Salesforce: Now A Dividend Stock With Upside Potential

Summary:

- Salesforce beat top and bottom line estimates last week.

- The cloud-based software company achieved $9.5B in free cash flow and FCF margin growth.

- The firm is buying back a ton of its stock and introduced its first-ever dividend.

- Salesforce’s AI service offering, Einstein, is a catalyst for growth.

- Shares are not cheap, but continue to have upside potential.

hernan4429

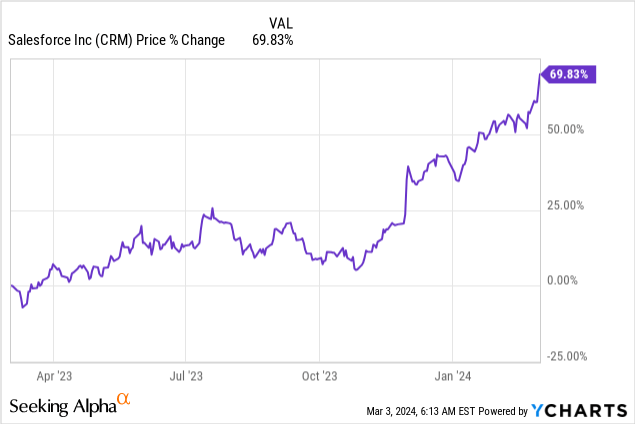

Salesforce (NYSE:CRM)’s shares have increased 70% in the last year as the company executed well against its growth strategy, announced aggressive stock buybacks and targeted an improved free cash flow profile. The cloud-based software company also released a very solid earnings report for Q4 last week, which easily beat top and bottom line estimates. Shares continue to have upside revaluation potential, in my opinion, as the company rolls out its AI products and is on track to surpass $10B in free cash flow in FY 2025. Shares are not overvalued, in my opinion, and the risk profile remains favorable!

Previous rating

I rated Salesforce a strong buy in December — Crushing It With FCF, Buybacks, And Raised Outlook — after the CRM applications provider also reported better than expected earnings for the third fiscal quarter. The free cash flow profile continued to improve in the fourth-quarter, and I believe the cloud software company has upside potential in both revenues and free cash flow related to the integration of AI capabilities into its core CRM platform.

Earnings beat, double-digit revenue momentum, on track to achieve more than $10B in free cash flow

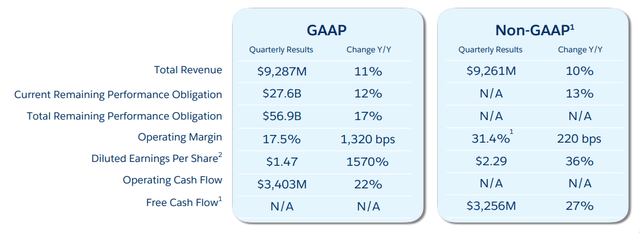

Salesforce reported a solid fourth-quarter earnings sheet last week that resulted in both a revenue and an earnings beat: the CRM applications provider earned $2.29 per-share on $9.3B in revenues in the fourth fiscal quarter, which implied a $0.02 per-share earnings beat and revenues coming in $66.6M higher than expected.

Salesforce’s Q4’24 revenues increased 11% year over year to $9.3B while the cloud-based data platform saw a massive (+1,570%) Y/Y surge in GAAP profits to $1.47 per-share. In the last year, Salesforce has continually expanded its core servicing offering and focused on growing its free cash flow.

The fourth-quarter is a very robust quarter for software companies (as is FQ1) because companies typically decide during these two quarters to enter into, or extend, their software contracts with service providers. In the fourth-quarter, Salesforce generated a massive $3.3B in free cash flow, which calculated to a FCF margin of 35.1% (+4.4 PP Y/Y). In FY 2023, Salesforce generated an impressive $9.5B in free cash flow on revenues of $34.8B — implying a year over year FCF margin improvement of 4.4 PP and a total free cash flow margin of 27.2%. The growth in free cash flow is led by platform expansion, a growing product suite, as well as improving customer monetization.

|

$millions |

FQ4’23 |

FQ1’24 |

FQ2’24 |

FQ3’24 |

FQ4’24 |

Y/Y Growth |

|

Subscription and Support |

$7,789 |

$7,642 |

$8,006 |

$8,141 |

$8,748 |

12.3% |

|

Professional Services |

$595 |

$605 |

$597 |

$579 |

$539 |

-9.4% |

|

Revenues |

$8,384 |

$8,247 |

$8,603 |

$8,720 |

$9,287 |

10.8% |

|

Cash Flow From Operating Activities |

$2,788 |

$4,491 |

$808 |

$1,532 |

$3,403 |

22.1% |

|

Capital Expenditures |

($218) |

($243) |

($180) |

($166) |

($147) |

-32.6% |

|

Free Cash Flow |

$2,570 |

$4,248 |

$628 |

$1,366 |

$3,256 |

26.7% |

|

Free Cash Flow Margin |

30.7% |

51.5% |

7.3% |

15.7% |

35.1% |

4.4 PP |

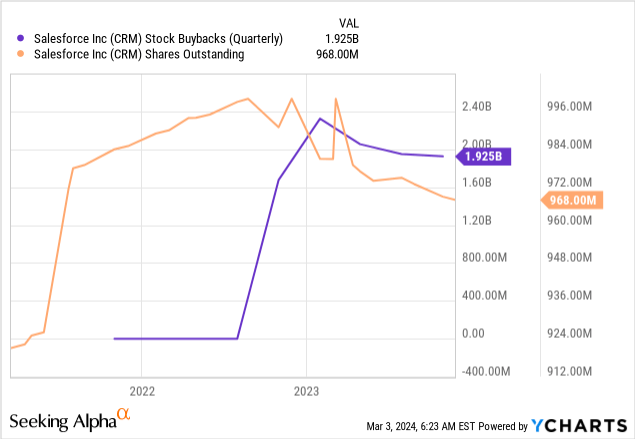

My expectation is that a lot of Salesforce’s free cash flow will go to shareholders in FY 2025. Salesforce authorized a total of $30B in stock buybacks and repurchased $7.7B worth of its shares in FY 2024. This calculates to a quarterly average stock buyback spend of $1.9B. Salesforce has about $18.3B left on its buyback authorization which, at a current price of $316.88, represents about 6% of the company’s market cap.

Dividend introduction

Salesforce announced its first-ever quarterly dividend of $0.40 per-share last week, with the following dates being noteworthy:

Record date: March 14, 2024

Pay date: April 11, 2024.

The dividend introduction makes Salesforce a dividend stock with an initial forward dividend yield of 0.5%. I expect significant growth for Salesforce’s dividend going forward, as CRM is now a free cash flow play. My comments about Meta Platforms (META) becoming a dividend growth play apply here as well.

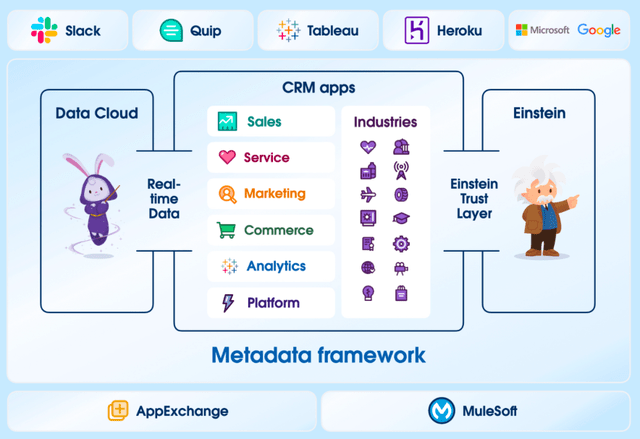

Revenue catalyst: Einstein AI (AI for CRM)

Salesforce has incremental revenue upside relating to growing product uptake of Einstein AI which includes artificial intelligence capabilities that are integrated in Salesforce’s popular CRM software platform. Einstein AI, which is an artificial intelligence assistant, can help companies provide fast, effective and cost-efficient customer service, help improve workflows and provide other data-driven tasks that are meant to boost efficiency.

Einstein AI is available through the Cloud and the deployment of this AI technology has huge implications for Salesforce’s Analytics business… which was renamed from ‘Data’ to ‘Integration & Analytics’ in the fourth-quarter.

Einstein AI can help companies gain insights into work- and order flows and leverage the strength of consumer data, thereby allowing the AI to make predictions about what action a customer is most likely to take next.

Integration & Analytics revenues accounted for a 21% top line share in FQ4’24 and this segment is now the biggest revenue contributor for Salesforce. Going forward, I definitely see this segment as the one with the highest growth potential, as there are endless application scenarios for predictive analytics across a whole range of industries.

| Revenue Share | FQ4’23 | FQ1’24 | FQ2’24 | FQ3’24 | FQ4’24 |

| Sales | 16% | 13% | 12% | 10% | 10% |

| Service | 15% | 13% | 12% | 11% | 12% |

| Platform and Other | 18% | 12% | 11% | 11% | 10% |

| Marketing and Commerce | 16% | 10% | 10% | 8% | 7% |

| Integration & Analytics | 20% | 20% | 16% | 22% | 21% |

(Source: Author)

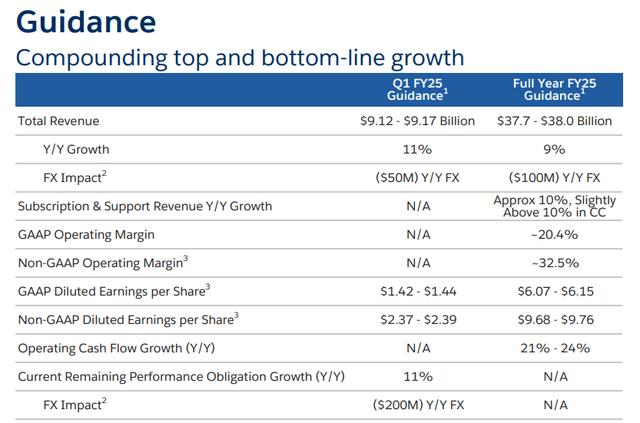

Guidance

Salesforce’s guidance for the current fiscal year, FY 2025, implies a revenue deceleration. The cloud-based software company projects between $37.7B to $38.0B in revenues, which represents a revenue growth rate of 9% year over year (FY 2024 growth rate: 11%). Assuming that Salesforce can maintain its FY 2024 free cash flow margin of 27%, the company could generate more than $10B in free cash flow this year, at the mid-point of its top line guidance.

Salesforce’s valuation

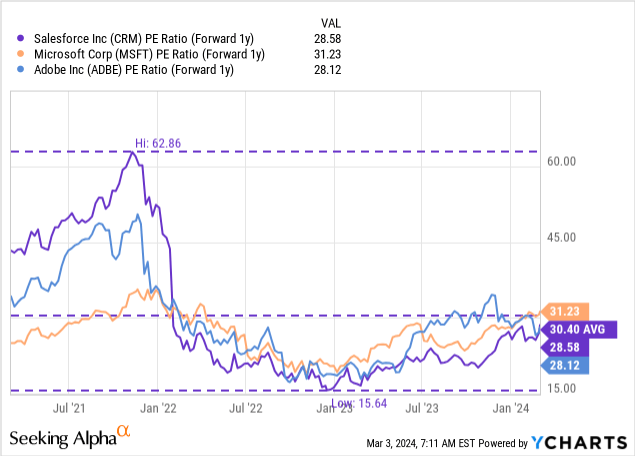

Salesforce has seen a sharp upward revaluation of its shares in 2023 due to the company’s strong execution in the CRM application market, solid top line growth and improving FCF margins. Salesforce is also widely profitable in terms of earnings and free cash flow and expected to see 19% EPS growth this year and 13% next year.

Shares are currently trading at a P/E ratio of 28.6X which is slightly below the 3-year average P/E ratio of 30.4X. Microsoft (MSFT), which I recently ditched because I thought shares were overheating and because the Personal Computing business rebounded, is trading at 31.2X forward earnings.

Microsoft has a higher P/E ratio than Salesforce largely because of its fast-growing Azure Cloud business and impressive free cash flow strength. Adobe (ADBE) is another large application service provider and is trading at a similar P/E as Salesforce.

I believe given Salesforce’s expanding free cash flow margins, dividend introduction, aggressive buybacks, double-digit EPS growth prospects and the upscaling of Einstein AI, the firm’s shares could have a fair value P/E ratio of 31-32X P/E, implying a fair value range of $342-354.

Risks with Salesforce

The biggest risk for Salesforce, as I see it, is a potential slowdown in top line growth as well as underwhelming performance and product up-take related to Einstein AI as the company scales its artificial intelligence offers. Salesforce is still growing its revenues, but growth rates have normalized post-pandemic quite a bit which may turn some investors off. What would change my mind about CRM is if the cloud-based software platform failed to achieve FCF growth and margin expansion in FY 2025.

Final thoughts

Salesforce delivered a solid fourth-quarter earnings sheet last week that continued to show double-digit top line growth, significant free cash flow, expanding FCF margins and the outlook (especially for FCF) is not bad at all. In my opinion, Salesforce continues to have upside revaluation potential as it scales its Einstein AI service offering, which could support cost-savings and efficiency gains/higher conversions for Salesforce’s enterprise clients. With Salesforce potentially set for $10B+ in free cash flow in FY 2025 and the company buying back a ton of stock, plus paying a dividend, I believe the risk profile remains favorable even after a 70% share price appreciation in the last year!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.