Summary:

- Salesforce’s significant growth and AI adoption justify a ‘Buy’ rating, supported by robust CRM market leadership and impressive gross margin expansion.

- Despite slowing sales growth, Salesforce’s gross margins are improving, with AI products like Einstein AI driving future profitability and efficiency.

- Salesforce’s valuation is attractive, trading at a moderate P/E multiple compared to competitors, with substantial profit growth expected in 2025.

- Share repurchases and AI advancements position Salesforce as a top investment for 2025, offering compelling value for CRM customers and investors alike.

John M. Chase

The stock price of Salesforce Inc. (NYSE:CRM) fell on Wednesday, in-line with the broader market, after the second quarter sales forecast for Micron Technology Inc. (MU) took investors on a sharp dive lower.

Concerns about interest rates also added to this week’s jittery cocktail, pressuring stock market valuations across the sector spectrum.

In my last piece on Salesforce, I pointed to the software company’s considerable growth as a main justification for my ‘Buy’ stock classification.

With that said, though, Salesforce profits from AI adoption in its main CRM business that could help the software company grow its sales and gross profits more quickly in the coming years.

Salesforce also still has a very compelling valuation, and the company is repurchasing a lot of shares in the market.

Impressive Gross Margin Expansion

Salesforce is a leading company in the market for cloud-based customer relationship management software. Salesforce helps companies improve their customer service experience through streamlining sales and customer engagement processes.

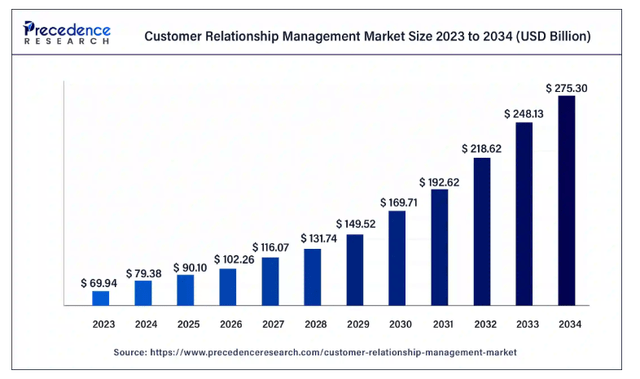

Managing sales flows and customer experience is big business, and the CRM market is anticipated to keep growing at a fast rate in the coming decade.

Precedence, a market research and consulting company, has published estimates for growth in the CRM market that indicate sustained growth for Salesforce and other software providers.

Based on these estimates, companies operating in the CRM market and investors who buy their stocks, can anticipate average per annum market growth of 13%.

Customer Relationship Management Market Size (Precedenceresearch.com)

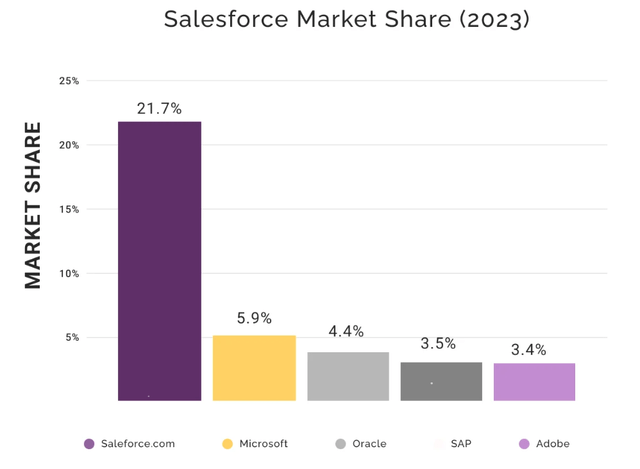

Salesforce dominates the market for CRM applications and has a market share, as of 2023, of 21.7%, substantially more than any of its competitors which include companies like Microsoft Corp. (MSFT), Oracle Corp. (ORCL) or SAP SE (SAP).

Salesforce Market Share (Salesforce Inc.)

The biggest asset that comes with an investment in Salesforce is that the software company is extremely profitable on a gross margin basis, a metric that I anticipate will be able to continue to grow now that Salesforce is seeing results from its heavy AI spending in recent years.

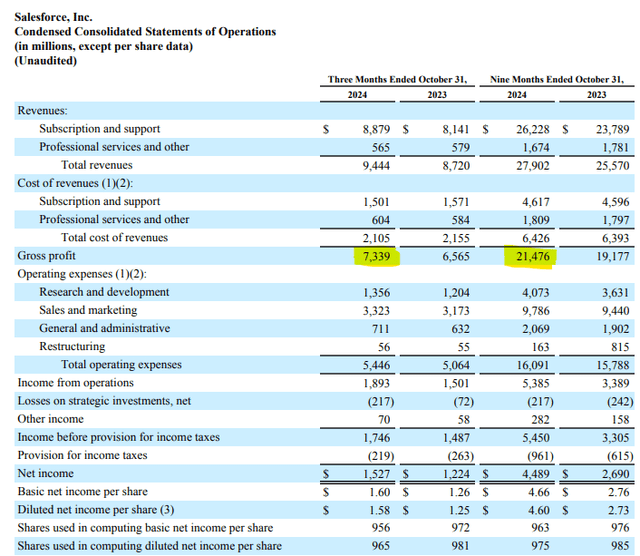

Salesforce had sales of $9.4 billion in the last quarter (ending in October), reflecting 8% YoY growth. However, because Salesforce is a leading company in the CRM market and has considerable scale, the company has positive operating leverage: Its gross profit, a major KPI for software businesses, rose 12% YoY, about 50% faster than sales.

Salesforce’s gross margin, as of October 31, 2024, was 78% compared to 75% in 3Q24, so despite slowing sales growth, the CRM company is actually producing better profitability.

On a YTD-basis, Salesforce had a gross margin of 77% this year compared to 75% next year. A catalyst for higher gross margins could come from the deployment of AI products moving forward.

Gross Profit (Salesforce Inc.)

Salesforce’s CEO, Marc Benioff, said on the last earnings call that the company was seeing traction with its artificial intelligence products, such as its AI chat-bots that help companies enhance the customer experience while saving costs for customer service staff.

Einstein AI is key to Salesforce’s growth and a generative artificial intelligence tool that allows companies to leverage Salesforce’s existing software platform. It can help companies speed up software development and increase efficiency and productivity.

Einstein AI is Salesforce’s main AI product, and the company just announced that it is hiring 2,000 more people to push its AI suite to corporate clients. The push to hire more people is likely inspired by favorable AI chatbot adoption within Salesforce’s business so far.

AI products, particularly Einstein AI, could therefore be catalysts for Salesforce to grow its gross margins in 2025, a main reason to buy the stock, in my view.

With Salesforce also being as profitable as it is, the company has potential for more share repurchases. Salesforce authorized $30 billion in share repurchases, of which $20 billion were already completed. The remaining $10 billion are likely to get executed by the end of the next year, so in 2025 we could see the authorization of a new share repurchase program.

Salesforce Is Too Cheap For Its Growth

The main thing that I think stands out with Salesforce is that the software company is growing, has a very robust market position as the leading CRM brand, but is still moderately valued.

After Salesforce reported 3Q25 earnings, the stock shot up and reached a new 52-week high at $369, suggesting that the market has not been optimistic enough about Salesforce’s potential for sustained growth in the market for CRM software.

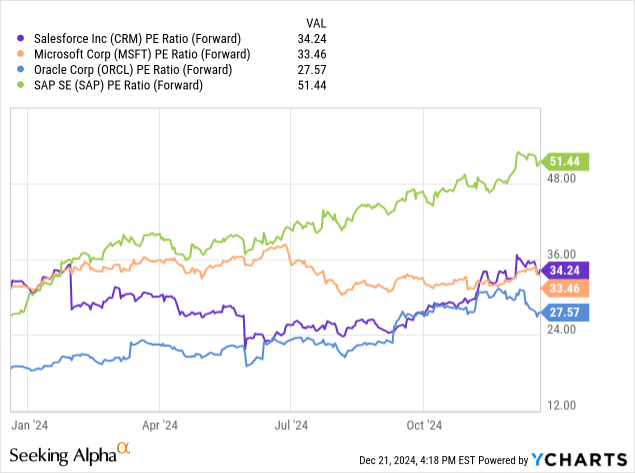

Salesforce is presently selling at a 2025 profit multiple (P/E) of 34.24x which is not a particularly high multiple for market leader in its niche for customer relationship management software.

Salesforce is also anticipated to see substantial profit growth as it scales its CRM platform and brings to market new AI tools, such as agent force 2.0 (in 2025), leading to 22% expected growth in earnings this year and 12% next year.

Salesforce is not the only company offering CRM software and it competes with a slate of high-profile productivity platforms like Microsoft, Oracle and SAP. Microsoft is selling for a 33x 2025 profit multiple, Oracle’s stock changes hands for 27x next year’s earnings and Germany-based SAP costs 51x 2025 profits.

Salesforce, however, is the leader in CRM solutions and with AI has a potentially potent catalyst in its business and more share repurchases on the horizon, my preferred productivity investments is Salesforce.

Why Investors Might Get Disappointed

Salesforce does not have a rich valuation multiple, taking into account that it is consistently growing in its main business and that AI could only help to accelerate the company’s growth.

Fundamentally speaking, Salesforce is seeing slowing sales growth in its main business, which is something investors need to be aware of. Yet, Salesforce exhibits impressive profitability in terms of its gross margins, which are growing.

Falling gross margins, on the flip side, would be a major potential concern for me, as it would slow AI adoption in 2025.

My Conclusion

Salesforce is a compelling software growth investment as the company is seeing solid sales growth and, more importantly, growing gross margins.

Expectedly, artificial intelligence is becoming a growth engine of Salesforce’s business as companies are clearly open about trying out and adopting Salesforce’s AI tools.

Salesforce’s Einstein AI helps companies bring products to market faster while cutting down costs, which translates into a compelling value proposition for the platform’s CRM customers, and by extension for investors of Salesforce.

With AI development accelerating, more share repurchases on the horizon and a moderate valuation, I think Salesforce could be a top investment for 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.