Summary:

- Salesforce’s most recent push to expand margins is most certainly interesting for investors and is already bearing fruits for the company’s bottom line.

- Moreover, with the advent of generative AI, Salesforce cloud-centric business model may once again find back to a ~20% topline CAGR on a 3-5 year view.

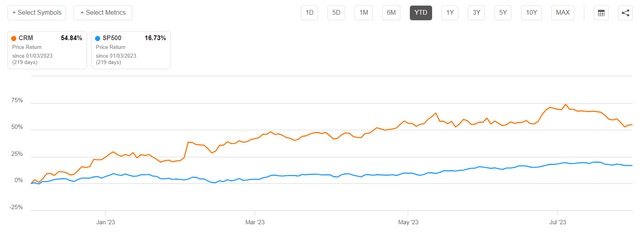

- Reflecting on the stock’s +50% run-up YTD, however, I believe CRM’s valuation has now stretched to a level of optimism that offers little room for more upside.

- Anchored on analyst consensus EPS expectations through FY 2026, a reasonable 9.25% cost of equity, and a proud 4.25% terminal growth rate, I model CRM fair implied intrinsic value at $168.39 per share.

- As a function of valuation, I assign a hold/underweight rating.

Stephen Lam

Salesforce (NYSE:CRM) shares have surged in 2023, as (i) shareholder activism on cost/ profitability, (ii) share repurchases and (iii) positive Gen AI sentiment provided a powerful valuation. Reflecting on the stock’s run–up, however, I believe CRM’s valuation has now stretched to a level of optimism that offers little room for more upside. For reference, Salesforce shares have outperformed vs. the broader U.S. equity markets YTD by a factor of more than 3x: Since the start of the year, CRM stock is up approximately 55%, as compared to a gain of only 17% for the S&P 500 (SP500).

Anchored on analyst consensus EPS expectations through FY 2026, a reasonable 9.25% cost of equity, and a proud 4.25% terminal growth rate, I model CRM fair implied intrinsic value at $168.39 per share; and thus, as a function of valuation, I assign a Hold/ underweight rating.

Price Increases Support Margin Expansion Thesis

In FY 2024, responding to shareholder activist pressure from Third Point, Elliott Management, Inclusive Capital, Starboard Value, Strive Asset Management, and Value Act, Salesforce directed its attention towards expanding profitability, FCF generation and share repurchases. In that context, Salesforce has already managed to boost its operating margin by almost 400 basis points and guided for an additional 500 basis points expansion for FY 2024, aiming to bring the company’s operating margin to a notable ~28% by year end.

With that frame of reference, Salesforce announced intentions to push for an average 9% like-for-like price increase across the company’s subscription platforms, including Sales Cloud, Service Cloud, Marketing Cloud, Industry Clouds, and Tableau. Notably, Salesforce most recent price increase, which targets both new and existing customers, marks the most aggressive re-pricing of the company’s software services since at least 2016.

Although the company has set to push price hikes as early as August 2023, investors should consider that a full repricing of Salesforce’ subscription business may take up to 2 years, as contracts, discounts and customer relationships may cause some pricing “stickiness”. Anchored on a similar argument, I doubt that Salesforce will manage to push a 9% like-for-like price increase for all customers. Nevertheless, there should be little doubt that the eventual benefits of Salesforce’ price increase strategy will be highly value accretive for the company and shareholders – likely bringing an additional revenue of approximately $1.2 to 1.5 billion and an approximate 10 to 20% boost in earnings, according to my calculations.

AI Opportunities Likely To Drive Growth At A 20% CAGR Through FY 2026

In late 2022 and 1H 2023, Salesforce topline growth has slowed down sharply from the mid-20% CAGR growth for the past decade, down to an estimated 10% YoY growth for the current fiscal year.

However, with the advent of generative AI, Salesforce cloud-centric business model may once again find back to a ~20% topline CAGR on a 3-5 year view, I believe. May confidence in topline growth is anchored on Salesforce newly announced features in Service Cloud GPT, Sales Cloud GPT, and the Einstein GPT Trust Layer.

For context, the Sales Cloud GPT promises to offer auto-generating personalized responses for faster customer request resolution; the Sales Cloud GPT enables the generation of personalized emails with limited customer input; and, the Einstein GPT Trust Layer introduces capabilities like encrypting communications, and restricting data access based on user permissions on Salesforce applications. Early management commentary suggests that SalesGPT and ServiceGPT will be included in Sales Cloud Einstein, and the Gen AI offering may be priced at $50 per month per user.

So, Salesforce fundamentals are pointing up; but now let us look at valuation to see if there is actually an opportunity for investors here.

Valuation: I Project A $168.39 TP

To estimate the intrinsic value of a company’s stock, I am a great fan of applying the residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

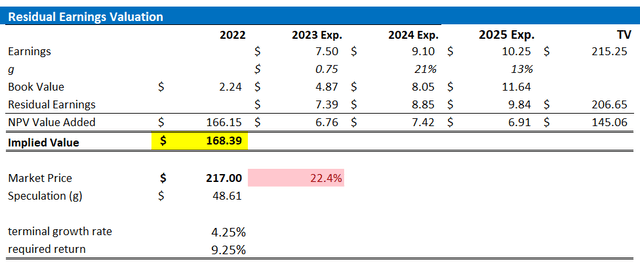

With regard to my valuation model for Salesforce, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, the analyst consensus is usually quite precise. As of early August 2023, consensus projects CRM’s EPS for FY 2024 (current year), FY 2025 and FY 2026 at $7.5, $9.1, and $10.25, respectively.

- To estimate the capital charge, I anchor on CRM’s cost of equity at 9.25%, which is in line with the capital asset pricing model on a 1.2 beta vs the S&P 500.

- For the terminal growth rate after 2025, I apply 4.25%, which I believe is a reasonable estimate post CRM’S FY 2026 (approximately 0.5 – 1 percentage points above nominal GDP growth).

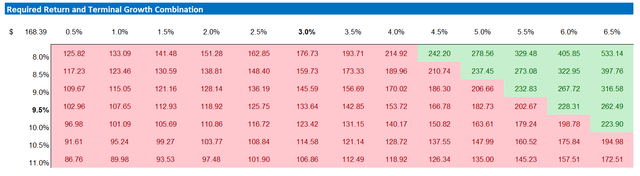

- Investors with different assumptions regarding CRM’s cost of capital and terminal growth may take reference from the sensitivity table enclosed.

Given the above assumptions, I calculate a base-case target price for Activision of about $168.39/share.

Company Financials; Author’s EPS Estimates; Author’s Calculation

My base case projection for CRM’s target price implies downside. However, it is crucial for investors to evaluate the risk and reward ratio of investing in a company based on a ‘scenario’ view. To assess different scenarios based on various assumptions, I have created a sensitivity table that analyzes CRM’s cost of equity and terminal growth rate. See below.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Conclusion

Salesforce most recent push to expand margins is most certainly interesting for investors and is already bearing fruits for the company’s bottom line. Moreover, with the advent of generative AI, Salesforce cloud-centric business model may once again find back to a ~20% topline CAGR on a 3-5 year view.

Reflecting on the stock’s +50% run-up YTD, however, I believe CRM’s valuation has now stretched to a level of optimism that offers little room for more upside. In fact, anchored on analyst consensus EPS expectations through FY 2026, a reasonable 9.25% cost of equity, and a proud 4.25% terminal growth rate, I model CRM fair implied intrinsic value at $168.39 per share, seeing about 22% downside for the risk/ reward to be balanced.

As a function of valuation, I assign a hold/ underweight rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.