Summary:

- Salesforce has added two key Generative AI to its product offerings.

- This is surely a big positive given the prospects offered by ChatGPT-style chatbots, but, for those who did not jump in early May, it is probably too late.

- Moreover, there is also the competition and, at this juncture, it is better to wait for the earnings call on Wednesday.

- Specific factors to look for are whether the guidance for this fiscal year is upgraded, and by how much as well as whether customers prioritize operational expenditure or nice-to-have AI.

- This thesis is also of the view that it is important to be realistic as to opportunities for a company that already proposes AI, while economic conditions deteriorate.

Sundry Photography/iStock Editorial via Getty Images

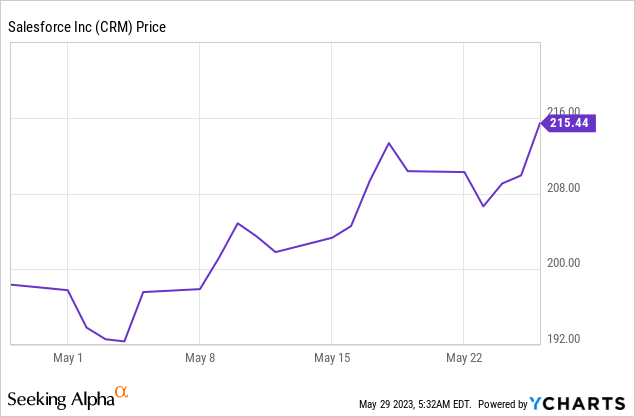

If you follow Salesforce’s (NYSE:CRM) stock, you would have noticed the upside as of May 4 (chart below) without a clear catalyst to justify such a price action except for the fact that its earnings results are on Wednesday 31, or in two days.

Well, the timing of the rally is related to the two GPT-related products it announced on May 4 for Slack GPT and subsequently, Tableau GPT on May 9 to take advantage of Generative AI. This follows Microsoft’s (MSFT) announcement earlier this year about partnering with OpenAI’s ChatGPT which also uses the same AI flavor to drive its chatbot.

These represent key additions to Salesforce’s product portfolio, but, for those who missed the upside, it is important to assess whether it is not too late since valuations may have become stretched. This is precisely the aim of this thesis and I start by providing some insights into exactly why the technology has become so pervasive.

The Case for Generative AI

For those of you who have done a search on Alphabet’s (GOOG) Google and have tried OpenAI’s ChatGPT which is also available through Microsoft’s Bing, the difference is obvious. As such, performing a conventional search as we have been doing for years certainly has its merits as it enables you to look for information that lies on the vast internet in a just couple of clicks. The same is the case for enterprises where employees have to look for data dispersed in various databases. However, whatever the effectiveness of the search engine, the employee is always faced with a flurry of results and has to go through each of them individually to look for actionable insights.

This amounts to complexity with 41% of senior IT leaders finding it difficult to fully grasp their own data because it is too complex or not accessible enough and roughly 33% being unable to produce decision-making insights from corporate data.

Now, think of a software robot doing the work as per the request through the words typed in the chatbot. This is what Slack GPT is all about, and, in addition to being a writing aid, it also produces AI-powered conventional summaries. For investors, Salesforce purchased messaging app Slack for a record $28 billion in July 2021.

Introducing Slack GPT (slack.com)

Subsequently, there was the launch of Tableau GPT to create data visualizations or What-if scenarios based on natural language queries instead of complex machine codes that salespeople can find particularly useful. On top, Tableau also boasts some real-time features like displaying the progression of items sold against the initial quota.

Now, all of these announcements are wonderful as it shows that Salesforce has taken action in order not to miss the Generative AI train, considering that nearly 80% of senior IT leaders believe the technology will help their organization make better use of data.

However, belief alone is not sufficient when it comes to valuing a company.

Valuing the Stock in View of Competition

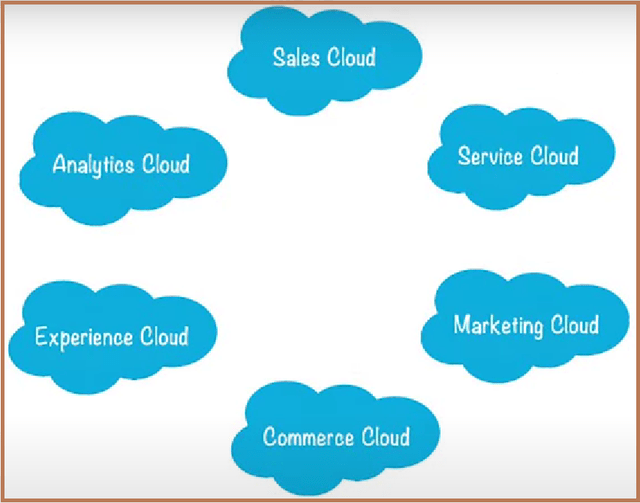

First, it is true that Generative AI is transformative in nature as it enables both people and businesses to significantly improve productivity. At the same time, the fact that it uses natural language making use of words that we commonly use, makes possible a faster learning curve as you do not have to interact with computer experts or learn coding to interact with intelligent algorithms. Thus, it may definitely help Salesforce drive its Sales, Services, and Platform segments to get more traction.

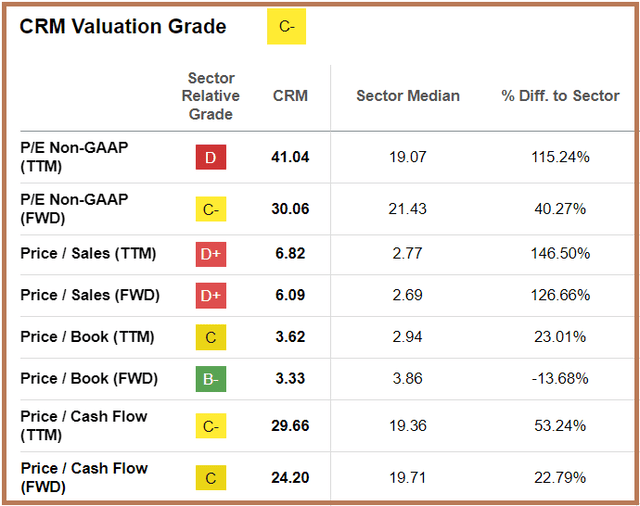

Moreover, as I elaborated in a previous thesis, Salesforce’s platform approach enables it to make fewer capital expenses and conversely accounts for the generation of higher free cash flow. For this purpose, a record $2.8 billion of cash were generated from operations in the fourth quarter of fiscal 2023 (FQ4’23) which ended in January, representing a 41% year-on-year growth. This was mostly due to customers renewing their contracts which also tend to be continued in the first quarter (FQ1’24), and driven by the two GPTs I mentioned earlier, the topline growth is likely to beat estimates. However, with a trailing Price-to-Sales ratio that is already above the sector median by over 140%, investors seem to have already priced in very high revenue growth figures.

Valuation Metrics (seekingalpha.com)

Next, looking at cash generation, at a trailing price-to-FCF multiple of 29.66x, Salesforce is again overvalued with respect to the sector median, this time by over 50%. Coincidentally, Microsoft also exhibits a multiple of 29.66x as if the market has placed a bar on Salesforce valuations based on the software giant’s metrics. The reason could be that the software giant has not only publicized the technology but has more levers to action in order to increase the flow of money brought by operations, namely through Azure cloud, the Bing search engine to generate advertising revenues as well as subscription fees originating from paid versions of ChatGPT.

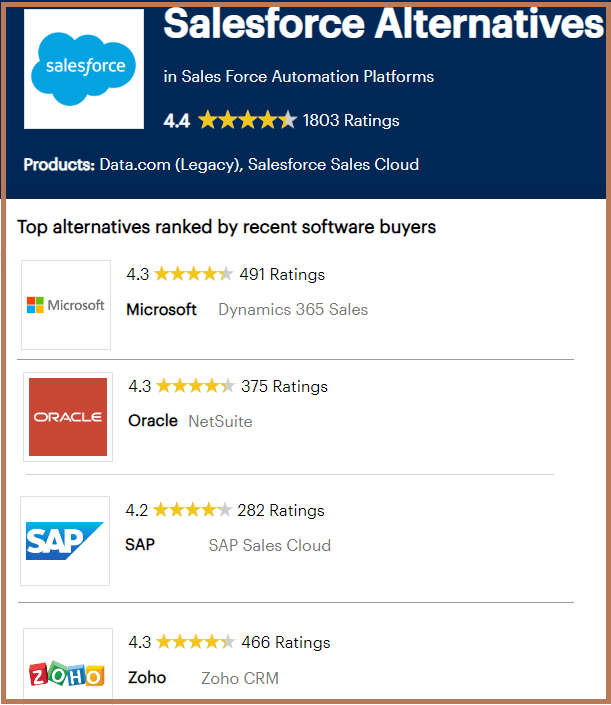

Furthermore, let us not forget that it also proposes a CRM tool called Dynamics 365 Sales on a SaaS basis just like Salesforce. It may not be as popular as it scores only 4.3 compared to Salesforce’s 4.4 as pictured below, but since people throughout the world are knowledgeable about ChatGPT, it may help Microsoft’s marketers to drive more sales of Dynamics 365.

Illustration prepared using data from (www.gartner.com)

Moreover, as pictured above, there are other smaller players like Zoho which can also benefit from AI. In this respect, Salesforce is trusted as the first SaaS provider for online CRM, enabling thousands of companies to join the cloud and also introducing them to predictive analytics through its Einstein product range. However, by their very nature, disruptive technologies, in this case, Generative AI allows new or smaller players to provide services to market segments that are not sufficiently profitable, or cash-generative that incumbents tend to ignore.

Thus, with OpenAI selling ChatGPT licenses using a per-per-use pricing model, smaller competitors have access to the technology implying more competition, in addition to Microsoft, Oracle (ORCL), and SAP SE (SAP).

Consequently, it is important to proceed with caution and not value Salesforce as a monopoly when investing.

Probably Too Late To Jump In

For those who failed to invest at the beginning of May when the major announcements were made, it is probably too late to jump in as the stock has already rose by 14.5% implying the trading opportunity has elapsed. For this matter, one must also bear in mind that the stock has already rallied nearly 60% YTD, both on the back of the upbeat Q4 earnings beat and AI prospects. Thus, it is better to be hooked on the financial results for FQ1’24 which ended in April.

In this case, similarly to Nvidia (NASDAQ:NVDA), there could be a surge in topline revenue as attracted by the announcements there may have advanced orders from existing customers for Tableau GPT which proposes recommendations to help salesmen meet goals faster using automation. However, after the initial frenzy, it is important to see if sales are sustained as Salesforce’s product offering already includes Analytics Cloud (pictured below) again powered by Tableau tools that enable massive amounts of data to be analyzed.

Moreover, Salesforce also proposes AI as part of its Service Cloud to analyze real-time customer data to promote engagement. Therefore, it can happen that these are sufficient for customers’ current needs, in turn signifying they do not want to invest additional resources in ChatGPT-style services. As for others, especially those hosted on other platforms, they may first want to make sure that their data does not get leaked into the public domain. In this respect, OpenAI recently had to disable certain features on data privacy grounds.

Thus, as new technology, Generative AI also comes with issues meaning that this is about making sure that the initial interests seen from customers are sustained and actually translate into revenues and profitability in the long term or during this fiscal year. In this case, FY-2024’s consensus revenue and EPS estimates are $34.65 billion and $7.17, which already represent 10.5% and 36.8% growth respectively. Thus, after so much enthusiasm, it is better to take a pause and wait, hence the reason for my “hold” position.

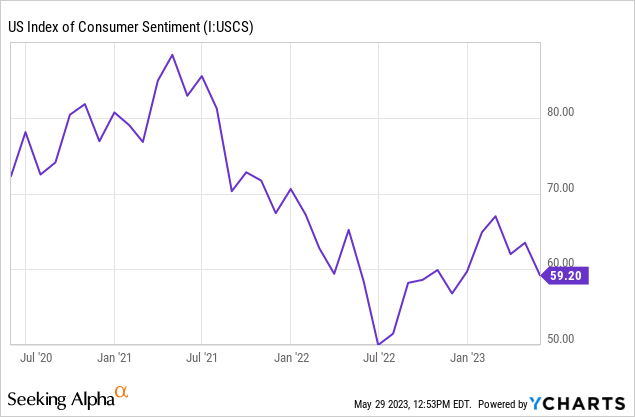

Pursuing further, amid all this AI hype do not forget the United States is witnessing higher inflation, and elevated interest rates compared to last year with the stock market being rattled by banking turmoil earlier this year. While large tech stocks were largely sparred, businesses, in general, have become more prudent in terms of spending, and there was a deterioration in consumer sentiment from April to May as shown below.

Also, according to the Economic Intelligence Unit, there could be a consumer-led economic slowdown. In these conditions, corporate priorities may change and focus on essential operations rather than nice-to-have AI.

Finally, after such an upside, it may not be the right time to invest in Salesforce, and key items to be on the lookout for during the earnings call are the number of orders pertaining specifically to Generative AI, the willingness of customers to pay for the additional services instead of sticking to normal operational expenditures, and most importantly whether the company is able to sustain profitability which has recently been achieved to a large extent on the back of the 8,000 job cuts.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.