Summary:

- The market’s recent negative reaction to Salesforce’s 1Q FY2025 revenue miss is likely a classic overreaction, making CRM’s stock undervalued.

- Despite a recent stock price drop, Salesforce’s revenue growth and margins remain stable, with potential for future growth through AI integration and international expansion.

- I recommend buying the dip in CRM stock for medium-term investment potential, estimating a 15% annual growth over the next 5 years.

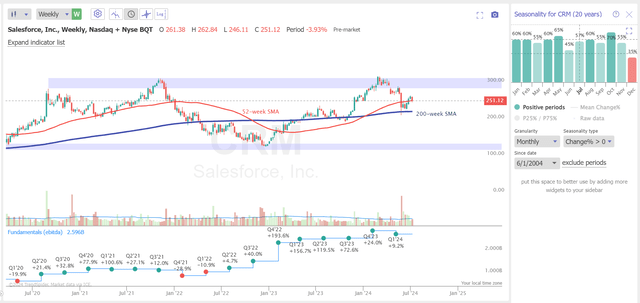

- Currently, the CRM stock is above its 200-week moving average and is trying to hold the 52-week moving average – if it manages to do so, I believe the stock will move higher.

- I decided to issue a “Buy” rating today, calling for buying the dip in CRM stock.

John M. Chase

My Thesis

At today’s price levels, Salesforce, Inc. (NYSE:CRM) stock seems to be an interesting pick to invest in for the medium to long term, given the company’s free cash flow development, margins, prospective growth rates, and valuation contraction amid all that. I believe that the market’s recent negative reaction to Salesforce’s 1Q FY2025 revenue miss is a classical overreaction, with the market making global conclusions from just a few data points – that’s why I think investors should buy the dip in CRM’s stock.

My Reasoning

Salesforce is a $240-billion market cap firm that sells CRM software in the cloud, which encompasses Sales Cloud, Service Cloud, Platform, Marketing and Commerce Cloud, and Integration and Analytics. According to the business description, Salesforce has grown to include mobile, social networking, analytics, and artificial intelligence. Salesforce distributes its software on a subscription basis as well through third-party channels, with 33% of its sales originating from outside the United States.

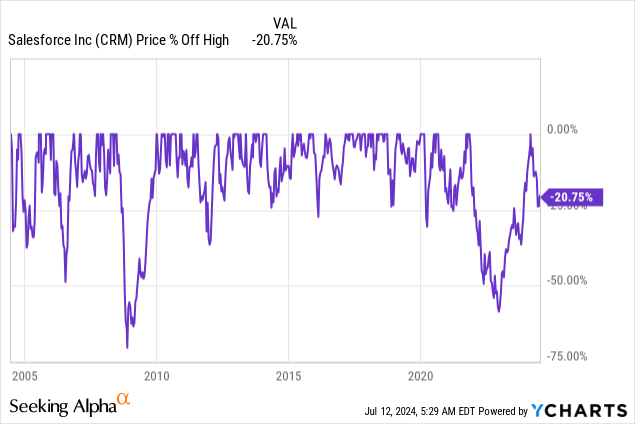

Over the past 10 years, the company’s revenue has grown at a CAGR of almost 24%, while the free cash flow has increased even more rapidly, at a CAGR of 32.3%. Meanwhile, CRM’s EPS has grown at a CAGR of 37.1%, making the company one of the fastest-growing entities even within its high-tech cybersecurity industry. Unfortunately, 1st quarter of the fiscal year 2025 results release led to a significant drop in CRM stock price, with a decline of nearly 25% from its all-time high at some point:

What scared market participants so much?

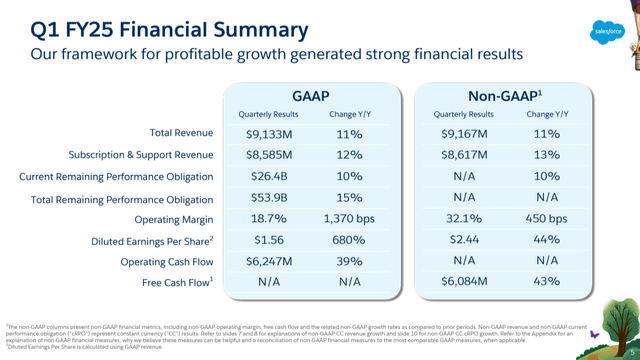

Q1 revenue was $9.13 billion, up 11% YoY both nominally and in constant currency: Subscription and support revenue grew 12% YoY, while Professional services revenue declined by 9.42% YoY because, as the management explained during the earnings call, customers were delaying or slowing projects, which led to reduced immediate revenue in this particular business segment. Meanwhile, the operating margin grew significantly, by 1,370 basis points – that’s in just one year. This strong performance allowed CRM to increase its ESP nearly sevenfold. What’s also noteworthy, it wasn’t just a paper profit, as CRM’s operating cash flow increased by almost 40% YoY:

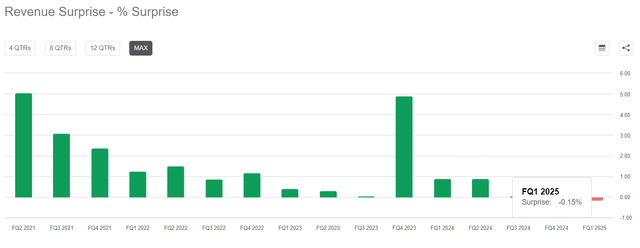

In fact, we can already see that revenue growth has slowed down significantly compared to the historical norm when the company was much smaller from an operational standpoint. That smaller size in the past allowed CRM to grow at a more rapid pace due to the low base effect, sometimes multiple times faster than what we saw in Q1 2025. Moreover, the negative market reaction was, in my opinion, due to this being one of the few quarters where the company missed its revenue consensus, albeit by a small margin of only 0.15% relative to the estimate:

What seems more important to me, however, is the fact that Salesforce was still able to beat the EPS consensus by almost 3%. And although sales in the first quarter were worse than expected, the management confirmed its guidance for the next quarter, which gives hope.

While the negative impact of delays and slowing projects cannot be ignored, I believe CRM can maintain its current position as it continues to expand its consolidated sales in the larger segments.

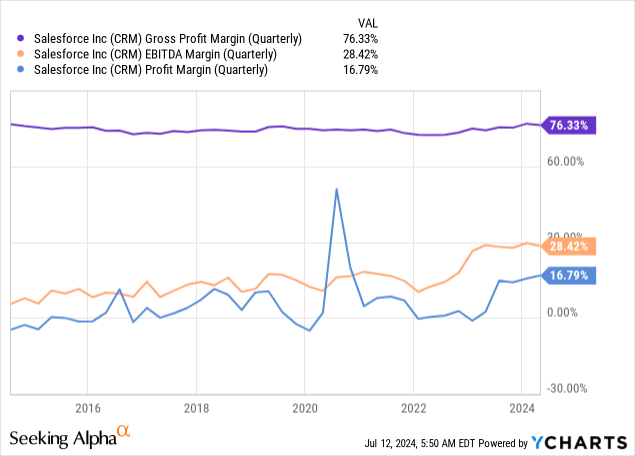

I very much appreciate the fact that the company’s gross margin remains relatively stable at 70.6%, even compared to five years ago. The same applies to the operating and net margins, as well as overall profitability metrics. All this says to me that CRM’s management is effectively controlling costs, which enables qualitative growth. So even against the backdrop of slower sales expansion, if we assume that cost management remains at current levels, we can expect a further, albeit modest, increase in the operating and net profit margin.

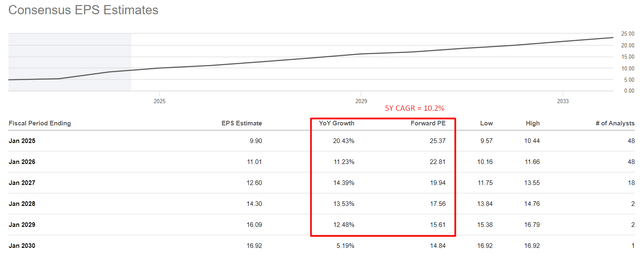

As I mentioned earlier, the company’s EPS has grown at a compound annual growth rate of 37% over the past 10 years; however, according to Seeking Alpha data, Wall Street is only expecting growth of 10.2% over the next 5 years. This means that growth is expected to decline by threefold over the next five years, against a backdrop of slowing sales growth.

Seeking Alpha, CRM, Oakoff’s notes

In my opinion, the growth rate could actually be much higher, thanks to the initiatives outlined by CRM’s management during the last earnings call. Salesforce’s intention, as far as I got it, is to be more productive and increase personalization for its clients by integrating AI into the Customer 360 platform (which isn’t done completely yet). The Data Cloud which merges data regarding customers from different platforms has been a major growth driver with strong adoption by large customers.

To drive broader platform adoption, the company is also focusing on multi-cloud deals and industry-specific solutions to answer varied customer requirements. Salesforce’s offering has a global reach, demonstrated by strategic initiatives in Japan, India, and Canada among others, so the potential TAM may be massive, in my opinion. I believe the transformative potential of Salesforce’s AI and data capabilities can provide a much higher growth rate for the company’s EPS compared to what’s priced in to date.

In light of the above, it’s also worth mentioning Seeking Alpha’s Quant rating, which gives the stock an “F” grade for valuation. I don’t think the situation is as bad as it seems. The company is still growing rapidly. Although sales in the first quarter were slightly below expectations, this was in a less critical business segment. I believe that new initiatives, such as the implementation of artificial intelligence technologies and the expansion of global reach, will help to not only maintain but even slightly increase profit margins. The company still seems to have a strong buffer in this respect. As a result, EPS figures are likely to rise faster than current forecasts.

But even if we take today’s estimates as the ultimate truth, the price/earnings ratio will only be 17.5x at the end of FY2028 (i.e. in 4 years from today). This is a relatively low multiple for CRM, especially when you consider that the current consensus forecast is for an ESP growth rate for that specific year. I believe that given the prospects of expanding margins and maintaining current growth (even if it slows down somewhat), the FY2028 multiple should be twice as high as 17.5x. This gives me a growth forecast for CRM stock of around 15% per annum over the next 5 years.

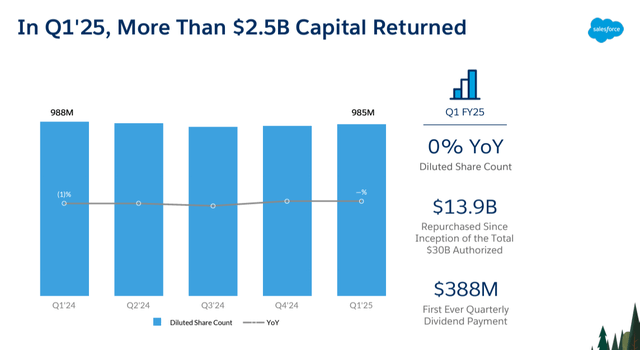

All CRM needs, in my view, is a clear catalyst for the market to understand all of the above. Ideally, this would be an extension of its share repurchase program. Over the last 10 years, the company has increased its shares outstanding amount by ~64%, which is quite significant. If CRM’s net income hadn’t been growing during this time, the dilution would have been very serious. As the business matures and against the backdrop of excellent FCF growth we saw recently, I believe Salesforce should accelerate its buyback program – the buybacks in the last quarter were a thing, but they didn’t significantly reduce the share count.

In my opinion, the emergence of this catalyst is a matter of time, especially considering that the stock price has fallen significantly from its ATHs in such a short time. CRM’s management should take note of this, particularly taking into account the broader technology market’s strength in the past few months.

As far as the technical picture is concerned, I see several reasons that are positive for Salesforce stock in the medium term. On the one hand, the price is still close to a very strong resistance level from which it bounced off at the beginning of 2024. On the other hand, the fundamental indicators, such as EBITDA growth rates, remain stable and the company is getting cheaper after the recent dip. The seasonality suggests that we’ll see strong buying pressure in the coming months, based on the trends of the last 20 years. Even though this is only statistical data and doesn’t have strong predictive properties, it’s still worth mentioning. Right now the CRM stock is above its 200-week moving average and is trying to hold the 52-week moving average – if it manages to do so, I believe the stock will move higher, driven primarily by fundamentals and a possible change in market sentiment.

TrendSpider Software, CRM weekly, Oakoff’s notes

That’s why I decided to issue a “Buy” rating today, calling for buying the dip in CRM stock.

Risks To My Thesis

The biggest risk I see for my thesis today is the possible underestimation of the extent of the decline in sales observed in the first quarter. The continued weakness in the professional services segment could lead to more serious problems for the company’s growth. Furthermore, management has not provided positive forecasts on this issue, as far as I can recall.

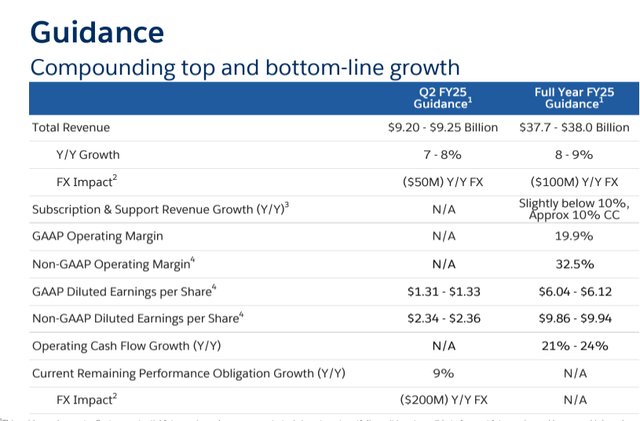

On revenue, we expect $9.2 billion to $9.25 billion, up 7% to 8% year-over-year in nominal and approximately 8% in constant currency. CRPO growth for Q2 is expected to be 9% year-over-year in nominal, including a $200 million FX headwind, resulting in 10% constant currency growth. This includes ongoing headwinds from professional services.

Source: CRM’s earnings call, empahsis added

Perhaps I’m also wrong in my assumption that the company’s margins could continue to rise. Yes, they improved significantly in Q1, but this process has its limits and today’s figures could be the maximum. As far as CRM’s EBITDA margins are concerned, we’re already seeing a stabilization and the absence of any meaningful expansion.

Of course, I have to say that my conclusions on technical analysis and valuation are subjective. If you as an analyst or potential investor can’t see the value of technical analysis, that’s understandable, because it’s more of an art than a science. The same goes for valuation – beauty is in the eye of the beholder, so if I’m willing to pay 30 times earnings in 5 years, you as a potentially more conservative investor might be willing to pay 2 to 3 times less than that (i.e. 20-10x). Ultimately, only time will judge us.

Your Takeaway

As I said at the very beginning of this article, Salesforce’s slight revenue miss and weakness in just 1 non-major revenue segment contributed to a massive stock price drop, which makes no sense to me. In my opinion, Salesforce’s continued focus on AI integration, multi-cloud deals, and international expansion, along with stable margins and effective cost management, suggest a strong potential for future stock growth, which I estimate at 15% annually for the next 5 years. That’s why I call CRM stock a great “buy-the-dip_ opportunity today for the medium term.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.