Summary:

- Salesforce’s stock gained 10% since my last analysis at Q1 FY25 despite broader pressures, and upcoming Q2 earnings could see an earnings and revenue beat due to lower analyst expectations.

- The company benefits from cost restructuring, AI innovations (Salesforce Einstein), and cloud growth, though it’s facing market saturation.

- Salesforce shows stronger earnings than revenue growth and is fairly valued but is vulnerable to competition from big tech and agile startups, particularly in AI and pricing flexibility.

Dzmitry Dzemidovich

I last covered Salesforce (NYSE:CRM) in June; I put out a Buy rating at the time after its 20% correction after its Q1 FY25 earnings. Since that analysis, the stock has gained over 10% in price, far surpassing the S&P 500’s 5.2% change. Now, its Q2 earnings are approaching on August 28th, and I am bullish on CRM coming up to these results as its valuation is slightly more appealing this time around, and analysts have lower expectations.

In Q2, we can expect strength from the company from Salesforce Einstein, accretion from its recent acquisitions, growth from its data management and cloud services, and further benefits from its cost restructuring. There is a likelihood of an earnings and revenue beat due to said lower expectations than in Q1 from analysts. For long-term investors, I think Salesforce is fairly valued, despite issues with its market saturation causing revenue growth slowdown and broader pressures from AI-led startups and big tech, which could disrupt Salesforce’s pricing power.

Q2 Earnings Expectations

Investors will be watching CRM’s Q2 results carefully because its Q1 results were below expectations, with an unusual revenue miss for the first time since 2006. The company missed its revenue estimate by $13.38M despite beating its actual normalized EPS estimate by $0.07. While Investor confidence was shaken following the Q1 results, there has been a gradual recovery in share price, and analysts have adjusted their expectations for Q2, with many lowering their EPS and revenue forecasts. As a result, we could see an earnings and revenue beat in Q2 based on these lower expectations.

This is a big week for technology earnings, with other major companies like Nvidia (NVDA), Dell (DELL), and CrowdStrike (CRWD) also releasing their results. The consensus for Q2 is that CRM will deliver 11.13% YoY growth in normalized EPS, with an estimate of $2.36. Furthermore, its revenue estimate is a strong $9.23B, reflecting a 7.3% YoY increase.

Management has been focusing on its AI innovations and new product offerings, such as Salesforce Einstein, to drive growth. Through these innovations, the company is becoming more resilient against increasing competition and elongated sales cycles by becoming more attractive to current and prospective customers. Furthermore, CRM’s various cloud services are expected to show continued growth.

Recent acquisitions, such as Spiff and Airkit.ai, are also expected to have been accretive to the company and contributed to its revenue in the quarter. Also, as the company processes over 250 trillion transactions across Data Cloud per week, management will likely highlight the importance of its data management capabilities for its relevance in cloud and AI operations moving forward.

The company has also been undergoing cost restructuring, including workforce reductions, to improve profitability. In Q1, this contributed to a 450 basis points expansion in its non-GAAP operating margin, and this focus and expansion is likely to have continued throughout Q2.

Broader Valuation Analysis

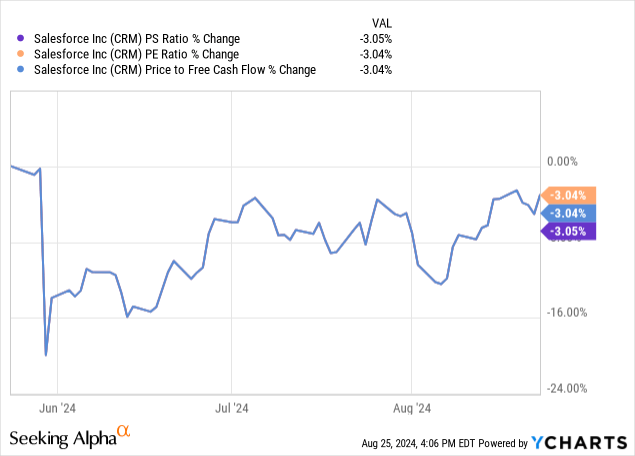

Despite the valuation multiple drop that happened after Q1, Salesforce is now only 3% cheaper on its three core valuation multiples than before its Q1 results were reported. Therefore, one cannot exactly call this a value opportunity anymore. Instead, I think the stock is likely currently fairly valued as the market has driven up the price considerably following the post-Q1 correction.

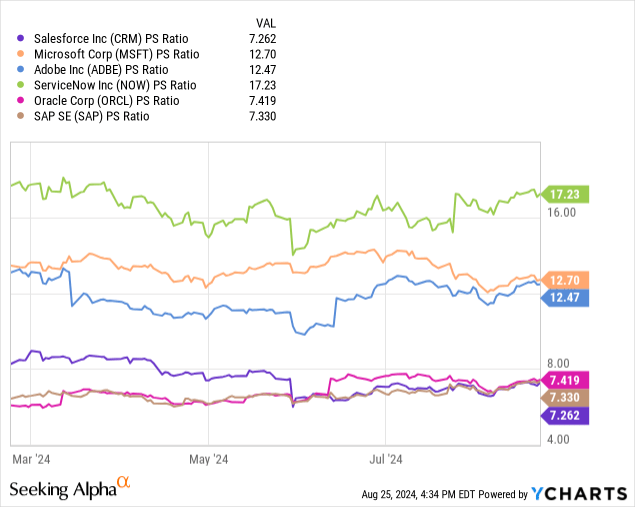

Furthermore, compared to other leading direct competitors, Salesforce has the cheapest valuation based on their PS ratios:

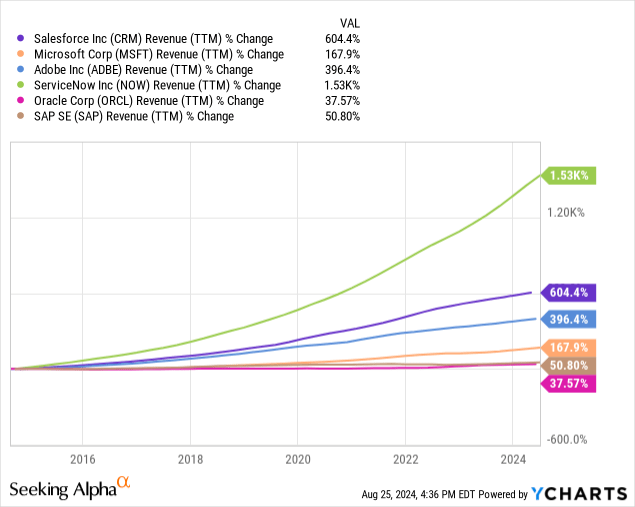

Additionally, it has the second-highest percentage growth over 10 years in its TTM revenue. These two factors combined, the lowest PS ratio compared to dominant peers and the second-highest 10-year TTM revenue growth, are certainly a reason to be bullish on CRM right now, in my opinion.

That being said, over recent years, Salesforce’s growth rates have diminished. Its YoY revenue growth as a 5-year average is 21.9%, but just 11.04% YoY right now. Therefore, Salesforce definitely deserves its TTM PS ratio contraction from 8 as a 5-year average to 7.18 today, especially as Wall Street analysts expect it to deliver annual revenue growth of below 10% moving forward, at least until the fiscal period ending January 2028 is complete. With that taken into consideration, one might rightfully question whether Salesforce’s valuation is sustainable over the long term.

However, where Salesforce has slowed in revenue growth, it has improved in earnings growth. It has forward diluted EPS growth as a 5-year average of just 16.5%, but it’s 28.1% right now. Additionally, its PE non-GAAP ratio has contracted from 44.67 as a 5-year average to 29.46 today; this is a reason to be bullish.

In summary, broadly, I think Salesforce is roughly fairly valued. It is certainly showing signs of market saturation, but its strategy on internal efficiency and margin expansion is working, and I believe this is going to be further reinforced by AI capabilities in the long term. However, I consider its market position to be somewhat vulnerable right now with the rise of small-scale AI companies that could begin to offer services at a lower cost to consumers than Salesforce’s fully-fledged software suite. As a result, investors should realise the stock is both not undervalued and carries medium-term to long-term operational risk as a result of new AI capabilities in the startup market.

Long-Term Risk Analysis

Salesforce’s platform is known for its robust capabilities, but this also comes with the need for extensive user training, which can be a barrier to adoption, especially for smaller businesses with limited resources. Its business model also involves per-user fees, which can become costly and, again, likely deters SMEs. Furthermore, the total cost of ownership for businesses using Salesforce extends to customization, integration, and ongoing maintenance.

Therefore, it is no surprise that competitors like HubSpot (HUBS), Zoho, and Zendesk are positioning themselves as simpler, more agile alternatives to Salesforce. These platforms emphasize ease of use, faster implementation, and lower costs, which is certainly more attractive to SMEs seeking quick implementation and minimal maintenance costs.

However, Salesforce is exploring hybrid pricing models to combine per-user and consumption-based pricing, such as the UE+ product. Furthermore, management is focusing on delivering simplicity through its unified platform, Customer 360, driving integrated customer success across multiple business functions.

Furthermore, I believe that Salesforce is one of the least powerful large tech companies operating in AI. Firms like Microsoft (MSFT), Alphabet (GOOG) (GOOGL), and other big tech firms are much more likely to develop AGI. Salesforce is unlikely to ever do so with its current trajectory. Therefore, I think big tech firms could develop new data management and customer relationship managers that outcompete Salesforce over time as a result of power in automated, intelligent technology capabilities. This long-term risk is likely more pronounced than the risk from startup AI firms that target SMEs to undercut Salesforce in price.

Conclusion

Salesforce is not currently a value play, but it is a worthwhile investment at the current valuation. Q2 has lower expectations after a disappointing Q1, and I believe the company could outperform the consensus estimates for both top and bottom lines, although its top line is what continues to be at risk due to its market saturation and revenue growth slowdown. Pre-Q2 might be a wise time to buy CRM if looking for a long-term holding because if the company has outperformed this quarter, then the stock is likely to become moderately overvalued, providing a less attractive valuation than at the time of this publication.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.