Summary:

- Salesforce has returned to its historical acquisition sprees to drive opportunistic growth, with it building upon its existing AI-driven solutions.

- With Einstein 1 already delivering 25T transactions across all of the cloud (+212.5% QoQ/ +316.6% YoY), we believe that FY2026 may bring forth improved top/ bottom line growths.

- The growing multi-year RPOs/ gross profit margins also provide the much-needed insights into Salesforce’s sticky SaaS offerings along with pricing power.

- Combined with the relatively cheap FWD PEG non-GAAP ratio and raised FY2025 guidance, the stock remains a compelling Buy at every dip.

- It goes without saying that Salesforce’s balance sheet is likely to deteriorate in the intermediate term, with it triggering near-term risks.

Yoshiyoshi Hirokawa

Salesforce’s Investment Thesis Remains Robust, Thanks To The Improving Performance Metrics & Intensified Acquisition Spree

We previously covered Salesforce, Inc. (NYSE:CRM) (NEOE:CRM:CA) in June 2024, discussing its market-leading position in the Customer Relationship Management market, albeit with declining market share and decelerating RPO growth.

While its slower monetization of Einstein 1 and the lowered FY2025 guidance raised growth concerns, justifying the recent correction, we believed that the SaaS company was highly compelling then, attributed to its robust performance metrics and reasonable valuations.

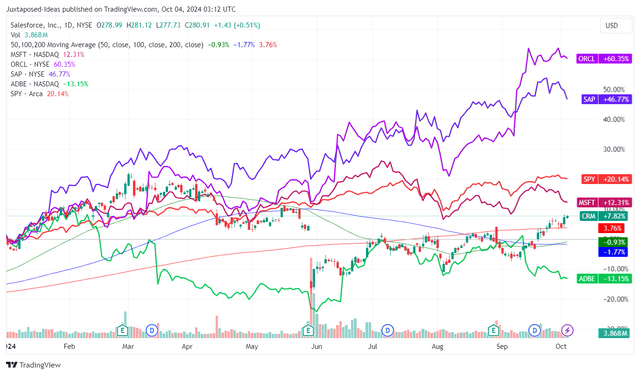

CRM YTD Stock Price

Since that Buy rating, the Salesforce stock has recorded an impressive total return of +21.4%, well outperforming the wider market at +4.9%.

A similar recovery has also been observed in numerous SaaS companies, aside from Adobe (ADBE), with it appearing that the worst of the July/ August 2024 market correction is well behind us.

This uptrend may also be significantly aided by the lifting market sentiments surrounding generative AI in general, with NVIDIA’s (NVDA) CEO highlighting the insane demand for its next-gen chips, Blackwell, as other generative AI/ cloud SaaS peers, including Palantir (PLTR) and Oracle (ORCL), continue to report robust top/ bottom-line performances.

The same has also been reported by Salesforce with a double beat FQ2’25 earnings call along with the raised FY2025 guidance, with it effectively dispelling any fears of its previous “poor performance” in the FQ1’25 earnings call.

If anything, readers only need to focus on three particular metrics for this SaaS company:

- Subscription & Support Revenue of $8.76B (+2% QoQ/ +9.5% YoY),

- Gross Margin of 76.8% (+0.5 points QoQ/ +1.4 YoY/ +1.6 from FY2020 levels), and

- multi-year Remaining Performance Obligation of $53.5B (inline QoQ/ +14.8% YoY),

with these still demonstrating the stickiness of its CRM offerings along with its pricing power, no matter the decelerating top-line growth from its 5Y CAGR of +21.3%.

At the same time, Salesforce has embarked on further acquisitions, including:

- Incentive compensation management platform company, Spiff, for $419M in February 2024,

- AI Voice Developer, Tenyx, for unspecified amount on September 03, 2024,

- SaaS data protection and activation, Own Company, for $1.9B on September 05, 2024,

- Data management provider for unstructured data, Zoomin, for unspecified amount on September 25, 2024,

after a short acquisition hiatus in 2023 – with the management returning to its historical trend of growing its toplines through external growth.

While Salesforce does not expect any “anticipated change to its fiscal year 2025 financial guidance” from these acquisitions, the management already hints at bottom-line accretion from “the second year and continuing thereafter” while bolstering its existing “AI-driven solutions and personalized customer interactions.”

This will also build upon its existing AI capabilities, with the management already highlighting “25T Einstein transactions across all of the clouds during the quarter” (+212.5% QoQ/ +316.6% YoY) with the platform “managing 250 petabytes of data for our customers.”

At the same time, while Salesforce has reiterated the FY2025 subscription revenue guidance at +10% YoY constant currency, they have moderately raised the FY2025 adj operating margins guidance to 32.8% (+2.3 points YoY) and adj EPS guidance to $10.07 at the midpoint (+22.5% YoY).

When compared to the original guidance of 32.5% (+2 points YoY) and $9.72 (+18.2% YoY) offered in the FQ4’24 earnings call, respectively, it is apparent that the SaaS company remains highly profitable despite the uncertain topline growth.

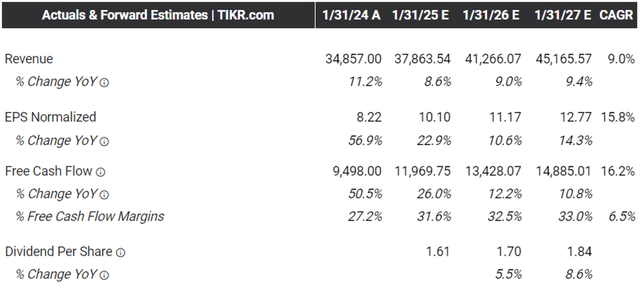

The Consensus Forward Estimates

As a result, it is unsurprising that the consensus forward estimates for Salesforce remains more than decent, with the company expected to generate accelerated bottom-line expansion over the next few years.

This is on top of the visible expansion in its projected Free Cash Flow generation from FY2026 onwards, as guided by the management, allowing the company to sustain its capital return program ahead.

For reference, Salesforce has already retired -1.3% of its float over the LTM and -2.7% since the peak share count of 1,001M in FQ2’23, while deleveraging by -$2.16B since the peak debts of $10.59B in FY2022.

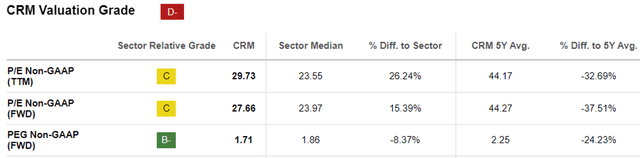

CRM Valuations

As a result of its still rich bottom-line prospects, we believe that Salesforce remains cheap at FWD P/E non-GAAP valuations of 27.66x compared to the sector median of 23.97x, thanks to the moderation from its 5Y mean of 44.27x and 10Y mean of 58.95x.

Even when comparing its FWD PEG non-GAAP ratio of 1.71x to the sector median of 1.86x and its 2.25x, the stock remains reasonable despite the recent recovery.

Lastly, when comparing to its CRM peers, including Microsoft Corporation (MSFT) trading at FWD PEG non-GAAP ratio of 2.38x, ORCL at 2.11x, SAP SE (SAP) at 3.18x, and ADBE at 1.60x, it is undeniable that Salesforce is still attractive at current levels, offering interested investors with the decent margin of safety.

So, Is CRM Stock A Buy, Sell, or Hold?

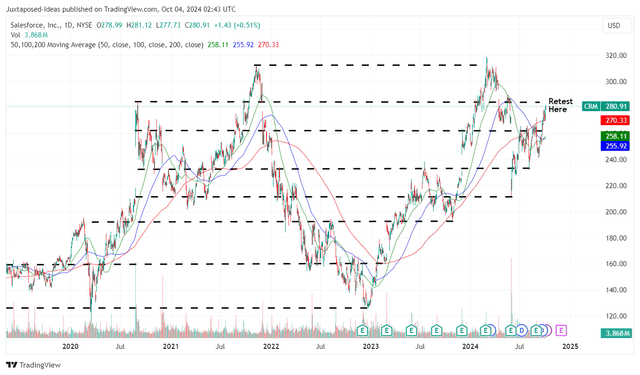

CRM 5Y Stock Price

For now, Salesforce’s bullish support has been observed in the rapid recovery since the recent correction, as the stock also runs away from its 50/ 100/ 200 days moving averages.

For context, we had offered a fair value estimate of $241.80 in our last article, based on the management’s FY2025 adj EPS guidance of $9.90 at the midpoint (+20.4% YoY) and the FWD P/E valuations of 24.43.

Based on Salesforce’s recently raised FY2025 adj EPS guidance to $10.07 and the market’s upgraded FWD P/E valuations of 27.66x (albeit discounted from its 5Y mean of 44.27x), it is apparent that the stock is trading near to our updated fair value estimates of $278.50.

Based on the consensus raised FY2027 adj EPS estimates from $12.58 to $12.77, we are looking at a raised long-term price target of $353.20 as well – with there remaining an excellent upside potential of +25.7% despite the recent recovery.

Assuming that Salesforce is able to return to its high double-digit growth stage upon the monetization of its Einstein 1 platform and synergy from its recent acquisitions, we may see the market eventually upgrade its FWD P/E valuations nearer to its 5Y means of ~44x, with it also triggering a near doubling upside potential to our bull-case long-term price target of $561.80.

Combined with the reasonable PEG non-GAAP ratio as discussed above and sustained shareholder returns through dividend incomes/ share retirement, we are reiterating our Buy rating.

Risk Warning

Market Volatility

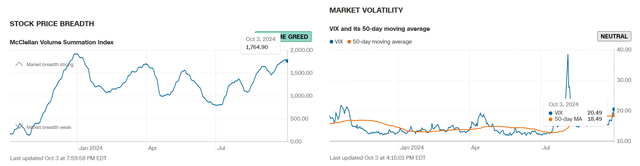

For now, market sentiments appear to be rather exuberant after the Fed pivoted by 50 basis point in the recent September 2024 FOMC meeting, as observed in the elevated McClellan Volume Summation Index at 1,764.90x compared to the neutral point at 1,000x.

There may be moderate volatility in the near-term as well, based on the rising CBOE Volatility Index at 20.18x compared to the 50-day moving averages of 18.49x and the start of the year at 14.49x.

As a result, while we remain optimistic about Salesforce’s long-term prospects, we urge interested investors to wait for a moderate retracement before adding, preferably at its historical trading ranges in the $260s for an improved margin of safety.

At the same time, Salesforce’s fast and furious acquisition cadence is likely to impact its balance sheet, down from the $4.2B of net cash reported in FQ2’25 (-49% QoQ/ +40.9% YoY).

With borrowing costs still expensive despite the recent Fed pivot, investors may want to pay attention to the SaaS company’s near-term balance sheet health indeed, since any hefty debt reliance may trigger higher interest expenses and consequently, bottom-line headwinds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.