Summary:

- Salesforce, Inc. is a leading CRM provider which has expanded its product range across service, marketing, and even big data/AI with Einstein and its Data cloud.

- The company reported strong financial results for Q4,FY23 as it beat both revenue and earnings growth forecasts.

- Salesforce has strong customer retention with revenue attrition at record lows of below 7.5%, which is fantastic given the macroeconomic environment.

- Its stock-based compensation as a percent of revenue is also trending lower in FY24, below 9%.

Bjorn Bakstad

Salesforce, Inc. (NYSE:CRM) pioneered Customer Relationship Management [CRM] software and was ranked number one in the category for 2022 by IDC. Since its founding in 1999, Salesforce has expanded its product suite to include multiple “modules” to enhance all aspects of a business from Marketing automation to customer service. Despite the increasing competition in the market from companies such as Adobe (Marketo) (ADBE) and HubSpot (HUBS), Salesforce has recently recorded super financial results with a “blowout” earnings report than beat both top and bottom-line growth estimates. In this post, I’m going to break down its financial results before revealing my intrinsic valuation model and forecasts for CRM stock. Let’s dive in.

Fourth Quarter Financials

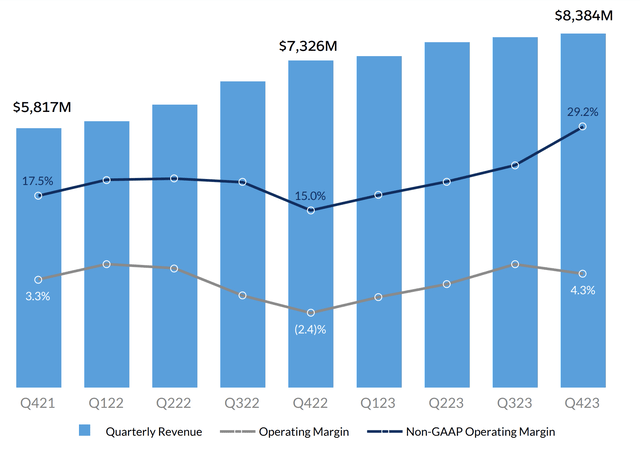

Salesforce reported super financial results for the fourth quarter of the fiscal year 2023. Its revenue was $8.38 billion, which beat analyst expectations by $391.63 million and increased by a solid 14.44% year over year. If I compare this growth rate to previous growth rates, it was actually slightly faster than the 14.19% reported for Q3,FY23. However, it was slower than the 21.77% growth rate in Q2,FY23 and the 24.28% growth rate in Q1,FY23 (all year-over-year growth figures). Slowing growth rates is a common trend I have spotted in my analysis of many technology companies (see my other posts). A positive is the growth rate decline for Salesforce is not as stark as its competitor HubSpot, as you can see in my prior analysis. I believe this is because Salesforce tends to target larger organizations and enterprises, thus it is slightly more immune to the macroeconomic environment. Whereas HubSpot tends to focus on more Small-Medium sized businesses and venture-backed startups.

Salesforce Revenue (Q4,FY23 report)

Salesforce is also less vulnerable than many companies to the effects of foreign exchange rate headwinds, as it derives 67.5% of its revenue from the Americas, with the majority of this in U.S. dollars. In Q4,FY23, the company reported $5.657 billion in Revenue (from the Americas), which increased by a solid 15% year over year. Its second largest region is EMEA, which contributed to 23% of revenue or $1.935 billion for Q4,FY23. This revenue increased by 13% year over year, but on a constant currency basis, this would have increased a rapid 20% year over year. Its third segment, APAC, contributed to 9.38% of total revenue or $792 million and increased by a steady 18% year over year or a blistering 30% on a constant currency basis.

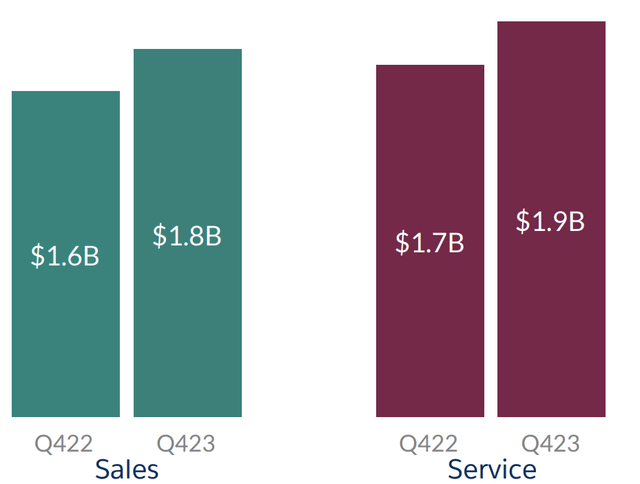

Breaking revenue down by product, it is clear Salesforce is well diversified. Its Sales Cloud reported $1.8 billion in revenue, which increased by a steady 13% year over year or 16% on a constant currency basis. Given the Sales Cloud is the legacy platform of Salesforce, this was a fairly good result. Salesforce has also recently announced plans to launch EinsteinGPT. This aims to integrate the viral ChatGPT technology (based on the GPT-3 model) with Salesforce’s Einstein AI. The goal of this is it aims to help salespeople generate reports, capture lead information, and even make coffee (just kidding). I believe this platform will be very successful given many organizations struggle with data quality inside Salesforce, there is an old joke which says it’s called “Sales-force” because you have to “force” Salespeople to use it. Then, of course, we have the current “buzz” around the AI industry which is forecast to grow at a rapid 37% compounded annual growth rate [CAGR].

Sales and Service Revenue (Q4,22 report)

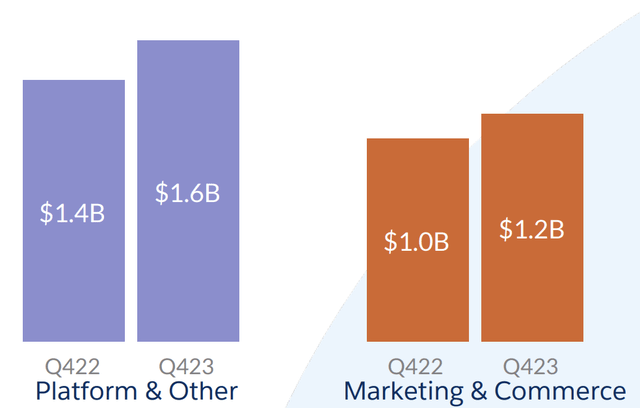

The Salesforce Service Cloud also reported steady financial results with $1.9 billion in revenue reported, up 11.67% year over year. Its Platform and Other segment also produced solid results with $1.6 billion reported, up 14.3% year over year. This segment includes its Salesforce platform App development environment for low-code apps in addition to the popular workplace chat platform Slack, which Salesforce acquired for an eye-watering $27.7 billion in 2021. The idea behind Slack is to help send fewer emails and offer a place for a more informal-style chat. I believe a platform such as this would be considered optional pre-pandemic when more employees were in the office. However, I believe since the rise of remote and hybrid working platforms such as this have become necessary in the workplace.

Slack also offers various integrations with video platforms such as Zoom, file management products such as Google Cloud docs, and much more. In addition, the product has effectively become a “platform” in its own right with a wide variety of apps on offer. This includes everything from the ability to run polls directly inside the chat to generating automated alerts from various apps. This is great for a couple of reasons, firstly, the more integrations and apps installed a company uses with Slack, the more “sticky” the platform is likely to be. This is based upon the “layering” effect, which is a method of increasing user adoption. Then, of course, we have the ability to capture value from the extra services. Slack’s pricing is also extremely reasonable with a free plan and then between $5-$10 per user for upgrades. This type of plan is great as let’s say American Express (AXP) (a Salesforce customer) also uses Slack. Its 77,300 employees could theoretically be charged a staggering $386,500 per month to use the service (at $5/user for all employees).

Platform and Marketing (Q4,FY23 report)

Salesforce Marketing and Commerce revenue has also grown by a rapid 20% year over year to $1.2 billion, which is fantastic. Given Sales go hand in hand with Marketing for a “go to market” motion, the marketing product is an easy cross-sell for B2B organizations.

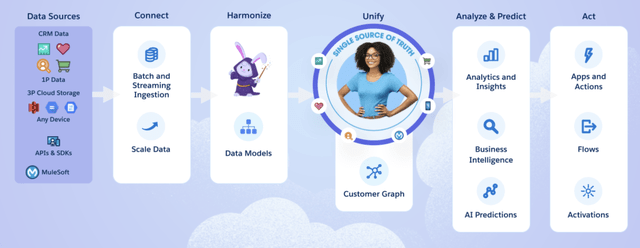

The Salesforce Data Cloud has also proven to be immensely popular with $1.3 billion in revenue generated for Q4,FY23, up 18% year over year. This is basically a customer data platform [CDP] that helps organizations to bring together siloed data from multiple sources. This can be then used to create a “customer graph”, which helps to identify relationships between various factors and ultimately be used to derive insights. Given the big data industry was valued at $162.6 billion in 2021 and is forecast to grow at an 11% compounded annual growth rate [CAGR] up until 2026, I forecast Salesforce to benefit from this trend, as its customers look for solutions to unlock insights from their “big data”. Tableau, the data visualization platform, outperformed expectations in the quarter for revenue and is also poised to benefit from the aforementioned “big data” trend.

Margins and Balance Sheet

Salesforce reported an operating margin of 4.3% for Q4,FY23, which was substantially better than the negative 2.4% growth rate reported in Q4,FY22. On a non-GAAP basis, the result was even better with a strong operating margin of 29.2% reported for Q4,FY23, up substantially from the 15% reported prior. Its non-GAAP earnings per share were $1.68, which beat analyst forecasts by $0.32, which was solid.

Moving forward, management aims to focus on both “short-term” and “long-term” expense restructuring and employee productivity, which is a positive sign.

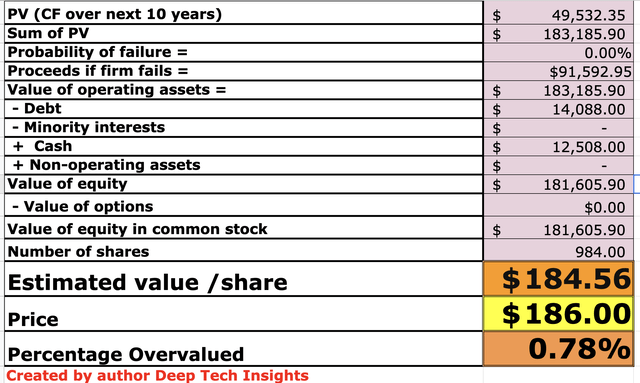

The company also reported $12.5 billion in cash and short-term investments. In addition, the business reported $14 billion in total debt, of which $1.18 billion is due within the next 2 years.

Valuation and Forecasts

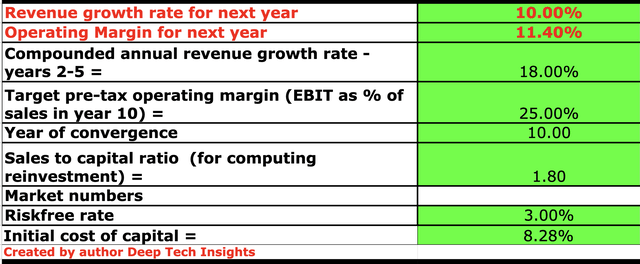

In order to value Salesforce, I have plugged the latest financial data into my discounted cash flow valuation model. I have forecast 10% revenue growth for “next year”, which in my model includes the next four quarters. This is in line with management’s forecast of $34.5 billion to $34.7 billion for the full year of 2024. This is a slower growth rate than the 14.4% YoY growth rate reported in Q4,FY23. However, I expect this to be driven by the uncertain macroeconomic environment, which will likely result in longer sales cycles. For years 2 to 5, I have forecast a faster growth rate of 18% per year. I expect this to be driven by improving economic conditions. In addition, I forecast strong adoption of its EinsteinGPT, Data Cloud, and Tableau given the aforementioned tailwinds across “big data” and AI.

Salesforce stock valuation 1 (Created by author Deep Tech Insights)

To increase the accuracy of my valuation model, I have capitalized R&D expenses, which has boosted net income. In addition, I have forecast a pretax operating margin of 25% over the next 10 years. This may seem overly optimistic but it is also only slightly higher than the 23% average for the software industry. Given Salesforce is an “above average’ company in my eyes, due to its strong leadership position, product innovation, and high customer retention, I don’t deem this to be unachievable. Management also announced in its earnings call that they will be increasingly focused on profitability and forecast a non-GAAP operating margin of 25% by FY26. For clarity, my forecasts are on a GAAP basis.

Salesforce stock valuation 2 (Created by author Deep Tech Insights)

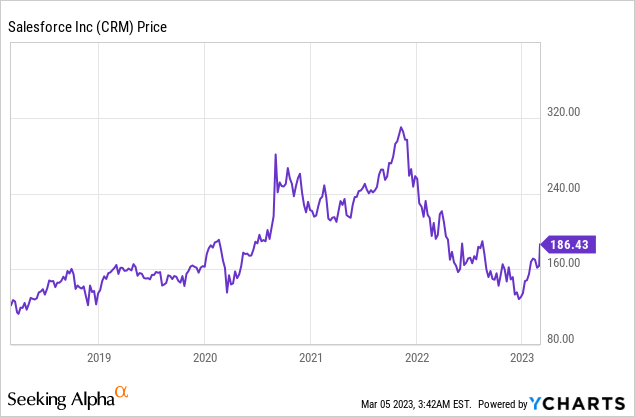

Given these factors, I get a fair value of $186 per share, given CRM stock is trading at ~$185 per share at the time of writing, it’s ~0.78% overvalued, which in my mind is “fair value” for such a high-quality company.

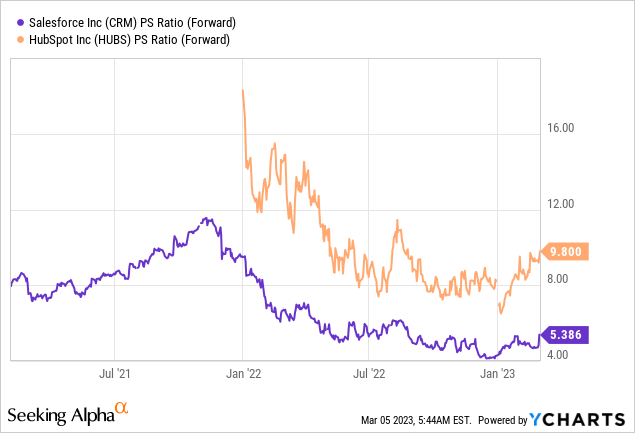

The company also trades at a price-to-sales [P/S] ratio = 5.34, which is 31.6% cheaper than its 5-year average.

Final Thoughts

Salesforce is a tremendous company that has continued to diversify its business model across multiple areas from Sales to team communication and now big data and AI. I believe its “modular” approach is a fantastic strategy that makes the upselling and cross-selling of services pretty easy. The company also has a strong culture of “trailblazers” which acts as a competitive advantage in terms of talent retention. My intrinsic valuation model and forecasts indicate the stock is “fairly valued” at the time of writing and thus I will deem it to be a great long-term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.