Summary:

- Salesforce has undergone a significant change in its business strategy and with that, I have also changed my rating on the stock.

- Following these changes and the recent rally in growth stocks, CRM delivered a total return of more than 70% over the past year.

- I go in detail on what the new strategy entails and what could be expected from the stock after the drastic increase in recent months.

Stephen Lam

Having a constant opinion on a stock over long periods of time is almost always the wrong thing to do when it comes to investing. Although there are examples of inherently bad business models and poorly managed enterprises, in the vast majority of cases, businesses evolve, strategies change and valuations swing from buy to sell territories.

Probably one of the best examples that I have of such a radical change is Salesforce (NYSE:CRM). A company that has been among the Wall Street darlings in the technology space and as such has been enjoying enormous attention by growth-seeking investors.

Just as the hype around CRM was near all-time high at the end of 2020, I called the business – ‘a strong ecosystem with red flags all over it‘. As a contrarian view on a very popular stock and one of the few sell ratings at the time, the analysis was met with significant opposition in the commentary section.

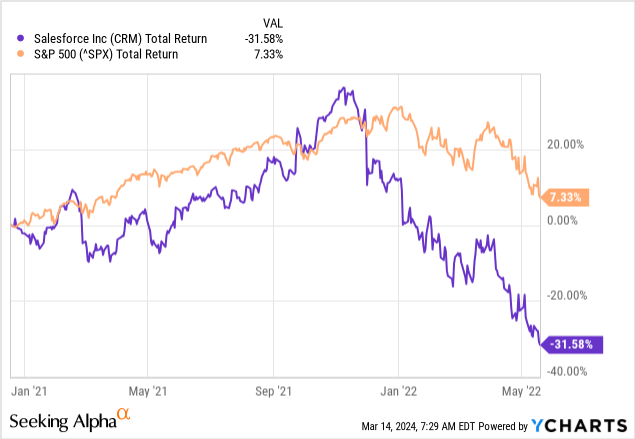

The stock went on to mostly trail the broader equity market in the following months, just to come crashing down by more than 30% by May 2022 while the S&P 500 remained in positive territory through the same period.

The reason why I use May 2022 as an end point on the graph above is because that is when I changed my rating on the stock to ‘Hold’ as significant portion of the risk involved was taken off the table as the stock price collapsed. And, I retained ‘Hold’ rating in my previous coverage.

Alongside the lower valuation, a lot of other changes have been happening within Salesforce’s business itself since then. That is why I have been carefully following each of the company’s quarterly results with, with the focus on the ongoing shift in Salesforce’s growth strategy.

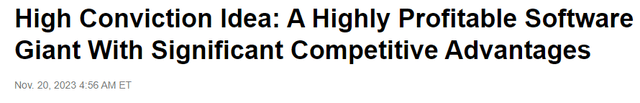

This was the case until November of last year when Salesforce became one of my high conviction ideas for my subscribers at The Roundabout Investor.

Seeking Alpha (The Roundabout Investor)

Since then, CRM delivered a total return in the excess of 35%, thus significantly outperforming the S&P 500 and even though this performance could be partially attributed to the strong market rally in growth stocks, it is also a product of Salesforce’s recent U-turn on its growth strategy.

A U-Turn On Its Strategy

After the CEO of Salesforce Marc Benioff announced that he will be following “the Oracle playbook” about a year ago, the company has witnessed a drastic change in business fundamentals.

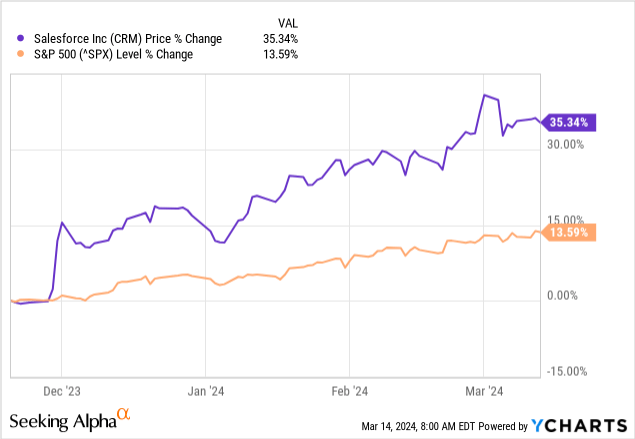

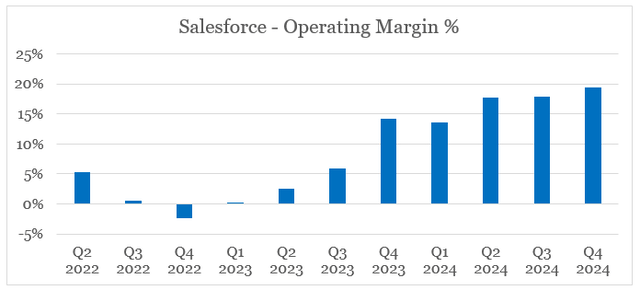

A priority has been given to achieving high GAAP profitability, which was one of my main concerns when I initially published my bearish thesis on the company. During the last reported quarter, CRM reported GAAP operating margin of nearly 20%, compared to an operating loss two years ago.

prepared by the author, using data from Seeking Alpha

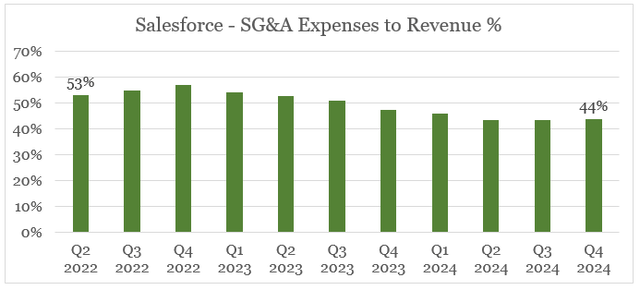

The key development behind this success has been the reduction of the company’s sales, general & administrative expenses relative to sales. In other words, CRM’s management has been laser focused on improving efficiency at the business and thus capitalizing on the potential for economies of scale.

prepared by the author, using data from Seeking Alpha

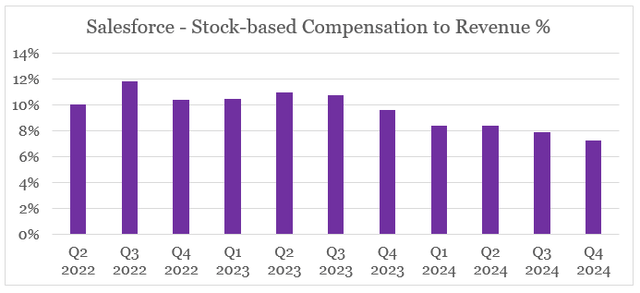

Another shift in Salesforce’s strategy, has been the less reliance on large M&A deals and a stronger focus on internal growth and the development of value-added services, such as the conversational AI assistant – Einstein Copilot. At the same time, the stock-based compensation expense has also been reduced as a share of revenue and, in combination with the recent share repurchase program, has reduced shareholder dilution.

prepared by the author, using data from Seeking Alpha

To my surprise, during the last conference call, the management has also introduced a quarter dividend, which, although small at the moment, is a major step in the right direction.

Now I’m thrilled that we’re opening the door to another incredible part of our ongoing transformation today with the introduction of our first ever dividend. And that’s amazing to say that word for the first time in 25 years in Salesforce history, our first ever dividend (…)

Source: Salesforce Q4 2024 Earnings Transcript

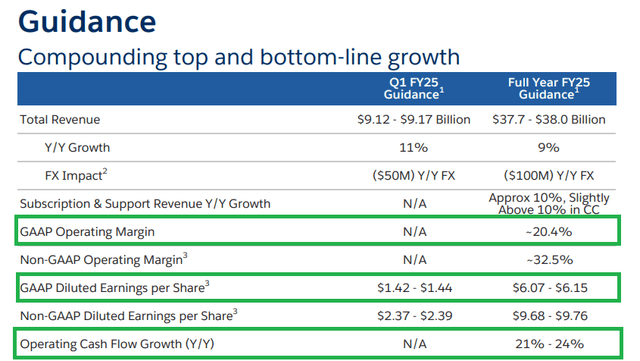

Following on all these developments, the guidance for FY 2025 is quite favourable with GAAP operating margin expected to come above 20% and operating cash flow expected to improve by more than 20%.

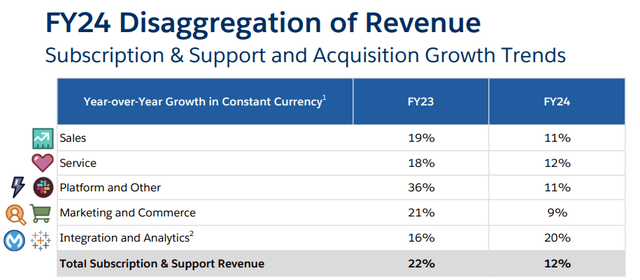

Salesforce Investor Presentation

Annual revenue growth has slowed down significantly to an expected topline growth rate of only 9%, but that is hardly a problem as long as CRM continues to improve its existing competitive advantages and focuses on GAAP profitability.

CRM Pricing And The Road Ahead

After increasing by more than 70% over the past year, CRM is no longer as attractive as it was back when I turned bullish on the stock. The recent rally in growth stocks also overshadows performance through the rest of the year and with that I would be cautious when adding CRM stock at current levels.

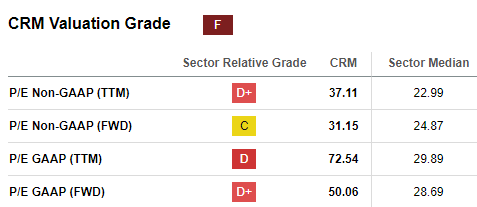

Even though significant progress is being made on the company’s bottom-line figure, the forward GAAP P/E ratio now stands at 50 which is by no means attractive.

Seeking Alpha

As I said above, growth has slowed down meaningfully and with that, I would expect that market participants would be more focused on margins and overall return on capital, as opposed to short-term revenue growth.

Salesforce Investor Presentation

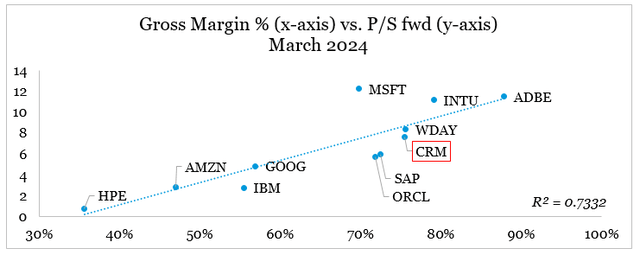

On a cross-sectional basis, CRM is now fairly priced when we consider the company’s high gross margin and its forward sales multiple (see below).

prepared by the author, using data from Seeking Alpha

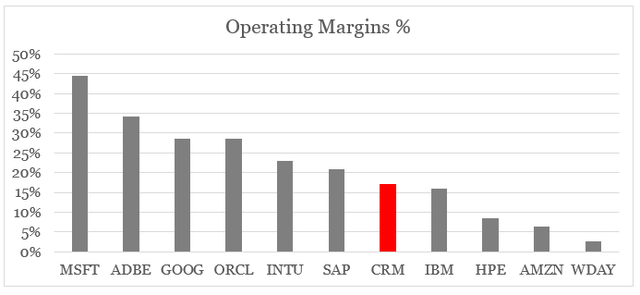

There is, however, long way to go before Salesforce would be placed among the most profitable enterprises in the cloud sector on a GAAP operating margin basis (see below). But the opportunity for more realized economies of scale in combination with its exceptionally high gross margin would make that possible in the coming years.

prepared by the author, using data from Seeking Alpha

Moreover, Salesforce’s unique ecosystem and focus on large corporate clients also creates a significant competitive advantage for the company. Having access to data across different aspects of a business also allows CRM to train its AI Assistant and offer a significant differentiating service to its customers.

(…) a lot of other companies might say they can do this. But I assure you, without the deep integration of the data and the metadata across the entire platform, with the Copilot’s deep integration of that data, they cannot do it. They cannot do it. I assure you they cannot because they don’t have the data and the metadata, which is so critical to making an AI assistant so successful.

Source: Salesforce Q4 2024 Earnings Transcript

All that positions CRM very well for the future, but as we saw above, short-term volatility in the share price is to be expected as CRM now trades much closer to its fair value and further progress is needed on its bottom-line figure.

Conclusion

Salesforce delivered a total return in the excess of 35% in a matter of few months since I added it to my high conviction ideas. Although the stock is now trading closer to its fair value and short-term volatility is to be expected, the long-term potential remains as long as the management stays on the current course. Given the strong rally in growth stocks in recent months, I would be cautious when adding CRM at current levels and would be looking for more signs that the management is making progress towards achieving industry-leading GAAP profitability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.

This idea was discussed in further detail in The Roundabout Investor. To find similar investment opportunities and learn more about how the roundabout investment philosophy could protect portfolio returns during market downturns, follow this link.