Summary:

- Salesforce reported a beat and raise for the fiscal first quarter, yet the stock reversed its rally in recent months in exchange for declines.

- Expanding margins and stalling growth might suggest an AI strategy at Salesforce that lacks differentiation.

- The advent of generative AI might become a disruptive threat to Salesforce’s CRM moat.

Stephen Lam

Salesforce’s (NYSE:CRM) rally this year has been stopped short as a tepid forecast for fiscal 2024 setback investors’ confidence in the business’ prospects on AI. While the company has delivered an impressive earnings beat alongside a raise to the current year’s bottom-line forecast, tepid growth is dialling up market wariness over its exposure to a cautious IT spending environment amid deteriorating macroeconomic conditions, alongside an AI bet that might not be paying off as much as hoped.

Specifically, fiscal first quarter revenues grew 11% y/y, marking the slowest pace of expansion in more than a decade. By keeping the full year revenue guide unchanged, which would represent y/y growth of about 11%, management is suggesting that recent observations of lengthened deal cycles, deal compression, and focus on “fast time-to-value wins” among its customer base will remain lingering challenges to the business. It also implies that even though “every CEO in the world is talking to [Salesforce] about generative AI right now”, the company’s foray in the field is doing little to drive reacceleration.

Although Salesforce has delivered substantial improvements to profitability – which highlights management’s execution skills – modest growth observed in recent quarters, alongside the lagging top-line guidance for fiscal 2024, are drawing questions on whether management is doing enough to ensure ongoing optimization efforts will not compromise market share gains, especially amid heightened competition and urgency to cross-sell AI applications. With CRM’s stock currently trading largely in line with its software and technology peers that have exhibited similar growth and profitability profiles, and considering the downside risks still facing the underlying business’ near-term fundamentals, the durability to Salesforce’s AI trade is now in question.

Salesforce’s AI Strategy

To some extent, Salesforce has been ahead of the curve in the implementation of AI across its suite of customer relationship management software solutions via the “Einstein AI Platform” launched last year prior to the burst of interest initiated by the advent of OpenAI’s ChatGPT in late 2022. The solution enables predictions and recommendations by applying machine learning capabilities in data analytics, and resonates with increasing customer demand for tools to make sense of their massive data troves. To date, only 4% of companies claim to have a “highly sophisticated approach to leveraging data”. This leaves a sizable addressable market within the corporate environment in which Salesforce could penetrate, especially given recent AI momentum.

Every CEO I’ve spoken with sees AI as a revolution beginning and ending with the customer, and every CIO I’ve spoken with wants more productivity, more automation, and more intelligence through using AI.

But instead of riding along with a first mover advantage, Salesforce has been struggling to play catch-up when it comes to capturing opportunities in the budding subfield of generative AI. Building on the Einstein AI Platform, Salesforce has quickly adopted OpenAI’s GPT large language model technologies, and recently launched “Einstein GPT”. Einstein GPT effectively tailors OpenAI’s GPT generative models for CRM applications, with functions spanning “automated customer service response [and] initial sales emails”. In addition to consumer use cases, Einstein GPT aims at further deepening Salesforce’s foray in the developer ecosystem by leveraging the technology to offer low- and no-code solutions.

We are going to roll Einstein GPT for our developers in the ecosystem, which will not only help not only the local developers to bridge the gap, where there’s a talent gap, but also reduce the cost of implementations for a lot of people.

Specifically, low- and no-code “Trailblazers” – or Salesforce employees – are now able to leverage Einstein GPT, along with some of the company’s proprietary LLMs (further discussed in later sections), to augment productivity by at least 20%. This is further corroborated by recent observations in the enterprise environment that “novice workers benefitted most from [the assistance of AI]”, with the technology improving performance by as much as 35%.

The results underscore Salesforce’s prospects in capturing opportunities stemming from growing enterprise demand for no- to low-code techniques to improve productivity in the data-driven era. More than 40% of corporate employees have noted that such no- to low-code solutions – which Salesforce already offers through MuleSoft and will further improve through Einstein GPT – will be critical in creating value in the data-first environment, while also addressing an ever-expanding talent gap:

93% of organizations say it has become more difficult to retain skilled developers… 91% of organizations say automation solutions can help developers do more with less.

Source: salesforce.com

In addition to Einstein AI and Einstein GPT, which the company will be incorporating across all of its apps, Salesforce has also introduced the “GPT trust layer” to address enterprise security requirements. The GPT trust layer is integrated with Einstein GPT to enable a secured experience for customers when using AI-enabled CRM applications – via the GPT trust layer, customers can use LLMs critical in building their respective generative AI-enabled CRM solutions without the need to move or store their data in the model, enabling a “secure and trusted” experience critical to the enterprise environment.

The GPT trust layer gives connected LLM secure real time access to data without the need to move all of your data into the LLM itself. It’s an incredible breakthrough for our customers and working with LLMs in a secure and trusted way. While they’re using the LLMs, the data itself is not moving and being stored in the LLM.

The GPT trust layer is likely to become a differentiating factor for Salesforce’s AI-enabled CRM solutions amongst competitors. Close to 40% of the private sector have cited cybersecurity improvements as a top priority, complementing the expanding demand environment for AI-enabled cloud-based CRM and productivity solutions which Salesforce aims to deeper penetrate via its AI strategy.

And zooming out of how Salesforce plans to monetize the burgeoning AI opportunities, the company has also expanded its foray into primary research within the field through the development of its proprietary LLMs, following the footsteps of pioneers like Google’s PaLM and LaMDA (GOOG / GOOGL), OpenAI’s GPT, and Meta Platforms’ LLaMA (META). Similar to the GPT trust layer, Salesforce’s proprietary LLMs – spanning ProGen and CodeGen – will be key to reinforcing its competitive advantage in AI-enabled CRM solutions by mitigating its future reliance on third-party models such as OpenAI’s GPT technology, and differentiate its value proposition from competitors.

- ProGen: The ProGen LLM is specific for chemistry and biology use cases, supporting the development of “solutions for addressing challenges in human disease and the environment”. Within Salesforce AI Research, the ProGen LLM is already being used to “identify potential treatments for neurological and autoimmune disorders”, underscoring the technology’s increasingly mission-critical role in supporting “bioscience and healthcare” applications. The development is likely to further Salesforce’s success in industry-specific clouds, such as “Health Cloud”, and deepen its market share gains across generative AI opportunities in the healthcare and life sciences industry.

- CodeGen: The CodeGen LLM is built to enable customers – spanning no- to low-code business users and pro-code developers – the ability to code and build apps through simple text prompts. Unlike existing text-to-code solutions, the CodeGen LLM will facilitate the development of conversational AI abilities in the process – similar to the dialogue-like experience offered by ChatGPT today. This will continue to complement Salesforce’s deepening foray in CRM-focused productivity solutions introduced in recent years, which is corroborated by its integration of MuleSoft, Tableau and Slack. Continued advancements through CodeGen, and the integration of ensuing technologies across Salesforce’s AI-enabled applications will be key to “[opening] up coding to new segments of the population”, driving “big productivity gains” for existing and prospective customers.

Digital ecosystems are evolving into systems with ever-increasing functional complexity, and at some point these systems’ complexity may increase beyond our capacity to understand them, let alone build them. We may soon get to the point where projects require technology such as conversational AI programming, in order to create the mega-complex software systems of the future — both on the massive scale that will be required, and in a timeframe that would be impossible for a team of human programmers to produce on their own… Next-gen programming needs, both at Salesforce and at other organizations, seem destined to make conversational AI programming systems like CodeGen essential to our future.

Source: blog.salesforceairesearch.com

Is AI a Threat or an Opportunity for Salesforce?

In the trade-off between optimizing costs and ensuring growth, investors under today’s uncertain market climate have been unwilling to compromise neither.

Investors are entering a new month with little clarity on interest rates and the economy. That’s boosting the appeal of stocks with robust cash flows and promising revenue growth, even if they come with hefty price tags.

Source: Bloomberg News

While Salesforce fits the bill on both requirements for profit and growth, the increasing pace of divergence between top-line deceleration and margin expansion are drawing concerns over the longer-term durability of its market leadership in CRM software. The fiscal first quarter marked Salesforce’s slowest growth in more than a decade, with a similarly muted pace expected in the current quarter, underscoring the weight of persistent macroeconomic challenges on the IT spending environment.

The advent of generative AI has also heightened competition – while Salesforce has aimed to differentiate its value proposition in the AI era through the GPT trust layer and introduction of proprietary LLMs, its moat as the market leader in CRM software is at risk of disruption. Specifically, the widespread availability and adoption of generative AI has improved sales productivity capabilities across the industry at a rapid pace, eroding the lustre from Salesforce’s aspirations to complement and expand its existing market leadership in CRM SaaS with the implementation of Einstein AI Platform and Einstein GPT capabilities.

For instance, Microsoft’s (MSFT) integration of OpenAI’s GPT technology across its productivity software as observed through its expanding “Copilot” suite accentuates the threat of generative AI accessibility to Salesforce’s market leadership in CRM SaaS. Microsoft Dynamics 365 – a productivity suite that is already widely implemented across today’s private sector – has recently leveraged Copilot solutions enabled by GPT-4 to bolster its foray in CRM solutions. Copilot can be used to automate email responses, conduct sentiment analysis, provide feedback and customer insights, automate generation of product descriptions, and “flag external factors such as weather financials, and geography that might cause supply chain issues”. This is essentially similar to offerings that Salesforce aims to enhance with Einstein GPT, underscoring the risks of workplace technology consolidation and rising threat of competition dealt by the advent of generative AI that could ultimately dull the company’s leadership in CRM SaaS.

A tepid growth outlook at Salesforce underscores its AI strategy is not expected to materialize into meaningful incremental revenue within the foreseeable future. While management has cited the integration of Einstein GPT and other generative AI capabilities across its app portfolio, the strategy is likely to bolster its existing revenue streams by levelling its value proposition against competitors’, instead of driving meaningful incremental share gains. In other words, Salesforce’s AI strategy is likely to play a greater role in preventing obsolescence, rather than driving new value. This underscores further pressure on its top-line and little alleviation from recent market interest in generative AI. While the company has staged an impressive feat in expanding its margins, the impact of slowing growth could ultimately catch up and add pressure to Salesforce’s bottom-line, underscoring risks to the longer-term durability of its profit profile.

Fundamental Analysis

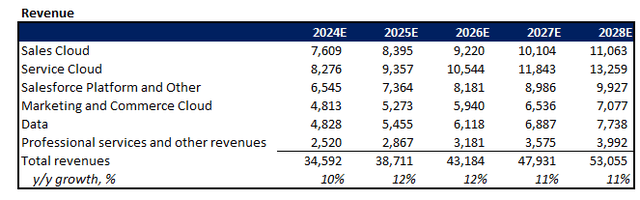

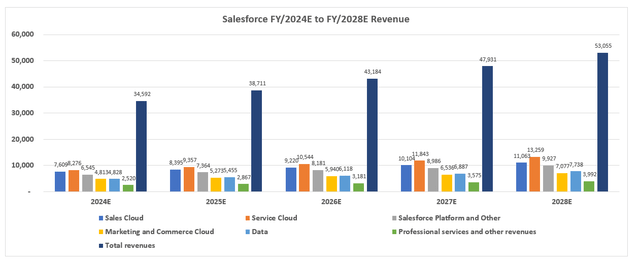

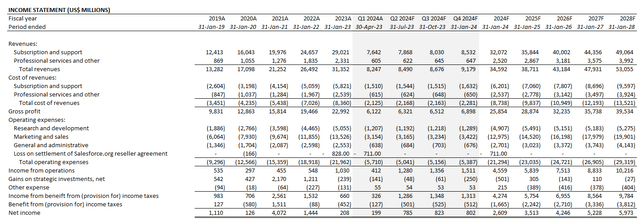

Adjusting our fundamental forecast for Salesforce for the company’s latest results and forward guidance cited by management, with additional consideration of its demand environment given risks and opportunities facing the company on the emergence of generative AI, revenues are expected to expand at a moderate pace of 9% on average over the next five years. DataCloud is likely to emerge as one of the fastest-growing subscription revenue streams for Salesforce, in line with expectations that offering will be built into “every cloud and Customer 360” alongside Einstein GPT over time to address incremental opportunities stemming from the increasingly data- and AI-first environment. Meanwhile, professional services sales are likely to remain subdued in the near-term considering the challenging macroeconomic backdrop that has weighed on the global IT spending environment.

Author

Author

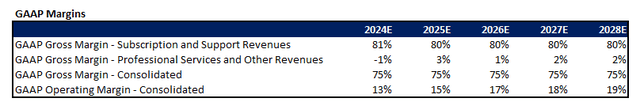

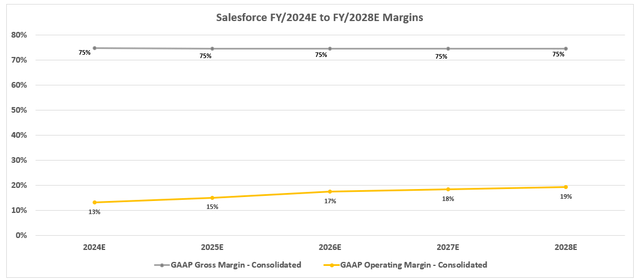

This is likely to drive a greater subscription and support revenue mix within the foreseeable future at Salesforce, and serve as an additional tailwind to the company’s ongoing margin expansion efforts given the subscription-based segment’s higher-profit nature.

Author

Author

Author

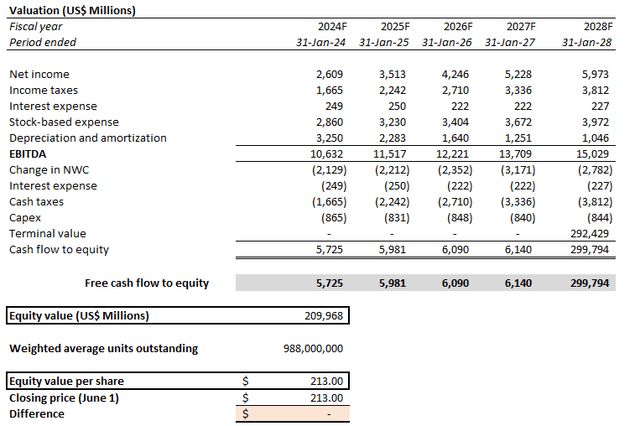

Valuation Analysis

Author

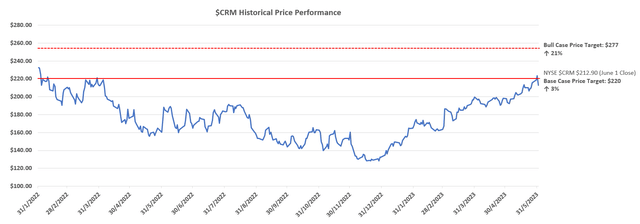

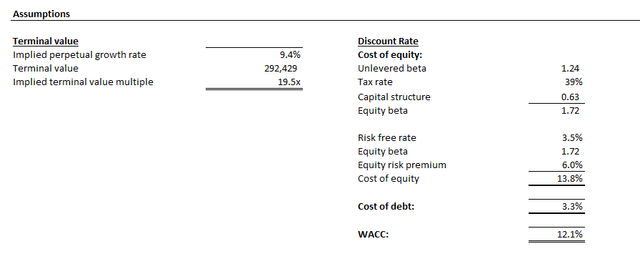

Based on the discounted cash flow analysis on projected cash flows taken in conjunction with our fundamental forecast for Salesforce, with the application of a 12.1% WACC in line with the company’s capital structure and risk profile, the stock’s current price at about $213 apiece implies a more-than-9% perpetual growth rate. While this would present a significant valuation premium relative to the pace of economic growth across Salesforce’s key operating regions, it remains in line with trends observed across the broader SaaS and tech industry given the cohort’s role in driving expansion across the economy. The premium can also be reasonably attributable to Salesforce’s existing market leadership in the provision of CRM software, and reflects the market’s optimism over the company’s recent efforts in bolstering profitability.

Author

Author

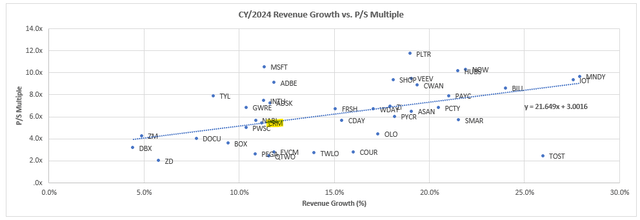

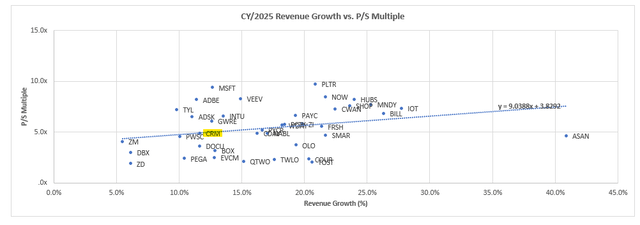

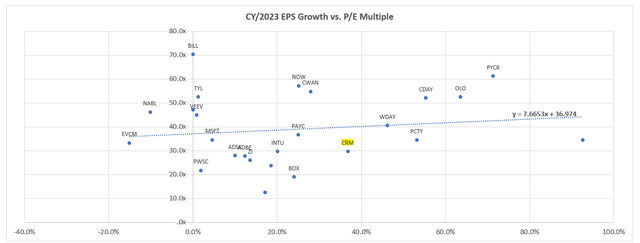

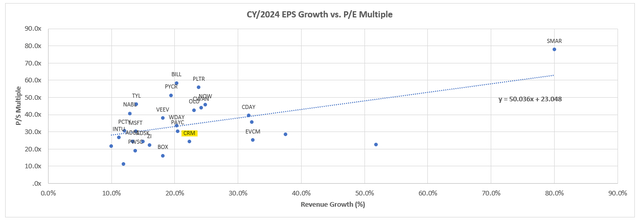

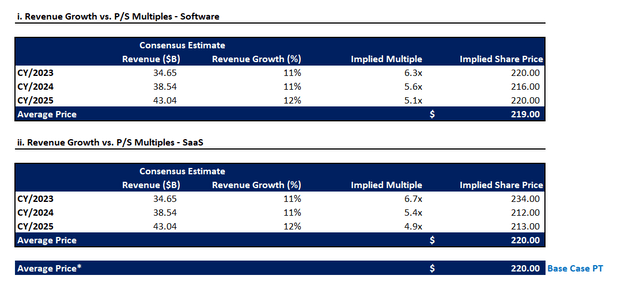

And considering a multiple-based valuation approach, Salesforce’s current market value at about 6x estimated sales and 30x estimated earnings is relatively in line with its broader tech and SaaS peers with similar growth and margin profiles.

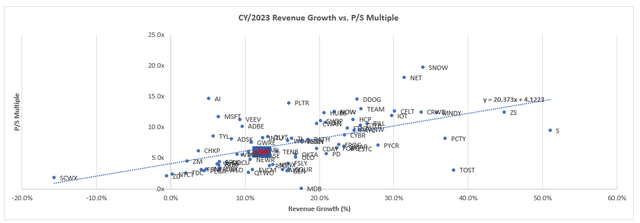

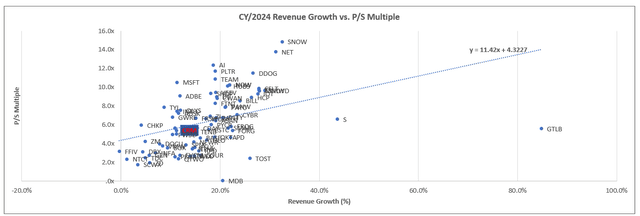

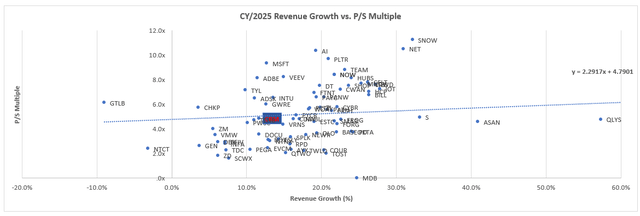

i. Sales Growth vs. P/S Multiple – Software

Author, with data from Seeking Alpha

Author, with data from Seeking Alpha

Author, with data from Seeking Alpha

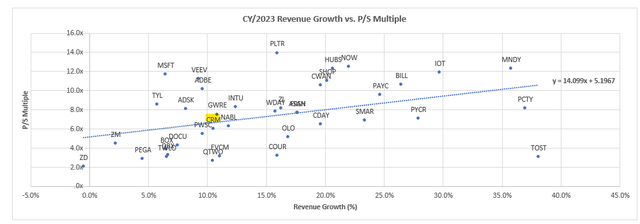

ii. Sales Growth vs. P/S Multiple – SaaS

Author, with data from Seeking Alpha

Author, with data from Seeking Alpha

Author, with data from Seeking Alpha

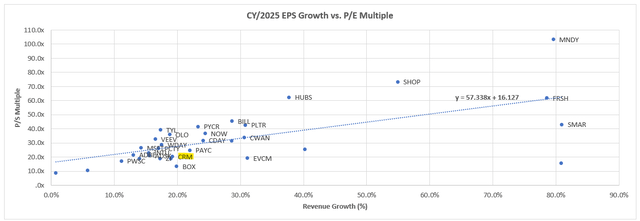

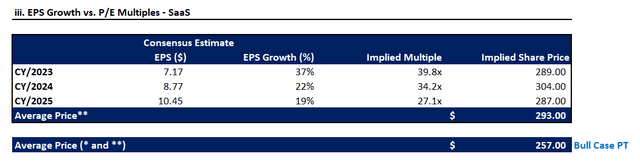

iii. EPS Growth vs. P/E Multiple – SaaS

Author, with data from Seeking Alpha

Author, with data from Seeking Alpha

Author, with data from Seeking Alpha

Considering growth comparables across both the broader software universe and SaaS sub-industry, Salesforce should trade near the $210-$220 range on a relative basis to its peers, which is in line with the stock’s performance at current levels.

Author

And taking incremental consideration of earnings comparables across both the broader software universe and SaaS sub-industry, Salesforce stock has the potential to rise to the $250-range to reflect its margin expansion efforts.

Author

However, drawing on the foregoing analysis, sustainability at the $250-range for the stock would rely on Salesforce’s ability in proving durability to its pace of margin expansion. This would rely on prospective measures that could sustainably reaccelerate the underlying business’ growth prospects in the longer-term, which Salesforce’s current prioritization over its generative AI strategy has yet to prove.

The Bottom Line

Despite accelerating interest over generative AI, the emerging technology is likely to do little in bolstering Salesforce’s growth prospects within the near-term. The struggle accentuates issues to the durability of the company’s ongoing margin expansion efforts – an impressive feat that might not last if growth continues to stall, whether due to transient macroeconomic challenges or more structural disruptive and competitive factors stemming from the advent of new technologies, like generative AI, among other factors. Given ongoing risks to Salesforces’ restructuring plan and uncertainties over its demand environment, we believe the stock is right where it should be right now, and reasonably reflective of the underlying business’ prospects in capturing secular tech tailwinds – like those brought forth by generative AI – ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!