Summary:

- Salesforce is expected to report Q3 results with a Non-GAAP EPS of $2.06/share and $8.72 billion in revenue, representing YoY growth of 47% and 11% respectively.

- Expectations for the company’s performance are on the rise, with EPS estimates increasing from $1.52 to $2.06 and all recent revisions being positive.

- Key things to monitor include cost control, operating margin, and the impact of stock-based compensation on shareholder returns.

- Salesforce’s strong ecosystem makes the stock one to be bought on weaknesses.

John M. Chase

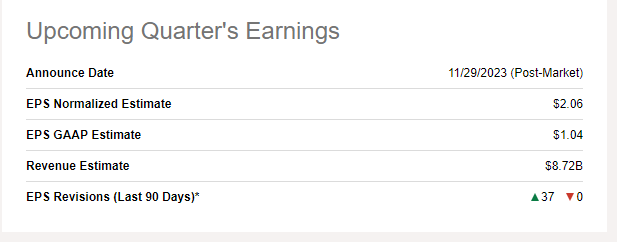

Salesforce, Inc. (NYSE:CRM) is set to report results for its Q3 that ended October 31st, 2023 after hours on Wednesday, November 29th. Analysts expect the company to report a Non-GAAP EPS of $2.06/share on the back of $8.72 billion revenue. Should Salesforce meet the estimates, it’d represent an impressive YoY EPS growth of 47% and YoY revenue growth of 11%.

My previous coverage on Salesforce was ahead of its Q1 report when I rated the stock a “Hold”. Since then, the stock has gone up about 2% compared to the market’s near 9% jump. With that background out of the way, let’s now preview Salesforce’s upcoming Q3 report on these parameters:

- Expectations heading into earnings

- Historical surprise

- Key things to look for

- Valuation

- Technical setup

CRM Q3 Preview (seekingalpha.com)

Expectations On The Rise

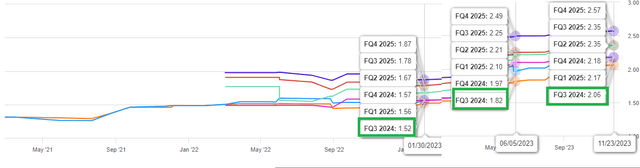

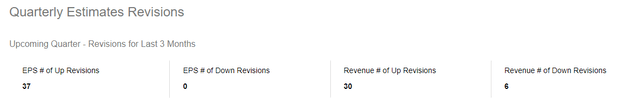

Expectations are on the rise heading into Q3 as EPS estimate has gone up from $1.52 at the beginning of the year to $1.82 in June to $2.06 at present. In addition, over the last 3 months, all 37 EPS revisions and 30/36 revenue revisions have been to the upside. Based on this setup, it is fair to say that Mr. Market will be disappointed if the company does not beat expectations.

CRM Q3 EPS Expectations (seekingalpha.com)

CRM Revisions Count (seekingalpha.com)

History Suggests A Beat

Salesforce has beaten EPS and revenue estimates each of the last 12 quarters. EPS beats have been by double-digit margins most of the times while revenue beats have been by an average of 1%. Going by that trend, I expect Salesforce to report at least $2.20 (57% YoY growth) in EPS on revenue close to $8.80 billion (12% YoY growth).

Key Things To Monitor

- Operating expenses showed a 7% YoY decline in Q2 while overall revenue went up nearly 12% YoY. I am fairly optimistic that Q3 will continue this trend as the company had projected an overall cost savings of $3 billion to $5 billion at the beginning of the (calendar) year.

- Operating margin went up nearly 60% YoY in Q3 2024 to reach 32% and if the company manages to control costs (covered in the last bullet below as well), I expect another strong quarter in this regard. Especially with the stated goal to be among the most profitable software companies in the world (page 3)

“Our goal is to make Salesforce one of the largest and most profitable software companies in the world“

- Slack, Salesforce’s answer to Microsoft’s Teams (MSFT), once again has a new CEO after Lidiane Jones decided to join Bumble as its CEO. Slack was and is still in the thick of action when it comes to Salesforce’s integration with generative A.I and it will be interesting to hear from Salesforce in general, and Slack’s new CEO in particular, on their vision going forward.

- This Seeking Alpha article by Luca Socci highlighted a problem with Salesforce and most technology companies (don’t ask if we are back in the year 2000?): stock-based compensation [SBC].

- In its Q2 report, Salesforce highlighted that it returned nearly $2 billion to shareholders in the form of repurchases. To be fair to the company, total shares outstanding did go down by 6 million in Q2 but even if we assume the company purchased all these shares at $220/share between May and July 2023, we arrive at $1.32 billion. That means nearly one-third of the advertised $2 billion went towards offsetting dilution caused by SBC. I suggest investors to monitor the shares count at the end of Q3 as well to determine how much of the intended $20 billion is likely to be used to merely offset SBC dilution effects.

CRM Stock Chart (seekingalpha.com)

Valuation

- Salesforce is heading into Q3 report with a forward multiple of 27, which compares favorably against the 30 at the time of my Q1 preview.

- When you factor in the expected earnings growth rate of nearly 25%/yr over the next five years, the stock has an attractive Price-Earnings/Growth [PEG] of 1.08.

- 50 analysts have given the stock a median price target of $255, representing nearly 15% upside from here.

- Please note that Seeking Alpha’s quant ratings award only a “D” to CRM stock on its valuation compared to sector peers.

Overall, from a valuation perspective, the stock appears more attractive heading into Q3 report than it did during my Q1 preview.

Technical Setup

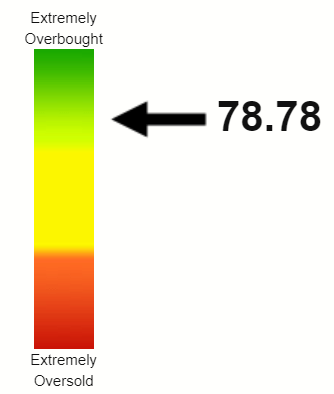

On the back of a 10% monthly gain, Salesforce stock’s Relative Strength Index [RSI] has gone past the overbought level, inching towards 80 as of this writing. Stocks, especially technology stocks these days, may remain overbought for a while before tracing back. In addition, at $224, Salesforce’s stock is trading fairly close to its 100-Day moving average (4.50% below current market price) and 200-Day moving average (~9% below current market price).

Overall, I like the stock’s technical set up heading into Q3 report as there is still room on the RSI front before the stock gets dangerously overbought while strong support in the form of 100-Day and 200-Day moving averages are not far away.

CRM RSI (stockrsi.com)

Conclusion

I am upgrading Salesforce’s stock to a “Buy’ based on its technical strength heading into earnings and the fact that its PEG at 1.08 looks extremely attractive. For all we know, the company may have had a disappointing Q3 and the stock may get hammered. But, what I am more confident about is the company’s long-term potential to tap further into its already strong ecosystem by leveraging the promising Einstein across the board. From collaborative workspace (Slack) to its ERP, Salesforce is perfectly positioned to not just help its customers operate efficiently but also to eliminate its own operational redundancies through A.I.

If the stock sells off after Q3 report, consider that a buying opportunity on one of the strongest ecosystems available.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.