Summary:

- Salesforce has justified its premium valuation with resilient top-line results and margin expansion.

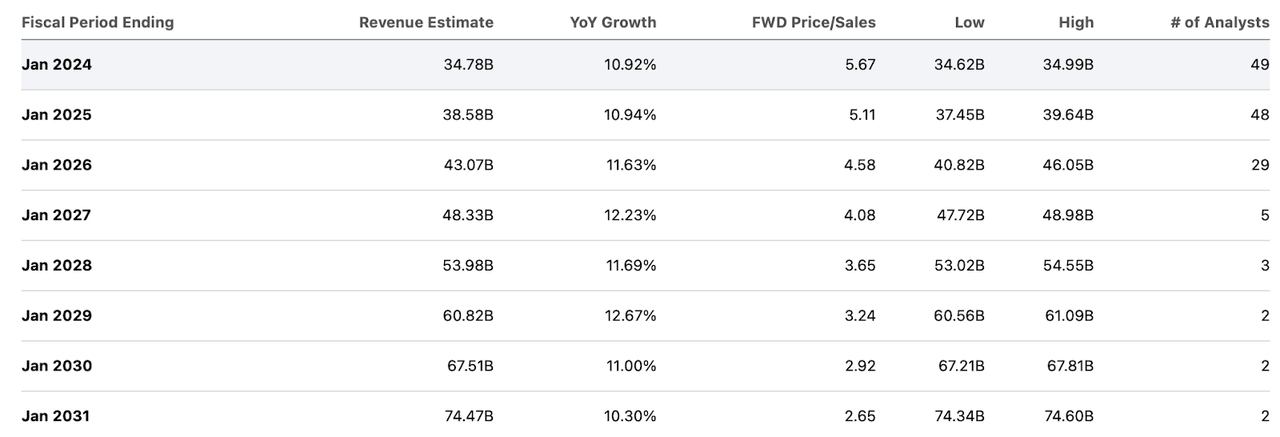

- The company’s revenue growth may not accelerate as much as hoped, but it is still expected to remain in double digits.

- The company has delivered on 30% operating margins 2 years ahead of schedule.

- I reiterate my buy rating as the stock is too cheap given its net cash balance sheet and positive cash flow generation.

Kevin Dietsch/Getty Images News

Salesforce (NYSE:CRM) has lived up to its reputation. The stock has often traded at premium valuations relative to tech peers, perhaps due to it being one of the pioneers of the subscription revenue model. The company has justified that respect based on its strong financial performance over the past several quarters, in which the company rapidly delivered margin expansion even in the face of a tough macro environment. CRM has a net cash balance sheet and has delivered on margin targets many years in advance. On the offsetting side, management appears to show greater confidence in its abilities to sustain and grow profit margins as opposed to delivering on accelerating top-line growth. Given the company’s strong performance amidst a tough environment, I reiterate my buy rating for the stock as this is a name that I believe will sustain a premium multiple upon maturity.

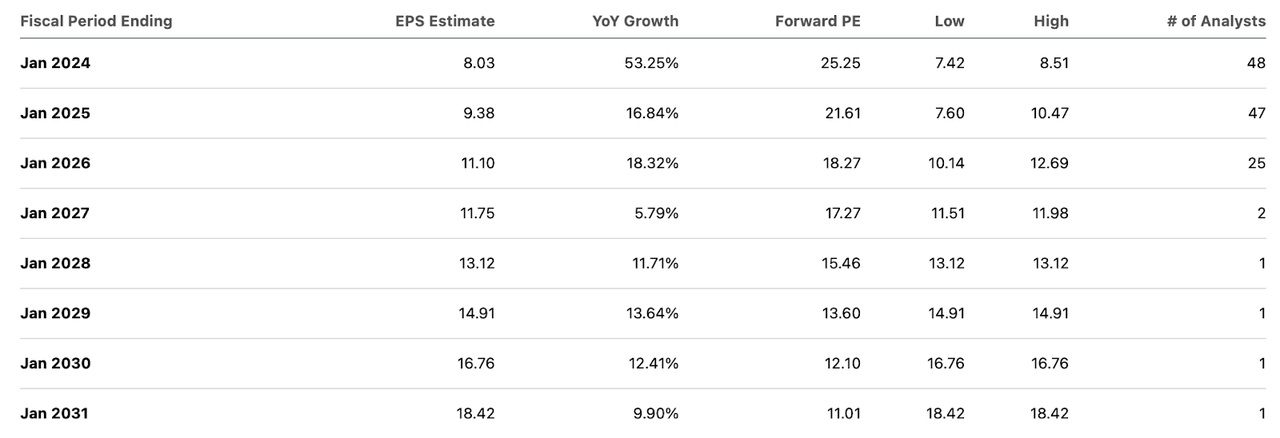

CRM Stock Price

CRM has bounced strongly off the lows, but over multi-year time horizons has been a lukewarm investment. While the company has delivered strong profit growth during this period, the deceleration in top-line growth has pressured the valuation multiple.

I last covered CRM in August where I explained why I found the near term setup to be attractive for long term investors. That thesis continues to play out, though I suspect that revenue growth may not accelerate as much as hoped over the coming years.

CRM Stock Key Metrics

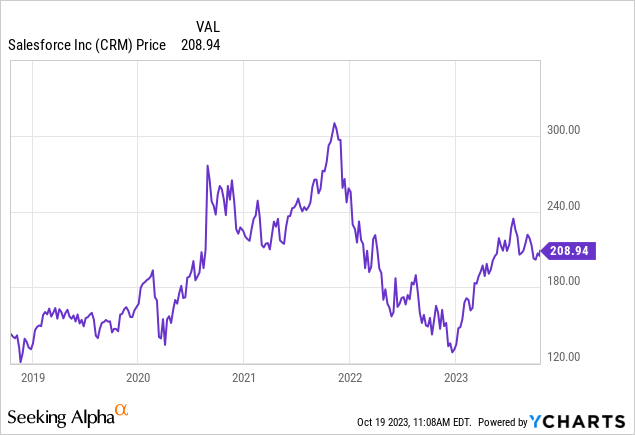

In its most recent quarter, CRM delivered 11% YoY revenue growth to $8.6 billion, coming ahead of guidance for $8.53 billion in revenue. CRM continues to be impacted by geographic headwinds in EMEA, likely driven in part by the Russia-Ukraine war.

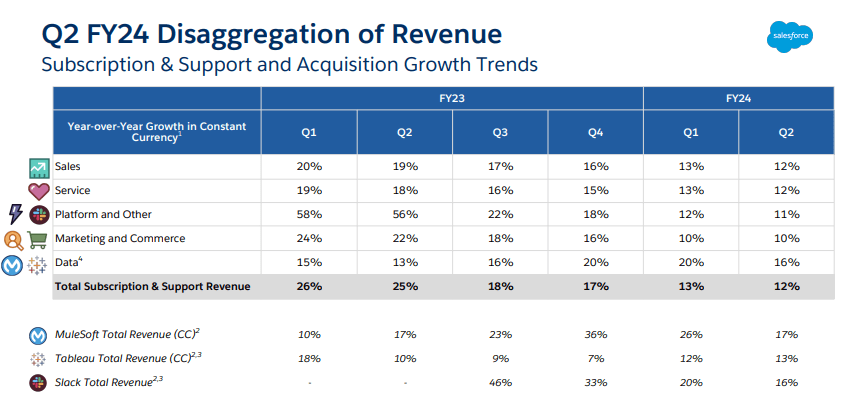

FY24 Q2 Presentation

Whereas in past quarters the company was able to drive strong overall growth due to accelerated growth at MuleSoft and Slack, those two segments have slowed down rapidly.

FY24 Q2 Presentation

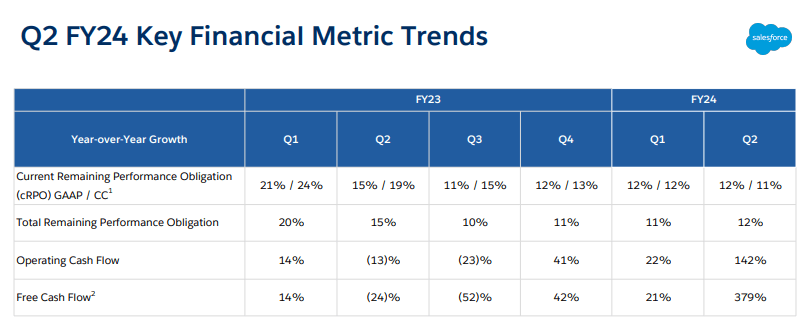

CRM delivered 11% YoY growth in current remaining performance obligations (constant currency), ahead of guidance for 10% growth. That suggests that forward revenue growth should remain in the double-digits for at least a while longer.

FY24 Q2 Presentation

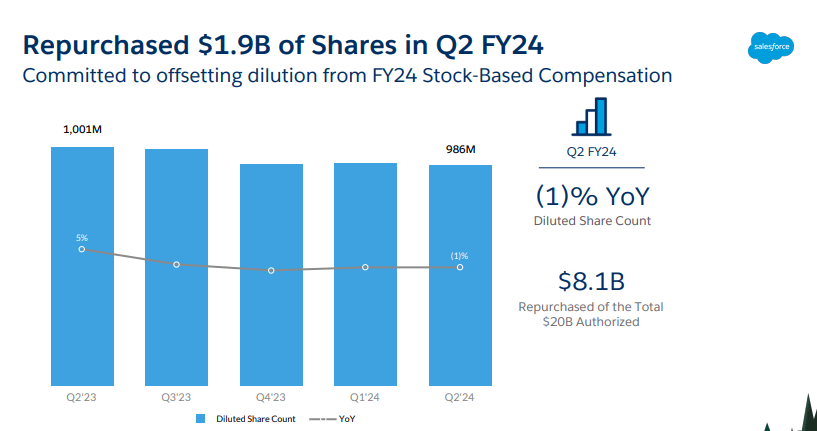

CRM repurchased $1.9 billion of stock in the quarter – it is stunning to see the rapid transition from focusing just on the top-line to driving profit expansion and returning cash to shareholders.

FY24 Q2 Presentation

CRM ended the quarter with $12.4 billion of cash and $4.8 billion of strategic investments versus $9.4 billion of debt. That represents a strong net cash balance sheet and I expect the company to eventually take on net leverage over the long term.

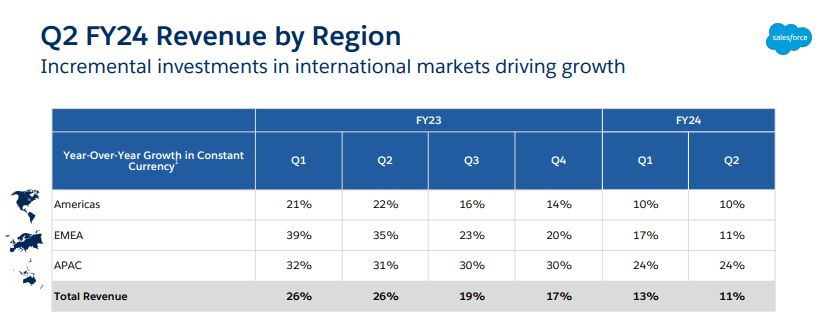

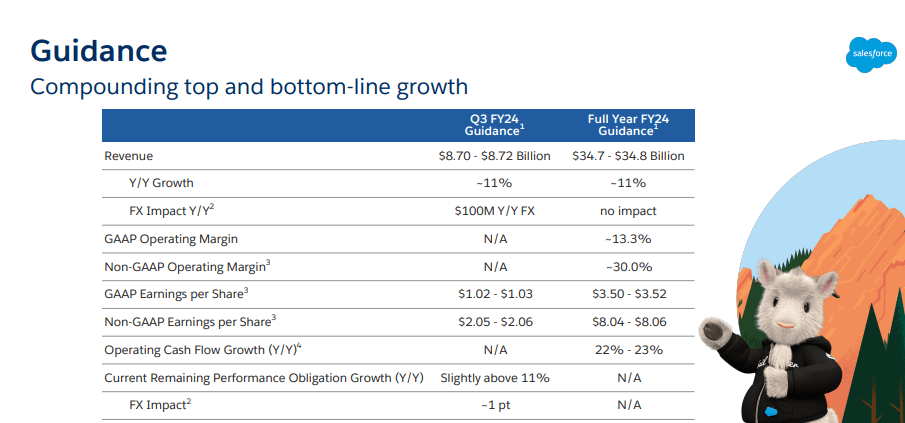

Looking ahead, management is guiding for up to $34.8 billion in full-year revenues (slightly higher from prior guidance of $34.7 billion) and up to $8.06 in non-GAAP earnings per share (up from prior guidance of $7.43).

FY24 Q2 Presentation

It is notable that management now expects the company to generate a 30% non-GAAP operating margin for the full year. This reflects a very impressive string of “beat and raise” quarters, as management had at one point been guiding for a 25% margin by fiscal 2026, implying that the company has over delivered on expectations many years in advance. Earlier this year, CEO Benioff stated intentions to make the company the “most profitable software company in the world.” At the time, I thought that rhetoric was over the top, but the dramatic profitability push is making me a believer

On the conference call, management touted their positioning for generative AI as they have been able to integrate AI capabilities into their product suite. Management emphasized that they remain committed in maintaining the “trust” from investors, which (in my interpretation) mainly refers to their commitment to profitable growth. Management called 30% operating margins the “floor, not a ceiling” though also noted that they are “not planning any other major restructuring efforts.”

An analyst asked management if they believe that they can reaccelerate revenue growth to the 15% to 20% range over time due to AI. However, CEO Benioff did not give a straight answer to the affirmative, instead stating that he is “quite addicted to the bottom line as well.” Even as a bull, I think that investors should interpret this response to indicate that the company is maturing in terms of top-line growth and the focus moving forward is squarely on growing the bottom-line.

Is CRM Stock A Buy, Sell, or Hold?

Generative AI appears to be bolstering near term revenue growth rates in spite of a tough macro environment. Based on my analysis of peers in the tech sector, CRM appears to also be benefiting from having a deep product portfolio from which it can cross-sell new products to existing customers. These factors plus the company’s dramatic operating margin expansion appear to have helped the stock regain a more healthy valuation, with the stock trading at just under 6x sales – a rather fair multiple given consensus estimates for low double-digit top-line growth. I note that consensus estimates are probably achievable given that the company may see some acceleration upon an improved macro environment.

CRM is no longer just a price to sales story and the stock looks very reasonable on a price to earnings basis after just a handful of years.

I previously valued the company using the assumptions of a return to 15% top-line growth, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), which led to a valuation of around 7x sales. That 15% assumption may prove too aggressive, but the 30% net margin assumption may prove too conservative. Assuming 11% forward revenue growth and 40% long term net margins leads to a valuation of around 6.6x sales, a similar valuation and still implying solid upside.

What are the key risks? Financial stability is not a huge risk here given the net cash balance sheet and expanding cash flow margins. Competition is probably not a serious near term risk given that the macro environment appears to be pushing customers more towards established platform companies like CRM. Instead, the main risk may be that of forward growth and valuation. Management’s reluctance to issue long term revenue growth guidance may be signaling that they believe growth may not accelerate much from here. It is possible that top-line growth decelerates from here instead of accelerates even under more favorable macro conditions. While the company has arguably earned a premium valuation due to the expanding profit margins (the timing of which came amidst a tough macro environment), I wouldn’t be surprised to still see some downside in the event of top-line deceleration. Over the long term, it is possible that the company experiences competition from incumbent names like Microsoft (MSFT) as well as smaller upstarts. CRM is not obviously on either end of that spectrum and that is a double-edged sword.

I reiterate my buy rating for the stock given the strong financial position and GARP-like valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!