Summary:

- Salesforce is expected to report Q1 non-GAAP earnings per share of $1.61, a 65% growth compared to the same quarter in 2022, with revenue expected to reach $8.17bn, an 11% increase.

- The company has historically beaten both top and bottom lines every quarter since April 2019, with impressive EPS beats.

- Salesforce’s stock is showing solid technical strength heading into earnings, with growing accumulation and strength in its moving averages.

- Ultimately, I expect the company’s tone on AI to influence the stock’s post-earnings direction.

Bjorn Bakstad

Salesforce, Inc. (NYSE:CRM) is set to report results for its Q1 that ended April 30th, 2023 after hours on Wednesday, May 31st. This article presents five things investors need to be aware of, especially if you are considering an earnings related trade. Let us get into the details.

Steadily Increasing Expectations

Salesforce is expected to report non-GAAP earnings per share of $1.61 when it reports on Wednesday, which represents an impressive 65% growth compared to the 98 cents the company reported in the same quarter in 2022. Revenue is expected to come in at $8.17 billion, nearly 11% higher compared to the $7.38 billion in the same quarter in 2022.

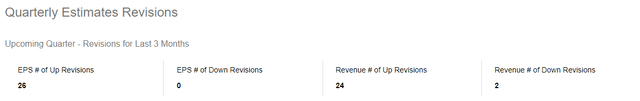

Another way to confirm increasing expectations is by looking at estimates revision over the last 3 months. Both the upcoming quarter’s estimates and the current fiscal year’s estimates have gone up. EPS revisions in particular have a score of 59/59, meaning every single revision has been to the upside in the last 3 months.

In short, expectations are fairly high as the company heads into earnings.

CRM Quarterly Estimates (Seekingalpha.com) CRM Annual Estimates (Seekingalpha.com)

Beating Expectations, Historically

Despite the increasing expectations, bulls can take solace from the fact that Salesforce has beaten both top and bottom lines every single quarter dating back to April 2019 as tracked here by Seeking Alpha. Revenue beats have been marginal most of the quarters but some EPS beats have been by a wide margin. In the 16 quarters tracked, only two EPS beats have been by less than 12%. Impressive to say the least.

Einstein

Okay, not that Einstein, but Salesforce’s Einstein GPT. Salesforce announced in early March that the company plans to integrate its generative AI, Einstein GPT, into every facet of the company’s business from sales to customer service. The skeptic in me thinks it has become quite fashionable to name drop “AI” as many times as possible in conference calls these days. The believer in me recalls how NVIDIA (NVDA) humbled me after recent earnings. But NVIDIA is a different beast all together when it comes to its AI prospects.

I highly doubt something meaningful happened in the short time span between the Salesforce announcement date (March 7th) and the end of the quarter (April 30th) but the company’s commentary on how it plans to monetize and/or optimize operations using AI will be interesting to hear. Seeking Alpha readers have not fallen for the hype yet, at least based on some of the comments in the SA news article linked above.

SA User Comments on Einstein (Seekingalpha.com)

Cheap And Pricey

I can make a case for Salesforce’s stock being both cheap and pricey at the same time. It depends on your outlook for the company. Let’s take a look:

- Even if you believe AI is the future, at 30 times forward earnings, Salesforce is almost as pricey as the AI frontrunner Microsoft Corporation (MSFT). Anyone in their right mind is sure to pick Microsoft as the better bet on AI at this point in time.

- If you don’t believe the AI hype, then you may look at companies like Alphabet (GOOG) (GOOGL) and wonder why would anyone buy Salesforce stock at 30 times forward earnings when Google can be had at 23.

- But investing is all about the future. So, Salesforce’s expected earnings growth rate of 18%/yr gives it a Price-Earnings/Growth (“PEG”) of 1.66 even with the not-so-cheap forward multiple of 30. I am not able to find too many stocks of well-known growth companies with a PEG < 2 these days.

- Back to the pricey side, the stock is already up 60% YTD and has reached another 52-week high. How much room does it have up here even if it delivers on the lofty expectations?

- Okay, before you start doubting my sanity for talking like a split-personality, I am sure you get the point. The stock is neither too pricey nor too cheap here. Generally, given the stock’s momentum and run-up pre-earnings, I’d bet on the bearish side but the magical (or dreaded) two words, “Artificial Intelligence” have influenced Mr. Market’s reaction to many tech earnings this year.

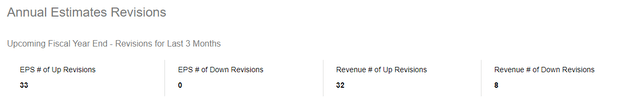

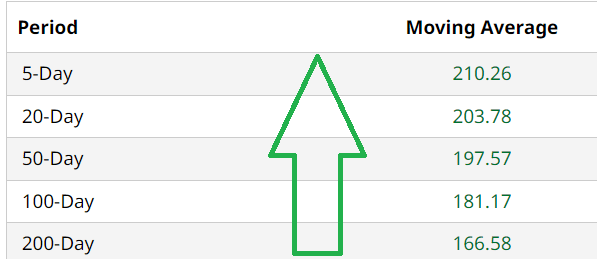

Technical Strength

Salesforce’s stock is showing some solid technical strength heading into the earnings. The stock’s moving averages are progressively better as shown below, indicating growing accumulation and strength. Despite this strength, the stock’s Relative Strength Index (“RSI”) is below 70, although barely. Given the recent strength shown by technology stocks, I won’t be surprised should the stock’s RSI reach 90 after a strong earnings report.

CRM Moving Avgs (Barchart.com) CRM RSI (Stockrsi.com)

Conclusion

I am unlikely to make earnings-related play this time around due to my travel commitments. However, if I were to place a bet, I’d bet on the long side given the recent momentum in technology stocks in general and the AI related ones in specific. Salesforce’s technical momentum suggests the big players are likely betting on the company to report stellar earnings.

Good luck to you if you are planning to make a play on the earnings report. As always, be cautious and do not bet your house on a single trade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, NVDA, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.