Summary:

- Saleforce has not yet proven it can stick to a financially disciplined approach to its uses of capital.

- However, the recent pivot to profitability has allowed the company to impress investors by proving the power of its scale.

- While the stock has recovered from its bottom, there is still ample room of multiple expansion given the current valuation.

wdstock

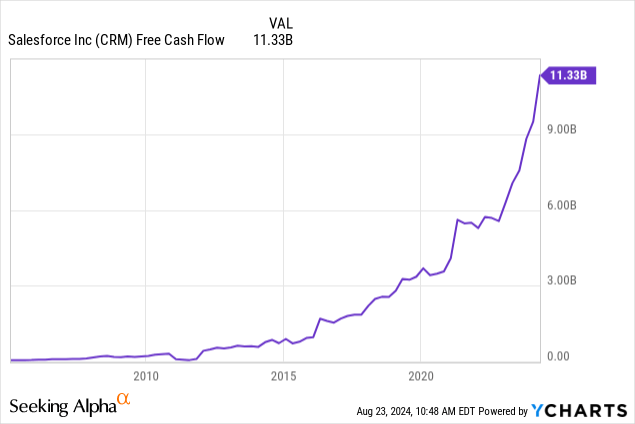

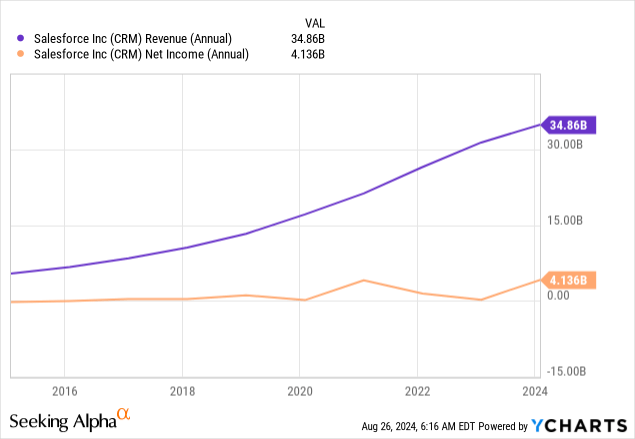

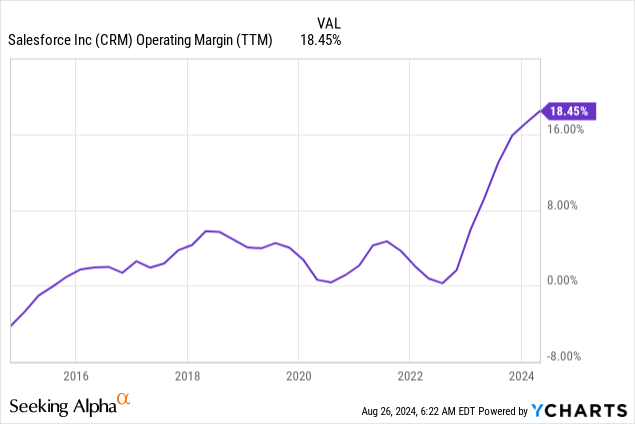

Salesforce (NYSE:CRM) offers one of my favorite suites of products thanks to its AI CRM platform. Everyone knows about its steady revenue growth, which has more than tripled from $10.5B in FY2018 to $34.9B in FY2024, making it the leader in the industry. In addition, Salesforce ended FY2024 with $56.9B in remaining performance obligations, which is a strength of the business. However, only recently the company switched to profit mode at the request of several activist investors, achieving a 30.5% operating margin. This has caused Salesforce’s cash flows to jump exponentially in recent years, with $10.2B in operating cash reported at the end of FY2024 (+44% YoY).

When a growth company reaches the scale to turn into a cash-generating machine, investors face the hard task of estimating future cash flows and – as a consequence – what the correct valuations may currently be.

Moreover, Salesforce’s numbers are among the most promising cloud and AI plays, which are surely seen as two main growth drivers for the next decade.

Salesforce’s Recent Financials

That Salesforce’s revenue growth has always been on a reliable path is something widely known. However, this didn’t drive the bottom line of the company up, with many investors becoming concerned about Salesforce’s use of capital which made its earnings almost non-existent until recent years.

We all know Salesforce spent a lot of money on acquisitions (Slack, for example). But things changed when Salesforce was circled by activist investors, such as Elliott Management and Starboard Value, because its profitability was not growing or, even better, exploding.

Marco Beniof, co-founder and CEO, eventually addressed the issue and announced in its FY2023 letter to shareholders that the company was switching gears and focusing on profitability. Guess what happened? In a few quarters, Salesforce’s operating margin and free cash flow exploded, quickly painting a new picture for the company.

So, the stock quickly recovered to its ATHs above $300. But then, when the company reported its Q1 2025 earnings with an EPS beat and a revenue miss of $20M (with revenues up 10.7% YoY to $9.13B), the stock plummeted over 20% because of “weak” guidance, maintaining a revenue forecast between $37.7B and $38B (8%-9% growth YoY) and expecting the non-GAAP operating margin close to 32.5%. Moreover, one of Salesforce’s most important KPIs – remaining performance obligation (RPO) – Salesforce ended its Q1 with $53.9B, up 15% YoY. This represents the revenues under contract that are in the pipeline for the company. As such, it is of utmost importance because it helps us feel the pulse of Salesforce’s future. The number released by the company pleases investors. However, some analysts were disappointed as they considered this a sign of slowing growth.

Salesforce’s Q1 earnings also carried one big change: the company paid its first quarterly dividend of $0.40 per share (a total of $388M), coupled with a huge buyback that made Salesforce’s return to its shareholders over $2.5B in a quarter. So, the fact that Salesforce is now a dividend payer can attract a new cohort of investors. Surely, there won’t be high-yield seekers. But those focused on dividend growth can consider Salesforce a nice bet for the future. The company’s fwd dividend yield is 0.61%, but its payout ratio is just below 4.5%, leaving a lot of room for nice boosts to the dividend thanks to Salesforce’s strong cash generation.

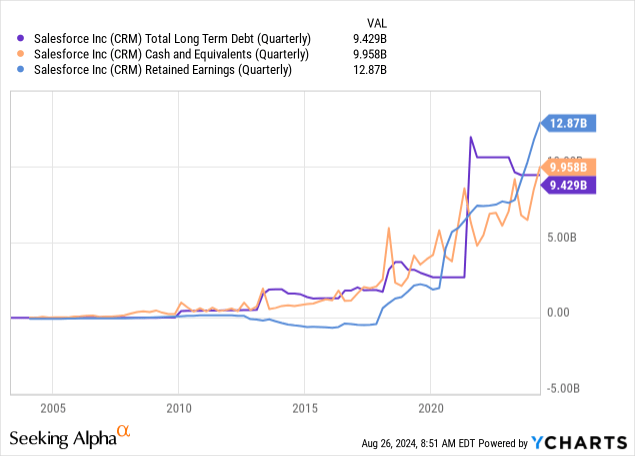

Salesforce’s balance sheet is superb. The company has almost $10B in cash and another $7.7 in short-term investments while carrying only $8.43B in LT debt. Most of it was taken in 2022 with rather low rates and, since then, the company has already paid down over $2B. Salesforce’s retained earnings increased rapidly, showing yet another sign of strength.

As a result, Salesforce runs with no leverage and a net debt negative position of $4.3B. No wonder, Moody’s recently upgraded the company’s credit rating to an A1.

What does this mean? First of all, Salesforce is in great health. Secondly, in the case of new M&A, the company has multiple options before itself. Thirdly, the company might also choose to leverage its expanding balance sheet by taking on new debt (once rates are lower) to foster some extra shareholder returns.

Q2 Earnings Preview

As many companies do, Salesforce ended its Q1 earnings call with its expectations for Q2, the one we are about to see reported.

On revenue, Salesforce expects a range from $9.2 billion to $9.25 billion, which would be up 7% to 8% YoY. RPO growth in Q2 should be +9% YoY. GAAP EPS is expected to be in the range of $1.31 to $1.33 and non-GAAP EPS of $2.34 to $2.36.

But one key driver we should keep in mind to understand how Salesforce is leveraging its strengths is this: thanks to its CRM, Salesforce manages more than 250 petabytes (1,024 TB or 1,048,576 GB or 10^15 bytes, meaning a petabyte can store half a trillion pages in .docx format or similar) of customer data. As we move into AI, having such a massive amount of data is critical to being successful. As Marc Benioff explained during the call, Data Cloud is a big business (bold is mine):

The second key point is we’ve rebuilt the way that we are delivering a foundation of data for our customers. Why is that so important? Because we have now rearchitected all of our apps and all of our capabilities to fuel and fund this Data Cloud, it means that our customers going forward, are going to be able to take this Data Cloud and leverage that into their future capability and growth, especially profitability and productivity. And that is where our whole company and I think our whole industry, is eventually going to go. Not every company is as well positioned as you know for this artificial intelligence capability of Salesforce because they just don’t have the data. They may say they have this capability or that capability, this user interface, that model, that, whatever, all of these things are quite fungible and are expiring quickly as the technology rapidly moves forward. But the piece that will not expire is the data. The data is the permanent key aspect that — as we’ve said in our — even in our core marketing, it’s the gold for our customers and their ability to deliver our next capability in their enterprises.

There is no way to look at Q2 earnings without considering the words Amy Weaver, President, and CFO, spoke during the last Morgan Stanley Technology, Media & Telecom Conference: in less than 24 months, the company has a “newfound discipline, a newfound maturity”.

Analysts are currently expecting Q2 2025 EPS of $2.36 (11.13% YoY growth), which is in the high range of what Salesforce guided for. This is because Salesforce has been able to overdeliver every quarterly EPS estimate for the past four years. This puts us in a tough spot: if Salesforce doesn’t beat its guidance, investors will be nervous and the stock may fall once again. Nonetheless, FY 2025 EPS is expected to grow over 20% YoY, giving us a fwd PE of 26.7. After that, growth expectations moderated to low double-digit growth. Since I find it hard for Salesforce to decelerate its EPS growth from 20% to 11% in just one year, I believe chances are the stock is trading at a discount to its FY2026 and FY2027 estimates. Currently, the fwd PE is 24 and 21 respectively, but if Salesforce’s EPS grows a bit faster than 11% in 2026 and 14% in 2027, we are clearly before lower multiples. Given Salesforce’s new buybacks, the share count may go down and expand the final EPS outcome. If the company, for example, pulls off a 15% EPS growth in 2026, its PE comes down to 23.2. I am not advocating the company is trading at an incredibly low fwd PE, but a 23 is not expensive considering the moat and the huge revenue backlog the company has.

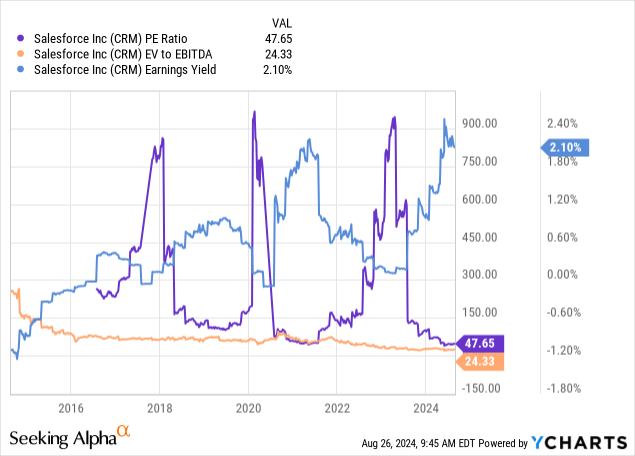

In terms of valuation, Salesforce trades at a GAAP PE above 47, but its non-GAAP PE is almost half as much (TTM: 29.5; FWD 26.7). Its EV/EBITDA has moved downward and its earnings yield is the cheapest ever, though still a 2.1%. These metrics show that Salesforce has indeed recovered from its bottom, but it still is lacking multiple expansion. I think this is because Salesforce faces the issue of credibility. Not every investor is willing to bet on a decade of disciplined management with a focus on profitability. If that were the case, given Salesforce’s RPO, we would be before one of the safest havens in the market and the multiples would probably spike up. Moreover, investors keep being scared by big M&A. Once again, Salesforce has committed to accretive acquisitions only, but, of course, this will have to be proven true once the deals materialize. Most importantly, Salesforce will have to prioritize its cash and debt over equity.

Salesforce has had a big issue with stock-based compensation diluting shareholders. In FY2024, SBC was 8% of revenues and the company guides for FY2025 to be below 8%. Just a year and a half ago, the company was double-digits.

So, in this upcoming report, there are three things to look at: operating margin expansion, RPO growth, and SBC moderation. If these things move in the right direction, we have new confirming data of a newfound financial discipline that is bound to reward Salesforce’s shareholders. Though the stock is still highly volatile, my rating remains a buy, perhaps a bit cautious, but in any case, convinced of the long-term bull case. In this light, a sudden drop would be welcomed as a buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.