Summary:

- We expect CRM to deliver a strong Q4 earnings report.

- CRM has rallied over the past year amid a trend of climbing profitability.

- The introduction of artificial intelligence tools through the Einstein 1 Platform is driving a new round of growth as a tailwind for the stock.

Bloomberg/Bloomberg via Getty Images

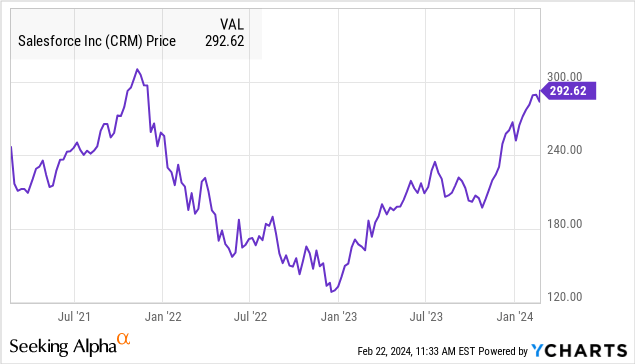

Salesforce (NYSE:CRM) is set to report its Q4 earnings on Wednesday, Feb. 28, after the market close. While the company hasn’t captured the same level of attention as other mega-cap tech leaders, CRM has quietly rallied more than 80% over the past year and is just a few points away from reclaiming its all-time high from 2021.

The story here has been the combination of a stronger profitably benefiting from a string of cost savings initiatives while also capturing a new round of growth driven by the launch of several AI tools across the platform.

Indeed, we covered many of these points with a bullish note last year and expect another strong report this quarter to set the tone for more upside in shares. There’s a lot to like about CRM with a case to be made that shares remain undervalued considering the growth runway and earnings quality.

CRM Q4 Earnings Preview

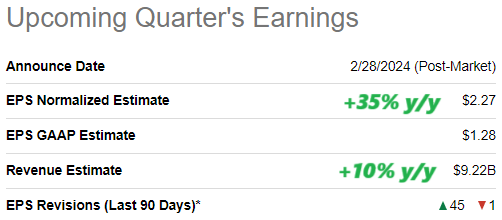

According to consensus, CRM is forecast to post Q4 non-GAAP EPS of $2.27, representing a 35% increase over the period last year. The revenue estimate of $9.2 billion, if confirmed, would be higher by 10% over the period last year.

The idea of focusing “profitable growth at scale” has been a recurring message from CEO Marc Benioff, which is evident by the trend in margins sharply higher over the past year. This follows a broader theme in the technology sector with an emphasis on financial efficiency.

Going back to the disappointing period of weakness in 2022, steps including reducing headcount by more than 12% have helped expenses decline as a percentage of sales even while the business expanded. The adjusted operating margin in the last Q3 reached 31.2%, up from 22.7% last year. That shift is translating into higher earnings which we believe will continue this quarter.

Seeking Alpha

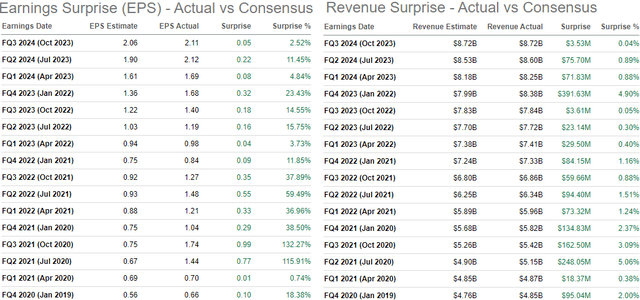

In terms of the EPS, the current estimate is a tick above the official company guidance, targeting non-GAAP EPS between $2.25 and $2.26. That said, there’s every indication results should come in strong, particularly considering the impressive earnings surprise track record Salesforce has presented in recent years. The data we’re looking at shows CRM has beaten both EPS and revenue estimates every quarter over the last five years.

Seeking Alpha

Beyond the headline numbers, the key monitoring points this quarter will be Salesforce’s revenue breakdown across Subscription & Support segments. While normalization of growth rates is expected as the business matures, staying in that double-digit range for the core sales platform is an important benchmark for the rest of the business.

In Q3, there was a sequential re-acceleration of growth in acquisition groups like “Mulesoft” and “Tableau” From Q2 we’d like to see it continue. Ultimately, the market reaction to the Salesforce report will likely depend on the strength of the new full-year fiscal 2025 guidance.

Is CRM Overvalued?

What we like about Salesforce is the sense that the CRM system has evolved into a critical or must-have utility for companies across various sectors worldwide. With the Americas region still representing around two thirds of the total business, the attraction here is that the growth opportunity worldwide remains in the early stages with Asia-Pacific representing a new growth driver.

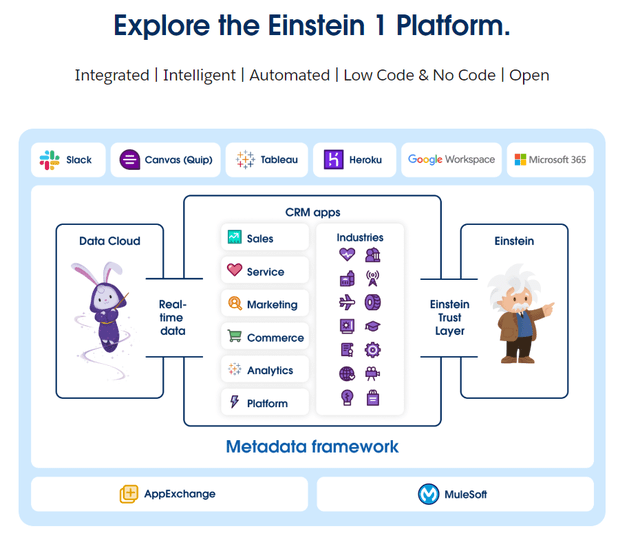

We mentioned that artificial intelligence is a major theme for the company this year, with the integration of predictive and automation generative AI capabilities through “Salesforce Einstein.”

source: Salesforce

There’s a thought that the functionality is not only bringing in new customers but also supporting customer engagement and activity levels that add to the value proposition. The upside is the potential for Salesforce to leverage these features to optimize pricing toward more profitability going forward.

The other strong point of Salesforce is its revenue profile which is nearly completely subscription-based with a high retention level. This is the company that pioneered the “SaaS” business model and we’d go a step further to claim CRM remains the king of software business productivity tools.

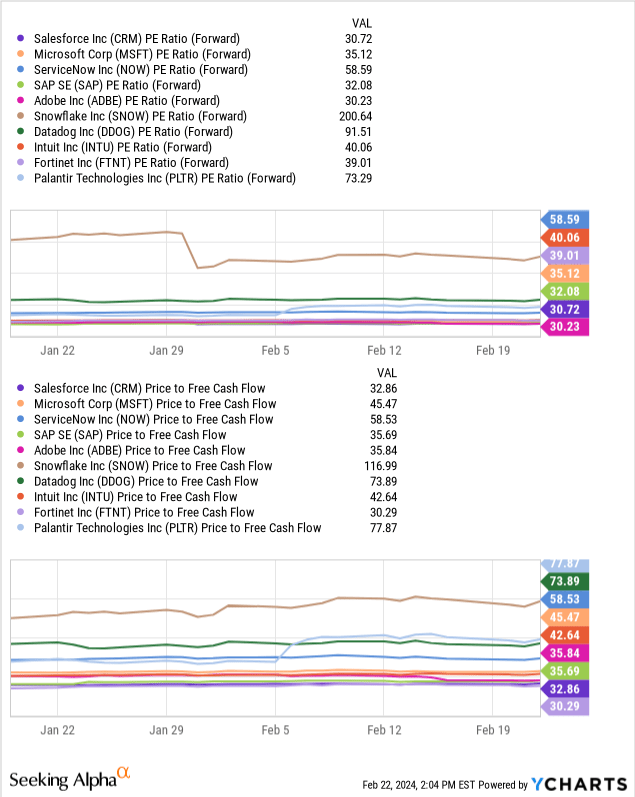

From there, we’d also say CRM stands out as attractively valued, trading at a 31x forward P/E or 33x as a price to free cash flow multiple, which is at a discount relative to a peer group of software tech names.

Final Thoughts

We remain bullish on CRM with the 2021 high of $312 as a near-term upside target. A solid Q4 earnings report coupled with positive 2025 guidance would work to justify a higher valuation premium alongside a new round of positive sentiment towards the stock.

On the upside, we’d like to see some indication of stronger top-line momentum reflecting the ability of Salesforce Einstein AI to capture new growth. We believe shares could trend toward $350 over the next year representing a 37x multiple on the current consensus fiscal 2025 EPS of $9.57.

In terms of risks, weaker-than-expected results would force a reassessment of the earnings outlook. CRM also remains exposed to macro conditions. Monitoring points this quarter include the operating margin as well as the breakdown of revenue across segments and at the regional level.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.