Summary:

- Salesforce has many qualities of a brilliant growing blue chip, ranked number one in enterprise software and number three in software with a huge Total Addressable Market.

- In early 2023 activist hedge funds threatened Salesforce on the grounds of insufficient profitability, too much emphasis on growth alone, too many acquisitions, and excessive expenditures.

- Salesforce succeeded in lifting profit margins by severe cost cutting but must maintain a proper balance for long term success.

Stephen Lam

Salesforce (NYSE:CRM) is the number one enterprise software company with a 22% share of the market followed by MSFT (MSFT) at 5.7% and Oracle (ORCL) at 4.7%. It is also the number three software company, in this category trailing Microsoft and Oracle. Though number one in the category it dominates it clearly has plenty of room to expand. It has an estimated Total Addressable Market with a self-generated figure of $290 billion by 2026. Trailing Q3 2023 (2024 FY) revenues were about $34 billion. That’s only 11.7% of the 2026 number which is itself up from the year ago $204 forecast of TAM for 2025. Current Remaining Performance Obligations increased by 14% to $23.9 billion in 2023 while long term RPOs increased by 21% to $48.3 billion non-cancellable contractual obligations. That’s the number combining Deferred Revenue and Backlog required under Accounting Standards Codification 606 starting in 2018, as provided here in the Q3 Salesforce report. It is a number useful to SaaS businesses in showing tangible evidence of momentum and success in acquiring long term contracts.

Then there’s AI, which for Salesforce is something of a double-edged sword. Its Einstein (now called Tableau CRM), the first generative modeling-ready AI built for Customer Relationship Management, provides cutting edge predictive recommendations in Sales, Marketing, Service and Information Technology. This leadership position is the core of Salesforce success but it comes with a responsibility.

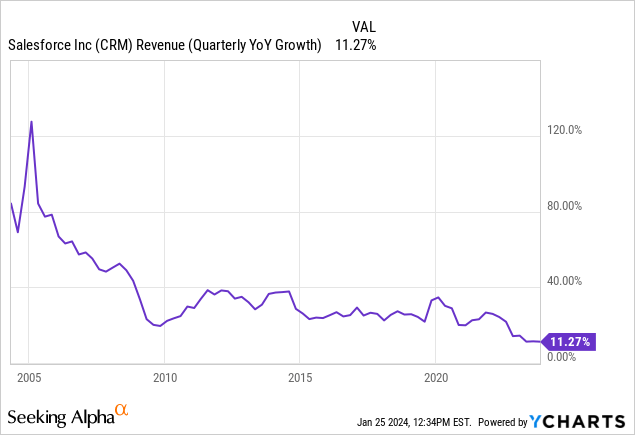

In this interview on January 17 from Davos CEO Benioff laid out his concerns about AI in dramatic terms, saying “We don’t want to have a Hiroshima moment. We’ve seen technology go really wrong. We want to make sure that we’ve got our head around this now.” It’s the importance of protecting customer data that serves as the major theme of the Salesforce lawman commercial with Matthew McConaughey (“If AI is the Wild West, is data the new gold?”). Its aim is to reassure Salesforce customers and others that their data is as secure as Dodge City patrolled by Marshal Matt Dillon. Meanwhile total revenue growth plugs along at lower increases than two decades ago but should still come in around 11% after the Q4 earnings report. The chart below shows the long term trend.

That steady decline in the rate of revenue growth can be best understood as what happens to most companies when they graduate from early growth (Salesforce IPO in 2004) to being large and well established. Growth in percentage terms inevitably comes more slowly – just ask Warren Buffett about how difficult it is for a large company to move the needle – and turning around the decline in percentage of revenue growth is likely to be the most intractable of future goals.

Slowing sales growth didn’t seem to bother the committee tasked with selecting companies to be added to the Dow Jones Industrial Average (DIA) in 2020. Salesforce was among the three most recent Dow additions replacing the unrelated ExxonMobil (XOM). It was clearly chosen because the 4 for 1 split of Apple (AAPL) cut its contribution to the average by 75% which would drop the technology sector from 27% to 20%. The Salesforce addition would bring the tech weighting back up to 23% but the more important impact was that by choosing Salesforce of all the many tech candidates the DJI put its imprimatur on both the particular company and the element of technology which pointed to a future combining enterprise software, Customer Relationship Management, and, ultimately, predictive AI. It made Salesforce into an instant blue chip with a bright future extending out for many decades. So everything is hunky-dory, right? Salesforce is a well-vetted company with an indisputable brilliant future. That’s the simple version of the Salesforce story.

Did The Activists Impose Their Views On Salesforce?

In the years when I kept busy in early retirement as a financial advisor a ranking Salesforce employee was referred to me by a friend who was also a client. The young man was around 30 and very bright. He knew very little about the financial markets but an astonishing amount about the business of manipulating data to run businesses more efficiently. His seriousness made me confident that he would one day be a CEO, if not of Salesforce of some significant company. He gave me an enthusiastic back-of-the-envelope description of what Salesforce did. I told him if it was as good as he made it sound he could consider just holding on to every share he received in Salesforce stock. If he really felt he needed to diversify his risks (I had never suggested anything quite like this to anyone before), he should buy some stodgy, old-fashioned, and safe blue chips like the ones in the Dow Jones Industrial Average. I don’t think I charged him for the meeting and my simple advice. What I probably should have done was ask him for the ticker symbol.

The rise of Salesforce had great intensity, not unexpected from leaders who were themselves very intense, but it was anything but smooth. Smooth and predictable were not qualities the culture valued. Here’s a table taken from Salesforce Wikipedia which shows its extraordinarily bumpy ride from its 2004 IPO to the present. The overall picture is of an extremely confident company which feels it can do as it pleases with the certainty that its choices will produce growth down the road.

| Year | Revenue US$millions | Net income US$millions | Total Assets US$millions | Price per Share US$ | Employees |

|---|---|---|---|---|---|

| 2005 | 176 | 7 | 280 | 5.19 | 767 |

| 2006 | 310 | 28 | 435 | 8.62 | 1,304 |

| 2007 | 497 | 0 | 665 | 11.69 | 2,070 |

| 2008 | 749 | 18 | 1,090 | 13.43 | 2,606 |

| 2009 | 1,077 | 43 | 1,480 | 11.37 | 3,566 |

| 2010 | 1,306 | 81 | 2,460 | 24.21 | 3,969 |

| 2011 | 1,657 | 64 | 3,091 | 32.93 | 5,306 |

| 2012 | 2,267 | −12 | 4,164 | 35.73 | 7,785 |

| 2013 | 3,050 | −270 | 5,529 | 45.94 | 9,800 |

| 2014 | 4,071 | −232 | 9,153 | 57.26 | 13,300 |

| 2015 | 5,374 | −263 | 10,665 | 70.66 | 16,000 |

| 2016 | 6,667 | −47 | 12,763 | 74.55 | 19,000 |

| 2017 | 8,392 | 180 | 17,585 | 90.26 | 25,000 |

| 2018 | 10,480 | 127 | 21,010 | 132.21 | 29,000 |

| 2019 | 13,282 | 1,110 | 30,737 | 155.10 | 35,000 |

| 2020 | 17,098 | 126 | 55,126 | 222.40 | 49,000 |

| 2021 | 21,252 | 4,072 | 66,301 | 255.33 | 56,606 |

| 2022 | 26,492 | 1,444 | 95,209 | 132.59 | 73,541 |

| 2023 | 31,352 | 208 | 98,849 | 79,390 |

A company producing numbers like this clearly feels it can turn on the profit switch whenever it wants to. It just wants to work less often and with less urgency than most companies. Most companies simply do not have the investment opportunities that Salesforce has had from the beginning. That has been the Salesforce point of view going all the way back to 2005. They have never been afraid to look their investors in the eye and tell them, we know best. Why sacrifice huge returns in a few years for a little higher profit margin today?

But there’s a bit more to it than that. Way back in 2020 when ESG and “stakeholder capitalism” had not yet come under powerful criticism CEO Benioff went so far as to say in this interview “Capitalism as we have known it is dead.” He went on to name some of the stakeholders of Salesforce including staff and employees as well as customers, LGBTQ members of this expanded Salesforce community, and ultimately “the planet,” which he saw as in a moment of crisis. Nothing is inherently wrong with serving any of these stakeholders, but he spoke at the moment (2020) when the stakeholder model of a new capitalism topped out. The question that remained was how to establish the right balance of corporate goals. Leaning too far away from the traditional profit-making goal of capitalism would leave Salesforce open to attack from outside activists.

From my little bit of information I understood that Salesforce was a company whose leaders had a few quirks. I caught the drift of this when flipping through the slides of the 2022 investor day with cartoonish visuals similar to the cartoons my wife’s preschooler grand kids constantly watch to my general disapproval. It took some persistence on my part but once you get past the cartoon figures the numbers and general pattern of organization tell the story of a company which had its operational side pretty much together until you take a close look at costs and profit margin.

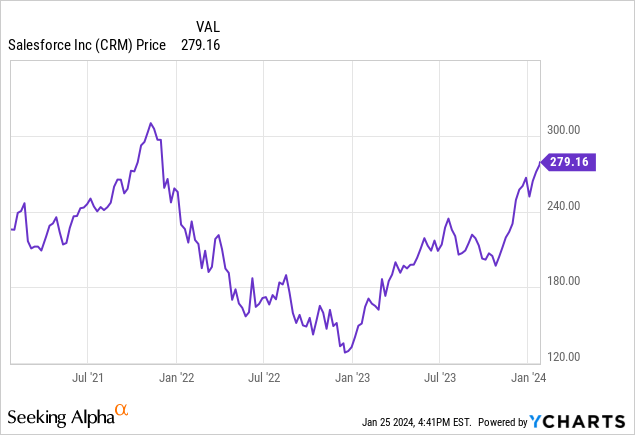

The stakeholder approach of Salesforce held up until early 2023 when a cluster of activist investors moved in on Salesforce and its “stakeholder capitalism” philosophy with threats and demands. The precipitating cause was the very large decline in Salesforce stock price in 2022. The chart below shows the 58% fall from $302 per share in December 2021 to $128 in January 2023. The decline was followed by a vigorous recovery now approaching the previous high. For the record I acquired a position on November 11, missing the absolute bottom but catching the bottom of the second leg up.

In March of 2023 the activist attacks reached their high point with Elliott Management (the Paul Singer led company which ousted the Twitter founder and outmaneuvered and outbid Warren Buffett for the former Texas Utilities asset then called Oncor). Elliott management went so far as to put together a slate of candidates for the Salesforce board of directors. There are a dozen or so good article clips that come up if you Google “Benioff on activist investors,” explaining here some of the context and here a defense of Salesforce and Benioff in Fortune.

An expanded list of hedge fund complaints, more or less in descending order of importance, would include the following:

- focusing on growth rather than profitability

- a general lack of control over spending

- too much spending on too many acquisitions

- need to reduce spending on sales and marketing

- need for a clear succession plan

- a political view too Woke for a business (perhaps limited to a conflict with former Strive hedge fund CEO Vivek Ramaswamy who spent much of the past year seeking the Republican nomination for President)

The investor day presentation cited above shows persuasively the operational side of Salesforce including Land and Expand (the concept of getting a foot in the door with a first sale, following up with success, and then selling and upselling more products) as well as the way customer loyalty improves with the number of clouds they use. To all evidence the operational side of Salesforce had been doing fine and CEO Benioff was in command of the details. The single most important issue of Elliott Management and several other prominent hedge funds – Dan Loeb’s Third Point, Jeff Smith’s Starboard Value, and Jeff Ubben’s Inclusion Capital among them – was dissatisfaction with profit margins.

The problem of low profit margins and high costs, with too many acquisitions and too many employees, were central to the complaints of the hedge fund activists. The one substantive and debatable issue all agreed with was investment for the future versus profits now. A dollar taken out of CAPEX was a dollar taken out of AI research. Of course that dollar goes directly into free cash flow and profits, the priorities of hedge funds and many shareholders.

With Elliott Management more or less serving as spokesperson, the hedge funds and Salesforce came to an understanding by the end of March 2023. Salesforce had already laid off 8000 employees in January, about 10% of its work force. This provided an early warning that even a company like Salesforce could not always function as one big happy family and never fire anybody. Benioff acknowledged that Salesforce had hired too many people during the pandemic years and had to take an action. By September it was clear that they had fired too many people and 3300 would be hired including a significant number who were hired back after the January lay off. Just two days ago as I write this Salesforce announced a further 700 layoffs, suggesting that Salesforce may not be finished with the project of becoming lean and fit.

The hastily put together layoffs and the equally hasty rehiring before having to lay off a second round have a little bit of the look of a CEO forced to act with a pistol pointed to his head. Meanwhile there was a major exit of executives including CEOs of recent acquisitions as their contract terms included no guarantees. Beneath the surface Salesforce had undergone an enormous change. Elliott and Salesforce signed a joint statement entitled “New Day” which emphasized value creation and “profitable growth (my italics).” Elliott’s potential board candidates stood down. The rest of 2023 was all about profitability and the margin improvement that comes immediately with cost cutting.

There has been no new dealmaking. The Slack acquisition made in July 2021 continues to look very expensive. At its acquisition price of $27.7 billion it still would be selling at 18 times sales. Growth increased revenue 40% over two and a half years. At the bottom of the market for Salesforce stock, one could argue that Slack at its purchase price was about 20% of Salesforce market cap. Now after the huge rally from the 2023 bottom the number is more like 10%. Even so, is it worth 10% of the value of Salesforce? It might be added that the Tableau acquisition at about half the cost of Slack ($15 billion) is not persuasively cheaper at 8 times revenues but perhaps earns its keep in its contribution to Einstein.

The Activist Hedge Fund Template

Hedge fund activists don’t generally act entirely without cause. Start with a company whose stock price has fallen more than 50%. Add in declining profit margins and a company culture which at least on the face of it had more bonhomie than discipline. The hedge fund formula is to load up on the stock while it is cheap, demand that profit margins be improved by severe cost cutting in all areas, watch the profitability lift the stock price and sell. This could not have been lost on CEO Benioff. The best thing he had going for him was that the leader, Elliott Management, seemed to be interested in actually fixing the core problems and getting the company back on the right track.

In the November Q3 report CEO Benioff forecast full year 2024 revenues (to be reported in February) at close to $35 billion. It will need to do a bit better than that to keep the annual rate increase added to the above revenue chart from dipping below 11%. It may well get enough of an increase to do it. Salesforce also retired long term debt and initiated a $1.9 billion share buyback to serve as a reward to patient shareholders (there being no dividend). Free cash flow per share, meanwhile, was forecast to exceed $15 per share in two years. Free cash flow, it should be pointed out, has been the one bottom line series in which annual increases have continued without interruption for a decade, a strong indicator of underlying strength.

Operating margins, Benioff was pleased to say, were up 30.5%, 1000 basis points as he prefers to put it – and headed toward 40% with a few years of discipline. CAPEX was a bit sluggish, down about a third as percentage of sales – a very important number. All the above numbers fit into the pattern from the Elliott/Salesforce New Day joint statement. The flip side of improved operating earnings and cash flow can be seen in the several expense areas from which increased profits were carved out. Here’s a simple table for 9 month YOY comparison as of Q3 2023:

| 2023 | 2022 | |

| Research and Development | 3532 | 3927 |

| Marketing and Sales | 9440 | 10441 |

| General and Administrative | 1902 | 1967 |

Those are huge numbers and the most interesting fact may be that they are similar across the board as if an edict came down saying cut X percentage of cost in your area. The question is, how much is too much? All three of the above categories have impact on results including the stagnant revenue growth number. The question as CEO Benioff well knows is finding the right number for the tradeoff between growth and profitability.

The SA Quant System Has Held Steady At Strong Buy

Salesforce holds one of the highest possible SA Quant numbers, 4.94 out of 5. This earns it the number 1 rank out of 191 Top Application Software Stocks (Industry) and 4 out of 549 Top Technology Stocks (Sector), with the three ranked ahead of it small caps. Of all 4561 stocks on Seeking Alpha it ranks #40, meaning that it was in the upper 1% in all groups.

Here are the Factor Grades:

| Now | 3M ago | 6M ago | |

|---|---|---|---|

| Valuation | D | C- | C- |

| Growth | B+ | B+ | B+ |

| Profitability | A+ | A+ | A+ |

| Momentum | A- | A- | A- |

| Revisions | B | B+ | B+ |

The Valuation grade is the inevitable inverse of persistently rising prices. I had wondered if the 26% increase I enjoyed from November 11 to the present would pull down the overall Strong Buy rating. It may in the future, but it hasn’t so far as the system sometimes accepts a D grade for Valuation when other Factors are very strong. The powerful Factors are of course Growth and Profitability, the latter the strongest for Salesforce. The Sector and Industry reinforce the overall Strong Buy rating as Salesforce ranks at the top in technology and one specific part of it with expectations of long term growth.

The Growth Factor was pulled down to the B+ rating as Revenue growth fell by 50% from the 5-year average. Earnings growth around 25% both for the present year and for the forward 5 year CAGR was not enough to cancel out the revenue decline. These figures were included in the above section as most numbers in that section were lifted or derived from Growth and Profitability Factors. The 75% Gross Profit Margin for both the present year and the 5-year average clearly held Profitability to the A+ rank.

Conclusion

The activist attack of early 2023 put CEO Benioff in an awkward position. The basic agreement with Elliott Management made good sense in broad outline, but Benioff needed to both execute and appear to execute – and do so quickly. Fingerprints of the New Day Joint Statement are all over the past year’s results but will likely need to be tweaked at the very least. As Benioff said, Salesforce had overhired during the pandemic and had to rightsize itself, first with layoffs and then with rehires, and now again a tweak with layoffs. Going more slowly on acquisitions made sense and some reduction of expenditures on sales and marketing (see this SA note) clearly made sense. One thing Salesforce must remember is that cutting costs to the bone is a one-time solution. It can be over-done, and it does nothing for growth of revenues.

Summing it up, the events of early 2023 precipitated by the hedge fund activists stem from two different narratives. The long held view of Salesforce from the inside made for a freewheeling approach which got the important things right, seized leadership in an important area, and left a few of the details to take care of themselves. The hedge fund view was that the profit margins and discipline about expenditures and deal making were more than details. Were the two views compatible? In the short run, on reported results, they were compatible enough.

One shouldn’t make too much of this report from SA News that on January 24 CEO Benioff sold a pre-planned $4.2 million of Salesforce stock. That’s walking around money for Benioff and reflects the need of executives whose assets are all in one company (like the kid who consulted with me almost two decades ago) and need to diversify. The Bloomberg Billionaires Index has Benioff at $9.9 billion so that a $4.2 million stock sale is less than one half of 1% – nothing for his fellow shareholders to be worried about.

In the longer run it remains to be seen whether Salesforce can graduate into corporate middle age with better attention to profit margins and cost control without losing its energy and creativity. Putting together the primary goals of its hedge fund critics who are driven by the conventional money-making goals and the creative long term view of current management can be a wedding made in heaven or in hell. The most positive bit of evidence so far is that CEO Benioff appears to have taken the task seriously as indicated by the numbers he forecasts looking forward a couple of years. If Salesforce hits its longer term goals for margins – an ultimate bump up from 35% to 40% – and manages to have strong sales even with a tight budget, Salesforce is likely to enjoy a future with solid growth and rewards for shareholders. Summing it up, he hedge fund activists probably did Benioff a favor.

Am I likely to sell the position I picked up on November 11, 2023? Absolutely not. If anything I may add as the price corrects and/or favorable new developments tilt the scales in a positive direction. Salesforce is the sort of stock which can start as a moderate position in your portfolio and grow into one of your largest holdings. There were unquestionable problems with Salesforce which led CEO Benioff to be surrounded by activists but with patience and a little touch those problems can be solved in a way that holds up for long term growth. Few companies have the Total Addressable Market ahead of them that Salesforce enjoys or the well thought out operational principles such as Land and Expand with current customers (get a foot in the door, do well, sell more and upsell). Few other companies have the grasp of predictive AI that Salesforce enjoys along with a business model designed to make use of it. Salesforce still appears to have a long runway for profitable growth (with revenues only 11.7% of TAM) and a future more assured than most tech companies.

The Q3 interim report on November 29, 2023, included a per share quarterly earnings number of $2.11 which had doubled YOY cutting the forward PE ratio in half to about 35. That’s extraordinarily cheap for a company growing as fast and consistently as Salesforce, and one can be reasonably confident that the earnings numbers YOY and FWD will continue to creep up with each future report causing the PE to creep down. I’m confident that Salesforce will blow through its previous $302 high without difficulty and now supported by much better numbers than in late 2021 will have space to rally further. My next objective is $500. I’m comfortable with the SA Quant System in its rating of Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.