Summary:

- Salesforce reported better-than-expected Q1 earnings and revenues and raised its EPS outlook for FY 2024.

- The company generated $4.25B in free cash flow in Q1, with a free cash flow margin of 51.5%.

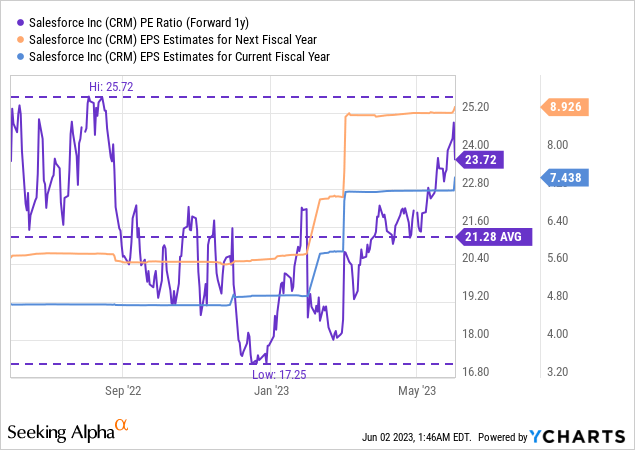

- Shares are attractively valued with a P/E of 24X.

Sundry Photography

Salesforce (NYSE:CRM) reported better than expected earnings and revenues for the first-quarter and the software company also increased its EPS guidance for FY 2024 (while maintaining its revenue guidance of 10%). Nonetheless, the share price of the CRM applications provider dropped 5% the day after the company submitted its earnings card. Considering that Salesforce generated a free cash flow margin in excess of 50% in FQ1’24, I believe the software firm remains a strong buy for investors on the drop!

Salesforce beat on the top and the bottom lines

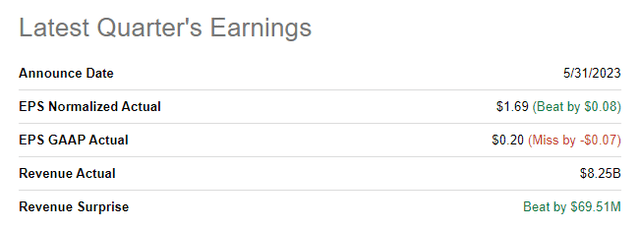

Salesforce reported better than expected EPS and revenue results for the first-quarter on Wednesday which included $1.69 per-share in adjusted earnings compared to a consensus estimate of $1.61 per-share. Regarding revenues, the software company also did better than the consensus estimate with actual revenues of $8.25B beating revenues by approximately $70M.

Double-digit growth in core business segments

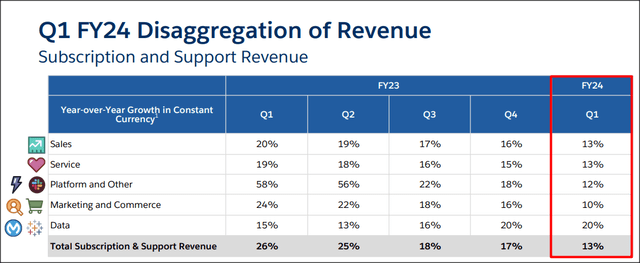

Salesforce generated 11% year over year (13% in constant currencies) top line growth in its first fiscal quarter and posted revenues of $8.25B. While growth across business segments decelerated in FQ1’24, Salesforce continued to report double-digit top line growth for all of its core segments. The three largest segments remained Sales, Service and Platform which help companies scale their digital transformations and improve customer service as well as conversions. Although growth is decelerating, the company is seeing a big improvement in its free cash flow (margins) which I believe is a top reason for investors to own Salesforce’s shares.

Free cash flow

Salesforce exceeded my expectations for free cash flow by a mile. I estimated that Salesforce generated $3.4-3.7B in free cash flow in FQ1’24 as the first-quarter is typically a strong quarter due to customers renewing software contracts during this period. Salesforce generated $4.25B in free cash flow in the first fiscal quarter which calculates to a free cash flow margin of 51.5%. Total free cash flow was up 21.5% compared to the year-earlier period and the firm’s free cash flow margin saw an improvement of 9.2%.

|

$millions |

Q1’23 |

FQ2’23 |

FQ3’23 |

FQ4’23 |

FQ1’24 |

Y/Y Growth |

|

Subscription and Support |

$6,856 |

$7,143 |

$7,233 |

$7,789 |

$7,642 |

11.5% |

|

Professional Services |

$555 |

$577 |

$604 |

$595 |

$605 |

9.0% |

|

Revenues |

$7,411 |

$7,720 |

$7,837 |

$8,384 |

$8,247 |

11.3% |

|

Cash Flow From Operating Activities |

$3,676 |

$334 |

$313 |

$2,788 |

$4,491 |

22.2% |

|

Capital Expenditures |

($179) |

($203) |

($198) |

($218) |

($243) |

35.8% |

|

Free Cash Flow |

$3,497 |

$131 |

$115 |

$2,570 |

$4,248 |

21.5% |

|

Free Cash Flow Margin |

47.2% |

1.7% |

1.5% |

30.7% |

51.5% |

9.2% |

(Source: Author)

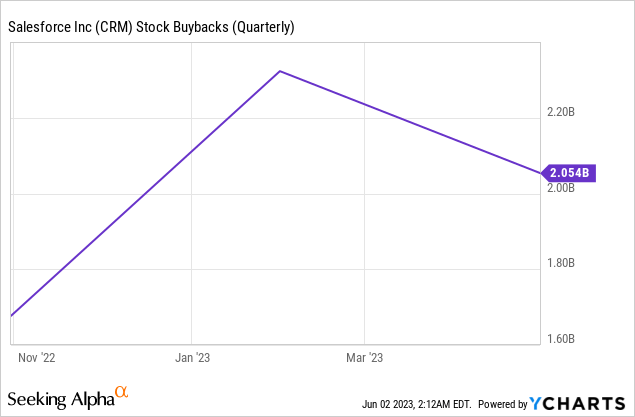

A good portion of this free cash flow is going to be used for stock buybacks going forward… which is another reason for investors to consider shares of Salesforce.

Salesforce initiated its first-ever stock buyback last year and said that it would buy back $10B of its shares. The software company doubled its stock buyback authorization to $20B earlier this year. In the most recent quarter, Salesforce bought back $2.1B of its shares compared to $2.3B in the previous quarter. In FY 2023 (Salesforce’s last fiscal year), the company repurchased $4.0B worth of its shares.

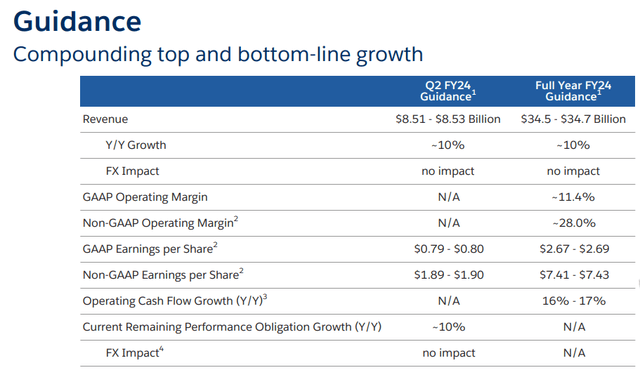

Salesforce raised its adjusted EPS guidance for FY 2024

Salesforce did not raise its top line forecast for FY 2024 and continues to expect $34.5-34.7B in revenues, implying about 10% year over year growth. However, Salesforce increased its earnings forecast from $7.12-7.14 per-share to a new range of $7.41-7.43 per-share.

Salesforce’s valuation

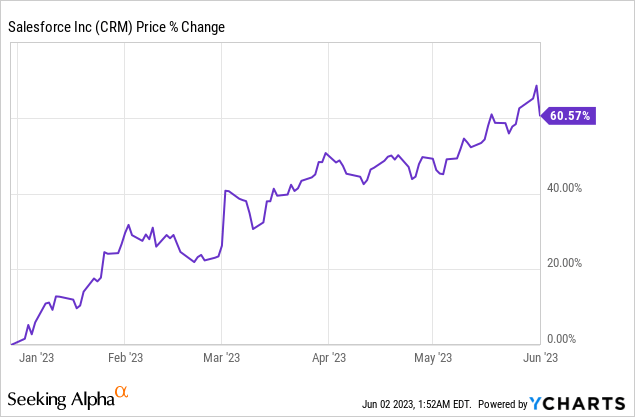

Salesforce’s EPS estimates have received a bump after the software company presented its outlook for FY 2024. Analysts currently project Salesforce to earn $7.44 per-share in FY 2024 (this year) and $8.93 per-share in FY 2025 (next year) which implies annual EPS growth rates of 42% and 21%. Based off of next year’s estimates, Salesforce’s earnings potential is now valued at a P/E ratio of 23.7X which is slightly above the firm’s 1-year average P/E ratio of 21.3X. Given Salesforce’s free cash flow strength and raised EPS guidance, I believe that shares, despite a 61% increase in price so far this year, remain very attractively valued.

Risks with Salesforce

Salesforce faces headwinds regarding top line growth as the PC and software markets overall remain challenged. This has a lot to do with companies optimizing their IT spending and scaling back expenditures in the Cloud market due to growing macroeconomic uncertainty. There is also a seasonality component that investors need to be aware of: the seasonal renewal of software contracts is set to lead to a drop-off in free cash flow generation in Salesforce’s FQ2 and FQ3… but Salesforce should see a strong rebound in FCF in FQ4.

Final thoughts

A day after Salesforce presented its results for the first fiscal quarter, the company’s share price dropped 5%. However, I believe the firm’s first-quarter earnings card was quite good: while the top line guidance was not changed, Salesforce raised its adjusted EPS forecast on improving profitability. The firm’s free cash flow margins exceeded 50% in FQ1’24 and investors can look forward to receiving a lot more free cash flow going forward as stock buybacks. Shares of Salesforce also remain very attractively valued with a P/E ratio of 23.7X and I am buying the post-earnings drop!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.