Summary:

- Salesforce’s revenue growth has slowed, leading to a decline in valuation and stagnant stock price performance. But I’m positive and wait for strong Q2 figures.

- A bright spot in Salesforce’s Q1 report was the growth in their cRPO, which rose 10% YoY to $26.4 billion.

- Despite some challenges, I think the company’s strategic acquisitions and AI technology developments could drive growth and exceed market expectations.

- Based on my calculations, Salesforce is undervalued by a third of its market cap, so I rate it a “Buy” 1 week ahead of the Q2 FY2025 report release.

JHVEPhoto

Intro & Thesis

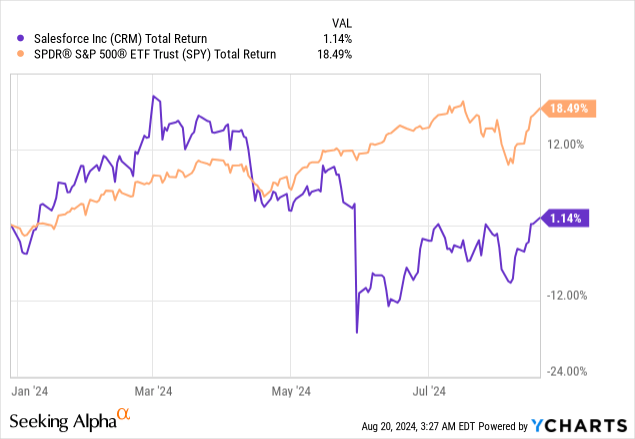

Over the last 11 years, Salesforce’s (NYSE:CRM) revenue has increased by more than 18% annually, based on Seeking Alpha’s data, due to high demand in its end markets (CRM develops customer relationship management software to help businesses manage their various sales, marketing services, and more). However, this growth rate has recently begun to decline, causing the company’s valuation to depreciate rapidly. As a result, the stock price remained basically unchanged on a YTD basis amid the growing S&P 500 index (SPY) (SP500).

From what I see today, it seems to me that CRM’s valuation has fallen to a level that justifies a “Buy” rating, assuming the business growth is not going anywhere (even if it does slow down). Also, I think the company could pleasantly surprise investors next week when it announces its fiscal Q2 FY2025 results.

Why Do I Think So?

Let’s first take a look at CRM’s latest financial results and then try to compare the management’s forecasts with the market forecasts for Q2.

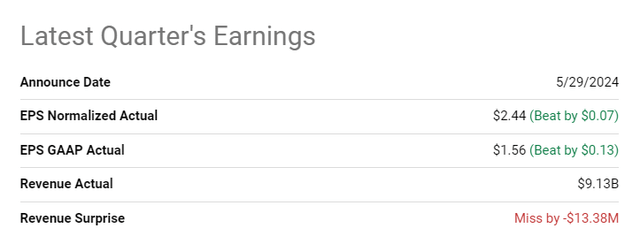

In fact, Salesforce reported “ugly” for its fiscal 1Q FY2025, with revenue at the low end of guidance and a slight miss on consensus expectations (though it beat EPS consensus).

Seeking Alpha, CRM

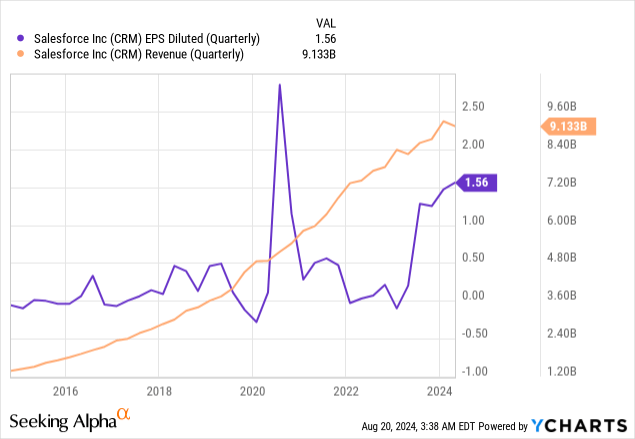

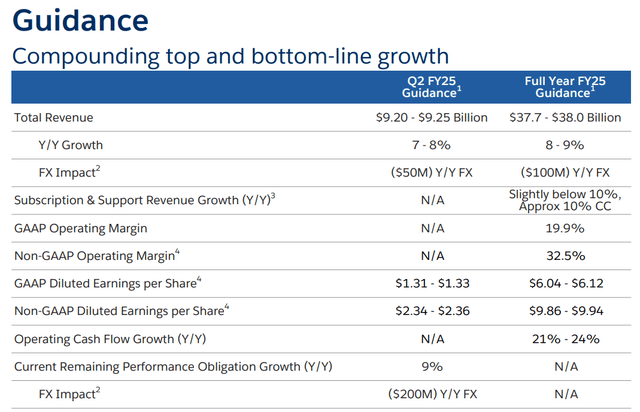

What caught the market by surprise was that CRM’s management lowered its full-year 2025 revenue growth forecast to 8-9% YoY while raising its non-GAAP EPS guidance – these revisions and the top-line miss caused a nearly 20% drop in Salesforce’s stock on May 30, 2024. According to the management’s comments, the main reasons for the worse projections were “a cautious buying environment, elongated deal cycles, and high-budget scrutiny from customers.” Basically, however, nothing bad happened in the first quarter: earnings continued their rapid recovery (7.8x YoY), and revenue was only slightly lower than in Q4 FY2024, but that didn’t stop it from posting YoY growth of 10.74%.

Non-GAAP EBIT rose by 29% (to $2.93 billion), posting a margin of 32% – that’s an expansion of ~450 basis points YoY, which is likely the result of the company’s January 2023 restructuring and layoffs.

Salesforce made a bigger adjustment in January 2023, cutting 8,000 positions — or 10% of its workforce — while pointing to a slowdown in customers’ buying.

“Our customers are taking a more measured approach to their purchasing decisions,” Salesforce CEO Marc Benioff wrote in a January 4, 2023, letter to employees.

Another bright spot in Salesforce’s Q1 report was the growth in their Current Remaining Performance Obligation (cRPO), which rose 10% YoY to $26.4 billion. The cRPO is actually the key metric that reflects the momentum of Salesforce’s sales pipeline by measuring billed, and unbilled business expected to be recognized in the next year. Although this growth was slightly below the company’s 11% guidance and slower compared to the 12% growth in Q1 of the previous fiscal year (and the forward guidance for cRPO growth in Q2 is also expected to decline further to 9%, also contributing to some market disappointment), the YoY increase in cRPO during Q1 still indicates a strong sales pipeline, in my view.

I believe Salesforce should eventually speed up its growth through strategic acquisitions and AI technology developments. Why? First, Spiff’s acquisition should improve on Salesforce’s Sales Cloud by combining incentive compensation management, which may result in enhanced sales efficiency and customer satisfaction. Second, the newly introduced Einstein Copilot – a generative AI assistant that “allows customers to analyze their own data with strong governance without needing expensive AI model training” – is integrated seamlessly into Salesforce’s existing packages, thus providing great value to customers, in my view. So I think CRM’s customer retention rates are likely to stay stable, or even improve from here.

Furthermore, as Argus Research analysts wrote in their recent report (proprietary source, May 2024), the company “diversified its AI partnerships beyond OpenAI to include other major competitors like Cohere, Hugging Face, and Anthropic thus ensuring a more diverse and robust AI strategy.”

Therefore, I think the guidance for Q1 and FY2025 given by management after Q1 is more than feasible. Management expects the non-GAAP EBIT margin to increase further compared to Q1 and reach 32.5%, which seems to be a pretty solid result. I think Salesforce’s operating leverage should be sufficient to at least exceed the midpoint of Q2 guidance.

CRM’s IR materials

But what does the market expect? According to Seeking Alpha, consensus estimates for FY2025 are right in the middle of the guided range, and the Q2 consensus gives a small 1-cent premium to the middle of management’s forecast (i.e., the premium is <1%). So Wall Street estimates look very conservative to me ahead of the Q2 FY2025 report release – after massive earnings revisions we saw after the “ugly Q1”, I think Salesforce has every chance of beating current Q2 forecasts.

Seeking Alpha, CRM’s ESP revisions

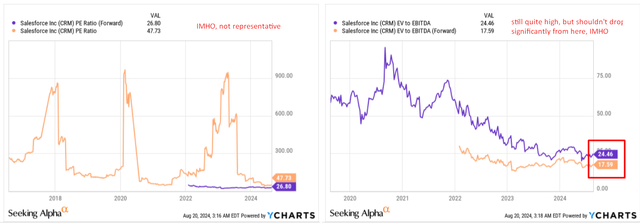

At the same time, I think the company can’t be considered overvalued given the relatively flat stock performance year-to-date. The business has continued to grow, and this growth, coupled with the stagnant stock price, has allowed CRM to grow out of its overvaluation, effectively shedding any excessive premium. Today’s non-GAAP P/E (TTM) of 29.34x appears above industry norms, but if we examine the forward metric, it indicates that the market is anticipating a contraction, suggesting that CRM should continue to shed its premium. But the extent of this anticipated contraction seems excessive to me. Even though the company’s revenue growth is slowing, its EPS figures are recovering quickly, which should theoretically help maintain the valuation premium. Additionally, the current forward EV/EBITDA ratio, which I find more indicative than the P/E ratio, also suggests a contraction to around 17-18x by the end of next year.

YCharts, the author’s notes

I believe CRM’s EV/EBITDA should remain at 20-22x by the end of next year, as the company has a strong chance of continuing to exceed bottom-line consensus estimates due to its prudent cost management approach and existing operating leverage. So if the actual EBITDA figure in FY2026 is like 5% higher than today’s forecast (YCharts data), then the company’s fair market cap in a year, after adjusting for net debt, should be ~$343 billion, which is 33.3% higher than the current market cap.

For this reason, I have decided to add the CRM stock to my coverage with a “Buy” rating one week before the company’s fiscal Q2 FY2025 report release.

Where Can I Be Wrong?

I’m confident about the future of Salesforce, but there are a few things that could make my bullish stance wrong. First of all, the market where CRM operates seems to be highly competitive and dynamically evolving. So Salesforce has to constantly innovate its products as it faces stiff competition from companies like Amazon’s (AMZN) AWS, SAP, Oracle (ORCL), Microsoft’s (MSFT) Azure, IBM (IBM), and some smaller, sometimes more agile competitors.

Another problem I see is Salesforce’s high valuation, which reflects the company’s success as a growth company, but also makes it vulnerable to market changes. As the CRM stock still trades at relatively high multiples, even a small financial underperformance can lead to a significant drop in the company’s market cap. So my calculations of its fair value may be out of touch with reality.

Also, data privacy is now of great importance to both Salesforce’s reputation and customer confidence – releasing customer data without consent poses a significant risk to the company’s image and requires stricter privacy policies in America or even abroad.

Concluding Thoughts

Despite all the risks mentioned above, I believe that the market is too skeptical about the future growth of CRM. Yes, we are clearly seeing a slowdown in revenue growth – everything has a limit, and every once fast-growing company should experience this at some point. In my opinion, however, the most important thing is for management to get their act together in time and start focusing on margins, which Salesforce is doing quite successfully. Yes, the industry itself has problems today, but they apply to everyone, not just CRM.

Overall, I have no doubt that the stock should retain at least some of its premium to the market because the company is a leader in certain niches. By my calculations, the current consensus looks very conservative, so the stock is undervalued by about 1/3 of the market cap. Therefore, I have decided to rate Salesforce a “Buy” today and expect relatively strong Q2 numbers on August 28, 2024 (the day of the report release).

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!