Summary:

- I firmly believe that the recent dip presents a compelling buying opportunity, as Salesforce’s rock-solid fundamentals continue to strengthen.

- Several robust positive factors indicate that the Q1 post-earnings sell-off was merely an emotional overreaction by the market.

- My valuation analysis suggests that the stock is significantly undervalued, with upside potential ranging from 20% to 66% under various scenarios.

Sundry Photography

Investment thesis

My previous bullish thesis about Salesforce (NYSE:CRM)(NEOE:CRM:CA) did not age well as the stock price decreased by around 7% over the last three months, while the broader market rallied by 10%.

The reason for CRM’s poor performance compared to the broader U.S. market is a massive sell-off after the earnings release. In my analysis I explain why I remain bullish. The post-earnings panic was an overreaction, in my opinion. The company’s fundamentals are still-rock solid, and I see several positive developments. CRM’s valuation became much more attractive after the recent dip, making the stock a no-brainer at current prices. All in all, I reiterate a “Strong Buy” rating for CRM.

Recent developments

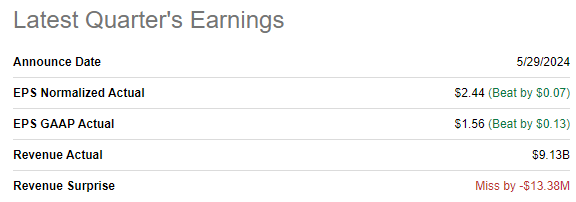

CRM released its latest quarterly earnings on May 29, when the company surpassed EPS consensus estimates but missed on revenue. The top line grew by 10.7% on a YoY basis, and the adjusted EPS expanded from $1.69 to $2.44.

Seeking Alpha

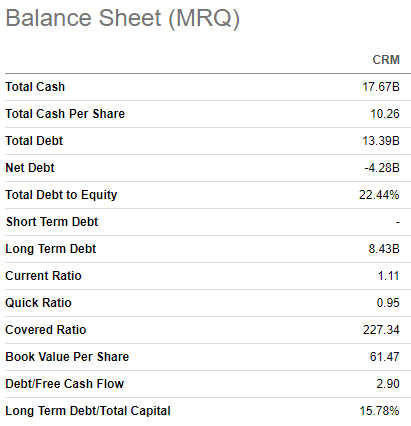

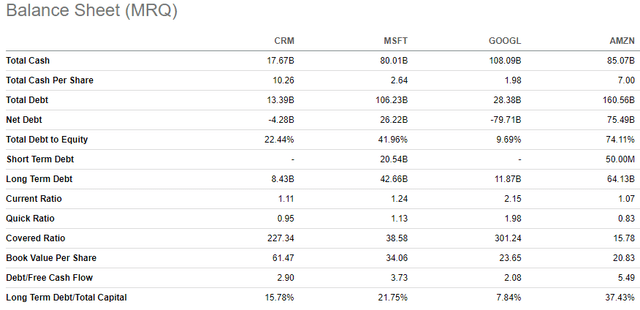

The EPS improvement was of high quality since it was achieved by the expansion of the operating margin from 13.6% to 18.8% YoY. Strong Q1 performance enabled CRM to further improve its financial position. The company had $17.7 billion in cash as of the latest reporting date, and its financial leverage is low. Having a sound balance sheet is crucial because it provides the company with substantial financial flexibility, which can be exercised to invest in new growth opportunities. Past performance is not a guarantee of future victories, but CRM’s historically high profitability adds optimism regarding the company’s ability to reinvest successfully.

Seeking Alpha

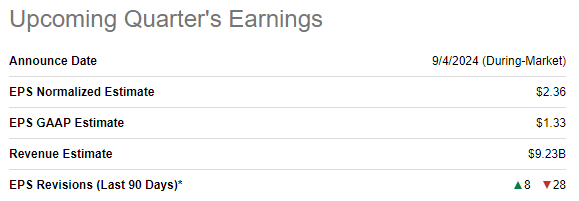

The upcoming earnings release is scheduled for September 4. Quarterly revenue is forecasted by consensus at $9.23 billion, which indicates a 7.3% YoY growth. The adjusted EPS is expected to expand further, from $2.12 to $2.36 on a YoY basis. As we see below, there were 28 downward EPS revisions over the last 90 days, which signals that Wall Street analysts are quite cautious about the FQ2 2025 earnings release.

Seeking Alpha

I do not share Wall Street’s cautious sentiment. I see no catastrophe in CRM’s Q1 revenue miss because it was insignificant. A $14 million revenue miss is just 0.15% of the company’s Q1 revenue, which is almost invisible.

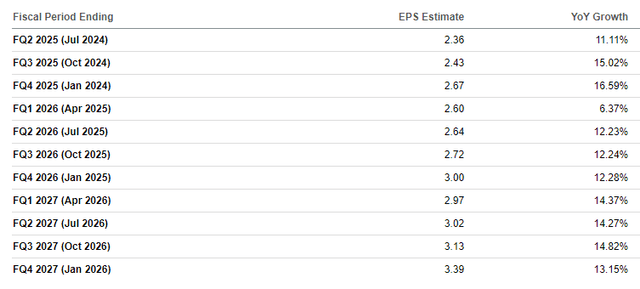

The most important to me is that revenue continues growing at a notable pace and CRM demonstrates strong operating leverage which results in the EPS expansion. From the long-term perspective, the EPS dynamic forecast looks quite impressive. According to the below table, CRM is expected to deliver double-digit YoY EPS growth in the next ten out of eleven quarters.

Seeking Alpha

The fact that the market highly likely overreacted to the slight revenue miss in Q1 is a massive insider buy during the earnings aftermath. According to the source, one of the company’s directors, Mason Morfit, bought 428,000 CRM shares worth around $100 million on June 3. Such a massive insider buy from the company’s co-CEO speaks volumes about the management’s confidence in CRM’s bright future prospects.

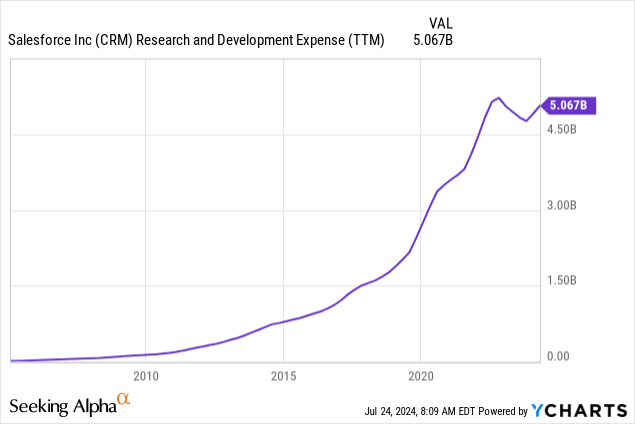

The company continues demonstrating revenue growth and financial discipline, which is a massive blend to deliver value for shareholders. The company continues seeking for more efficiency and recently it was announced that CRM trims 300 more positions. While this round looks insignificant compared to the company’s total above 70,000 headcount, the management’s commitment to keep an eye on costs is the most important. Moreover, I like the thought approach as CRM needs to balance between seeking efficiency and sustaining its massive R&D budget, which is close to historical highs. The fact that the company’s staff was recently ordered to return to office also demonstrates the commitment to improve efficiency of internal operations.

The R&D budget is deployed efficiently as the company continues consistently rolling out new cutting-edge features to its suite of products. Last week the company launched its Einstein Service Agent, which is a fully autonomous AI agent that “boasts an advanced understanding of context and nuance”.

To conclude the core part of my analysis, I think that there are no reasons to be less bullish about CRM. The recent sell-off looks like a noise to me because CRM’s fundamentals are still rock-solid and improving further. The top-line keeps growing, operating leverage drives the EPS expansion, CRM’s financial position is a fortress and the management’s commitment to efficiency and innovation is still intact.

Valuation update

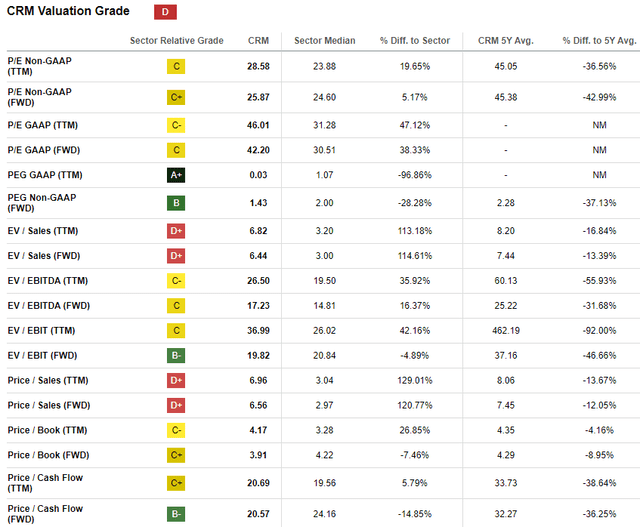

The stock rallied by 13% over the last 12 months, significantly lagging behind the broader U.S. market. This year, CRM demonstrates a decline so far with a 3% YTD share price decrease. Despite Seeking Alpha Quant assigning CRM a low “D” valuation grade, I believe that the stock is undervalued from the multiples perspective. I think so because CRM’s current valuation ratios are notably lower than the company’s historical averages across the board.

Seeking Alpha

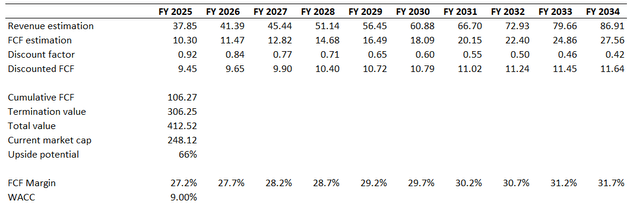

I am using the same 9% WACC, which aligns with the range recommended by valueinvesting.io. I am not changing my WACC assumption because the Fed still has not made any moves in its monetary policy. Consensus revenue estimates for FY 2025-2034 project a 9.7% CAGR, which I incorporate since the level is quite conservative in light of CRM’s bright prospects. For the base year, I use a TTM 27.2% FCF ex-SBC margin and expect a 50 basis points yearly expansion. I ignore the net cash position for CRM since it is insignificant compared to the company’s scale.

Author’s calculations

According to my DCF template, the business’s fair value is slightly around $413 billion, which means there is a massive 66% upside potential. Such a big discount for the undisputed leader in its niche might be too good to be true. Therefore, I want to simulate a more conservative scenario.

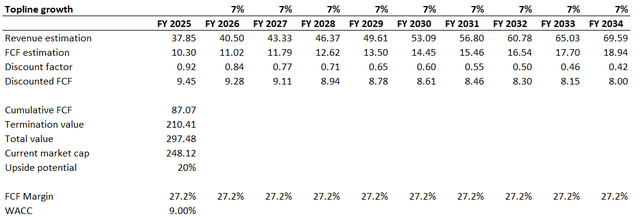

For the second scenario I assume a 7% revenue CAGR over the next decade and no FCF margin expansion. I will leave other assumptions unchanged for this simulation.

Author’s calculations

In the above table we can see that even with modest revenue growth and no profitability expansion over the next decade, CRM is still 20% undervalued. The margin of safety looks wide, meaning that the valuation is indeed compelling.

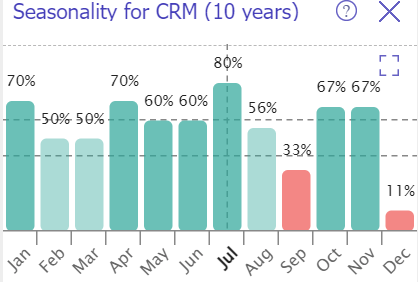

TrendSpider

CRM stock’s seasonality analysis over the last decade suggests that usually the timeframe between August and December is historically weaker than the first seven months of a year. However, as we saw above, CRM’s performance was not very good YTD. This might mean that this year does not follow historical patterns and we can expect the stock’s stronger performance during the remainder of 2024, especially given the massive undervaluation.

Risks update

CRM operates in a highly competitive environment where it competes with giants like Amazon (AMZN), Microsoft (MSFT), Google (GOOG), Oracle (ORCL). Moreover, the technological landscape is evolving rapidly and every year new startups emerge that can potentially bring more threats to CRM. The company has been quite successful in dealing with the intense competition, but past success is not a guarantee of future wins. CRM’s financial power is much lower compared to companies with trillions in market caps. It is important to understand that CRM does not only compete directly with these giants but also competes for the best talent and potential new acquisitions.

Seeking Alpha

The sell-off that happened to the stock after the FQ1 2025 earnings release was massive. As I described in the core part of my analysis, the earnings miss was not significant. Nevertheless, due to CRM’s prior flawless earnings surprise history, investors were extremely disappointed even with a shallow revenue miss against consensus forecasts. The stock lost 19.7% of its value in one day on May 30, the next day the report was released. Potential investors should be aware that expectations around CRM are inherently high due to the company’s excellent performance, and even a small earnings miss might lead to a big sell-off.

Bottom line

To conclude, CRM is still a “Strong Buy”. I firmly believe that the recent dip was caused by the market overreaction as fundamentals remain rock-solid, and the company is expected to continue consistently delivering double-digit EPS growth over the next several quarters. The valuation with a massive upside potential means that the stock is a no brainer, in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.