Summary:

- Salesforce Inc. is undervalued by the market despite impressive profit growth and profitability.

- Salesforce’s stock price dropped due to a disappointing sales forecast, but its profit potential remains strong.

- With a low profit multiple and potential for growth, Salesforce is considered a steal for investors looking for a high margin of safety.

Bjorn Bakstad

Salesforce Inc. (NYSE:CRM) is an absolute steal right now as the market undervalues the company’s profit potential as a leading cloud company. Salesforce is very profitable and produced impressive profit growth in the last quarter.

Salesforce’s poorly received forecast for the second quarter, particularly with respect to sales, culminated in a panic-driven selloff in May from which the stock is yet to fully recover. With that said, though, Salesforce’s profit surge is well underpriced and I think that the stock is poised for a rebound.

The technical chart situation has already started to improve and with Salesforce selling at only 23x leading profits, I think investors still have an opportunity here to establish a position.

What’s Going On With Salesforce?

Salesforce is a key cloud platform and provides customer relationship management software to its enterprise customers. Salesforce helps companies keep track of leads, conversions, communications and sales and allows companies to manage customer relationships remotely.

The cloud-based software company also owns the enterprise market-focused Slack chat and productivity app and Salesforce has integrated AI capabilities into its platform in order to support its platform analytics functions.

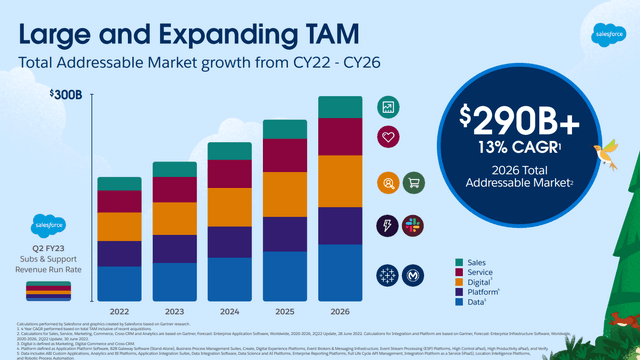

The addressable market for Salesforce’s cloud, data and software solutions is growing and anticipated to hit $290 billion by 2026.

Large And Expanding TAM (Salesforce)

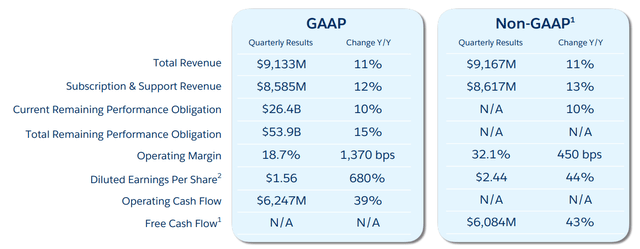

In lock-step with the market, Salesforce has grown is sales at double digits, but lately seen a bit of a slowdown. With that said, though, the company’s CEO, Mark Benioff, has done a hell of a job in recent years in growing the cloud company to a market valuation of $250 billion and more than $36 billion in 1Q24 run-rate sales. Salesforce’s 1Q24 sales rose 11% YoY to $9.1 billion with subscription sales rising 12% YoY to $8.5 billion.

Total Revenue Growth (Salesforce)

Though Salesforce’s 1Q24 profits skyrocketed, the cloud company’s forecast for 2Q24 spoiled the earnings presentation in May. Salesforce forecasted 7-8% sales growth in the second quarter, disappointing investors. However, the cloud company kept its forecast for 8-9% growth on a per annum basis unchanged. The selloff has made Salesforce’s stock much more compelling, in my view, particularly in the context of the company’s surging profits.

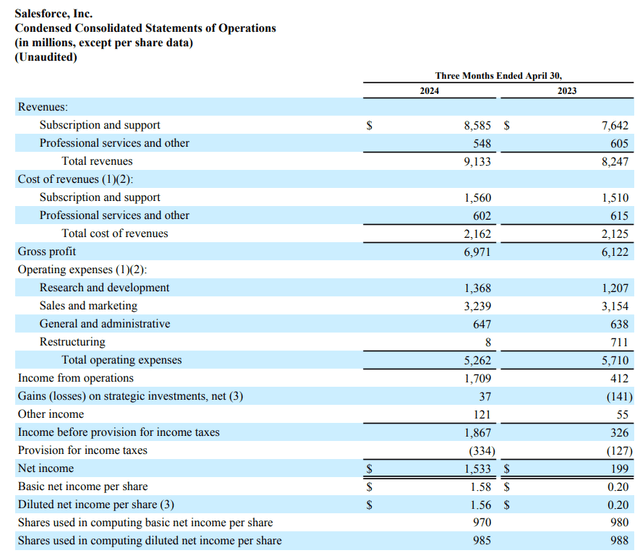

A look at the company’s 1Q24 earnings press release shows why: Salesforce, while ‘only’ seeing 11% growth in sales, produced $1.5 billion in profits, up 670% YoY. On a diluted per share basis, Salesforce’s profits skyrocketed 680% YoY to $1.56. Salesforce underlying growth in the addressable market, robust value proposition for enterprise customers and easy-to-handle relationship management software are key to the company’s success.

Condensed Consolidated Statements Of Operations (Salesforce)

Technical Analysis

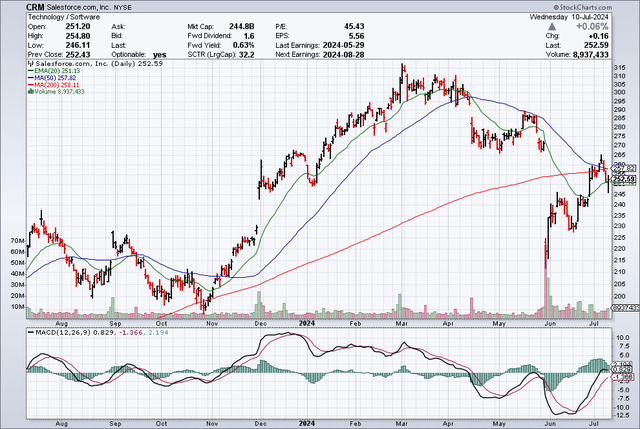

Salesforce’s stock crashed and burned immediately after the cloud company presented its outlook for second quarter sales. The outlook, discussed above, deeply disappointed investors concerned about Salesforce’s growth potential, triggering a steep selloff from which Salesforce has started to recover.

In May, Salesforce’s price plummeted from around $270 to $215 in a single day before rebounding to $252 (at the time of writing). In the process, Salesforce broke through the 200-day moving average, a long-term bullish trend line.

With that said, though, Salesforce recaptured the 20-day moving average line at the end of June and presently battles with the 200-day moving average line. A recapture of this trend line would indicate gap close potential and a stock price move toward $270.

Moving Averages (Stockcharts.com)

Salesforce Is A Steal

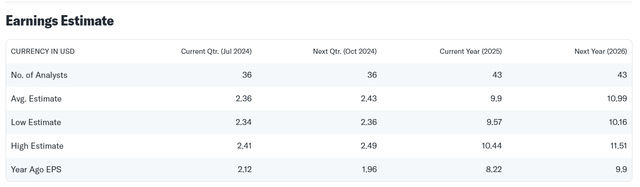

Salesforce’s profits are cheap, and maybe even a little bit too cheap which helps investors capitalize on a high margin of safety that often only becomes apparent after excessive and sudden valuation declines. Salesforce is anticipated to produce 11% YoY profit growth next year.

Now, this growth rate may not be stunning, but Salesforce is producing a boatload of profits now, which limits risks for those investors that are taking the plunge here: Salesforce, with a present stock price of $252, is selling for only a 22.9x earnings multiple. Before the crash, Salesforce sold for 24.5x next year’s earnings.

Oracle Corp. (ORCL), which also offers customer relationship management software, is selling for a 20.0x profit multiple and is anticipated to produce 15% profit growth next year.

SAP SE (SAP) is selling for 30.3x leading profits, but it also anticipated to grow quicker, with an implied YoY profit growth rate of 34%. ServiceNow Inc. (NOW) is eyeing 20% profit growth and changes hands for 46.2x next year’s sales.

While ServiceNow is probably a bit overpriced, given the range of available profit multiples, I think that Salesforce is particularly cheap. With a mid-range profit multiple of 25.0x, Salesforce would hardly be overvalued, in my opinion, particularly because the stock sold for a similar multiple before the May crash.

A 25.0x profit multiple implies at least an intrinsic value of $280 which would be my low end estimate. An SAP-like multiple of 30.0x would put the intrinsic value of Salesforce closer to $330.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Disappoint

Salesforce is growing its sales and its earnings, but it operates in a competitive market where many companies offers software solutions for enterprise customers.

Growing competition in the market for cloud-based software solutions as well as the advent of artificial intelligence capabilities pose risks for Salesforce and the company might continue to see softening sales growth as a consequence.

Leveraging the strength of AI, small software companies could potentially offer similar platform services as Salesforce and thereby add to the company’s sales headwinds.

My Conclusion

The market presently does not acknowledge that Salesforce’s profits are well undervalued. Though it is true that Salesforce’s anticipated dip in sales in 2Q24 took investors by surprise, the full year outlook was not changed. I wish investors paid more attention to Salesforce’s big upswing in profits in 1Q24 which is what ultimately underpins the company’s valuation.

As far as I am concerned, Salesforce’s stock is a steal with a minimum intrinsic value of $280 (and up to $330 in the max case) and I anticipate that the gap at $270 will be closed in the short-term.

In the long-term, Salesforce has ample opportunities to grow and scale its software, cloud and data platform and the valuation reflects a decent margin of safety when compared against other data companies.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.