Summary:

- Despite weak FY2024 revenue growth, the company is expecting a 42% growth in adjusted EPS and a 550 bps expansion in non-GAAP operating margin.

- The company’s valuation appears more reasonable when considering forward-looking indicators, such as a P/E ratio of 28.4x, lower than Microsoft’s 34x and software industry average’s 44x.

- I’m bullish on the stock as the management’s focus on profitability over top-line growth is poised to yield long-term benefits for shareholders.

Stephen Lam

Investment Thesis

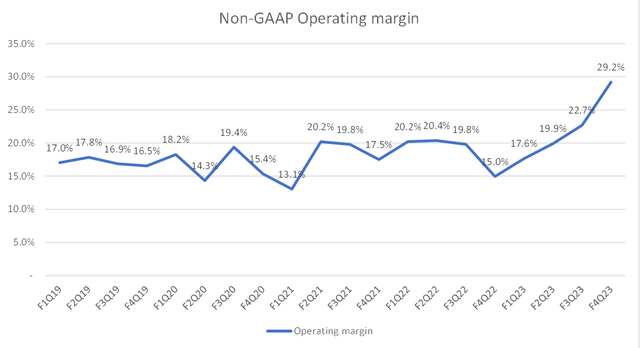

Salesforce (NYSE:CRM) is down 6% aftermarket due to a conservative FY2024 revenue outlook, despite better-than expected 1Q results. The company is renowned for its ability to generate added value through incremental synergies resulting from many M&A deals. Those acquisitions included Tableau in 2019 for $15.7 billion and Slack in 2021 for $27.7 billion. Despite facing fierce competition from Microsoft (MSFT) and Oracle (ORCL), CRM has achieved a top-line growth of 24% CAGR from FY2019 to FY2023. Furthermore, the company has improved its non-GAAP operating margin from 17.1% to 22.5% over the past four years, which demonstrates a consistent trend of demand growth and operational efficiency.

However, we should distinguish between CRM’s organic and inorganic growth, as investors are particularly focused on the company’s ability to maintain organic growth without relying solely on additional deals. I believe this is considered a key driver for expanding its valuation multiple in the long term. Recognizing this, the management has shifted their focus towards longer-term structural improvements as they have removed the M&A committee. With a renewed emphasis on organic growth and margin expansion, I hold a bullish outlook on CRM stock, as the company appears to be on the right track to benefit shareholders.

1Q24 Takeaway

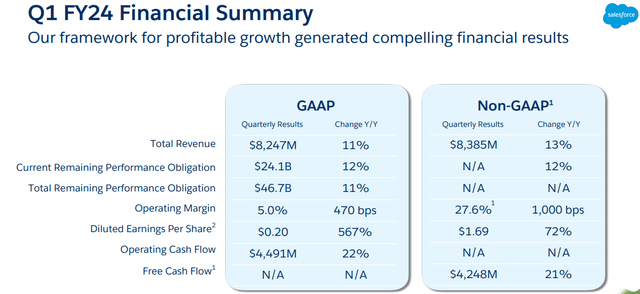

1Q24 Presentation

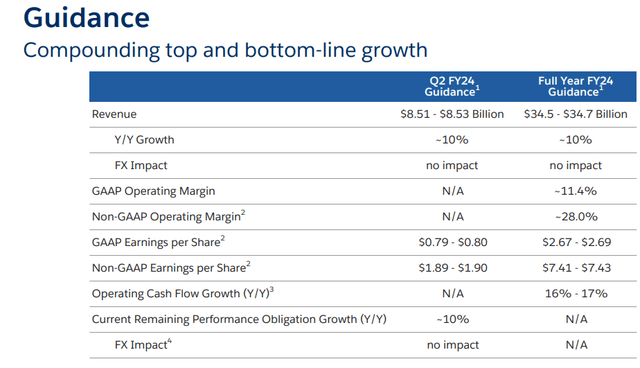

While CRM beat on both revenue and adjusted EPS in 1Q, the company didn’t raise its full year guidance, which disappointed investors. Instead, the company provided a mid-point FY2024 outlook of $34.6 billion, slightly below the street estimates of $34.65 billion, indicating a potential growth slowdown. The company’s 2Q revenue outlook is above estimates, which indicates a worsening growth outlook in 3Q and 4Q. However, investors should keep in mind that CRM is currently prioritizing profitability over top-line growth. I still see a positive sign as the company raised its non-GAAP operating margin to 28%, a significant improvement from 22.5% in FY2023. This will result in FY2024 adjusted EPS growing by 42% YoY, a significant acceleration compared to 9.1% YoY in FY2023. In the following sections, I will discuss the management’s priorities.

Prioritizing Margin Expansion

Company Model

During Investor Day in September last year, the CEO Marc Benioff demonstrated a high level of engagement and alignment with shareholders, particularly prioritizing profitability and FCF growth. The company’s current focus is on margin expansion, as evidenced by the significant improvement in CRM’s non-GAAP operating margin since 3Q FY2023, reaching a new high. The most remarkable achievement was the 650 bps QoQ improvement in the margin during 4Q FY2023, reflecting a strong dedication to enhancing operational efficiency. Furthermore, the management projects FY2024 non-GAAP operating margin to be 28%, implying an improvement of 550 bps YoY. However, it’s important to know that the company’s focus on profitability may result in a shift away from its top-line growth, which can be attributed to a disappointing FY2024 revenue outlook.

Key Growth Metrics

Company Model

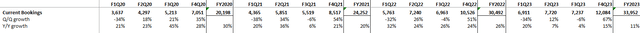

In the software industry, bookings play a crucial role as key growth drivers. Unlike revenue, bookings reflect additional contract value a company receives within a given period. It’s important to understand that bookings do not directly represent the revenue received from its customers in the current quarter. Bookings can be derived by adding change of remaining performance obligations from total revenue.

Company Model

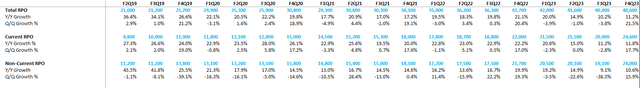

Remaining Performance Obligations (RPO) refers to the backlog of contracts that a company will fulfill in the future. These obligations can be converted into future billings, ultimately contributing to revenue generation. The management of Salesforce provides RPO and cRPO (Current Remaining Performance Obligations) numbers in its Earnings Presentation.

When analyzing CRM’s current bookings trend, which typically covers a period of less than 12 months, the change in current RPO is added to the total revenue. For instance, using the table as an example, the current bookings in 4Q FY2023 amount to $12,084 million. This figure is calculated by adding the dollar change of cRPO QoQ ($24,600 million – $20,900 million) to the total revenue of $8,384 million.

1Q24 Presentation

From the tables above, we can see that cRPO growth decelerated to 11.8% YoY in 4Q FY2023 compared to 22.2% YoY in 4Q FY2022, which was contributed by the slowdown on current bookings growth, which dropped to 11.2% YoY in 4Q FY2023 compared to 21.1% YoY in 4Q FY2022. This trend has translated into deceleration of revenue growth. However, in 1Q FY2024, cRPO grew 12% YoY, a slight improvement on a year over year basis from the last quarter. As mentioned earlier, the company is focused on margin expansion, which began to show significant improvement in 4Q FY2022 and reached to 27.6% in 1Q FY2024. Over the course of five quarters, the company achieved an impressive expansion of 12.6%. The company is expected to significantly improve its operating margin in FY2024.

Valuation

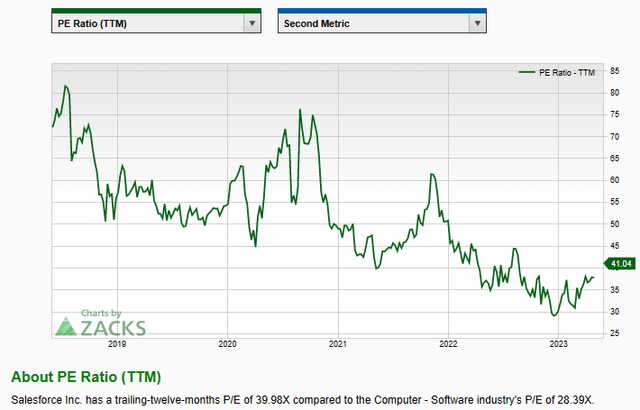

Zacks

CRM is currently trading at a premium valuation of 41x P/E TTM. However, relying solely on TTM EPS to evaluate CRM’s value may not be meaningful, as the company is primarily focused on its bottom-line growth. This means that forward EPS estimates are significantly higher than TTM EPS.

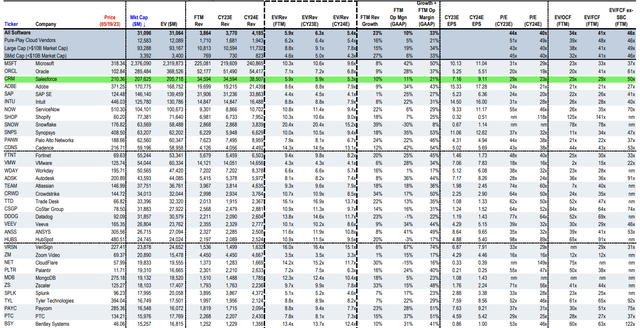

Source: Bloomberg Finance L.P., CapitalIQ, J.P. Morgan estimates

According to the CRM’s FY2024 earnings outlook, CRM’s adjusted EPS is expected to reach $7.42 in FY2024, implying 42% YoY growth. If we factor in the estimated FY2024 EPS and the current post-1Q selloff price of $210, CRM is trading at 28.4x P/E, lower than Microsoft’s 34x and software industry average’s 44x (Prices might be different now). In addition, the company is trading at 5.9x EV/Sales CY2023, which is lower than the large cap software average of 9.1x. This indicates that CRM would not be trading at a premium multiple based on forward-looking indicators.

Conclusion

In sum, CRM delivered better-than-expected 1Q results, beating revenue and adjusted EPS estimates. However, the company’s decision not to revise FY2024 guidance and provide a conservative revenue outlook disappointed investors and triggered a 6% selloff in the aftermarket. Despite this, CRM’s focus on profitability and margin expansion is evident, with a significant improvement in its non-GAAP operating margin over the past quarters as top-line growth decelerated. The management sees further margin improvement for FY2024, indicating their commitment to profitability. This margin expansion is expected to drive a 42% YoY growth in adjusted EPS in FY2024. When considering CRM’s valuation, factoring in the estimated FY2024 EPS and its current price, the stock appears to be trading at a relatively lower P/E ratio compared to peers like Microsoft. Therefore, I maintain a bullish view on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.