Summary:

- Salesforce delivered a strong Q3 with $9.44 billion in revenue, 8.3% YoY growth, and increased forward guidance, despite a slight EPS miss.

- CRM’s A.I. initiatives, particularly Agentforce, are expected to drive future growth and increase net dollar retention, validating my bullish investment thesis.

- Despite risks from competitors and potential market volatility, CRM’s valuation remains attractive, with significant free cash flow and shareholder returns through buybacks and dividends.

- CRM’s projected revenue growth and strong financial metrics position it well for future gains, making it a compelling investment opportunity in the A.I. space.

PM Images

I must tip my hat to Mark Benioff and the team at Salesforce (NYSE:CRM), as this is what a great quarter looks like. Time and time again, I have seen great companies sell off after delivering a strong quarter because they missed a fictitious consensus estimate that analysts were looking for. CRM generated $9.44 billion in revenue, which was an 8.3% YoY increase but missed on the EPS number by $0.04 as the street was looking for $2.45 in non-GAAP EPS. While some may consider this quarter a mixed bag because CRM beat on the top line metric but missed on the bottom line, I believe it was a pivotal moment for CRM as it set a new standard for forward growth. CRM added $0.30 to their bottom line YoY as non-GAAP EPS grew 14.22% YoY. When I go through the numbers, there isn’t a lot to complain about, as CRM delivered growth across the board, increased forward guidance, and returned $1.6 billion to shareholders through buybacks and dividends. I believe that CRM will continue to increase their moat, and A.I. agents will lead to increased net dollar retention levels and drive future earnings growth from their existing customers.

Following up on my previous article about Salesforce

I wrote an article about CRM on 5/31 (can be read here) and discussed why the sell-off after Q2 earnings created an opportunity for investors. CRM is up over 500% over the past decade, and there are many investors who missed out on investing in this great company. The first large pullback started in November 2021, as shares fell from around $305 to around $130 in December 2022. When the bear market ended, tech caught a new bid, and shares of CRM climbed back to around $315 at the beginning of 2024. Investors got another opportunity as shares fell back to around $230 during the spring. Since I wrote my article on 5/31, shares of CRM have been up 56.91% compared to the S&P 500, which has climbed 15.33%. When the dividend is taken into account, CRM’s total return is 57.41%. I had discussed why I felt the market got the quarter wrong and that the sell-off on Q2 earnings was an overreaction. It looks like I was correct, and Q3 validated my investment thesis based on their results. I am following up with a new article because I still believe there is a lot of growth left in the tank. I think that CRM is still a worthwhile investment as A.I. Agents could lead to increased net dollar retention and generate new revenue streams in the future.

Risks to investing in Salesforce

The investment community experienced CRM dropping 1/5th of their market cap after Q2 earnings were released roughly 3 months ago, so thinking that a massive drawdown can’t occur is a mistake. Just because I am bullish on CRM doesn’t mean they will be able to execute their strategy or monetize A.I. the way they believe they can. If CRM misses its growth numbers, it’s not unreasonable to think that shares will experience a similar sell-off to what they did in Q2. Salesforce also faces risks from competitors that have the ability to spend tens of billions to develop new revenue streams. Companies such as Microsoft (MSFT), Oracle (ORCL), and Adobe (ADBE) have large customer basis that utilize their software stacks. If these companies decide to compete with CRM, there is a possibility they could take market share by having a comparable product and be a loss-leader in the first several years to establish a base. By investing in CRM, your betting on the fact that CRM’s best days are in front of them rather than behind them and that innovation will continue for years to come. Investors should do their due diligence before investing in CRM.

Despite its size, Salesforce continues to grow, and I am bullish on their future

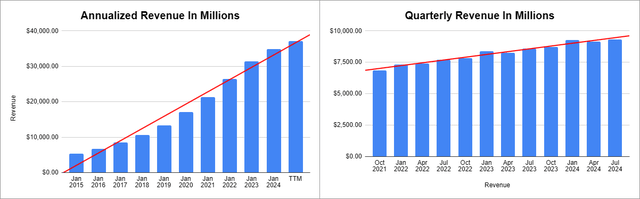

Sometimes, investors don’t need to look for the next big thing, and they just need to look at what is currently working. When the market experienced a renaissance in software companies, it’s still perplexing why CRM was overlooked. When everyone was looking for the next growth story, CRM was hiding in plain sight. When looking at CRM on an annualized basis, the revenue growth YoY has been in the double digits for the previous 9 years. Q4 is always their largest revenue quarter, so there is still a chance that CRM will grow at an annual rate of close to 10% this year. Over the trailing twelve months (TTM) CRM has added $2.33 billion in revenue, which is a 6.69% growth rate compared to their previous fiscal year. While growth has been slowing, keep in mind that this is a company that has been generating over $30 billion in revenue for the past 3 years and is rapidly approaching the $40 billion mark. On a quarterly basis, CRM is putting up strong growth numbers. In the past 2 quarters, CRM has grown at over 8% as they added $722 million to the top line in Q2 and $724 million in Q3.

Even after the recent upswing, people may not be bullish enough about CRM. I am glad the market got this one correct, and shares didn’t sell off on a non-GAAP EPS miss of $0.04. Q3 was a strong quarter and set the stage for the future. CRM generated $9.44 billion in revenue during Q3 and produced $7.34 billion in gross profit. CRM is operating at a 77.71% gross profit margin and a 20.04% operating margin as it generated $1.89 billion in income from operations. This is a business that, after taxes, is producing $1.53 billion in pure profit over a 13-week period for a 16.17% profit margin. For every dollar, that CRM grows its top-line by a large amount of that capital flows to the bottom line. CRM also generated $1.98 billion in cash from operations, and because it is a software company with minimal CapEx expenses, its free cash flow was $1.78 billion, which was an increase of 30% YoY in Q3. This is exactly what investors should be looking for, great companies that are growing and generating large amounts of profitability.

Steven Fiorillo, Seeking Alpha

I am bullish on CRM’s future because they are in a prime position to benefit from companies allocating capital to their A.I. spend. I don’t believe that the majority of resources will be allocated to new A.I. software, but rather to new A.I. features in their current software stacks. Many companies have already spent countless resources, from monetary to staff hours vetting, implementing, and using their current software stacks. I believe the more likely scenario is that companies such as CRM will be the winners in the A.I. race, as they will be able to upsell current clients on new product features, which will increase their net dollar retention to a level that exceeds the annual increases per user. CRM’s Agentforce, a complete A.I. system within its product stack, can transform how businesses utilize their current software stacks to drive efficiency and monetization across their ecosystem. One of the critical aspects to consider is that Mr. Benioff indicated that CRM solidified more than 200 deals during the kickoff week for Agentforce, and thousands of potential deals are coming in the upcoming quarters. He cited companies such as Accenture (ACN), Ace Hardware, and International Business Machines (IBM) as companies that are building digital labor forces on the CRM platform through Agentforce. This means that net dollar retention is increasing from the largest companies, which will drive larger amounts of revenue, which is bullish for CRM.

Why I feel CRM still offers a value proposition for investors

Some investors may feel as if they missed the big bump, and in the short-term that may be true, but CRM could have years of growth ahead of themselves. Sometimes, you can pay too much for growth, but when companies are raising guidance, the investment community should pay attention to what is occurring. CRM provided guidance for Q4 revenue to come in at $9.9 billion – $10.1 billion. This is significant because CRM has never exceeded $10 billion of quarterly revenue. This guidance range is an increase of 7-9% YoY. CRM also raised its operating margin guidance to 19.8% and its cash flow growth to 26% YoY from 24%. This is the reason why CRM can allocate billions back to shareholders through buybacks and dividends. In Q3, CRM returned $1.2 Billion in buybacks and $400 million in dividends.

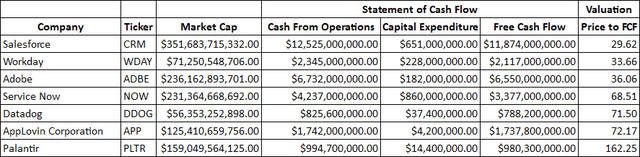

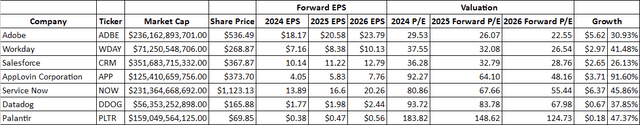

CRM also trades at an attractive valuation. One of my favorite metrics to look at is the price to FCF. CRM has generated $11.87 billion in FCF over the TTM while its peers, including Workday (WDAY), Adobe (ADBE), ServiceNow (NOW), Datadog (DDOG), AppLovin Corporation (APP), and Palantir (PLTR) have generated between $788.20 million and $6.55 billion of FCF. These 6 peers that I listed have generated a total of $15.55 billion in FCF over the TTM, and CRM has generated 76.36% of their FCF in the same period. CRM is trading at 29.32 times their FCF while the peer group average is 67.68, and the next closest companies are trading at 33.66 and 36.06 times their FCF. On a forward earnings basis, CRM is expected to generate $12.79 in EPS during 2026 and trades at 28.76 times 2026 earnings. The analysts are only projecting 26.13% EPS growth over the next 2 years for CRM, but that could change over the next several quarters. Companies like NOW are trading at 55.44 times earnings with 45.86% growth on the horizon, and PLTR Is trading at 124.73 times 2026 earnings with 47.37% growth on the horizon. I think the valuation is still attractive, especially since CRM can continue buying back shares and add to their EPS while driving larger levels of revenue.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

Conclusion

This is one of those quarters where there was nothing to complain about, and Mr. Market got it right even when there was a slight miss on the bottom line. CRM is in a prime position to benefit from an A.I. revolution, as Agentforce could provide a springboard of growth over the next several years. Companies are likely to implement Agentforce to maximize their potential with the current software stack from CRM, rather than looking for an alternative system. The current valuation is still relatively inexpensive, while CRM is still growing its top and bottom line. CRM is generating close to $12 billion in annualized FCF, buying back shares, and paying a dividend. CRM has never generated more than $34.8 billion in revenue and is on track to generate around $38 billion this year, $41 billion next year, and exceed $50 billion in 4 years from now. If CRM maintains its margins, this valuation could be inexpensive, and the upside potential could be massive as CRM is absolutely an A.I. play.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.