Summary:

- Salesforce is a top provider in CRM and has grown past sales automation by utilizing cloud computing.

- The company had strong Q3 results, beating revenue and cRPO growth expectations.

- Salesforce has a strong growth potential in the customer service market, with a complete product line and integration of AI.

- The stock is currently trading at a discount.

John M. Chase

Thesis

Salesforce, Inc. (NYSE:CRM) has grown past sales automation to become a top provider in CRM, which is one of the biggest and fastest-growing areas in enterprise software markets. Salesforce stands out from the rest because it was one of the first companies to use cloud computing. It has also become a true multi-product success story by riding on the shoulders of several large and growing products. I think that the company will continue to grow in a healthy way and that new products like Integration Cloud and Analytics will create good cross-selling possibilities. Moreover, the stock is trading at a discounted multiple to its historical average, which I believe provides a good buying opportunity. Hence, I assign a buy rating to the stock.

Q3 Review and Outlook

Salesforce posted strong results for the third quarter, posting both top- and bottom-line beats. CRM posted slightly higher than expected revenue growth (11.3% vs. 11.2% expected) and much better than expected in terms of cRPO growth (14.4% reported vs. 10.9% expected). The company posted an operating profit of 31.2%, which led to an EPS beat for the quarter.

The management’s forward guidance for Q4 was in the range of $9.18 billion and $9.23 billion. Moreover, the company expects to post revenues in the range of $34.75 billion to $34.8 billion in FY2024, expecting an increase of 11% YoY. The adjusted operating margin is expected to be 30.5% for the year and the operating cash flow growth has been raised to 30-33% for the year. Hence, I believe the management continues to be confident in the demand environment even though the macro environment currently remains unstable. This confidence can be attributed to the company’s vast product portfolio and healthy demand for its recently launched products like the Einstein 1 platform.

Growth Potential Still There Despite Large Scale

CRM is the biggest player in the public-cloud customer service market (over six times bigger than its closest competitor, Oracle). The company has grown faster than the overall market over the past few years, and I expect this trend to continue in the near term. In most industries, customer service is quickly becoming the thing that sets one business apart from another. This is especially true as more and more deals happen online. Salesforce has one of the most complete product lines in this segment, and it is especially useful for online stores that sell goods through many channels. Moreover, the company has continued to innovate and integrate AI into its product portfolio, which will keep pushing revenue growth in the medium term. The company has started to see the benefits of its focus on AI over the past year, with 17% of the Fortune 100 now being Einstein GPT Copilot users. It’s only been a few months since this feature was made available, so this early interest gives an idea of the potential of the product.

Owing to the need for clean and organised data for this new feature and the company’s strong multi-cloud sales momentum, CRM should have a big chance to cross-sell more, especially Mulesoft and Data Cloud. The business has already seen this start to happen; Data Cloud was a part of six of the top ten deals in the previous quarter.

Financial Outlook & Valuation

Although sales growth has remained in-line with expectations, Salesforce has made profitability gains consistently, and I expect the company’s margins to continue to improve going forward in 2024. The management’s success in improving margins provides some relief to the company as it looks to spark sales growth, which has been affected by macro headwinds. I expect a rebound next year, combined with margin expansion, that would continue to drive solid earnings growth in the near-term. For 2024, hiring will probably be slow, and companies will continue to try to keep sales and marketing costs low. Because of this shift in focus on profit, I believe there won’t be any big acquisitions in the near future.

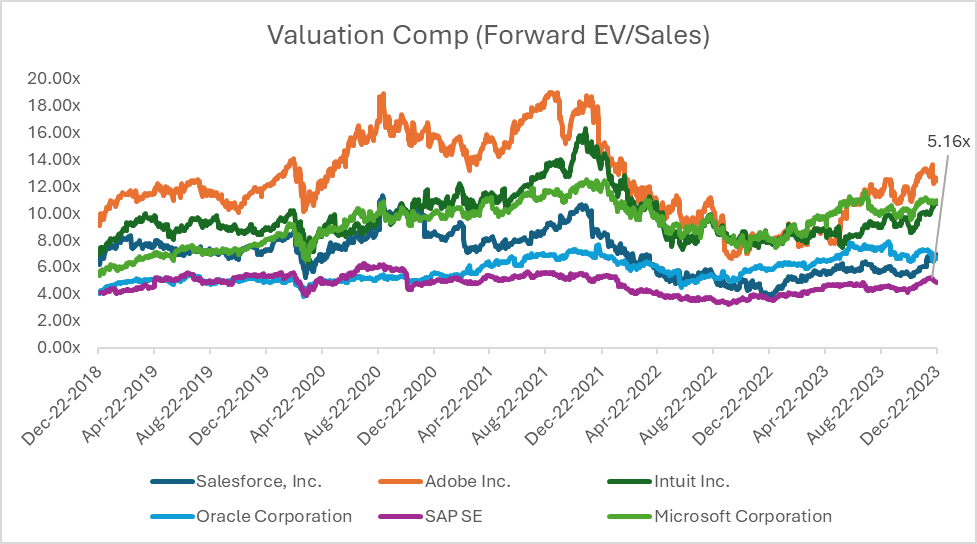

Salesforce has traded at a relative discount to other mega-cap software names, which I view as somewhat warranted, given the lower margin profile and execution risks. However, the stock is currently trading below its five-year average EV/Sales multiple of 7x (as per Capital IQ). CRM’s comp group companies like Adobe, Microsoft and Oracle have been successful in posting non-GAAP operating margins of over 40%, and I believe with CRM’s M&A strategy now on hold, the company can also continue to improve its margins to that level. I believe that will cause the multiple to re-rate upwards towards its comp group. Hence, I am positive on the stock and assign a buy rating to the stock.

Capital IQ

Risks

Salesforce’s growth in billings has slowed down over the past few quarters, which is keenly observed by investors. If the year-over-year billings’ growth rate keeps slowing down, it could be bad for CRM stock. Moreover, Salesforce has continued to grow as a company, in part by taking business away from older companies like Oracle, Microsoft, and SAP. Even though competitors haven’t yet gotten as much attention from investors as Salesforce has with its product portfolio, new products and offerings from legacy vendors can slow Salesforce’s growth and market share, which will lead to a downside in the stock price.

Conclusion

Salesforce has become a true multi-product success story by riding on the shoulders of several large and growing products. The company is set to grow with its Integration Cloud and Analytics and has the potential to continue to improve operating margins and move closer to the 40% range of its peers. The stock is currently trading at a discount to its five-year average, and I believe this provides a good buying opportunity. Hence, I assign a buy rating to the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.