Summary:

- Salesforce stock is finally trading near 52-week highs.

- The company is showing resilient revenue growth amidst a tough macro environment, highlighting the strength of its wide product suite.

- The company has unveiled its generative AI product offerings, officially making it an AI stock.

- With a net cash balance sheet and ongoing share repurchase program, I reiterate my buy rating for the stock.

Justin Sullivan

Like many tech peers, Salesforce (NYSE:CRM) joined the artificial intelligence bandwagon. The company has already integrated generative AI into its product suites including its new offering Slack GPT. CRM continues to show resilient revenue growth while it drives stronger operating margins. The company maintains a net cash balance sheet and is repurchasing stock. Even accounting for the strong recent price action, the valuation remains reasonable even without a material acceleration in top-line growth. CEO Benioff has done it again as CRM is rapidly adapting to the changing environment – to the benefit of its shareholders.

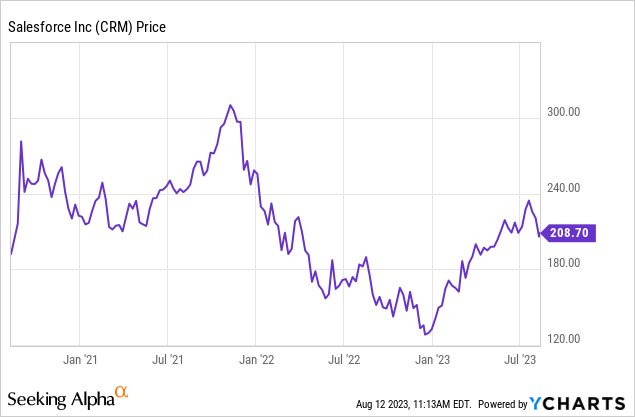

CRM Stock Price

After a recent rally, CRM stock was trading near 52-week highs but remained far below all-time highs.

I last covered CRM in April where I rated the stock a buy due to its rapidly developing cash flow story. The stock is up marginally since then as enthusiasm for AI has helped bolster an improving fundamental picture.

CRM Stock Key Metrics

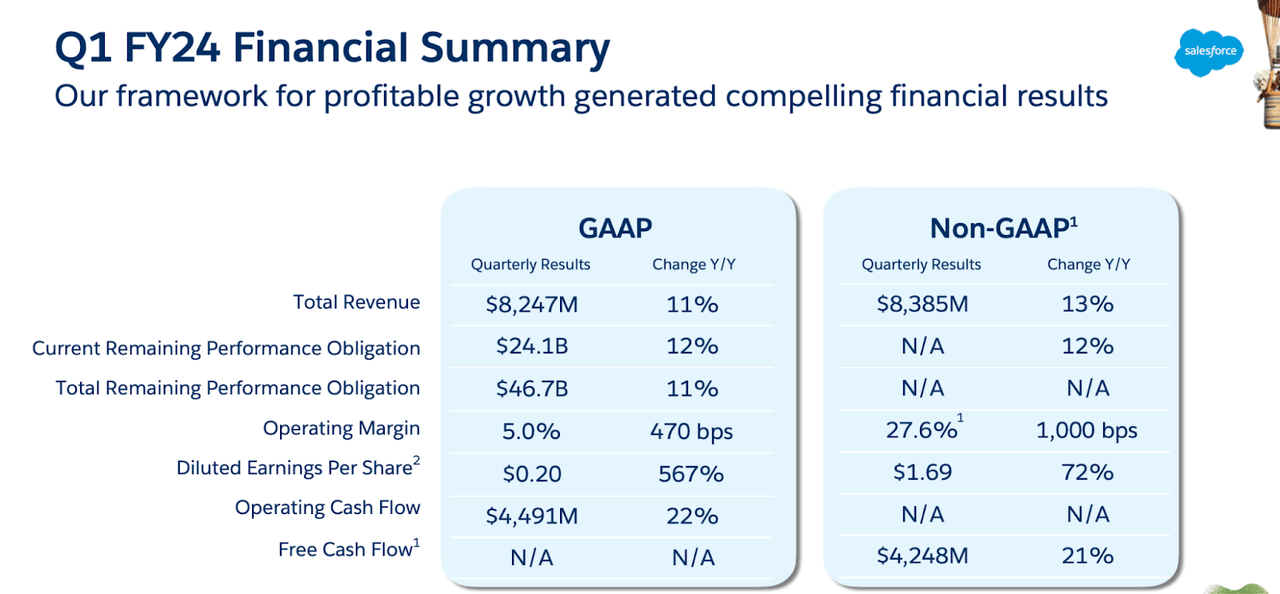

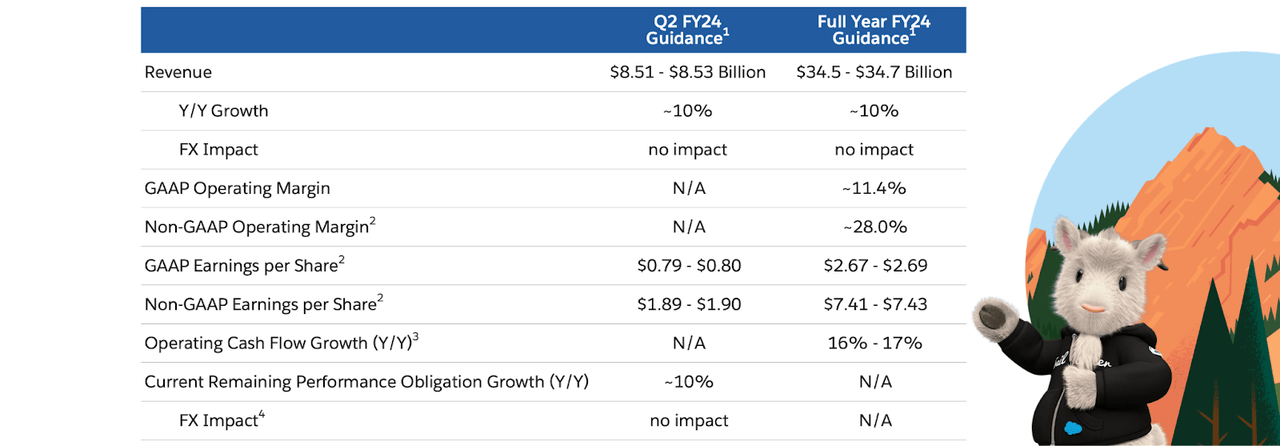

In its most recent quarter, CRM generated 11% YOY revenue growth to $8.25 billion, comfortably beating management guidance for $8.18 billion. The company generated an impressive 27.6% non-GAAP operating margin – it is incredible that CRM has been able to drive such large operating leverage in spite of the tough macro environment.

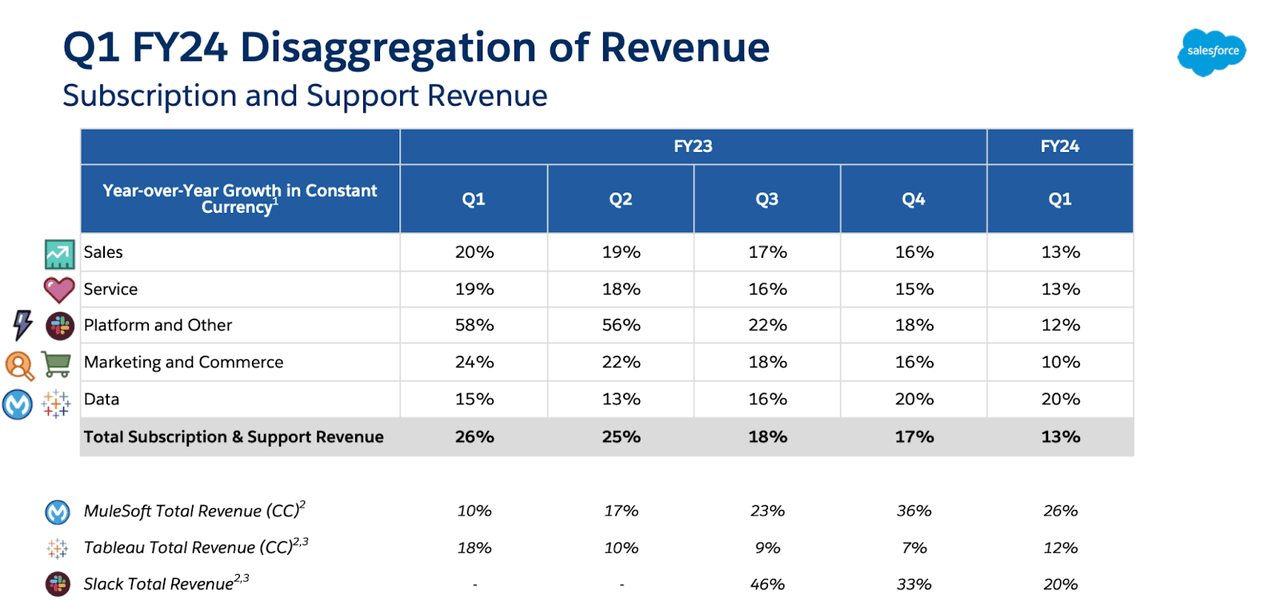

CRM has seen its strongest growth in its recent acquisitions, with MuleSoft revenue growth coming in at 26% and Slack revenue growth at 20%. It is worth noting that Slack revenue growth has decelerated sequentially at a rapid pace since the third quarter of the last fiscal year.

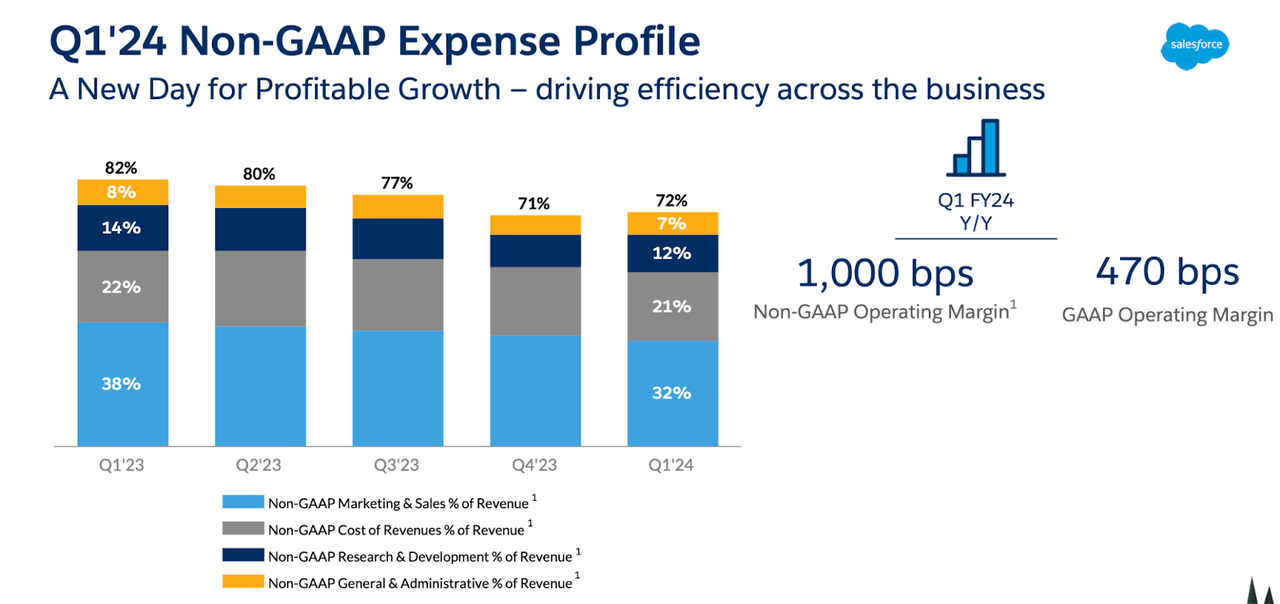

Like many tech peers, CRM has offset decelerating top-line growth with strong gains in margins. CRM delivered 470 bps in GAAP operating margin expansion and 1,000 bps in non-GAAP operating margin expansion, largely driven by operating leverage in marketing & sales. As seen across the tech sector, larger companies with more complete product portfolios are seeing some surprising tailwinds from the tough macro environment as customers are sticking with more well known offerings.

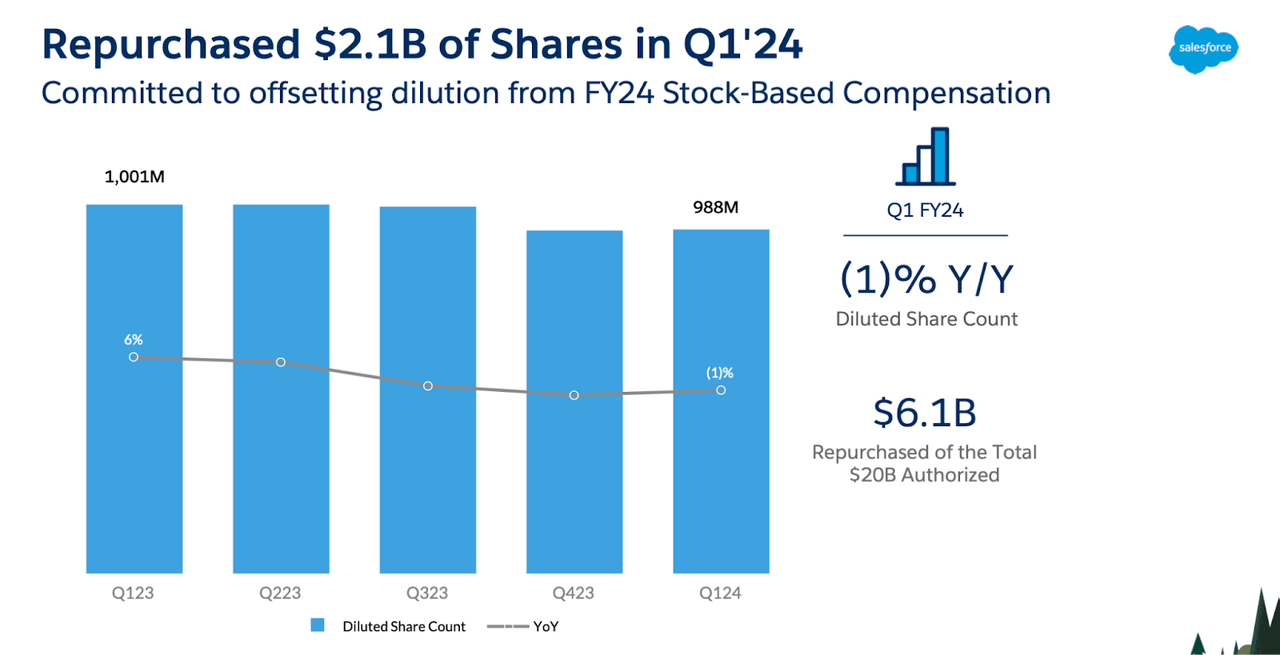

CRM has coupled the gains in profitability with its ongoing share repurchase program. CRM repurchased $2.1 billion of stock in the quarter which after accounting for stock-based compensation led the fully diluted share count to decline 1% YOY. CRM still has $12.9 billion remaining of its share repurchase authorization.

CRM ended the quarter with $14 billion of cash and $4.6 billion of strategic investments versus $9.5 billion of debt. Between the company’s net cash position and robust free cash flow generation, this represents a rock-solid balance sheet.

Looking forward, CRM maintained its full-year revenue guide but increased its non-GAAP operating margin expectation to 28%, up from 27%.

This is a management team that historically raises revenue guidance as the year goes on, but the tough macro environment easily excuses this omission this past quarter. On the conference call, management reiterated that “improving profitability is our highest priority.” Prior to the tech crash when interest rates were near-zero, such commentary would have been unheard of. But after the valuation reset and dramatic rise in interest rates, Wall Street has rewarded management teams which are showing a willingness and ability to boost profit margins. Management noted some headwinds due to its previously announced headcount reduction, as the associated reorganization has led to understandable volatility in normal business operations. That commentary has been echoed across the sector but I expect the company to move past these quickly.

Is CRM Stock A Buy, Sell, Or Hold?

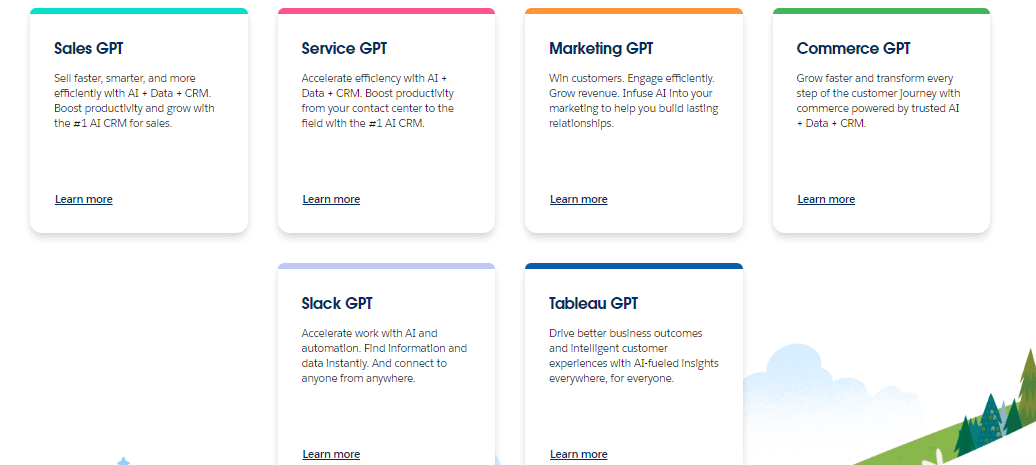

In true Benioff-form, CRM has quickly embraced the generative AI movement. At its AI Day in June, management unveiled how it was integrating generative AI across its entire product suite. These include Slack GPT which can “deliver instant conversation summaries, research tools, and writing assistance directly in Slack,” as well as integrations in all of its other product offerings.

Salesforce

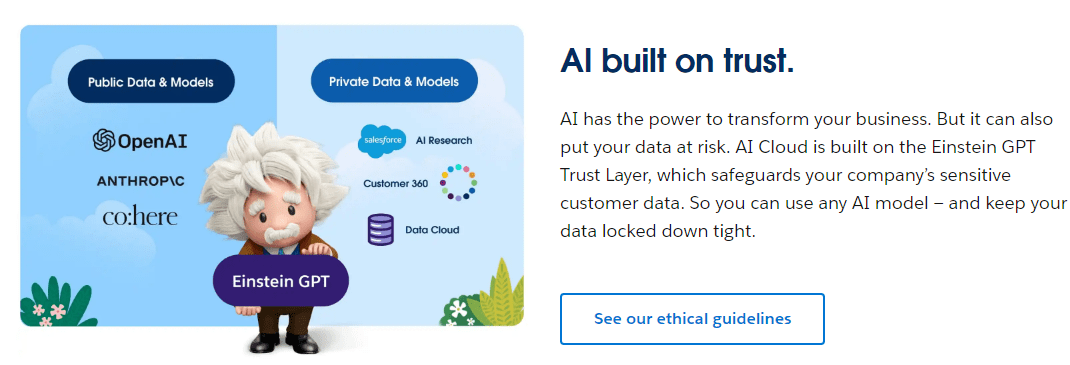

CEO Benioff has sought to differentiate itself from peers by focusing on a core message: “AI built on trust.” Many customers are undoubtedly concerned about how AI may impact product safety and integrity – CRM aims to deliver AI improvements without compromising quality of service.

Salesforce

Over time, I expect many more tech peers to quickly integrate generative AI into their product suites, but CRM must be given credit for being able to execute so quickly on this themselves. I am of the view that generative AI tailwinds may be unlikely to offset macro headwinds in the near term, but may help bolster the long term digital transformation secular growth story. After the rally, CRM stock still traded reasonably at around 6x sales.

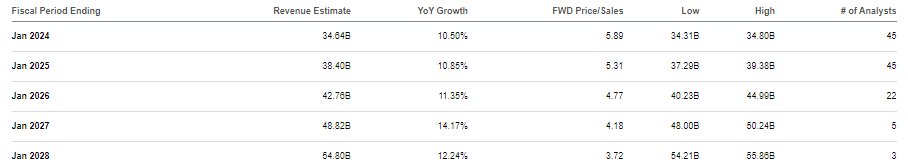

Seeking Alpha

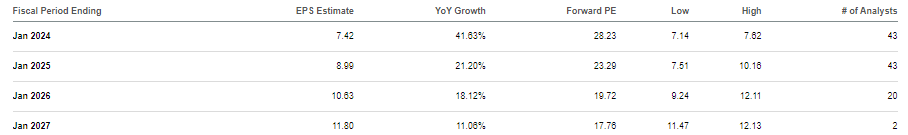

That valuation is not so demanding in light of consensus estimates for sustained double-digit revenue growth as well as the stock’s reasonable earnings multiple.

Seeking Alpha

The silver lining from the tough storm faced by the tech sector over the past 2 years is that increased focus on profitability. I personally did not doubt these company’s ability to drive profitability over the long term, but Wall Street clearly possessed such doubts. With CRM management showing a commitment to profitability through both actions and words, I expect the stock to continue an upward re-rating as investors come to appreciate the long term earnings potential of the company. Based on 15% forward growth, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see CRM trading at around 7x sales. That implies double-digit potential annual upside from annual growth, annual earnings, and multiple expansion.

What are the key risks? As I have written previously, the company’s growth rates in the past appear to have been driven in no small part due to M&A. Now that the company has such a large revenue base, there is the risk that revenue growth never re-accelerates. Perhaps the past M&A was an effort by management to hide decelerating organic growth rates, though it is hard to argue against how their acquisitions have fit nicely in their product suite. If growth were to remain at just 10%, then my fair value estimate would decline to around 4.5x sales, implying significant downside. The company’s strong balance sheet and improving profit margins may provide some downside protection, but operating leverage will be difficult if revenue growth slows down. Generative AI is ironically another risk. While it may appear for now that AI should boost the fundamentals (at least this seems to be implied by the stock price), the actual results remain unclear. It is possible that generative AI reduces the company’s competitive edge relative to peers. CRM competes against mega-cap tech titans and it is possible that the larger operators may have stronger AI offerings. I reiterate my buy rating as the near term picture is very promising as shareholders are getting almost everything they can wish for between resilient top-line growth, expanding bottom-line margins, and ongoing share repurchases.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!