Summary:

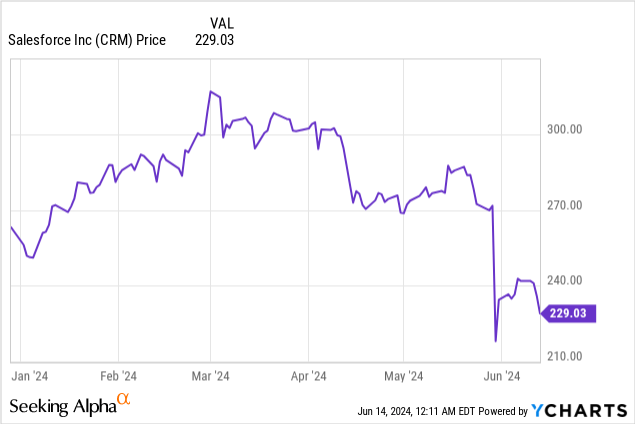

- Salesforce has continued to plummet after its Q1 earnings print, positioning this stock as a near-term buy.

- Investors panned the company’s weaker growth relative to the past, but key cloud areas are showing impressive constant-currency growth.

- The stock is trading at a ~1.1x PEG ratio, approaching a buy point if it slides ~5%-10% lower.

- Earnings also grew 44% y/y in the most recent quarter (vs. just 11% revenue growth) and is expected to grow 20% y/y this year.

Rosangela Perry/iStock Editorial via Getty Images

With the market continuing to dance around all-time highs, I continue to favor contrarian positions that go against the general market take. My goal in buying potential rebound plays is to reduce correlation to broader market swings, and to me, Salesforce (NYSE:CRM) is approaching buy territory.

Year to date, shares of Salesforce have lost more than 10% of their value, dramatically underperforming both the S&P 500 as well as other tech companies. Despite the recent introduction of its first-ever dividend, investors have panned Salesforce’s growth deceleration as well as the company, signaling that it may begin to pursue selective M&A again.

I last wrote a neutral opinion on Salesforce in October, back when the stock was trading at $170 per share. Since then, Salesforce has underperformed other tech stocks that have benefited from the AI boon – while at the same time, the company has continued to muscle through impressive EPS gains through its fierce cost cuts. Once the poster child for “growth at all costs” and a proponent of the prototypical enterprise software business model of spending a lot on sales and marketing upfront to acquire recurring-revenue clients, Salesforce has dramatically shifted its tone over the past year as CEO Marc Benioff proclaimed his commitment to profitability. Layoffs have made the company more efficient, while, in my opinion, not sacrificing any growth potential at all. To me, it’s a great time to switch my recommendation on Salesforce to buy.

The risks to Salesforce are well known and the reason why Salesforce has been dropping since Q1 earnings. Yes, growth is decelerating vs. 2022/2023 growth rates, but the company is still maintaining impressive momentum across a number of key areas, including what it now calls its integration cloud (Mulesoft, the Salesforce subsidiary specializing in API connections, in particular continues to do tremendously well). And it’s true that Salesforce may be beginning to ramp up its M&A engine again, per Benioff’s remarks on the Q1 earnings call:

We continue to acquire companies. We just acquired amazing new company called Spiff, which is part of our Salesforce automation platform […] And look, we’re not going to shy away from M&A for any one particular reason if it’s within our framework. But if it’s outside of our framework, we’re going to be extremely cautious.”

We do note, however, that while Salesforce has had quite an acquisitive past, its marquee acquisitions like Mulesoft, Slack and Tableau are driving the company’s growth today.

The other reasons to be bullish on Salesforce:

- Cloud products stretching across wide swaths of enterprise software. Salesforce has among the largest product portfolios in the enterprise software sector, spanning CRM, service management, API integration and other backend software, messaging (Slack), AI (Einstein), and other tools that give Salesforce a tremendous opportunity to “land and expand” within its customer base.

- Best in breed and a category leader across many verticals. Many of Salesforce’s products, such as Sales Cloud, were the original movers in the space. Sales Cloud is still considered the top product in the CRM space. The company also has a history of acquiring other best-in-breed platforms, such as Slack.

- Founder-led. Unlike many mega-cap tech companies, Salesforce is still led by its founder, Marc Benioff. The company has also done away with the co-CEO that wasn’t working out.

- Tremendous earnings growth. Careful consideration of headcount and cost structure, unlike in the past, has also helped Salesforce to grow operating earnings and EPS well in excess of revenue growth.

Valuation checkup

Salesforce isn’t cheap, I’ll make that clear. But in my view, for a best-in-breed company that’s still achieving double-digit growth rates, I view this as a high-quality company that is trading at quite a fair price, especially after a ~30% slide from year-to-date peaks near $320.

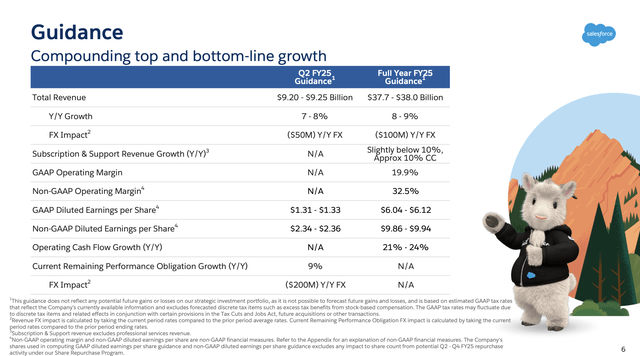

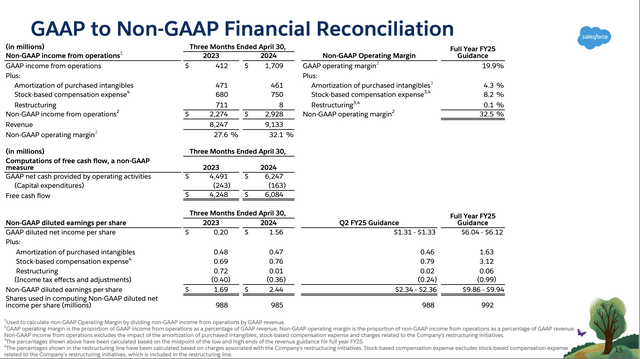

First, we’ll look at earnings multiples. For current year FY25, Salesforce has guided to $9.86-$9.94 in pro forma EPS, or $9.90 at the midpoint. The midpoint here represents 20% y/y growth vs. $8.22 in pro forma EPS in FY24.

Salesforce FY25 guidance (Salesforce Q1 earnings deck)

At current share prices near $230, this pits Salesforce’s P/E ratio at 23x. But on a PEG basis, factoring in the expected 20% EPS growth this year, Salesforce’s PEG ratio is just 1.15x, where a ratio <1x signals a company that is fairly valued for its growth.

In my view, Salesforce becomes a safe buy when its PEG ratio falls below 1x (a $198 buy target, or ~14% downside from current levels), but I’m also quite comfortable buying in the $215-$225 range as well, knowing that Salesforce has a knack for beating its estimates and raising its guidance later on (especially with positive trends in some of its cloud verticals, as we’ll cover in the next section), especially with positive trends in some of its cloud verticals, as we’ll cover in the next section

From a revenue multiple standpoint: Salesforce’s current market cap is $221.9 billion. After we net off the $22.6 billion of cash, cash equivalents, and strategic investments on the company’s balance sheet against $9.4 billion of total debt, its resulting enterprise value is $208.7 billion, which is a 5.5x EV/FY24 revenue multiple (the stock has historically hovered between 5-7x revenue multiples, but it’s fair for the stock to slide toward the lower end of that range as its growth is more modest now than in the past).

The bottom line here: In my view, Salesforce is buyable on the next major 5%-10% dip.

Q1 download

Though the markets widely panned Salesforce’s Q1 results, I found a lot to be positive on.

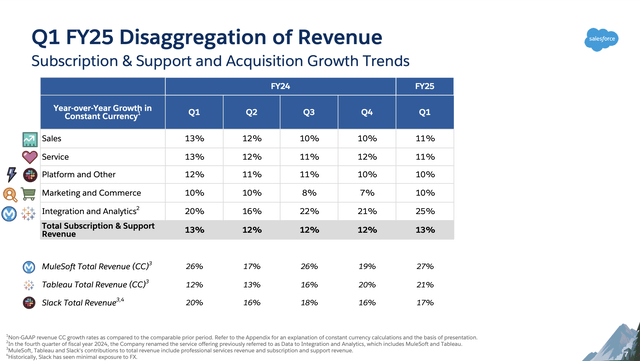

First, let’s take a look at the company’s growth trends by product:

Salesforce trended growth by product (Salesforce Q1 earnings deck)

On a constant currency basis, Salesforce’s growth rate in Q1 actually slightly accelerated to 13% y/y growth, despite missing Wall Street’s nominal estimates by a slight hair. We note that Sales Cloud, Salesforce’s original and oldest product, still saw accelerating growth despite the product’s maturity. The company’s integration and analytics portfolio, meanwhile, saw 4 points of y/y constant currency growth acceleration to 25% y/y, driven largely by an eight-point growth acceleration in Mulesoft, and helped as well by improvement in Tableau (business intelligence software) growth rates.

The company did cite macro-driven headwinds and budgetary cautions amid its customer base. Per President Brian Milham’s remarks on the Q1 earnings call regarding the buying environment:

Now let me briefly address the buying environment. We continue to see the measured buying behavior similar to what we experienced over the past two years and with the exception of Q4 where we saw stronger bookings. The momentum we saw in Q4 moderated in Q1 and we saw elongated deal cycles, deal compression and high levels of budget scrutiny. In addition, in Q1, as part of our ongoing transformation, we made some intentional changes in our go-to-market organization to drive long term productivity and create better customer experiences, which also played a role in the softer bookings performance. At the same time, we are seeing strong momentum in various parts of our business, particularly Data Cloud and industries. And we continue to drive our core growth levers, multi-cloud deals, again, were a highlight for us in the quarter with six of our top 10 deals, including six or more clouds, showing the depth and relevance of our portfolio.”

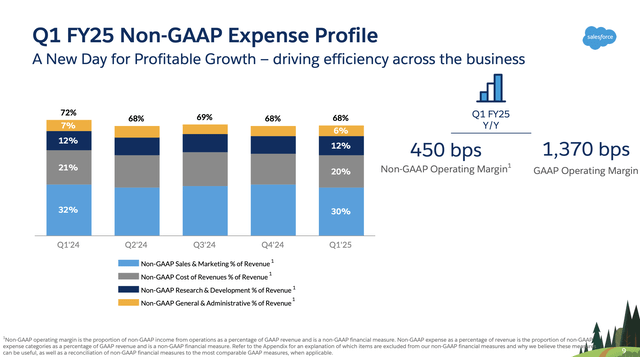

The bottom line, however, is where Salesforce shone. The company reduced pro forma operating expenses significantly as a percentage of revenue, particularly in sales and marketing (which reduced from 32% of revenue in the year-ago Q1 to 30% now).

Salesforce trended expense (Salesforce Q1 earnings deck)

Pro forma operating margins, meanwhile, leaped 450bps y/y, while pro forma EPS soared 44% y/y to $2.44, which beat Wall Street’s expectations of $2.36 with 3% upside.

Salesforce earnings (Salesforce Q1 earnings deck)

Key takeaways

With so much pessimism baked into Salesforce’s stock at the moment, I think it’s very likely that the stock will continue to fall to a buy point in the low $200s. It’s time to add this stock back to your watch list and lock in a position before it rebounds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.