Summary:

- Salesforce shares surged 11% after beating Q3 top line estimates, driven by strong AI adoption.

- The company is seeing real momentum in terms of Agentforce adoption, which is a key AI product for the CRM platform.

- Free cash flow grew more than three times faster than revenue, and Salesforce grew its FCF margins.

- Salesforce slightly raised its FY 2025 revenue guidance, projecting continued robust growth.

- Shares of Salesforce now trade above my fair value estimate of $331/share, which is why I am downgrading CRM stock to hold.

Just_Super/E+ via Getty Images

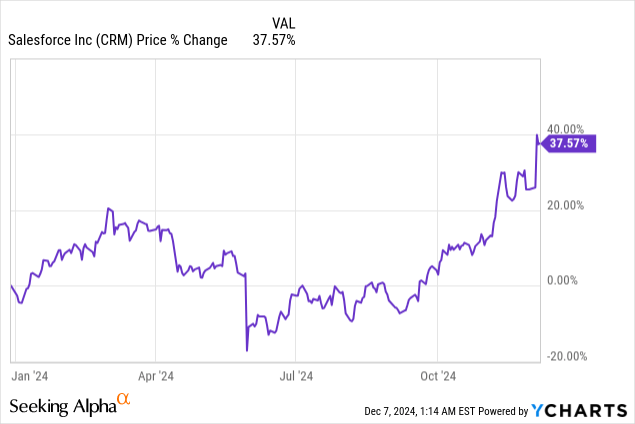

Shares of Salesforce (NYSE:CRM) surged 11% after the CRM applications provider submitted a better than expected earnings sheet (in terms of revenue) for the third fiscal quarter. Salesforce beat top line estimates by a wide margin and is seeing positive AI production adoption trend in its core business. The two core services, Service and Sales, continued to perform especially well in the October quarter, with both segments generating double-digit top line growth. Most importantly, Salesforce’s free cash flow grew three times as fast as its top line in the third fiscal quarter, and the company could announce a major new stock buyback next year.

Previous rating

I rated shares of Salesforce a buy in my last work on the software company in August — Top Value For Growth Investors — due to the company’s momentum with AI products, strong customer acquisition as well as robust free cash flows. In the third fiscal quarter, Salesforce continued to do well on all of these fronts, but shares have surged lately, causing my fair value target to be exceeded. For this reason, I am down-grading shares of Salesforce to hold.

Salesforce beat top line estimates, free cash flow growing 3 times faster than revenue

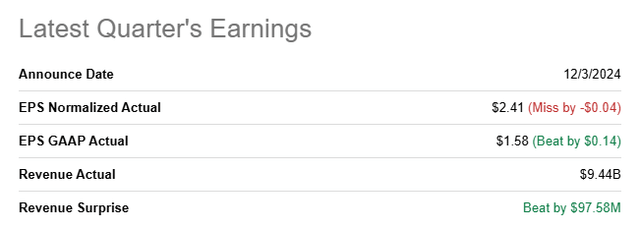

Salesforce beat predictions for the top line while missing slightly on the bottom line in the third fiscal quarter: the CRM company reported adjusted earnings of $2.41 per-share, which missed the average estimate by $0.04 per-share. The software company generated total revenues of $9.44B, which exceeded the consensus estimate by $98M.

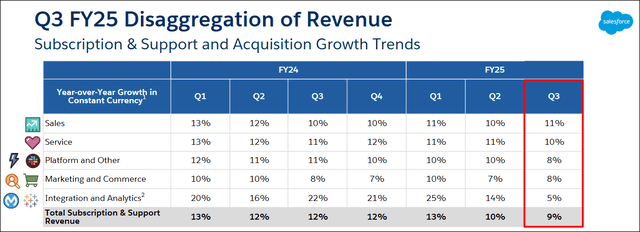

The sales and Service segments continue to be the two most important and fastest growing segments for the CRM applications provider. In the third fiscal quarter, Salesforce generated 9% top line growth and total revenue of $9.44B, the majority of which was contributed by its core subscription offering. Sales and Service grew their segment top line at 11% and 10% rates year-over-year, boosting the company’s consolidated revenue growth. Salesforce’s revenue growth trend is nonetheless moderating, but this has neither hurt the company’s shares nor its free cash flow potential.

One aspect of Salesforce that it going well is the roll-out of AI assistants, which the company confirmed was starting to make the company money. Salesforce has heavily invested into AI technology, such as Agentforce, which is a collection of AI chatbots that allow companies to build and deploy customizable AI agents in order to help them scale their operations.

Agentforce is seeing good traction on the AI front, according to the company’s CEO Marc Benioff, as companies continue to spend money on their AI transformations. At its core, Agentforce (and other AI chat assistants) help businesses streamline processes and these AI bots are increasingly operating autonomously, therefore offering companies productivity gains as well as lower costs. According to Salesforce’s CEO, the company is seeing strong demand for AI chatbot assistants (with thousands of deals in the Agentforce pipeline) which could potentially be a catalyst for a revenue acceleration in the quarters ahead.

Software companies tend to offer their customers new licenses annually, and most customers tend to renew their contracts mostly in the fourth and the first quarter of each fiscal year. Therefore, Salesforce sees a surge in free cash flow during those two quarters. In the last fiscal quarter, which ended on October 31, 2024, Salesforce generated $1.8B in free cash flow, which calculates to a free cash flow growth rate of 30%. Salesforce’s free cash flow therefore grew about three times faster than its revenues. Also, Salesforce’s free cash flow margins increased 3 PP year-over-year to almost 19% which gives the company a considerable amount of buyback potential.

|

$millions |

FQ3’24 |

FQ4’24 |

FQ1’25 |

FQ2’25 |

FQ3’25 |

Y/Y Growth |

|

Subscription and Support |

$8,141 |

$8,748 |

$8,585 |

$8,764 |

$8,879 |

9.1% |

|

Professional Services |

$579 |

$539 |

$548 |

$561 |

$565 |

-2.4% |

|

Revenues |

$8,720 |

$9,287 |

$9,133 |

$9,325 |

$9,444 |

8.3% |

|

Cash Flow From Operating Activities |

$1,532 |

$3,403 |

$6,247 |

$892 |

$1,983 |

29.4% |

|

Capital Expenditures |

($166) |

($147) |

($163) |

($137) |

($204) |

22.9% |

|

Free Cash Flow |

$1,366 |

$3,256 |

$6,084 |

$755 |

$1,779 |

30.2% |

|

Free Cash Flow Margin |

15.7% |

35.1% |

66.6% |

8.1% |

18.8% |

+3.1 PP |

(Source: Author)

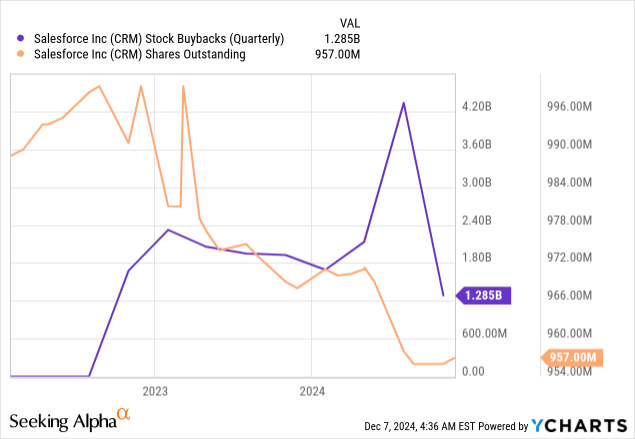

A lot of this free cash flow is going to get returned to shareholders eventually. Salesforce approved a $20B stock buyback last year and the firm is buying back shares at a rapid clip here as well: in Q3’24 Salesforce repurchased $1.3B worth of its shares and bought back a total of $7.8B in the first nine months of the current fiscal year. In the last three years, Salesforce has bought back approximately 3.4% of its outstanding shares. I fully expect Salesforce to ramp up its buybacks with growing free cash flows and project that Salesforce will announce a new buyback plan next year.

Salesforce confirms guidance for Q4’25

The software platform guided for $9.9-10.1B in revenue, implying 7-9% year-over-year growth, which about met expectations. Salesforce also slightly raised its full-year forecast for FY 2025 and now expects $37.8-38.0B in revenues, compared to $37.7-38.0B previously.

Salesforce’s valuation

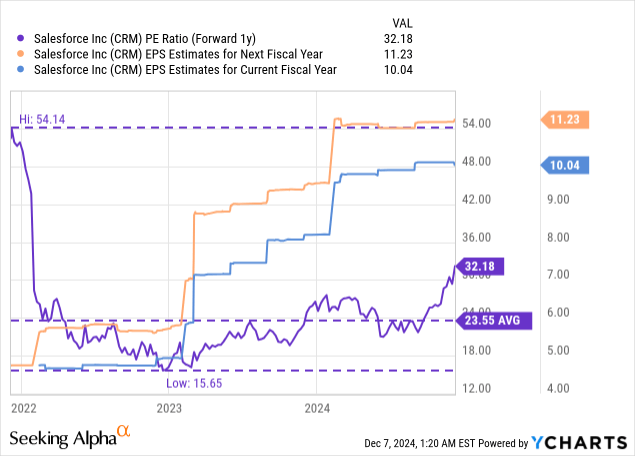

Salesforce is widely profitable, so the CRM applications provider can be valued based off of an earnings-based valuation ratio. Shares of Salesforce are priced at a forward (FY 2026) price-to-earnings ratio of 32.2X, which compares against a 5-year average price-to-earnings ratio of 23.6X. Software companies that run Cloud businesses at scale don’t tend to be cheap, and Salesforce is expected to put up some serious growth numbers in the years ahead, in part because of the roll-out of new expected AI products. However, I believe shares of Salesforce are now more than fairly valued.

In my last work on the AI CRM company, I said that I saw a fair value of $331 per-share, based off of a longer-term valuation average P/E ratio of 30.0X. This valuation multiplier has now obviously been exceeded, as has been my fair value target, and I am down-grading shares to hold as a result. The reason why I don’t lower my rating to sell here is that Salesforce’s AI pivot is paying off and the CRM platform could potentially see an acceleration of its revenue base going forward.

Risks with Salesforce

The biggest risk for Salesforce, as I see it, relates to a potential spending slowdown on CRM application software and AI products like Agentforce. CRM is valued based off of its potential for earnings and platform revenue growth, so a slowdown in terms of corporate spending is a key risk for investors. What would further change my opinion on Salesforce more specifically is if the platform were to see weaker free cash flow growth and margins, or if the company were to lose momentum with its AI tools.

Final thoughts

Salesforce delivered a strong earnings scorecard for the third fiscal quarter last week that highlighted continual momentum in Service and Sales, which generate the strongest top line growth for the CRM platform. Salesforce revenues came in slightly ahead of consensus estimates, and free cash flow growth looked very solid. Salesforce’s pivot to AI products is also paying off, so there were a lot of things to like about the company’s Q3’25 earnings release. However, shares have reached my fair value target and, as a result, I am down-grading Salesforce to hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.