Summary:

- Salesforce, Inc. stock fell steeply into a bear market in 2022 but has since recovered, outperforming its peers with a 1-year total return of over 106%.

- Management is confident in its margin expansion story, bolstered by the adoption of its AI platform. As a result, the best is yet to come.

- Salesforce is valued at a relatively attractive level, suggesting the market might not have priced in its re-rating potential fully.

- I argue why I assess that most of its near-term upside could be reflected, suggesting the risk/reward is more well-balanced now.

- Investors who missed buying before Salesforce’s earnings surge shouldn’t miss buying its next pullback.

John M. Chase

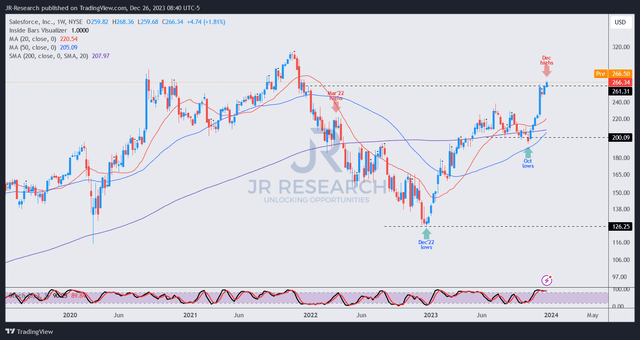

My bullish thesis on Salesforce, Inc. (NYSE:CRM) has finally panned out after CRM fell deep into a bear market before bottoming out in December 2022. The almost 60% decline was stunning for a wide-moat enterprise software company. As a result, its implied overvaluation in late 2021 fell steeply into highly pessimistic valuation levels late last year. Accordingly, CRM bottomed out at the 15x forward EBITDA multiple level, two standard deviations below its 10Y average of 29x. In other words, it reached peak pessimism, as I highlighted in August 2022.

CRM then staged a recovery in line with the broad market bottom in late 2022. Another opportunity arrived again in September 2023 as it consolidated for nearly five months at the $200 level. I reminded investors that I gleaned an accumulation phase, which could lead to a surging run if investors failed to capitalize on it.

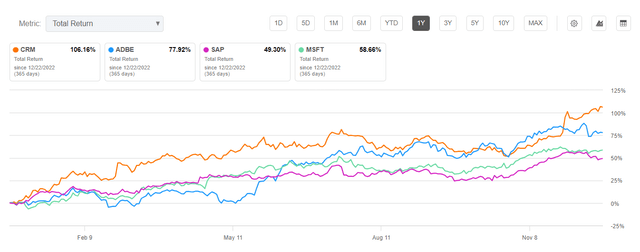

CRM Vs. Peers (1Y total return %) (Seeking Alpha)

That takeoff occurred in late November 2023, as Salesforce reported its fiscal third-quarter or FQ3’24 earnings release. As a result, CRM has significantly outperformed its peer set indicated above, posting a 1Y total return of more than 106%.

With that in mind, we should take a step back and reassess whether we should jump into CRM’s attempted breakout above the $260 zone or wait for a possible pullback to improve our risk/reward.

Even though AI growth inflection remains a nascent development, the market has tried to reflect Salesforce’s competitive advantages, as it has benefited from its market leadership.

Management reminded investors that Salesforce’s massive scale positions the company in well as the “third-largest enterprise software company.” The company updated its FY24 guidance, estimating full-year revenue of between $34.75B and $34.8B. In addition, it anticipates a significant recovery in its profitability growth, with an adjusted operating margin outlook of 30.5%, well above FY23’s 22.5%. Management also emphasized that it expects operating cash flow growth of about 31.5% at the midpoint. Therefore, the market has finally discovered its conviction in CRM’s bullish thesis.

Moreover, management underscored its confidence that its margin expansion story is far from over, bolstered by the strength of its AI tools by the largest companies. While Salesforce assessed similar headwinds in the smaller companies, large enterprises demonstrated their conviction in Salesforce’s AI platform. Notably, the company indicated that 17% of the Fortune 100 companies use its Einstein GPT copilots. As a result, I believe Salesforce has demonstrated its remarkable execution prowess, with AI expected to sustain its margin expansion thesis. CFO Amy Weaver accentuated that Salesforce “sees the current margin as a floor, not a ceiling, indicating room for further expansion.”

Revised analysts’ estimates suggest that Salesforce’s profitability growth could continue further. As a result, its adjusted operating margin could reach 33.7% by FY26. CRM is valued at an FY26 (year ending January 2026) adjusted EBITDA of about 17.9x, which isn’t expensive relative to its peers’ forward median of about 23.7x. As a result, I believe the market hasn’t fully priced in its valuation re-rating potential yet, accounting for execution risks as it encourages the market’s adoption of its AI tools.

CRM price chart (weekly) (TradingView)

With CRM re-testing its $260 resistance level, I assessed that a decisive breakout could lift its momentum higher toward the $300 zone. With CRM priced at a relatively attractive level, continued robust execution from Salesforce could attract more momentum buyers to hop on board.

However, I also assessed that the surge over the past year has normalized its medium-term average return closer to its long-term average. Accordingly, CRM last posted a 5Y total return CAGR of 16.7%, slightly below its 10Y average of 17.4%. In other words, I assessed that most of its near-term upside seems reflected and supported by its post-earnings surge.

As a result, I welcome a healthy pullback to digest the recent optimism and potentially improve our risk/reward before pushing to break its all-time highs subsequently.

Accordingly, I consider my bullish thesis on Salesforce, Inc. stock over the past year to have played out, allowing me to move back to the sidelines for now.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!