Summary:

- Salesforce’s Co-CEO Bret Taylor is set to leave Salesforce by the end of January 2023. We explain why it’s a significant loss for the company, given his responsibilities and influence.

- Therefore, Co-CEO Marc Benioff needs to restructure expeditiously with the right A-team to help Salesforce recover its growth cadence. However, Wall Street analysts seem unconvinced.

- Despite that, investors need to ask whether CRM’s valuation has reflected significant pessimism, despite the lack of robust GAAP earnings for now.

- Maintain Buy with a PT of $170.

JHVEPhoto

Thesis

Salesforce, Inc. (NYSE:CRM) has dominated the headlines for Cloud SaaS companies over the past week. After the company announced outgoing Co-CEO Bret Taylor would be leaving in late January at its recent Q3 earnings release, Tableau’s CEO and Slack’s CEO also announced their resignations in haste. Tableau’s CTO and two other senior executives from Slack also announced their respective exits.

The market has undoubtedly reacted negatively, given the flurry of departure of Co-CEO Marc Benioff’s senior leaders. Moreover, after Salesforce’s ambitious Dreamforce Investor Day in late September, the market had the right to be concerned. Taylor’s a technologist and is in charge of the company’s day-to-day running, as Benioff focused on other strategic roles. Hence, there could be some significant restructuring that Salesforce is compelled to execute, distracting its growth recovery priorities.

Coupled with the loss of Taylor’s technical and product leadership and expertise, we believe the recent de-rating after its Q3 release is justified. Benioff needs to get his house in order and help the company focus on reaching its FY26 targets telegraphed at Dreamforce.

We gleaned that the market sent CRM to re-test its October lows. As a result, CRM’s price action is getting increasingly close to its COVID bottom. Notwithstanding, CRM’s valuation has been battered, as it last traded at levels seen in March 2020. Hence, we believe significant pessimism has been priced in, even though its buying momentum toward a medium-term recovery has weakened considerably.

We remain optimistic about CRM’s medium-term recovery potential. But, we can no longer rule out a possible re-test of its COVID lows if the market anticipates more significant execution risks, given the company’s extensive restructuring exercise.

Still, we gleaned that the selloff has also sent CRM into oversold zones, with a potential mean-reversion opportunity in play.

Maintain Buy, with a new price target (PT) of $170, as we are less constructive about CRM retaking its August highs in the near term.

Why Taylor’s Exit Mattered?

There’s little doubt that Co-CEO Bret Taylor is a highly influential leader within Salesforce’s executive ranks and was seen as the heir apparent to Benioff. Moreover, even before the company elevated Taylor to the Co-CEO role, then-COO Taylor was already seen by employees as the “internal face” of critical company matters.

Taylor was also instrumental in laying “the groundwork” for the company’s Customer 360 strategy, which undergirds Salesforce’s current platform approach.

Moreover, Taylor honed his reputation as a “product-focused executive” who demonstrated his technical and product leadership in customer discussions. Relative to the more sales-focused Benioff, we believe Taylor’s product leadership at Salesforce could be missed. Also, Benioff appears to trust Taylor so much that many top executives in Salesforce reported directly to Taylor.

A leaked organizational chart viewed by Business Insider highlighted that Salesforce’s CFO, CTO, COO, and Slack’s CEO, were among 10 top executives reporting directly to Taylor. In contrast, Benioff had only two direct reports. As such, Taylor’s loss is significant to Salesforce’s current day-to-day operations, coupled with his technical prowess, dealing a considerable blow to Benioff.

What’s Next For Benioff And Salesforce?

Without a doubt, Co-Founder Benioff needs to step up and assume the day-to-day running mantle again, with the departure of Taylor after Salesforce concludes its FY.

The market and the Street are justifiably concerned whether Benioff’s FY26 target is still manageable with Taylor’s departure.

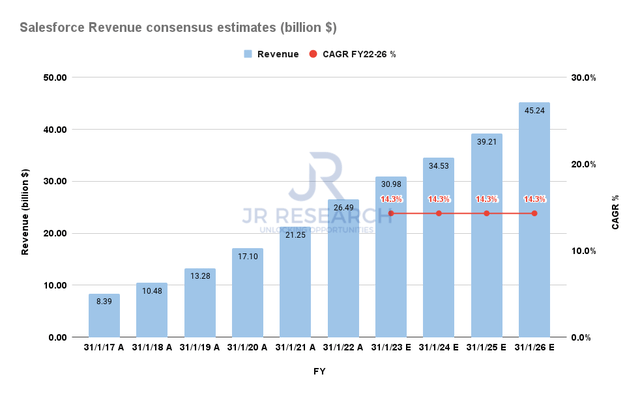

Salesforce Revenue consensus estimates (S&P Cap IQ)

As seen above, the Street expects Salesforce to underperform its FY26 revenue target of $50B. Notably, Wall Street analysts were already downbeat about the company’s prospects pre-earnings.

Furthermore, Salesforce highlighted notable challenges in enterprise deals leading to elongated sales cycles and deal values compression. Coupled with the uncertain impact and restructuring challenges from Taylor’s impending exit, analysts cut their estimates further through FY26.

As such, analysts’ revised revenue projections suggest a revenue CAGR of 14.3% from FY22-26, well below the company’s target of 17.2%. Hence, the bar has been lowered for Salesforce, suggesting that Benioff & his team have another opportunity to demonstrate its execution prowess.

However, with the market focusing on profitable growth moving forward for Salesforce, we believe the company’s challenges have intensified, which justified a de-rating.

So, the critical question is whether significant pessimism has been reflected.

Is CRM Stock A Buy, Sell, Or Hold?

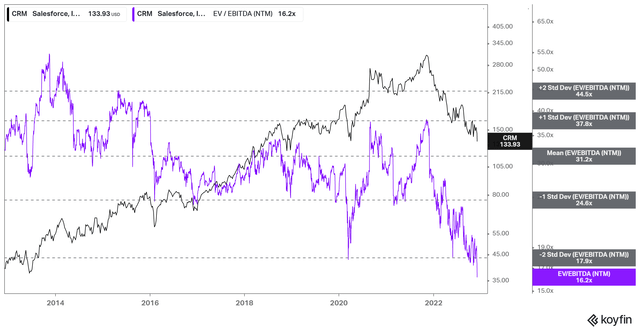

CRM NTM EBITDA multiples valuation trend (koyfin)

With the post-earnings selloff, CRM last traded at a NTM EBITDA multiple of 16.2, well below its 10Y average of 31.2x. However, it’s broadly in line with its SaaS peers’ median of 17.2x (according to S&P Cap IQ data).

| Stock | NTM EBITDA multiple |

| Microsoft (MSFT) | 17.4x |

| Adobe (ADBE) | 16.5x |

| ServiceNow (NOW) | 28.4x |

| Workday (WDAY) | 22.4x |

Selected peers’ NTM EBITDA multiples. Data source: S&P Cap IQ

However, with Salesforce reporting remaining purchase obligations (RPO) growth of just 10.2% in FQ3, down from FQ2’s 14.9%, we believe the market needed to de-risk its execution challenges.

Hence, Salesforce’s valuation likely needs to reflect a growth normalization phase relative to its other higher-valued peers. As such, it should trade closer to the valuations of Adobe and Microsoft, both of which have more robust GAAP earnings than CRM.

Therefore, we believe Benioff needs to demonstrate Salesforce can execute well before a material re-rating could be in store. But, investors need to be realistic and not expect the company to recover its 2021 highs anytime soon.

Maintain Buy, with a PT of $170.

Disclosure: I/we have a beneficial long position in the shares of CRM, MSFT, ADBE, NOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!