Summary:

- Salesforce shares surged over 10% post-earnings, driven by excitement around Agentforce despite decelerating revenue growth and plateauing margins.

- The company has significantly improved operating margins from 2% in 2021 to over 20%, but growth is slowing, especially in North America.

- Agentforce, a new AI-driven product, is seen as a potential game-changer, though its impact and differentiation remain uncertain.

- Salesforce’s current high valuation is unsustainable without significant revenue acceleration, leading to a ‘Hold’ rating and a borderline ‘Sell’.

wdstock

Salesforce (NYSE:CRM) shares are up over 10% in pre-market hours following a relatively mediocre quarter in terms of actual numbers, as investors and analysts are excited about the company’s Agentforce future.

The current market environment has many similarities to that of 2021, with the main one being the rise of stocks that have a good story, rather than actual fundamentals.

A closer look at this quarter’s results and next quarter’s guidance reveals a company that’s experiencing significant deceleration, with a margin expansion story that’s approaching an end.

Let’s dive in.

Introduction To Salesforce

Salesforce is one of the largest software companies in the world, with an expansive portfolio of solutions across sales, service, marketing, analytics, and commerce.

The company is the number one customer relations manager provider in the world and is known for inventing the SaaS business model.

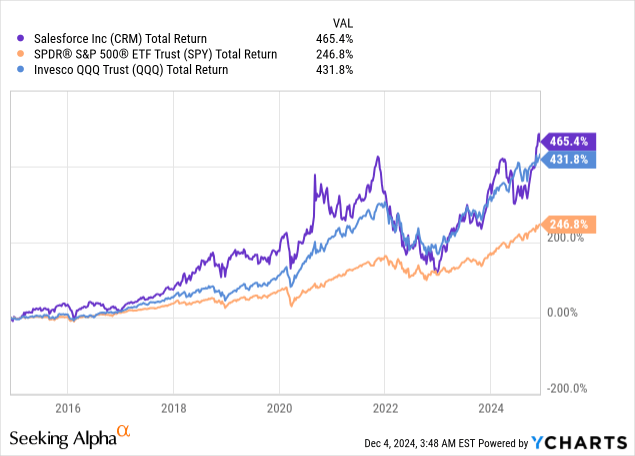

Led by its original co-founder Marc Benioff, Salesforce achieved revenue CAGRs of over 20% since its inception (including acquisitions), on its way to being a strong market beater.

Although Salesforce sees significant competition across each layer of its product stack, it created a moat through its integrated offering, unified data and cloud platforms, strong brand, and customer relationships.

One Of The Most Impressive Getting-Lean Stories After The 2022 Selloff

Many companies were caught red-handed in the fallout of the 2021 market craze. It feels like in the span of a heartbeat, the market completely flipped the switch on ‘Growth At All Costs’ to ‘Give Me Profits, Now’.

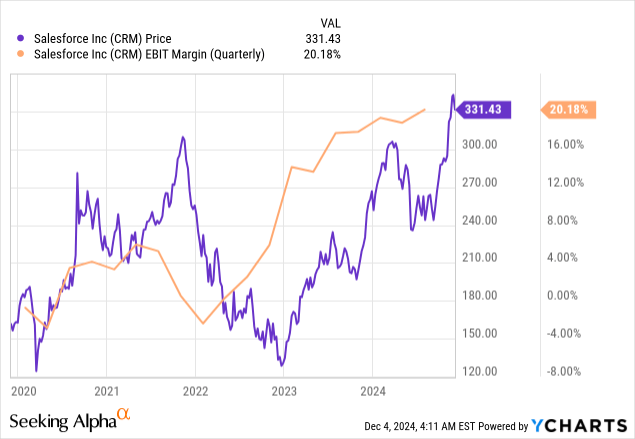

Salesforce was no exception. As weird as that sounds for a company as mature and at this scale, Salesforce’s operating margins stood at a miserable 2% back in calendar 2021. Then, after it was forced to change, boy that escalated fast.

From operating margins in the low-single digit, Salesforce achieved a GAAP margin of over 20% in the recent third quarter, driven by operational leverage across all items.

And, as we can see in the graph above, the stock responded, rising more than 2.5x from its 2023 lows, despite decelerating revenue growth.

That said, I believe that it is now approaching a plateau.

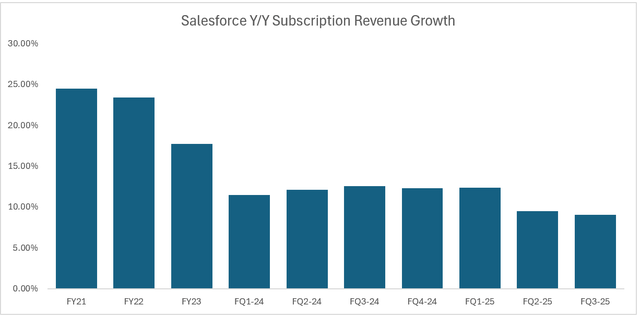

Anywhere You Look, You See Deceleration

Two things, in combination, drove Salesforce shares to all-time highs. The first, as discussed, was its execution on the margin front.

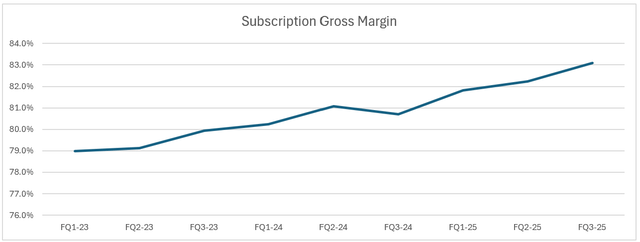

The company’s subscription gross margin is on a steady incline, reaching a peak of 83% in the recent quarter.

Created by the author based on data from Salesforce financial reports.

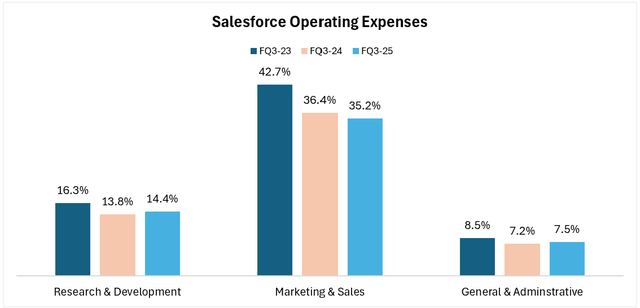

However, the operational leverage story appears to be stabilizing, with G&A, R&D, and SBC rising Y/Y as a percentage of sales. Further, they are also discussing recruiting 1,000-2,000 salespeople, reflecting a shift in preferences.

Created by the author based on data from Salesforce financial reports.

And while operational leverage plateaus, at least for now, revenue growth continues to decelerate, especially in North America, where revenue growth was only 6% in the third quarter.

Created by the author based on data from Salesforce financial reports.

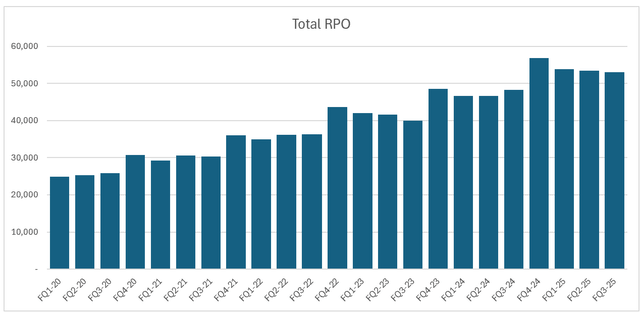

Furthermore, total RPO is down Q/Q for three consecutive quarters. Although there’s a seasonal effect, in most years, RPO didn’t decline between Q2 and Q3. Also, RPO growth dropped below 10% for the first time in at least five years.

Created by the author based on data from Salesforce financial reports.

So, if growth is decelerating and margins are no longer expanding rapidly, why is the market so enthusiastic? Well, the answer is Agentforce, which was only launched a week before quarter end.

Will Agentforce Truly Transform Salesforce?

Until not long ago, Salesforce, alongside other pure-software names, was viewed by the market as an AI loser. However, the launch of Agentforce, and the increasing suspiciousness regarding LLMs disruption of the software industry, drove shares to all-time highs.

Setting aside the general AI discussion, let’s talk about Agentforce, starting with the most important question – what exactly is it?

If you’re not capable of explaining, or fully understanding what is Agentforce, you shouldn’t feel bad. Even when CEO Marc Benioff is being asked about it, he takes the convenient route of providing examples like how physicians use it to make their job easier, or how technical support teams use it to automate certain queries.

In the recent earnings call, he referred analysts to help.salesforce.com, where we could check the “Agent” ourselves.

Although Salesforce is avoiding the use of the word ‘Chatbot’, Agentforce at its current state still appears to be a chatbot. However, it should be a highly accurate one, as it’s rooted in company-specific data, instead of having all-world knowledge.

Still, it’s hard for me to see why the market is so excited and so certain this will transform the company.

Remember, today, Salesforce is on pace to generate about $38 billion annually from revenues that are entirely predicated on the “old” seat-based business model. Even if Agentforce becomes a huge success, it’s hard to envision a world where it drives incremental revenues that truly move the needle for the company.

Also, unlike its existing business model, a usage-based business model isn’t as attractive in terms of margins, at least in theory. The SaaS business model is so attractive because there are zero marginal costs, and that is not the case in the AI world.

Valuation & Outlook

My commentary about Agentforce doesn’t go to say it won’t succeed, or that it can’t be a meaningful contributor to revenues, even in the near term. On the call, they disclosed over 200 deals and mentioned a strong pipeline.

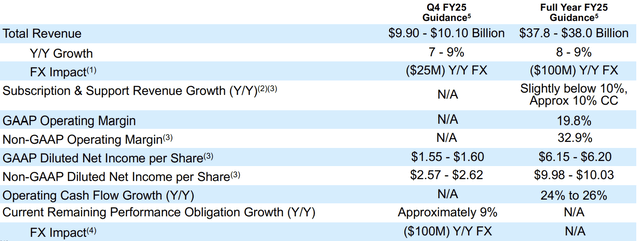

That said, their guidance for Q4 and the full year does not reflect any meaningful contribution, or change in recent trends:

Salesforce Fiscal Q3’25 Earnings Release

There is some chance they want to leave room for a big surprise next quarter, but guiding for 9% cRPO growth, which reflects another Q/Q deceleration, is a bit of a warning sign.

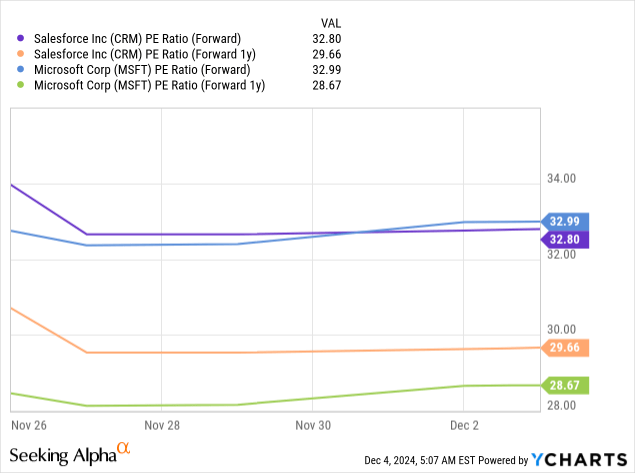

This brings me to valuation. Right now, Salesforce trades at 60 times forward GAAP earnings, and 37 times non-GAAP earnings, which exclude about $3.2 billion in stock-based compensation expenses (I view such adjustments as senseless). Looking at cash flow metrics, Salesforce is around 40x EV/FCF (when adjusting for SBC).

At current prices, Salesforce’s valuation is almost double that of Microsoft on a comparable basis, but even when taking Salesforce’s adjustments as is, it’s trading at a significant premium:

(Keep in mind, the graph is based on yesterday’s closing price, not the pre-market price. Salesforce current forward PE is 37x, and FY1 PE is 34x)

Microsoft revenues and earnings are expected to grow at a mid-teens pace for the foreseeable future. Meanwhile, Salesforce is expected to grow in high-single digit.

To me, the only reason this is happening is because the market is a) ignoring the SBC elephant in the room; b) pricing Agentforce like it’s going to be a resounding success in the very near term; c) punishing Microsoft for its significant capital spending.

I don’t view that as sustainable. In my view, a high-quality company like Salesforce that’s growing high-single digit is attractive below 30 times FCF or 35 times earnings.

Conclusion

Salesforce’s stock is surging despite a lackluster quarter, as the market is increasingly focused on companies that ‘Talk The Talk’ rather than ‘Walk the Walk.

Agentforce is already priced like a resounding success, with no actual numbers to show for it in the company’s guidance.

With Salesforce shifting focus from its extraordinary margin expansion story, revenue growth will have to accelerate significantly in order to justify the current valuation.

Right now, I don’t see that happening, and therefore I rate the stock a ‘Hold’. Personally, I would consider selling it and allocating my money elsewhere.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.