Summary:

- Salesforce is on a path to become the next Microsoft, with a wide and deep product portfolio and a commitment to driving profitable growth.

- The company showed strong cRPO growth in the latest quarter.

- While top-line growth may slow, I expect investors to reward the stock for its resilient business model and growing profitability.

- Salesforce remains a GARP stock for the long term.

Mike Coppola/Getty Images Entertainment

I am growing increasingly convinced that Salesforce, Inc. (NYSE:CRM) is on a path to become the next Microsoft Corporation (MSFT). Specifically, CRM has assembled a wide and deep product portfolio and has demonstrated a strong commitment to driving profitable growth. The company maintains a net cash balance sheet and has shown incredible operating margin expansion. While top line growth looks poised to slow moving forward, I expect the market to continue rewarding the stock for the commitment to profitability. Over time, I see CRM sustaining a premium valuation similar to MSFT as investors begin prioritizing consistent profits and share repurchases over revenue growth rates.

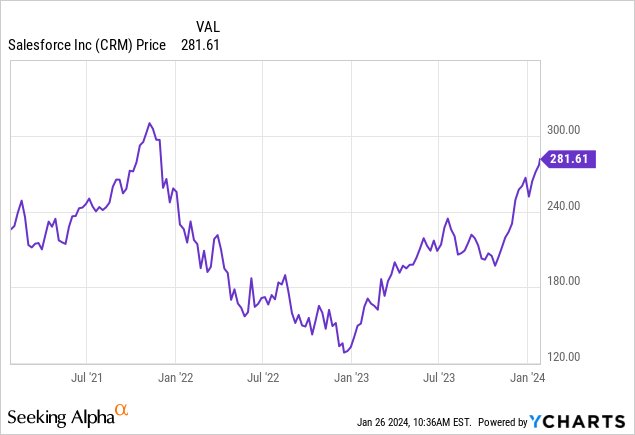

CRM Stock Price

CRM has doubled over the past year and is coming close to a return to all-time highs.

I last covered CRM in October, where I rated the stock a buy based on its rapid gains in profitability. The stock is up since then, but I continue to see long term upside here.

CRM Stock Key Metrics

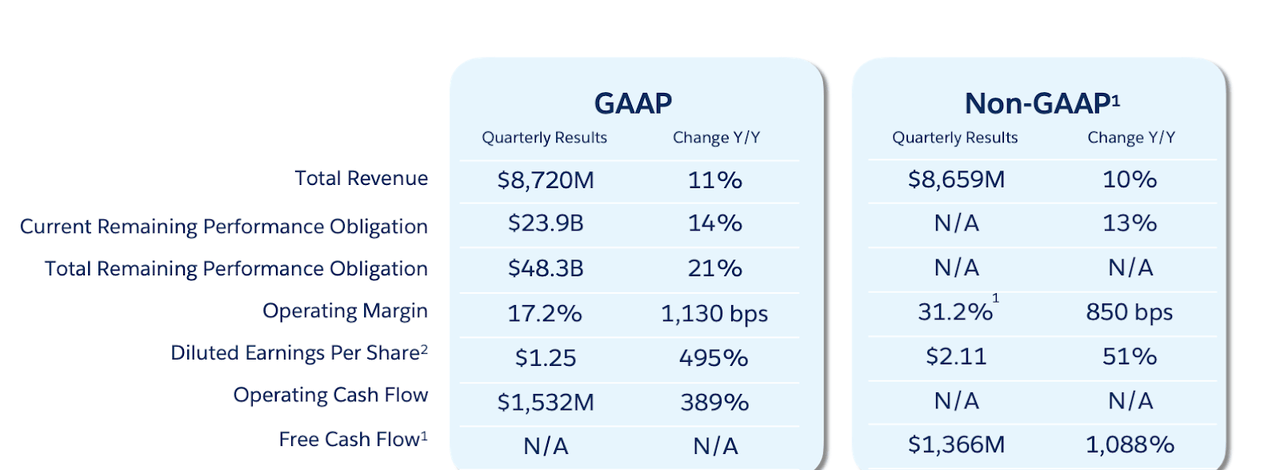

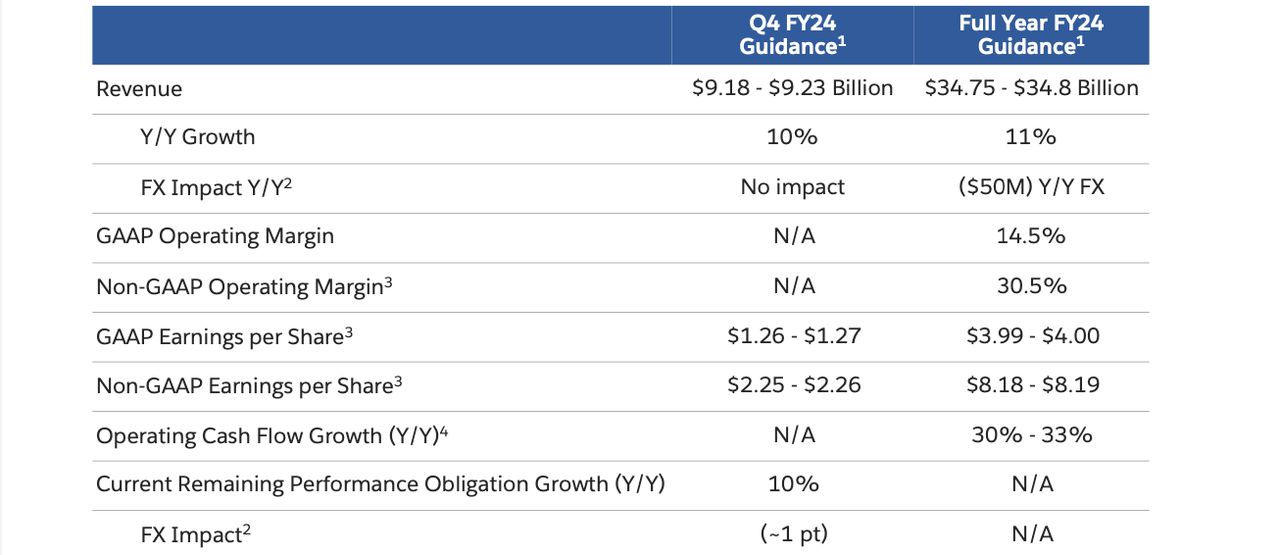

In its most recent quarter, CRM delivered 11% YoY revenue growth to $8.72 billion, coming in at the high end of guidance. GAAP EPS came in at $1.25, exceeding guidance for $1.03, and non-GAAP EPS came in at $2.11, exceeding guidance for $2.06.

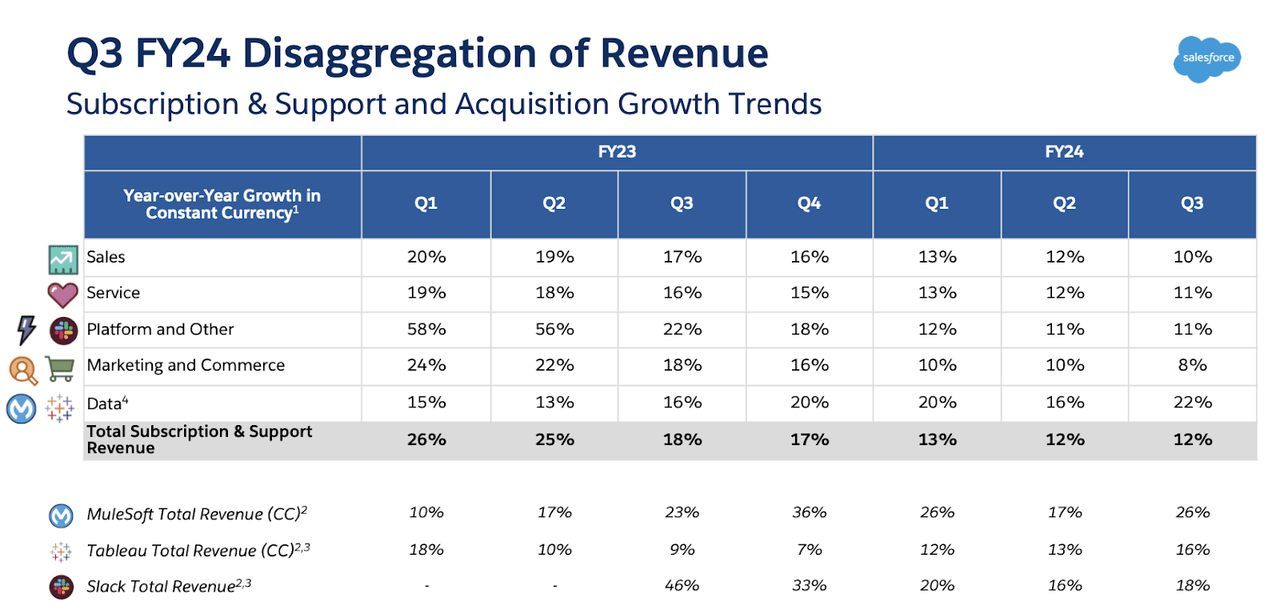

CRM saw revenue growth accelerate at MuleSoft, Tableau, and Slack, helping to bring up overall growth rates.

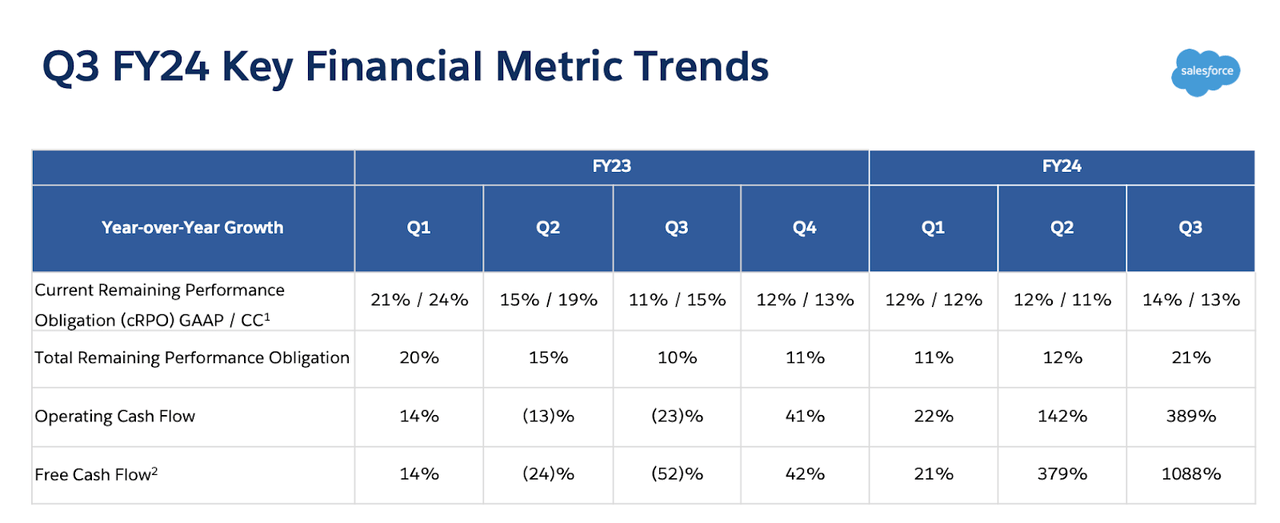

It was notable that CRM saw current remaining performance obligations (“cRPOs”) and RPOs growth in general accelerate, with cRPO growth coming in at 14% and total RPO growth coming in at 21%. While many other peers are still seeing customers hesitant about signing long term contracts, CRM appears to be moving past such headwinds. That helped free cash flow grow by 1088% YoY.

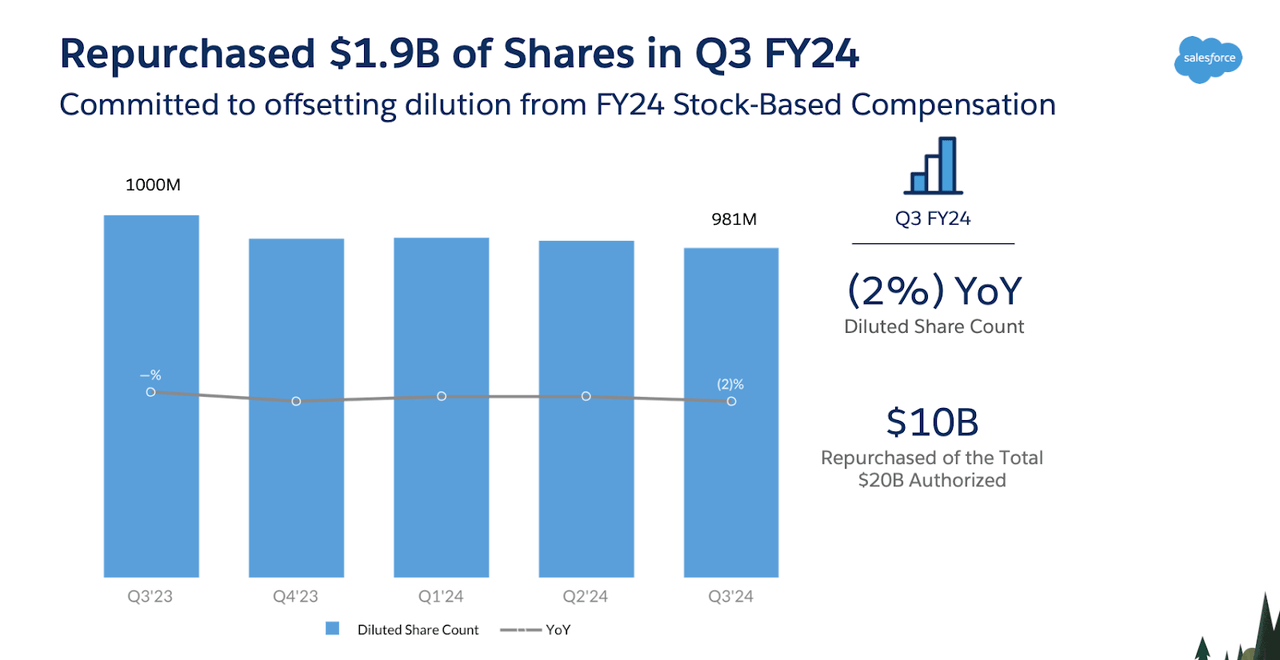

CRM ended the quarter with $11.9 billion of cash versus $9.4 billion of debt. CRM repurchased $1.9 billion in the quarter, leading to shares outstanding declining 2% YoY.

Looking ahead, management is guiding for the fourth quarter to see up to 10% YoY revenue growth and further growth in earnings per share. Management is guiding for cRPO growth to decelerate sequentially to 10% – we will need to see if management was just setting a low bar or if the strong cRPO growth this quarter was a fluke. Consensus estimates have CRM generating $9.22 billion in revenue and $2.26 in non-GAAP EPS.

On the conference call, management noted that they had 80% growth in deals more than $1 million. Management credited the strength as being due to their wide cloud product portfolio, noting that while the company saw some weakness last year due to the tough macro, they are seeing demand “come back.”

One of the generative AI themes that we have seen this year is for the larger incumbent tech companies to quickly integrate generative AI capabilities in their products, helping to give them a first-mover advantage in terms of generative AI. Management noted that 17% of the Fortune 500 are Einstein GPT Copilot customers, an incredible achievement. Generative AI may be key in helping to accelerate near term growth rates as macro conditions continue to improve.

While management noted that non-GAAP operating margins have accelerated from 17.7% three years ago to over 30% this year, they emphasized that this is “a floor, not a ceiling” and I personally do believe that the company has more room to expand operating margins at the very least from operating leverage alone.

Is CRM Stock A Buy, Sell, Or Hold?

CRM is an enterprise tech company which focuses on providing customer relationship management software. CRM is often credited with popularizing the software as a service model (“SAAS”) which is standard today.

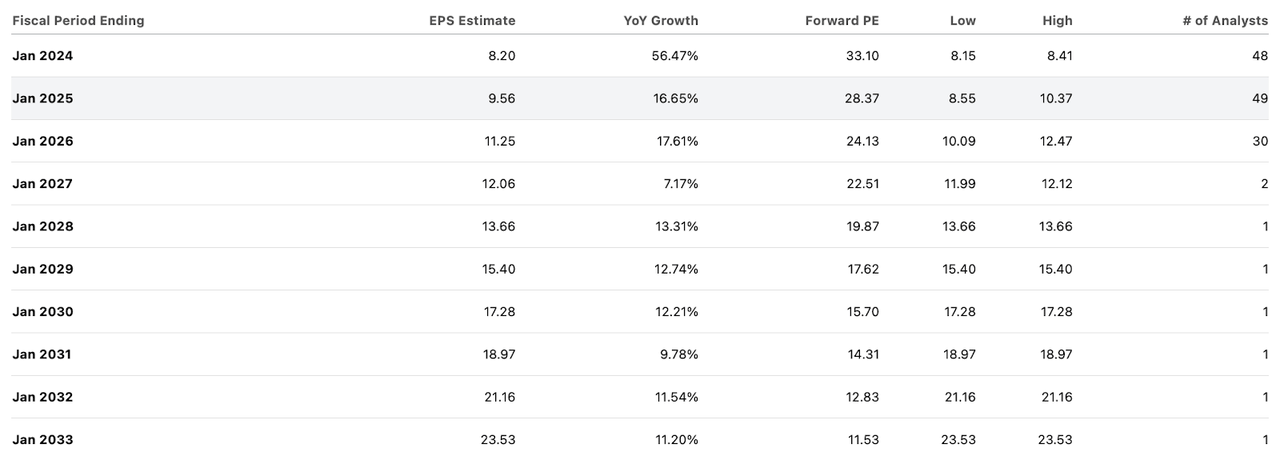

As of recent prices, CRM was trading at around 33x earnings, but consensus estimates have the company sustaining double-digit earnings growth for many years.

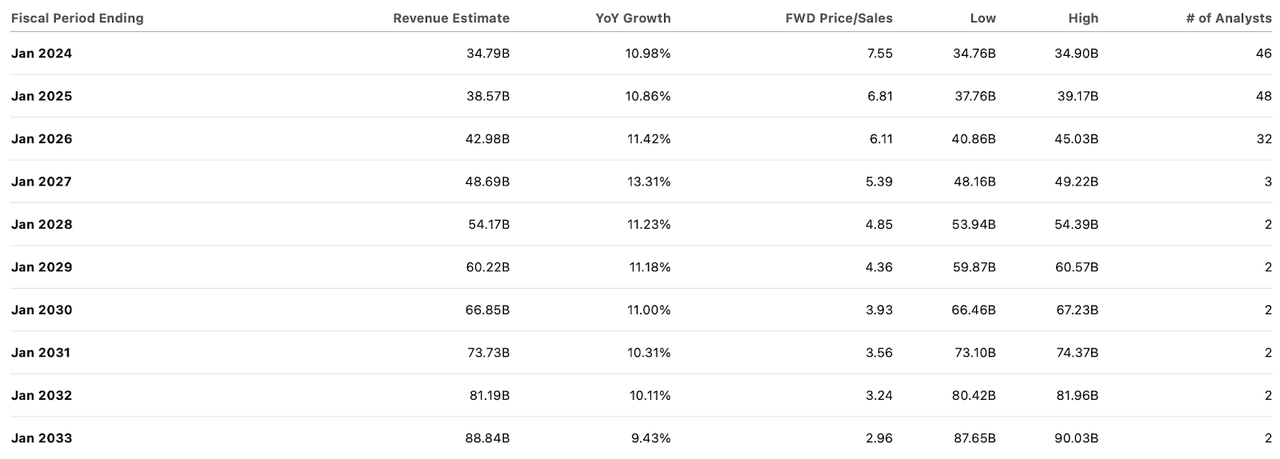

Those earnings estimates look quite reasonable when compared against consensus estimates for low double-digit revenue growth.

At this point, I find it unlikely for CRM to see top line growth accelerate to the 20% level, let alone the 15% level. I base that view on both management’s prior commentary as well as the modest cRPO growth. I can see CRM meeting consensus estimates of double-digit revenue growth over the coming year, but investors are warned against expecting hyper growth to return.

I previously valued CRM using assumptions of 11% forward revenue growth, 40% long term net margins, and a 1.5x price to earnings growth ratio (“PEG ratio”), which yielded a fair value multiple of around 6.6x sales. I now expect CRM to command a PEG ratio in the 2.5x range or higher upon maturity. To put that into concrete numbers, if we assume that CRM exits 2033 with an 8% revenue growth rate, then I’d expect the stock to be trading at around a 20x earnings multiple or higher. That would equate to a 8x sales multiple and imply around 11.5% annual return potential over the next 9 years, or around 14% inclusive of the earnings yield.

I justify the 20x terminal earnings multiple based on the net cash balance sheet, resilient revenue base, and where “slower-growers” of a similar risk profile typically trade at. I note that MSFT is trading at around 12x sales and 35x earnings, so my assumption offers some conservatism there.

Risks

What are the key risks? It is possible that consensus estimates prove too optimistic. While CRM has managed to sustain strong top-line growth rates in the past, much of that growth appears to have come from M&A. The company grew revenue at roughly a 24% pace during the pandemic, so I again caution against projecting top-line growth to accelerate so meaningfully.

The enterprise tech sector is arguably still quite new, and it is possible that competition (and therefore pricing pressures) becomes a bigger risk in the future. It is possible that CRM returns to its old acquisitive ways, making expensive acquisitions, perhaps in an effort to juice top-line growth. That would throw a wrench in the profit-focused investment thesis and may lead to both dilution to the earnings base as well as multiple compression.

While my investment thesis still has CRM trading at some discount to MSFT, it is possible that MSFT is simply too richly valued today (and indeed I do have that opinion) and using that as a benchmark proves inappropriate.

Conclusion

While the risk-reward proposition has become less attractive for Salesforce, Inc. as the stock moves up, I reiterate my buy rating, as the shares continues to look undervalued relative to the high quality of the business and balance sheet.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!