Summary:

- Salesforce revolutionized the way software companies generate sales by introducing SaaS business model to the world.

- The company’s financial performance has been nothing but stellar in recent years, and it is well-positioned to continue enjoying rapid top-line growth with widening margins.

- My valuation analysis suggests the stock is significantly undervalued.

Stephen Lam

Investment thesis

Salesforce, Inc. (NYSE:CRM) was the first company that introduced the software-as-a-service [SaaS] business model to this world with its cloud-based customer relationship management software. The company’s impressive financial performance over the last decade gives me high conviction in management’s talents and abilities to achieve further growth, evidenced by bright consensus earnings forecasts for years going forward. The management seems focused on margin expansion, according to the latest earnings release. Moreover, my valuation analysis suggests the stock is significantly undervalued, making CRM an appealing investment opportunity.

Company information

Salesforce was founded relatively recently, in 1999, and is now a leading customer relationship management company. The cloud-based software offers businesses of all sizes various enterprise applications, including sales and marketing automation, customer service management, and analytics. It offers its software through its Sales Cloud, Service Cloud, Marketing Cloud, and Salesforce Platform solutions. The company has its fiscal year end on January 31st. Thus CRM’s latest reportable quarter was the end of the fiscal year 2023.

CRM operates as one segment; however, revenues are derived from two sources: Subscription & support and Professional services & other revenues. Subscription & support revenues accounted for approximately 93 percent of the company’s total revenues for fiscal 2023.

Financials

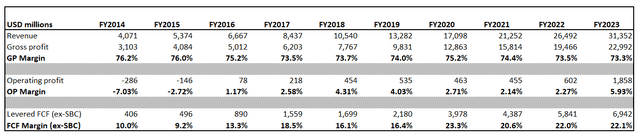

Usually, when I start coverage of a new company, I start analyzing financials over the long-term horizon. CRM’s growth over the decade has been stellar, delivering an above 25% top-line CAGR with a gross margin above the imposing 70% level. CRM has been investing heavily in innovation and aggressive top-line growth, so the operating profit went above 5% only in the latest full reportable year, FY2023. As a relatively young growth company, CRM has substantial stock-based compensation [SBC], which I eliminate when analyzing the free cash flow [FCF] profitability. Based on this analysis of adjusted levered FCF, we can see that this vital margin more than doubled over the last decade, which is also impressive, in my opinion.

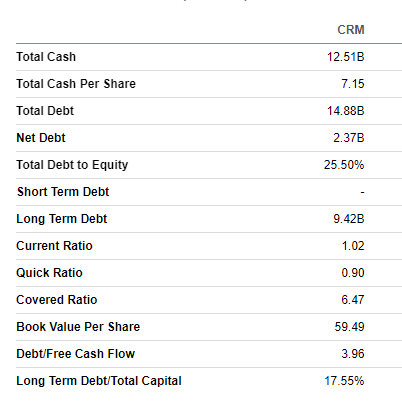

CRM’s balance sheet is strong in my opinion with rather conservative liquidity and leverage ratios. The company’s debt is rated at investment grade levels by both S&P Global Ratings and Moody’s with both agencies projecting a stable outlook.

Seeking Alpha

The company does not pay dividends and primarily uses free cash to invest in organic growth and innovation. However, in the fiscal year 2023, it was the first time in the company’s history that CRM announced a $10 billion share repurchase program. Within the program, the company returned $4.0 billion in FY23 to shareholders. During the latest earnings announcement, it was revealed that the share repurchase program was increased to $20 billion.

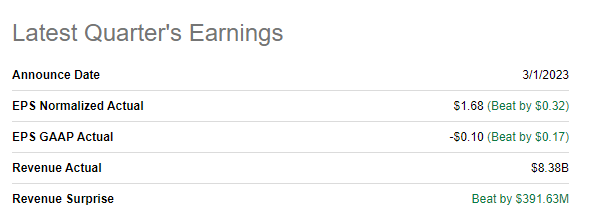

CRM announced its 4Q2023 financials on March 1, 2023. If we refer to the latest earnings, the company’s report showed outstanding results that exceeded analyst expectations regarding revenue and EPS.

Seeking Alpha

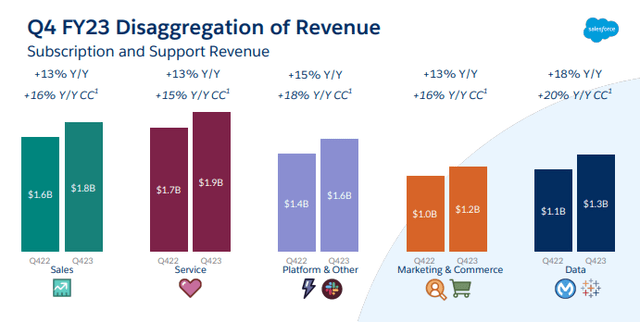

During the 4Q2023 CRM generated $8.38 billion revenue which was 14% more than the same period last year. Unfavorable foreign exchange movements made the top-line growth slower by 3 percentage points. Sales increased across all Subscription & support products, all growing at a double-digit percentage pace.

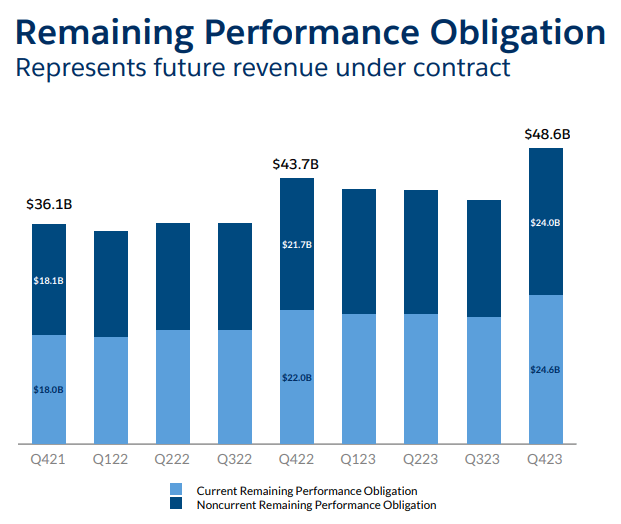

One of the company’s main performance metrics, Remaining Performance Obligation [RPO] demonstrates the strength of the company’s pipeline. RPO is expected to be recognized as revenue over the next year. Current RPO increased 12% compared to 4Q2022, and what is also important is that it demonstrated an 18% sequential growth rate after three quarters in a row of stagnating.

Salesforce.com

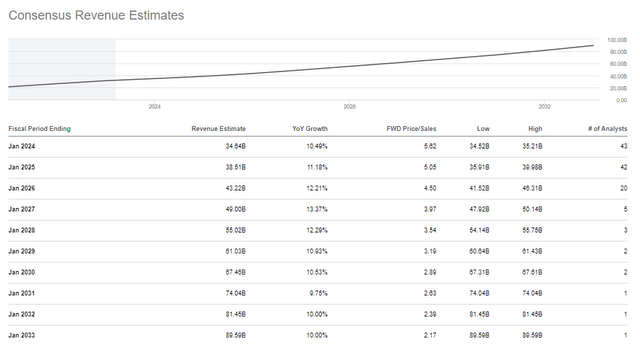

For both Q1 and the full fiscal year 2024, the management expects a 10% year-over-year top-line growth. The company announced its restructuring plan in January 2023, which includes a 10% cut of the global workforce and office costs optimization. The company is expected to incur charges of up to $2.1 billion relating to severance pay and office closures. The restructuring is necessary to meet and even exceed the company’s long-term financial plans. According to Amy Weaver, the CFO, CRM is exceeding its FY ’26 profitability goals years in advance. According to consensus earnings estimates, revenue is projected to grow roughly 10-13% each year with EPS expanding significantly.

I think that consensus estimates are reliable for CRM due to its strong market positioning. According to Dan Romanoff from Morningstar, the company has a Wide Economic Moat because of the company’s strong cross-selling power with all solutions being offered under one umbrella making CRM’s services products offerings much more compelling that competitors’.

Valuation

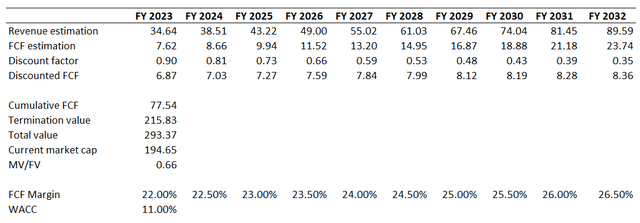

Since CRM is a growth company, I use a discounted cash flow [DCF] approach for valuation purposes. To execute DCF I need to incorporate a couple of assumptions. First, for the discount rate, I use WACC provided by Gurufocus and round it up to 11% to be conservative. Second, for future cash flows, I multiply revenue consensus forecasts for the next decade by historical levered FCF margin ex-SBC, which is currently at 22% and I expect it to expand by 50 basis points each year.

After applying the assumptions described above to the DCF model I arrived at a 0.66 market value to fair value ratio, which means the stock is significantly undervalued with about 40% upside potential.

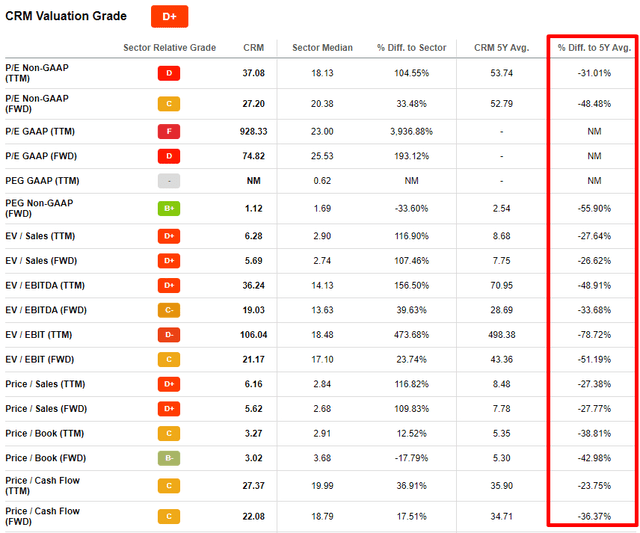

Seeking Alpha Quant valuation grades will not agree with outcomes of my DCF analysis since CRM got a low “D+” grade. I agree that CRM’s multiples are by far higher than sector median but the company is a leader in its niche and I believe that generous multiples here should not signal about undervaluation. We should rather compare CRM’s current valuation ratios to the company’s 5 year averages, and this comparison also suggests the stock is substantially undervalued at the moment.

Overall, I believe that my assumptions for CRM’s DCF are rather conservative and a comparison of current valuation multiples to historical averages also suggests that the stock is significantly undervalued at the moment despite a massive year-to-date rally of about 47%.

Risks to consider

Despite strong financials, bright future prospects, and undervaluation, investing in CRM stock is not without risks.

In the current reality, I see a challenging macroeconomic environment as a significant risk. The economic downturn, from one side, spending will inevitably lead to softening demand for the company’s services and products. From the other side, a difficult economic environment will lead to increased volatility for the stock price.

Next, as a technology company, CRM’s success relies heavily on the technological relevance of its products and services. If the company fails to keep up with technological advancements, its products and services may become inferior to competitors. Becoming technologically obsolete will result in losing customers to competitors offering more advanced and innovative customer experiences with more value.

Also, as a growth stock, CRM is valued by the market based on investors’ belief that the company will continue to grow and expand in the future. This means the company’s current stock price is based on optimistic expectations for its future performance. However, if the company fails to meet these expectations and its growth rates decelerate, it could significantly hit the stock price.

Bottom line

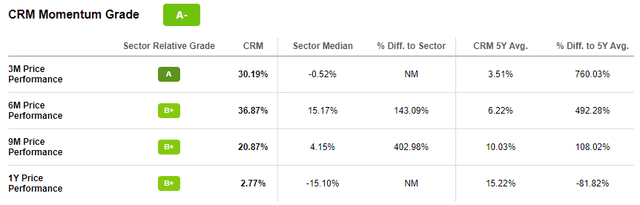

In summary, I believe that the current CRM stock valuation represents a very attractive investment opportunity for long-term investors. I have a high conviction here because of the company’s stellar top-line growth and management’s current intense focus on margin expansion. The company has vast cross-selling and upselling potential, and these opportunities support long-term consensus forecasts, which are rather aggressive. Moreover, the momentum is currently robust according to Seeking Alpha Quant ratings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.