Summary:

- Salesforce’s stock price dropped nearly 20% after mixed Q1 FY2025 results and weak revenue guidance.

- The company’s growth outlook has been muted, projecting single-digit revenue growth for the first time in history for both Q2 and FY2025.

- The significant slowdown in bookings and backlogs growth indicates sluggish demand, despite the presence of Generation AI tailwinds.

- The potential acquisition of Informatica adds uncertainty to the stock’s near-term performance.

- Despite margin expansion and the capital return program, the post-selloff justifies the current valuation only if the AI-related products have not materially boosted revenue outlook to double digits.

J Studios

Investment Thesis

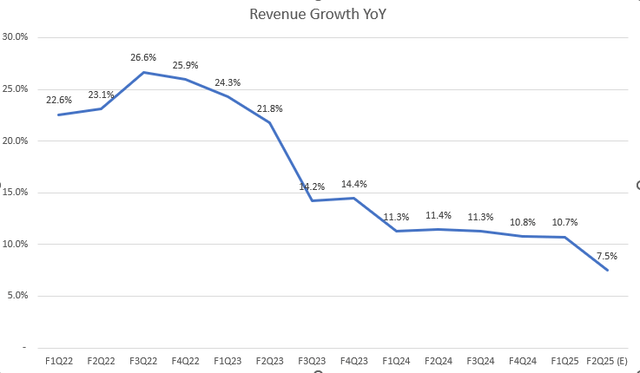

Salesforce (NYSE:CRM)’s price crashed by almost 20% after earnings due to mixed Q1 FY2025 results and disappointing forward guidance. Although the management is optimistic about long-term growth opportunities related to AI products, the company’s growth outlook has been muted, projecting single-digit revenue growth ever in history for both 2Q and FY2025. In my previous article, I discussed CRM’s trade-off between top-line growth and margin expansion. However, given the current backdrop of the AI frenzy, the fact that the company lowered the growth outlook disappointed investors as the stock was approaching an all-time high early this year.

I believe the growth reacceleration may take longer than previously anticipated based on the company’s guidance. The post-earnings selloff has largely reset expectations, and the stock may have a dead cat bounce in the near term. However, I hardly think the stock will climb back to its all-time high anytime soon. Therefore, I downgraded the stock to neutral from a buy rating as investors may adopt a wait-and-see approach regarding the monetization strategy for AI-related products.

1Q FY2025 Takeaway

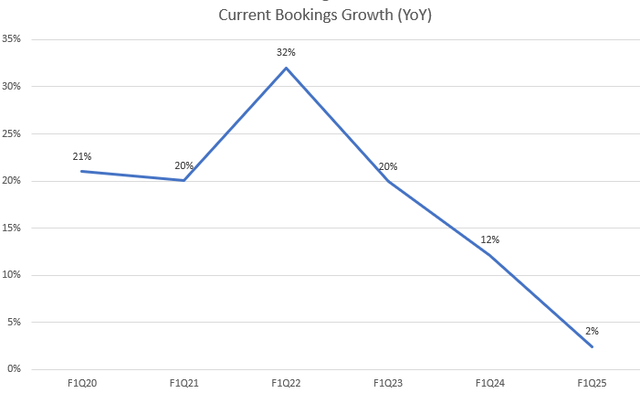

The company reported mixed results as the bottom line beat but the top line missed estimates. Although the market was anticipating the company’s revenue growth in FY2025 to drop into single digits, the company’s guidance is still below the consensus. This implies a gloomy growth outlook over the next few quarters. Meanwhile, growth in the current Remaining Performance Obligation (cRPO) continued to decelerate, growing 10% YoY compared to over 20% in FY2022 and FY2021. This implies a slowdown in bookings growth. I’ll elaborate this key metrics later.

Specifically, the company initiated Q2 FY2025 revenue guidance of $9.20 billion to $9.25 billion, up 7-8% YoY. The high end is below the market consensus of $9.34 billion. If you take the midpoint of the guidance range, the company will only grow 7.5% in the current quarter. I believe that investors are a little impatient to see the slow monetization of generative AI for the SaaS company.

Let’s do some bookings analysis. In SaaS industry, bookings are an important forward-looking growth driver, representing the additional contract value that customers commit to in a given period. Calculation of bookings needs two components: revenue and remaining performance obligations (RPO). RPO represents the commitments from contracts that the company will fulfill in the future, which can be converted into future billings and eventually contribute to revenue generation.

Current bookings are calculated using the current RPO that will be recognized in the next 12 months. To avoid the seasonality, the chart above shows only the Q1 results over the past 5 years. We can see that CRM’s current bookings grew by just 2% YoY in the last quarter. This suggests that demand for contracts is very weak. In addition, total bookings growth in the last quarter showed its first decline since Q3 FY2023, down by 3% YoY. I believe that CRM is currently facing a significant slowdown in demand, which will limit the stock’s upside potential from multiple expansions despite margin improvement and cash flow generation.

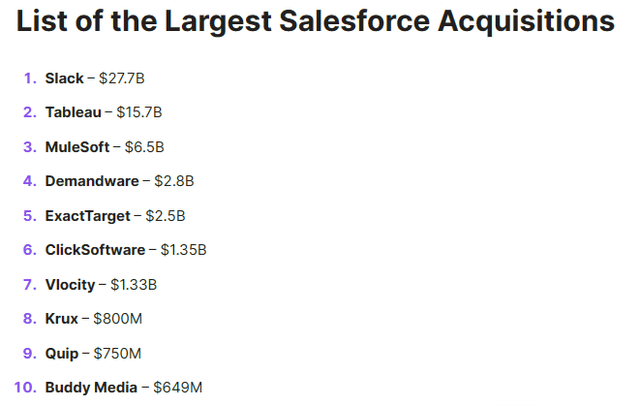

Inorganic Growth Model

CRM is well-known for its inorganic growth through M&As. As the management said, “M&A has been an incredible part of our past.” The company is currently considering acquiring Informatica to enhance its data integration capabilities. According to data from Bloomberg, this could be one of the top three acquisitions in the company’s history. Nevertheless, I think generating value accretion from acquired companies takes time, and this deal will add uncertainty for the stock in the near term. The stock was down 3.2% when the news was announced. I believe that a company consistently generating organic growth deserves a higher valuation than one relying on acquisitions.

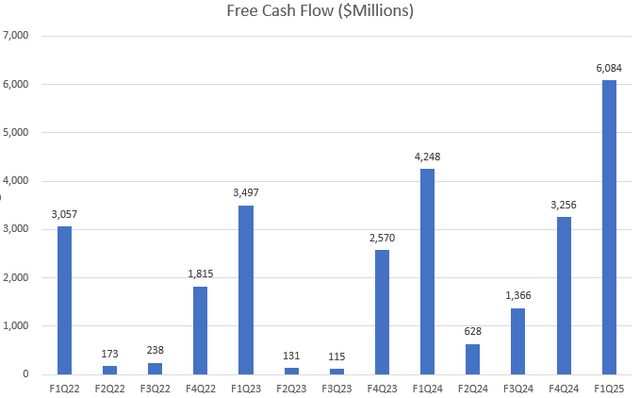

Working on Capital Return Program

I admit that CRM has done an incredible job with cash flow generation. In Q1 FY2025, the company generated $6.1 billion in FCF, growing 43% YoY. The management initiated the company’s first-ever quarterly dividend. According to the earnings call, CRM paid a quarterly dividend of $0.40 per share, totaling $388 million. In Q1, the company returned over $2.5 billion through share repurchases and dividends combined. Since the inception of the capital return programs, this brings the total cash return to more than $14 billion. I believe this program will attract more investors with an income-focused mandate in the future. However, we should be mindful that an increase in dividends is less likely to boost valuation multiples. We need to see a rebound in growth to sustainably build up the stock’s upside momentum.

Valuation

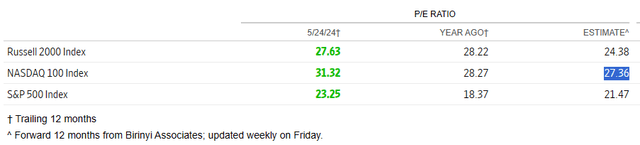

CRM is currently trading at 27.5x of non-GAAP P/E for FY2025, which is almost in line with the P/E of the Nasdaq 100 index. However, given CRM’s single-digit growth outlook, I believe the current valuation is not cheap, even though the multiple has come down 40% from the 5-year average. As I previously discussed, merely improving operating efficiency and initiating dividends will not convince investors to pay higher multiples for the stock. CRM is no longer a high-growth stock compared to two years ago. The current slowdown in demand raises doubts about the AI tailwinds for CRM in the near term. Therefore, I believe the stock is currently fairly valued compared to the broader technology index.

Conclusion

Despite CRM’s robust cash flow and margins expansion, its muted revenue growth outlook and slowdown in bookings raise concerns for demand. Meanwhile, the potential acquisition adds uncertainty to the near-term sentiment. While returning cash to shareholders is positive, it may not justify higher valuations without significant reacceleration in the top-line growth. The company’s current premium P/E multiple, while in line with Nasdaq 100, may not accurately reflect its slow growth outlook. Doubts about AI initiatives and a slowdown in demand contributed to the post earnings selloff. Therefore, I downgraded the stock to neutral from buy. I will turn more bullish on the stock if AI tailwinds materialize into an improved growth outlook in coming quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.