Summary:

- Salesforce’s stock has gained 15% since July, outperforming the broader U.S. market, driven by consistent revenue growth and improved profitability.

- The release of Agentforce enhances CRM’s offerings, boosting differentiation and pricing power, with a 38% upside potential, reinforcing a “Strong Buy” rating.

- Recent quarterly earnings surpassed expectations, demonstrating strong operating leverage and a robust balance sheet, positioning CRM well for future investments and acquisitions.

wdstock

Investment thesis

My previous bullish thesis about Salesforce’s (NYSE:CRM) stock aged well, as the stock gained around 15% since July. This is far better compared to around 6% delivered by the broader U.S. stock market.

There are numerous reasons to remain bullish. Revenue continues demonstrating consistent growth. The company’s profitability is growing even faster as exercising the cross-selling potential helps in driving down customer acquisition costs. Moreover, the recent release of Agentforce will highly likely make CRM’s suite of offerings even more differentiated and will help in exercising more pricing power. The valuation is still extremely attractive with a 38% upside potential. All in all, I reiterate my “Strong Buy” rating for CRM.

Recent developments

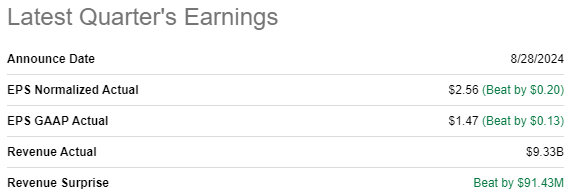

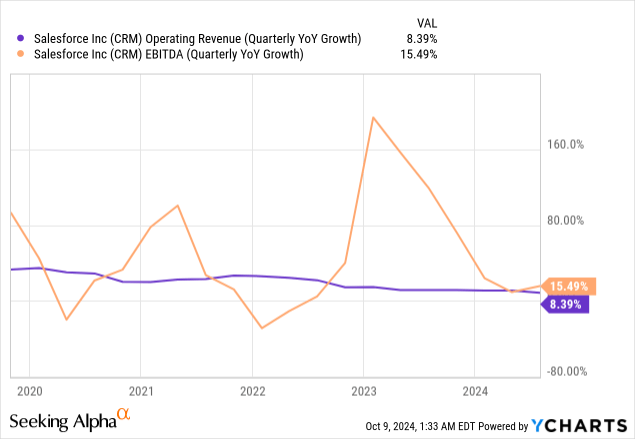

The company published its latest quarterly earnings on August 28, surpassing consensus estimates both for the EPS and revenue. The company’s sales were up 8.4% on a YoY basis, and the adjusted EPS expanded from $2.12 to $2.56. Another positive sign is that the bottom line demonstrated a QoQ improvement as well, from $2.44 to $2.56.

Seeking Alpha

Solid operating leverage was demonstrated once again by CRM in Q2. The gross margin improved YoY from 75.4% to 76.9%, which allowed it to expand the operating margin from 17.7% to 20.2% YoY. That said, CRM’s EPS expansion was of a very high quality.

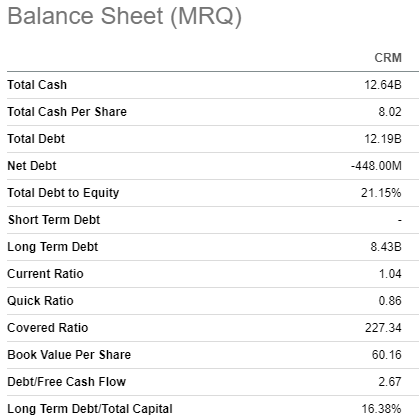

As a result of strong operating leverage, the company generated around $900 million in levered free cash flow [FCF] during Q2. This was notably better compared to $555 million during the same period last year. Therefore, CRM’s financial position remains rock-solid. The company ended Q2 with almost $13 billion in cash and insignificant leverage.

Seeking Alpha

CRM’s robust balance sheet makes it well-positioned to invest in improving its offerings or expanding the footprint via acquisitions. The company’s TTM R&D spending is $5.2 billion, according to the income statement provided by Seeking Alpha. CRM is well-known for its firm commitment to improve value for its customers, and it is like part of the company’s culture.

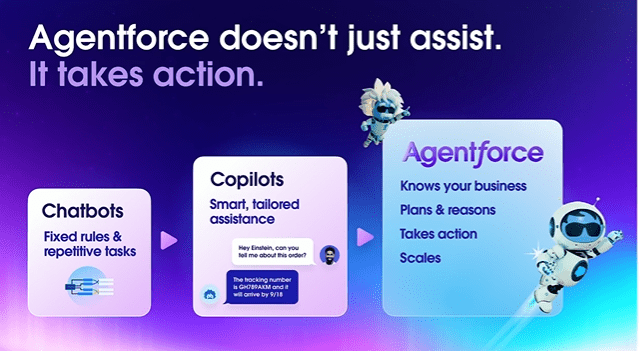

Salesforce

With the rapid adoption of AI capabilities, CRM seems eager to be at the forefront of this secular trend. Actually, the company was one of AI pioneers and released its AI-powered Einstein feature in 2016, several years before the emergence of ChatGPT and other hot AI products. Therefore, by releasing its Agentforce customizable AI Agent Builder, the company once again confirmed its strong commitment to deliver the latest technological advancements to its customers.

The above screenshot suggests that CRM’s Agentforce is another level of automatization compared to chatbots and copilots. According to the company’s official release, Agentforce “offers a new level of sophistication by operating autonomously, retrieving the right data on demand, building action plans for any task, and executing these plans without requiring human intervention”. If this is really the case, CRM’s Agentforce could be a true game changer, which will highly likely help employees of customers to save dozens of hours by automating more complex tasks rather than only routine ones. With greater value for customers, we can expect CRM to exercise its powerful cross-selling potential once again.

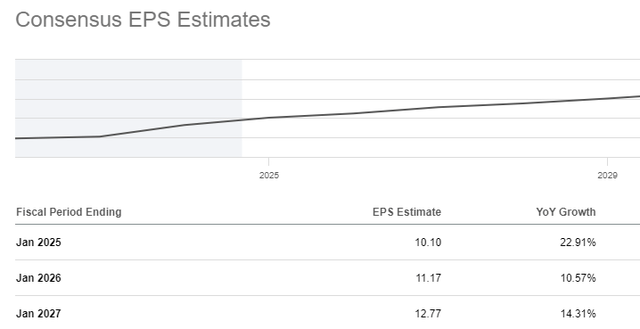

The above chart is a clear indication of CRM’s strong business mix that enables it to drive profitability growth, which is faster than revenue growth. CRM achieves operating leverage with its strong cross-selling potential and its strong pricing power. The suite of offerings is unique, and the Agentforce offering makes CRM’s ecosystem of services even more differentiated. Therefore, it is not surprising that despite a modest single-digit projected revenue growth for the next several of years, Wall Street analysts expect an aggressive EPS growth for the upcoming three fiscal years.

The release of Agentforce took place on September 12, and it appears that Wall Street analysts are also quite positive about the potential of a new product in my opinion. Several prominent equity research firms reiterated their bullish stance on CRM, while Piper Sandler and Northland upgraded the stock to “Buy”. Moreover, on October 3 Baird named Salesforce the “top large-cap software pick”.

TrendSpider

To wrap up, the blend of catalysts is still robust. The company’s revenue demonstrates consistent growth, while profitability outpaces it due to a strong cross-selling power, which drives down customer acquisition costs. The release of Agentforce highly likely improves differentiation of CRM’s suite of offerings. The balance sheet provides the company with vast financial flexibility to invest in differentiation more. With that being said, I see no reasons to become less bullish about CRM.

Valuation update

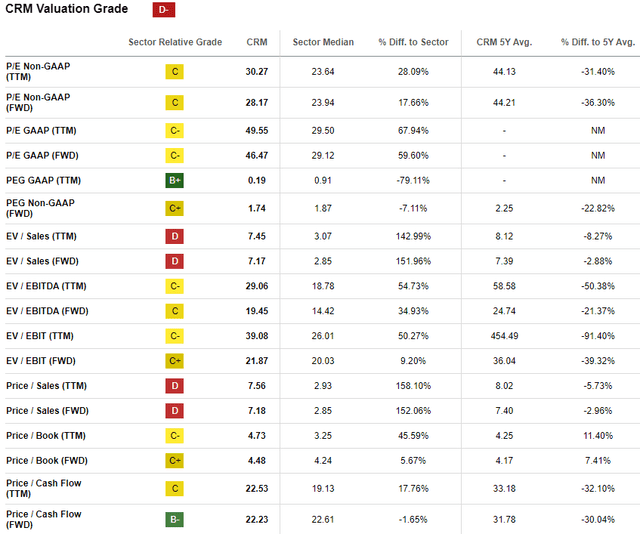

The stock rallied by 40% over the last 12 months, notably outperforming the S&P 500. On the other hand, the YTD performance is behind the broader market, with a modest 11% rally in 2024. As an unparalleled leader in its niche, CRM has high valuation ratios compared to the sector median. That is why Seeking Alpha Quant assigns CRM a very low “D-” valuation grade. Due to the company’s market leadership and unmatched profitability, I think it is better to compare CRM’s current valuation ratios with historical ones. From this perspective, CRM looks attractively valued as most of its ratios are notably lower compared to the last five years’ averages.

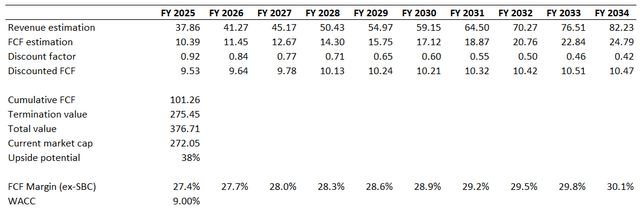

Looking at valuation ratios is never enough for me, and I want to proceed with the DCF simulation. I reiterate the same 9% WACC, which is within the range recommended by valueinvesting.io. A high single-digit [9%] revenue CAGR for the next decade projected by consensus looks fairly conservative. CRM’s TTM FCF margin ex-stock-based compensation [ex-SBC] is 27.4%. Since consensus conservatively projects a 9% revenue CAGR, I should also be conservative with the FCF expansion assumption. Therefore, I incorporate a modest 30 basis points yearly FCF margin expansion. The net cash position is ignored for CRM’s DCF, since it is almost immaterial compared to the company’s market cap.

My DCF simulation suggests that the company’s fair value is $376 billion. This is 38% higher compared to the current $272 billion market cap. Therefore, the upside potential is still compelling.

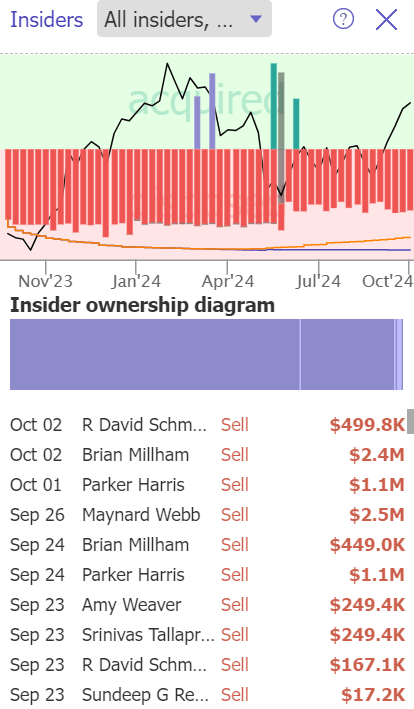

Risks update

Despite a very attractive valuation suggested by my DCF calculations, insiders are not in a rush to buy the stock. The below screenshot suggests that there was, by far, more insider selling than buying over the last twelve months. This might mean that I might be missing some red flags. On the other hand, the amounts of recent transactions look quite insignificant compared to the company’s $272 billion market cap.

TrendSpider

CRM faces stiff competition from the giants such as Microsoft (MSFT), Google (GOOG) (GOOGL), and Amazon (AMZN). Furthermore, the tech is changing at a rapid pace and each year new startups are coming up with more CRM competition. This company is actually pretty savvy in the fight with all the intense competition, but past success does not always guarantee future success. In terms of scale, CRM is not even close to these trillion-dollar companies. Let it be clear, CRM not only battles these giants on a one-to-one basis, but they are also going up against one another for the best talent and new customers.

TrendSpider

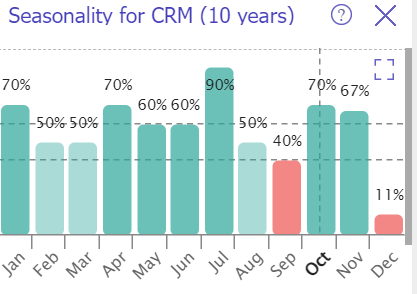

As the year-end approaches, I have to warn readers that the stock’s success rate in December is extremely low at 11%. This means that over the last decade, there was only one year when CRM gained in December, while the other nine years closed in red. Since I usually update coverage once in a quarter, it means that I will update my CRM thesis only in January 2025. Therefore, my subscribers and readers should be aware that December is very weak historically.

Bottom line

To conclude, CRM is still a “Strong Buy”. The blend of catalysts is strong, and the valuation is still extremely attractive. Of course, investing in CRM is not without risks, but I think that an upside potential outweighs all of them.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.