscal 2025. As usual, there is a great level of conservatism embedded in this year’s guidance, with management assuming that the elongated sales cycles that they have seen in recent quarters persists for the full year.

While management appeared to withdraw their guidance for $50 billion in revenues for fiscal 2026 due to “uncertain macro and currency environments,” I suspect that Wall Street was more than willing to overlook that on account of the impressive improvements to the bottom-line. When the stock was trading at high prices, Wall Street was looking for aggressive revenue growth. But after a valuation reset, Wall Street is now more focused on profits and CRM is showing that their tech business model gives them great control over profit margins.

Is CRM Stock A Buy, Sell, or Hold?

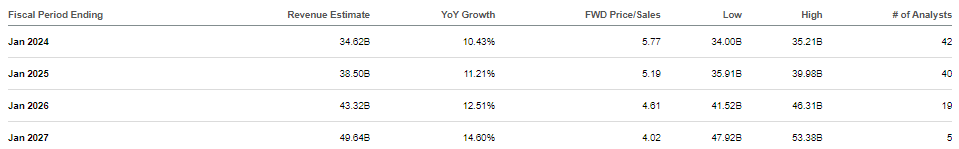

These strong improvements to profit margins could not have come at a better time. With consensus estimates for revenue growth dropping from the twenties to the low teens moving forward, CRM does not look cheap relative to peers with the stock trading at just below 6x sales.

Seeking Alpha

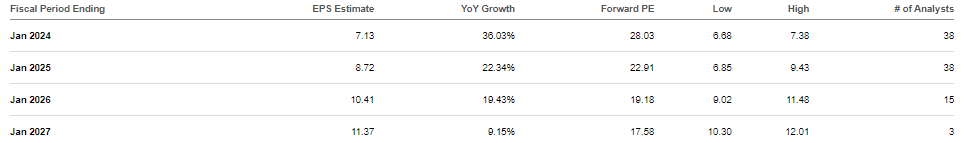

But on an earnings basis that valuation looks much more reasonable with the stock trading at under 30x forward earnings.

Seeking Alpha

I note that consensus estimates already have incorporated CRM materially missing on the prior $50 billion FY26 guidance (consensus estimates call for $43 billion in revenue) and are factoring in just 22% non-GAAP net margins for FY25 (as stated earlier management is guiding for 30% in the first quarter of FY25). I consider my prior target for 30% net margins over the long term to be conservative given management’s increased focus on profitability. Even using that same estimate, based on 13% projected growth and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see CRM trading at 5.9x sales, representing nearly 20% potential upside over the next 1.5 years. With CRM showing consistent margin expansion and buying back stock, I can see further upside to that target as the 1.5x PEG ratio may prove too conservative.

What are the key risks? While I am not surprised by the company’s ambitious margin expansion plans over the following years, I wouldn’t be surprised if top-line growth decelerates faster than consensus. CRM has arguably sustained an above-market growth rate over the past many years through costly acquisitions that gave it the image of being a “growth at any cost” type of company. While the sizable boosts to profit margins has successfully created the image of a profit-minded business, it may not be so easy to sustain fast top-line growth considering the size of the company. At the same time, I could also see CRM seeing some strength due to their wide product portfolio as many tech names in my coverage universe have touted the advantages of complete offerings over point solutions.

An underappreciated risk may be that of the management team. I have found CEO Benioff to at times come off overly-promotional. In this latest earnings call he even stated that they are “making Salesforce one of the most profitable software companies in the world with one of the highest cash flows and one of the very largest as well.” I can’t shake off the nagging feeling that Benioff is overly focused on helping the stock to sustain a premium multiple relative to peers in order to always leave open the possibility for all-stock M&A. Finally, while CRM has seen some relative strength as of late, it is possible that Wall Street begins to give less credit to non-GAAP margin targets which may lead to substantial volatility for the stock price. I continue to position ahead of a tech sector recovery with a strategic basket of undervalued tech stocks, and CRM fits right in such a basket due to its profitable secular growth profile. I reiterate my buy rating for CRM on account of the high potential for margin surprises.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!