Summary:

- Estimates for Salesforce earnings have been revised upwards significantly (22.9%) in response to its most recent quarter but are still not too aggressive in terms of their assumptions.

- Calculating through the numbers, we see that they imply margins that are significantly higher YoY, but only about half of what we saw in the last quarter.

- The question here becomes a matter of what portion of Salesforce margins are going to be durable QoQ versus how much they will revert to YoY norms.

- Given the company’s aggressive push towards profitability, I think we will see more margins preserved QoQ than may be expected, which should amount to a beat against consensus EPS estimates.

- CRM stock has also had excellent momentum this year and should continue appreciating as it grows earnings, making Salesforce a buy for the near term.

John M. Chase/iStock Unreleased via Getty Images

Overview

Salesforce (NYSE:CRM) has continued its run of growth and increasing profitability throughout this year, with a particularly strong 23.4% beat against consensus EPS for its Q4 2023. On the latest conference call management asserted a continued drive for further increasing profitability through headcount reductions, real estate divestment, and a wholesale disbandment of its M&A committee. These initiatives have come along with a doubling of the company’s share buyback program, from $10B to $20B.

All in all it looks like Salesforce is heading in the right direction on every metric. In this article I’ll review expectations for Salesforce and establish an outlook for its fiscal Q1 2024 earnings release, which is set to happen 10 days from now.

Earnings Analysis

Consensus EPS for fiscal Q1 2024 is set at $1.61 per share and expectations for revenue are $8.17B. This represents a y/y EPS growth of 64.74% and y/y revenue growth of 10.19%.

In the wake of its last earnings report, EPS consensus moved from $1.31 to $1.61 per share, an increase of 22.9%. This is (not accidentally) in line with the company’s most recent 23.4% beat against consensus EPS. Revenue consensus has only moved 1.74% throughout that same period, marginally less than the company’s last revenue beat of 4.9%. This indicates a relatively higher level of continuing pessimism on the firm’s top-line growth.

Since EPS consensus has been moved up roughly the same percentage as the company’s last beat on EPS, it may not be accounting for ongoing improvements in Salesforce’s margins that will persist q/q. While the EPS figure referenced so far refers to non-GAAP margin, I will assume a roughly equal level of relative change in the company’s GAAP/non-GAAP margins throughout recent periods.

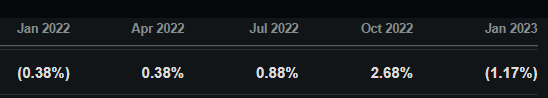

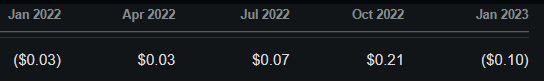

Fiscal Q4 2023 saw the company post a -1.17% GAAP net margin, which was actually a deterioration y/y; this was also reflected in GAAP EPS. On an absolute basis GAAP net margin decreased 0.79% and GAAP EPS decreased $0.07 y/y. These are the only 2 quarters out of the last 10 that have seen the firm post a negative GAAP net margin. Given the recent cyclicality here it is difficult to establish a trendline q/q, and it doesn’t seem useful to do so.

CRM GAAP Net Margin, Seeking Alpha CRM GAAP EPS, Seeking Alpha

Instead we can start with fiscal Q1 2023 (end Apr 2022) as a baseline for the upcoming fiscal Q1 2024 release. The GAAP EPS was $0.03 and the non-GAAP EPS for that quarter was $0.98. Current non-GAAP EPS expectations of $1.61 imply a y/y gain on non-GAAP EPS of 64.74%, which would yield an equivalent GAAP EPS of $0.05. This GAAP EPS figure would then imply a GAAP net margin of 0.63% at the ratios we saw in fiscal Q1 2023. We can pocket that number and price it into the company’s cost structure in FQ1 2023 to see what the estimates imply.

Unfortunately, Salesforce FQ1 2023’s operating margin of 0.27% yielded a GAAP net margin of 0.38% for the period, which represented a margin gain going from operating to net margin in that period. This was due to income tax expense offsets and as such cannot be extrapolated forward as an average relationship between operating and net margin.

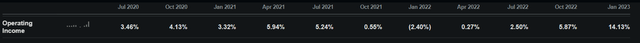

Instead, we can take the average of the last 3 quarters margin loss between operating and net margin; these 3 quarters have seen income tax expenses that are in line with historical norms.

|

FQ 2 ’23 |

FQ 3 ’23 |

FQ 4 ’23 |

|

|

Op Margin |

2.50% |

5.87% |

14.13% |

|

Net Margin |

0.88% |

2.68% |

-1.17% |

|

Margin Loss |

-1.62% |

-3.19% |

-15.30% |

|

Average |

-6.70% |

Source: Excel, Seeking Alpha

Since the implied GAAP net margin for the upcoming quarter is 0.63%, this would imply an operating margin of 7.33% at current numbers.

This overall appears to be a sensible figure in light of current trends. While this number is higher than any that we’ve seen over the last 10 quarters (apart from the most recent), this is in line with the company’s ongoing profitability push and is not so heavily skewed to the upside as to be unreasonable. It does in fact price in a good level of margin durability q/q.

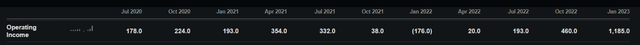

Seeking Alpha CRM GAAP Op. Margin, Seeking Alpha

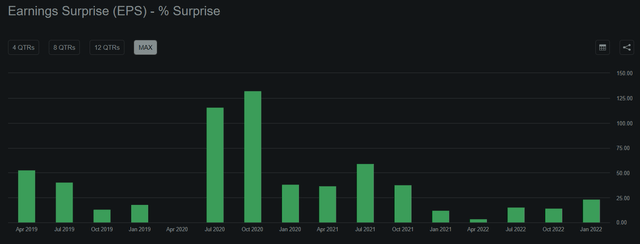

Having walked through the assumptions in current consensus figures I would say that they are sensible and would not disagree with them at this time. The caveat here is that Salesforce is an undeniably consistent consensus topper:

Notably, the percentage that Salesforce beats EPS consensus by is not steadily decreasing. If it were, that would indicate consistently more accurate consensus. Rather, we have seen a doubling q/q and a tactical trend towards increasing levels of outperformance. Since consensus was adjusted roughly in line with last quarter’s beat, however, that previous level of outperformance is already baked in. Additionally the implied metrics are a reasonable upside case that I can’t readily disagree with.

Overall I’ll put my chips down as a slight beat on non-GAAP consensus EPS at $1.67 per share. I am also expecting to see positive GAAP EPS somewhere in the realm of $0.05 per share.

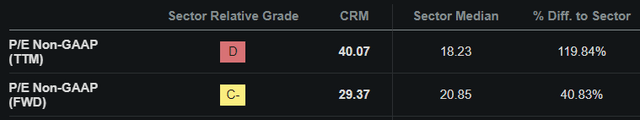

Connecting this to Salesforce’ valuation, we can see that it is trading at a significantly different premium on a TTM versus a forward basis. This valuation is opportune as it gets significantly cheaper over the next year at current estimated earnings growth rates.

Additionally, Salesforce has already appreciated well past the SP500 and the Dow Jones Index this year.

Nonetheless our current market prizes scale and profitability in the technology sector. Given the company’s relatively lower forward premium for its shares, I think Salesforce should see near-term appreciation even if it matches consensus as investors gain additional marginal confidence in its earnings growth rate.

Since I am expecting it to marginally outperform consensus this time around, I think this should yield a continued trend upwards as we have been seeing, which will be further buoyed by the company’s ongoing share buyback program. Overall I’m comfortable calling this a buy heading into earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.