Summary:

- Salesforce has expanded its cloud services into sales, service, digital, platform, and data cloud, driving topline growth.

- The adoption of multi-cloud solutions and cross-selling opportunities are enhancing Salesforce’s sales productivity and profitability.

- Salesforce’s data cloud, including analytics and integration, is experiencing impressive growth and adding value for customers.

Phiromya Intawongpan

Salesforce (NYSE:CRM) is the number one CRM service provider globally, and it has expanded its cloud services into sales, service, digital, platform, and data cloud. These multi-cloud platforms are becoming the core technology platforms for enterprises. They increased their deals of more than $1 million by 80% in Q3 FY23. The adoption of multi-cloud solutions is driving their topline growth. Their expense management initiatives enable them to expand their operating margins and grow their free cash flow. I am initiating a “Hold” recommendation with a fair value of $250 per share.

Please note that as the Salesforce fiscal year ends at the close of January, all references to FY23 in this article correspond to their official FY24.

Multi-Cloud Strategy

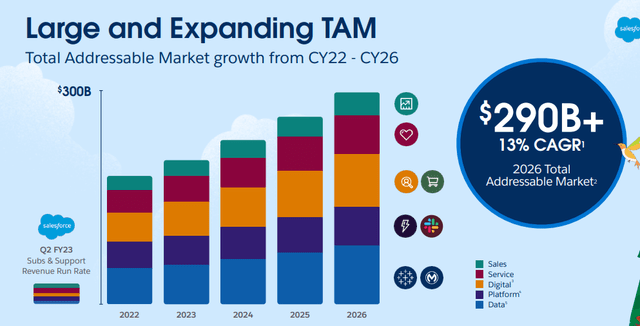

It is evident that Salesforce has already established itself as a leader in the CRM platform, among Oracle (ORCL), SAP (SAP), and Microsoft (MSFT). To further expand, they have diversified their cloud offerings into data analytics, services, digital, and platforms through acquisitions. The multi-cloud strategy provides them with more runway for future growth. Firstly, the total addressable market is growing at a 13% annual rate, according to their management, and most importantly, this growth spans across all these cloud platforms.

Salesforce FY23 Capital Market Day

Secondly, Salesforce possesses massive customer data, enabling them to conduct large-scale machine learning models and apply AI to these data clouds. These data analytics can add tremendous value for their customers by enhancing sales conductivity and sales pipelines.

Lastly, the multi-cloud offering can fully leverage their sales force and massive customer base. Cross-selling can significantly improve their sales productivity, thereby enhancing their margins and profitability.

80% Growth in Large Deals is Impressive

During Q3 FY23, large deals exceeding $1 million grew by 80% year over year. I believe that is the major takeaway from the earnings call. Additionally, nine out of the top 10 deals included six or more cloud services. It’s worth noting that the data cloud was involved in six of their top 10 deals in the quarter, and they added a net total of 1,000 new customers to their Data Cloud business. I find the growth impressive, and I anticipate that the data cloud could continue to expand in the near future.

Their data cloud includes analytics and integration. On one hand, Tableau provides their customers with the most advanced, end-to-end analytics solutions, using AI models to predict outcomes. These data analytics leverage massive datasets from these enterprises’ CRM systems, adding tremendous value for customers. On the other hand, Salesforce’s integration offering, powered by MuleSoft, enables enterprises to connect data from multiple systems. These integration capabilities help enterprises aggregate their operating data, allowing them to apply additional data analytics or AI machine learning to these massive datasets.

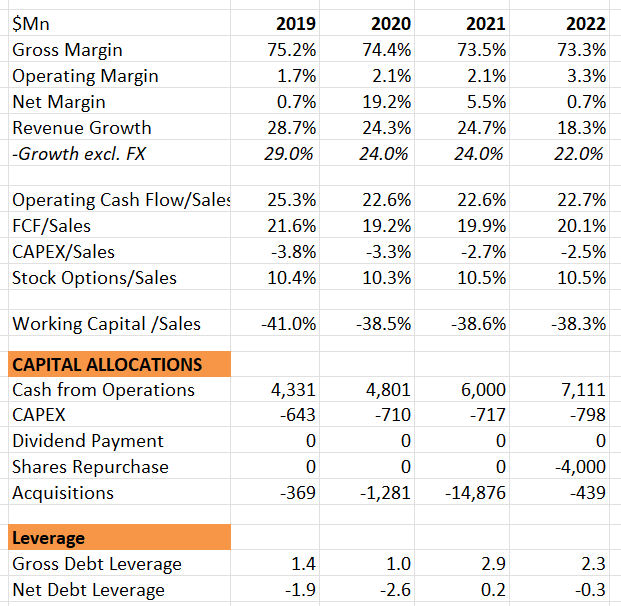

Recent Result and Outlook

Salesforce has experienced growth of more than 20% in the past, and the major challenge has been their low margin and the conversion of free cash flows. They pursued significant acquisitions to extend their leadership beyond CRM to other cloud platforms. These large deals and high stock options have impacted their margin profile over time. Starting from FY22, they initiated share buybacks without any dividend payouts. The majority of their free cash flow has been directed towards acquisitions in the past. On the balance sheet, they are quite strong with a net cash position, and the net debt leverage was -0.3x at the end of FY22.

Salesforce 10Ks

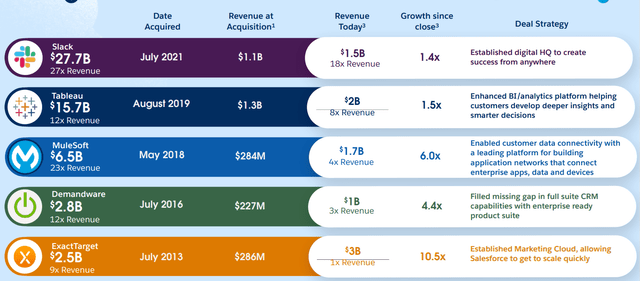

For significant deals, they acquired Slack for $27.7 billion in 2021, Tableau Software for $15.7 billion in 2019, and MuleSoft for $6.5 billion in 2018. The prices for these deals were quite high; for instance, Slack was only generating around $1 billion in revenue during the acquisition, meaning Salesforce paid more than 27x of sales. I acknowledge that Salesforce has done an excellent job integrating these businesses, cross-selling, and fully monetizing their massive customer base. As disclosed in their Capital Market Day, they have successfully grown these acquired businesses.

Salesforce FY23 Capital Market Day

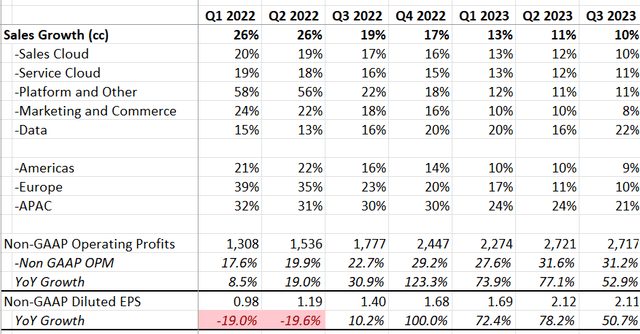

During Q3 FY23, they achieved 10% constant currency sales growth and 52.9% adjusted operating profit growth. The robust earnings growth is attributed to their multi-cloud large deals, as discussed previously. Their Data Cloud grew by 22% year over year, which is quite impressive to me. Their real-time customer data platform is really taking off to drive their growth.

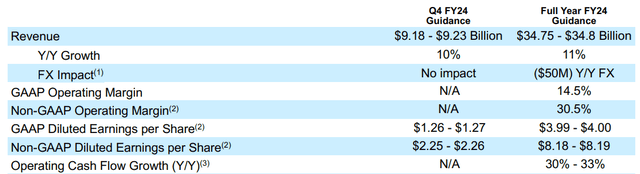

For the full-year guidance, they raised both the topline and bottom line. They predict an 11% revenue growth for the full year and a non-GAAP operating margin of 30.5%. I think the confidence to raise the guidance for the full year stems from these large deal sales and the growth in their Data Cloud. I believe their sales momentum is quite strong, and the guidance appears realistic. During the earnings call, they pointed out that the Data Cloud integrated an astonishing 6.4 trillion records, which represents a 140% year-over-year growth. It is quite notable for this explosive growth of data records.

Valuations

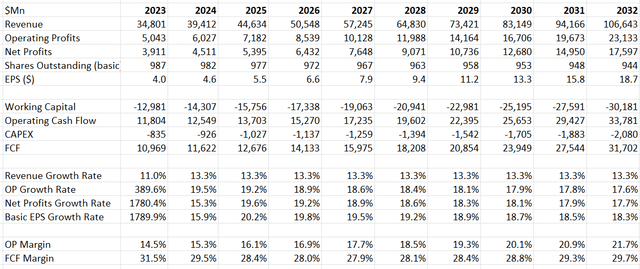

The model’s assumptions for FY23 are in line with their official guidance, with 11% top-line growth and a reported operating margin of 14.5%. The reported operating margin represents a significant leap for Salesforce, as they only earned a 3.3% margin last fiscal year. For normalized revenue growth, I assume 12% organic revenue growth and 2.5% acquisition growth. The organic revenue growth assumption aligns quite closely with the total addressable market growth. Given their acquisition history, I do believe my acquisition growth assumption is on the conservative side.

The model assumes their margin will continue to expand over time, primarily driven by operating leverage and internal initiatives for expense management. The operating margin is predicted to reach 21.7% by FY32, still a relatively low figure compared to other pure SaaS companies.

Salesforce DCF – Author’s Calculation

The model employs a 10% discount rate, 4% terminal growth rate, and a 23.5% tax rate. Based on my calculations, the estimated fair value is $250 per share.

Key Risks

High Stock Options: Stock option expenses represented more than 10% in the past, which is relatively high compared to established software companies like Microsoft and Adobe (ADBE). The good news is that Salesforce started to repurchase their stocks from the last fiscal year, and it’s more likely that they will have, for the first time in history, a reduction in shares outstanding at the end of this fiscal year.

High Sales and Marketing Spending: Salesforce has allocated a significant budget to sales and marketing events, with these expenses accounting for more than 43% of total sales. It is evident that they are heavily investing in advertising to attract new customers. With their focus on the digital and self-service model, as well as partner-led sales initiatives, the results may take a while to materialize. I recommend investors closely examine these sales and marketing expenditures over time, as they are crucial to future margin expansion.

Conclusion

The substantial growth in large deals across multi-cloud platforms is crucial for their future expansion, and I believe their Data Cloud will continue to grow rapidly, driven by AI and data analytics. I am initiating a “Hold” recommendation with a fair value of $250 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.