Summary:

- Salesforce reported Q2 results that beat expectations, while management revised full-year guidance higher.

- The company is seeing strong demand for its AI tools integrated across its software ecosystem.

- We are bullish on the stock and see more upside going forward.

Sundry Photography

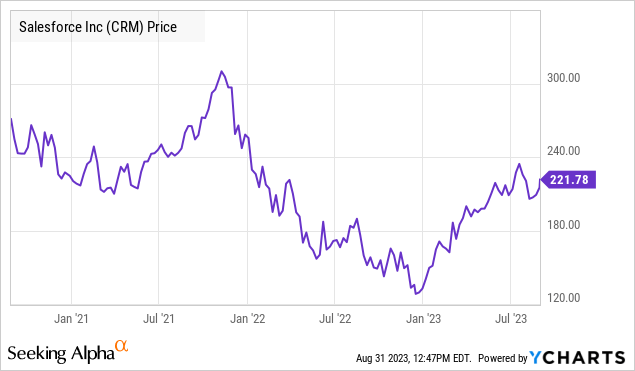

Salesforce, Inc. (NYSE:CRM) reported its latest Q2 results, highlighted by solid growth and firming profitability. The bigger story was likely the positive forward guidance, with CEO Mark Benioff citing an ongoing transformation of the company, including the launch of new artificial intelligence (AI) tools that have received a strong customer response.

Compared to a challenging post-pandemic period in 2022 dealing with a broader slowdown, our take here is that Salesforce has reclaimed its mojo with a fresh air of momentum. There’s a lot to like about the stock, that benefits from its unique position as the software category leader. In our view- CRM can rally back to its all-time high above $300 sooner rather than later.

CRM Q2 Earnings Recap

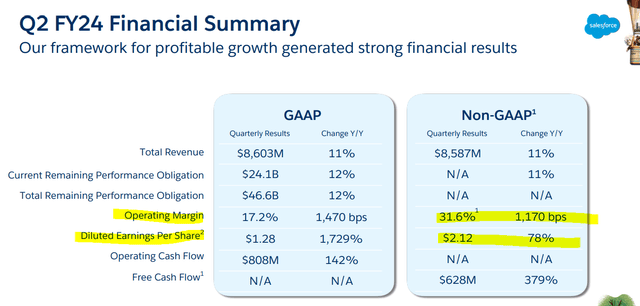

CRM’s fiscal 2024 Q2 EPS of $2.12 beat the consensus by $0.24 and was up 78% from $1.19 in the same period last year. Revenue of $8.6 billion increased by 11% year-over-year and was also ahead of estimates.

The theme for Salesforce this quarter was “profitable growth at scale“. This means that even as the pace of revenue growth has moderated from peak levels in recent years, the company is driving margins significantly higher.

Several cost savings and efficiency initiatives were put in place this year, and it appears the efforts are paying off. Some of the steps included an across-the-board headcount reduction of 10% back in January, with the idea of streamlining the operation.

Total operating expenses as a percentage of revenue are down to 68%, compared to 80% last year. The result here is that the adjusted operating margin at 31.6% compares to just 19.9% in Q2 2022. Free cash flow has also ramped up.

source: company IR

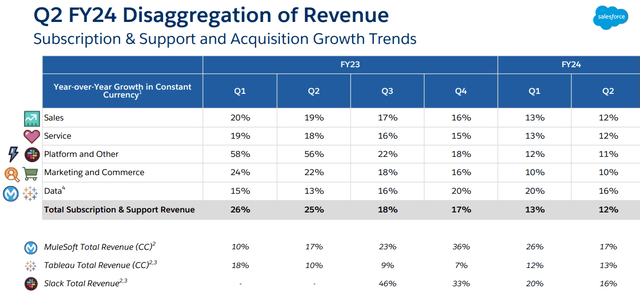

Operationally, we won’t ignore that the growth rates across core segments have slowed from trends last year. Sales and services revenue were both up 12% in Q2, compared to 19% and 18% respectively in Q2 fiscal 2023. That said, the understanding is that the company is lapping a high benchmark of pandemic-era comps where growth was exceptional.

The key point is to recognize that the strength of the platform is its high level of customer retention, representing a multi-year earnings runway. Simply put, corporations onboarding with the CRM ecosystem across tools like “Einstein”, “Data Cloud”, “MuleSoft”, “Slack” and “Tableau” are making a long-term commitment.

The read is that the integration of new AI tools has received a positive market response. During the earnings conference call, management cited major wins across various end markets during the quarter like JPMorgan Chase & Co. (JPM), and FedEx (FDX) as customers adding features or expanding their relationships. There is also momentum from regions like Asia-Pacific that are still seen as underdeveloped as a further growth opportunity.

source: company IR

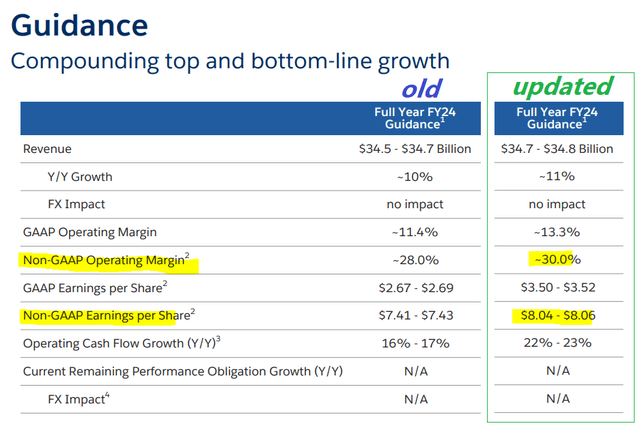

Putting it all together, the trends are good enough for the company to raise full-year guidance. Salesforce now sees fiscal 2024 revenue around $34.75 billion, up from a prior midpoint estimate of $34.6 billion announced in Q1, representing an increase of 11% y/y. An EPS midpoint target of $8.05, pushed higher from the $7.42 forecast last quarter, if confirmed, represents an increase of 52% y/y.

source: company IR

What’s Next For CRM?

We like CRM as a leader in artificial intelligence with the area of “customer relationship management” software as having immediate real-world applications to generate productivity gains.

So when we hear talk about how AI will change the world and companies will increasingly rely on AI tools, the argument we make is that much of that implementation will take place through the Salesforce ecosystem.

That was our interpretation of comments from management during the earnings conference call:

We’re democratizing generative AI, making it very easy for our customers to implement every job, every business in every industry. And I will just say that in the last few months, we’ve injected a new layer of generative AI assistance across all of the Customer 360.

In other words, for companies that already rely on CRM for managing day-to-day business functions, the integration of new AI functions adds to the overall value proposition of the service. The setup helps consolidate the company’s leadership position and supports a positive long-term outlook.

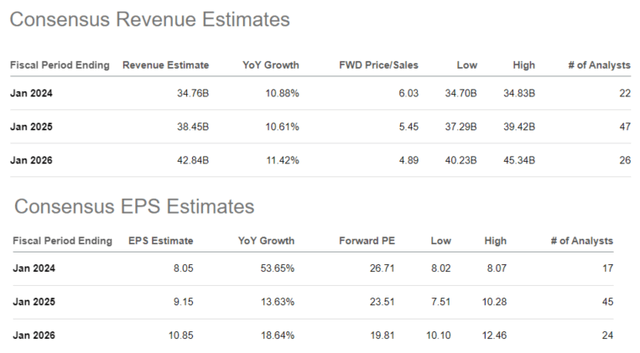

According to consensus, the market sees Salesforce revenue growth averaging around 11% per year for the next two years, while annual earnings growth continues a bit stronger at around 15% between fiscal 2025 and fiscal 2026. In our view, these forecasts could prove to be too conservative.

In terms of valuation, CRM is trading at a 27x forward P/E based on the current year consensus EPS, with that metric narrowing down to 20x by fiscal 2026. While there are examples of other stocks trading at lower multiples or generating a bit higher growth, we still make the argument that CRM remains attractive.

The positives here include the earnings momentum and room for margins to trend higher going forward. The subscription aspect of the business model combined with the critical role the ecosystem plays for underlying customers adds a layer of confidence to the revenue and cash flow trends by limiting the variability. We believe these factors combine to justify a valuation premium.

Seeking Alpha

CRM Stock Price Forecast

We rate shares of CRM as a buy, with a price target of $300 for the year ahead, representing a 37.5x multiple on the current consensus fiscal 2024 EPS. The way we see it playing out is that CRM is well-positioned to continue outperforming earnings expectations including into the second half of this year as a catalyst for the stock.

The bullish case here is that the operating margin has an upside as Salesforce expands its AI portfolio, capturing the market demand for these types of tools while justifying higher pricing. We also expect Salesforce, and the broader tech sector, to benefit from an improving macro backdrop amid easing inflationary pressures and stabilizing interest rates, supportive of a resurgence of business spending overall.

To cover risks, the company would adversely be exposed to the potential for deteriorating economic conditions. Signs customers are not responding to the AI offerings, or that a competitor is capturing market share, would undermine the earnings outlook. Weaker than expected results would open the door for a correction lower.

Seeking Alpha

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.