Summary:

- Salesforce reported strong Q3 results with double-digit revenue momentum and significant free cash flow.

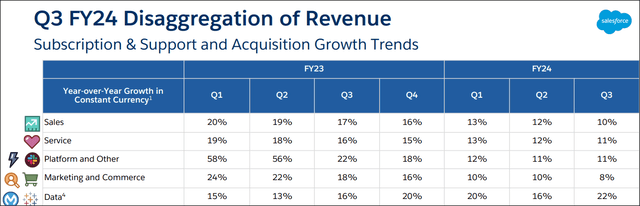

- With the exception of Marketing, the company’s core segments grew strongly Y/Y.

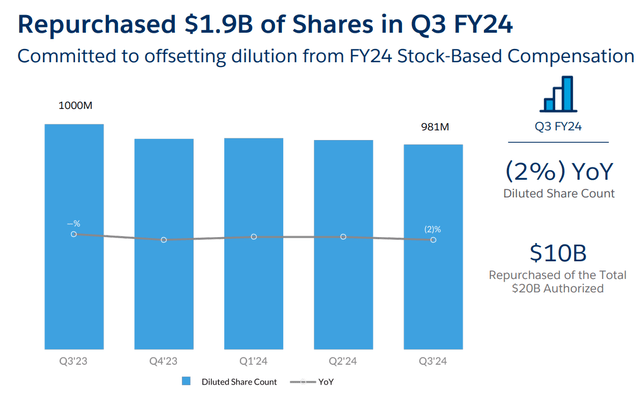

- Salesforce is seeing massive growth in free cash flow as well as improving FCF margins. The firm returns a lot of cash to shareholders through stock buybacks.

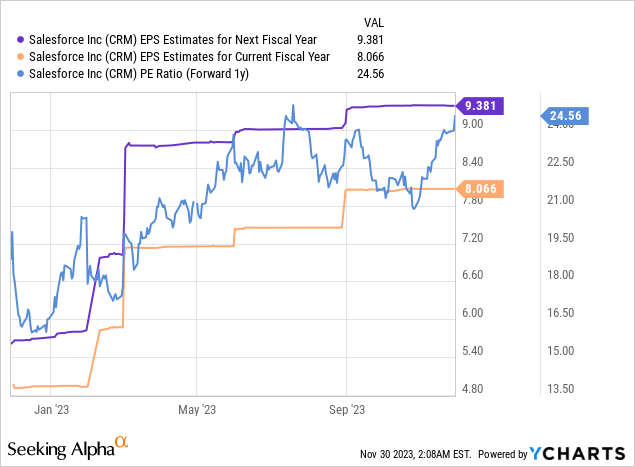

- Salesforce’s valuation remains favorable, and I expect Salesforce to see a new round of EPS upward revisions.

Stephen Lam

Salesforce (NYSE:CRM) reported third fiscal quarter results recently that widely beat estimates on the bottom line and showed continual momentum in the company’s core businesses. Salesforce reported double-digit revenue growth on a consolidated basis and the software firm also generated significant free cash flow growth compared to the year-earlier period. Salesforce is buying back a ton of its own shares and issued an upbeat cash flow forecast for FY 2024 as well. Although Salesforce is not a complete bargain, the company’s shares are a solid investment for growth-oriented investors, in my opinion.

Previous rating

Before the company’s earnings release, I had a strong buy rating on the CRM applications provider due to Salesforce’s revenue growth. Salesforce continued to execute well in the October quarter and managed to grow its free cash flow materially due to a strong performance in the Service and Platform segments. I believe Salesforce is going to see a new round of EPS upward revisions following the Q3 earnings release which could push shares into a new up-leg.

Salesforce delivered a strong performance, and sees massive free cash flow growth

Salesforce generated revenues of $8.72B in the October quarter, showing 11% year-over-year growth, with Service and Platform generating Y/Y top line growth rates of 11%. Growth at Mulesoft, an integration and API platform meant to streamline sales operations for companies, saw 26% revenue growth Y/Y. Marketing and Commerce saw the lowest growth rate of 8% year over year. Besides double-digit revenue momentum in its core businesses, I believe the real story at Salesforce is the drastically improving free cash flow picture.

Salesforce has managed to reach such a critical scale that the company is becoming a real free cash flow giant.

In the third fiscal quarter, Salesforce generated $1.37B in free cash flow on revenues of $8.72B… which calculates to a free cash flow margin of 15.7%. Year over year, Salesforce’s free cash flow grew 1,088% as the company signed on new customers to its platform and rolled out new software products.

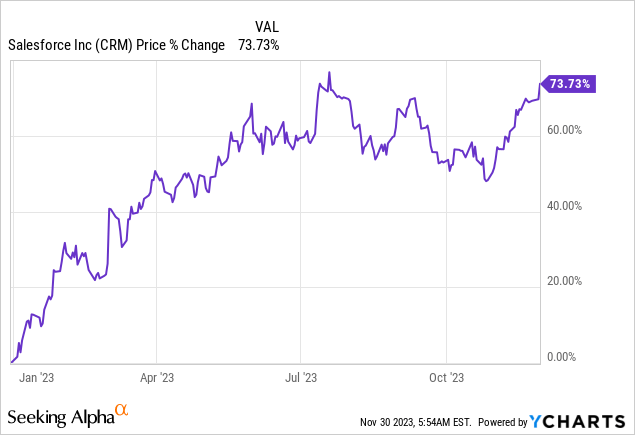

The growth in free cash flow as well as the associated stock buyback power are two reasons why I confirm my strong buy rating for Salesforce despite an impressive year-to-date stock return of 84%.

| $millions | FQ3’23 | FQ4’23 | FQ1’24 | FQ2’24 | FQ3’24 | Y/Y Growth |

| Subscription and Support | $7,233 | $7,789 | $7,642 | $8,006 | $8,141 | 12.6% |

| Professional Services | $604 | $595 | $605 | $597 | $579 | -4.1% |

| Revenues | $7,837 | $8,384 | $8,247 | $8,603 | $8,720 | 11.3% |

| Cash Flow From Operating Activities | $313 | $2,788 | $4,491 | $808 | $1,532 | 389.5% |

| Capital Expenditures | ($198) | ($218) | ($243) | ($180) | ($166) | 16.2% |

| Free Cash Flow | $115 | $2,570 | $4,248 | $628 | $1,366 | 1087.8% |

| Free Cash Flow Margin | 1.5% | 30.7% | 51.5% | 7.3% | 15.7% | 14.2 PP |

(Source: Author)

Upbeat cash flow outlook

The strong cash flow momentum Salesforce is seeing across its businesses resulted in the software company raising its OCF growth outlook for FY 2024. Salesforce now expects operating cash flow growth of 30-33% compared to 22-23% previous.

What happens with Salesforce’s considerable free cash flow?

Salesforce reinvests in its business and develops new software products to make the work of its enterprise client base more efficient and more scalable. However, the firm is also returning a lot more cash to shareholders, which I believe is a top reason to own shares of Salesforce. The software firm started to buy back shares last year and Salesforce announced a $20B stock buyback earlier this year. Salesforce bought back about $1.9B worth of its shares in the last quarter and $5.9B in the first nine months of FY 2024.

Salesforce’s valuation, EPS upside revisions

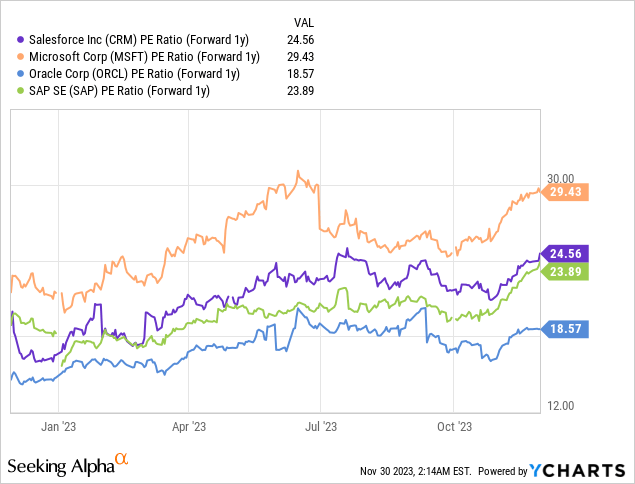

Considering the strength of Salesforce’s Q3’24 earnings scorecard as well as the raised guidance for full-year operating cash flow, the software firm may see a new round of EPS revisions. Shares of Salesforce soared 9% after earnings were reported (in the after-hours market) and are currently valued at 24.5X FY 2024 earnings.

Analysts project, on average – based on Seeking Alpha-provided consensus estimates — 56% EPS growth this year and 16% EPS growth next year. Considering the drastic upward revision for OCF growth, analysts are likely to submit a new round of EPS estimate revisions… which would make shares of Salesforce even cheaper.

Large software companies like SAP (SAP) and Microsoft (MSFT) are trading at similar or significantly higher P/E ratios than Salesforce while Oracle (ORCL), another large application service provider, trades at a 19X P/E ratio. Microsoft, despite its higher P/E ratio, is a strong buy for me as its Cloud business has decoupled from Alphabet (GOOGL) (GOOG)’s: Microsoft: A Top Bet On Cloud Growth.

Risks with Salesforce

The key risk that I see for Salesforce is that the software company could lose revenue momentum in its core businesses like Sales, Service and Platform which have been instrumental in driving the company’s consolidated top line and free cash flow growth in the past. Weakening free cash flow (and lower FCF margins) may also affect Salesforce’s ability to repurchase shares.

Final thoughts

I still like Salesforce as management executes well, generates a ton of free cash flow from its enterprise customer base and the business is seeing operating improvements which are reflected in a growing free cash flow margin. The company also maintained broad-based revenue momentum in the last quarter, with all segments except Marketing continuing to grow at double-digits.

I believe Salesforce is poised to see a new round of EPS estimate revisions after the Q3’24 earnings release which itself may push shares into a new up-leg. Considering that Salesforce managed to sustain its momentum in its core business segments and returns a lot of cash to shareholders through stock buybacks, I believe the risk profile remains skewed to the upside, despite the fact that Salesforce’s shares are not at a bargain level!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.