Summary:

- CRM is an undisputed leader in the industry which is expected to observe almost a 13% CAGR over the next seven years.

- CRM’s strategy is to invest heavy in innovation and improving its value proposition, which highly likely will help in protecting its dominant market share.

- Capital allocation is exceptional as CRM’s balance sheet is clean even after several multi-billion acquisitions in the last five years.

- The current share price is a gift as it’s rare to find a stock with a clean balance sheet and dominance in a thriving industry at a 22% discount.

jetcityimage

My thesis

Salesforce’s ticker (NYSE:CRM) looks very cool as it is also an acronym for the whole industry where the company operates: customer relationship management. Having the whole market’s acronym as its ticker is deserved because CRM is an undisputed champion in its industry. CRM’s strategic approach is a heavy focus of growth and innovation which allowed it to build an ecosystem of software applications vital for any business. The company is recognized as one of the most innovative companies in the world, which ensures its stellar profitability and a “moat”. The industry is growing and CRM’s dominance in it gives it a pole position to generate more value for its investors. The valuation is extremely attractive with a 22% discount to the intrinsic value, which makes CRM a Strong Buy.

CRM stock analysis

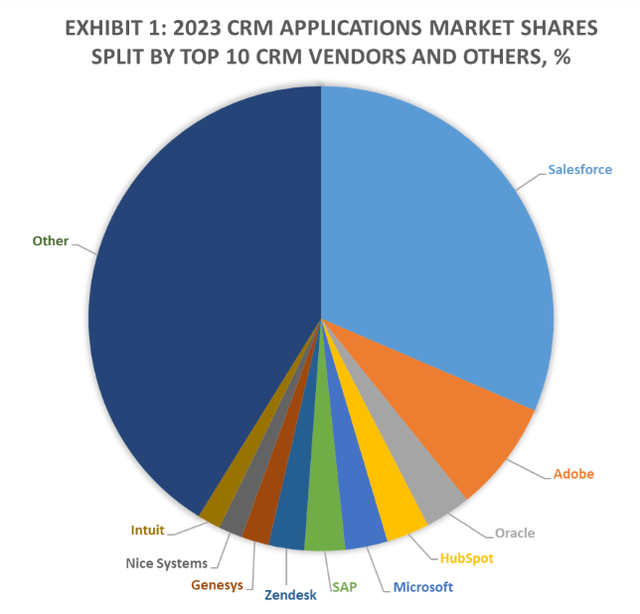

Salesforce is an undisputed leader in the customer relationship management applications market. According to appsruntheworld.com, CRM’s market share is unparalleled and much larger compared to the company’s closest rivals. The most important part is that CRM dominates in a growing industry, which is expected to observe a 12.9% CAGR between 2024 and 2031.

CRM’s value proposition is unique because it offers a comprehensive suite of applications which help businesses to streamline such vital operations as sales, marketing, customer service, customer support, document workflows, and analytics. Building such an ecosystem of offerings is a challenging task and CRM did it with internal investments in R&D as well as with the help of acquisitions.

Investor Day 2022 (latest available)

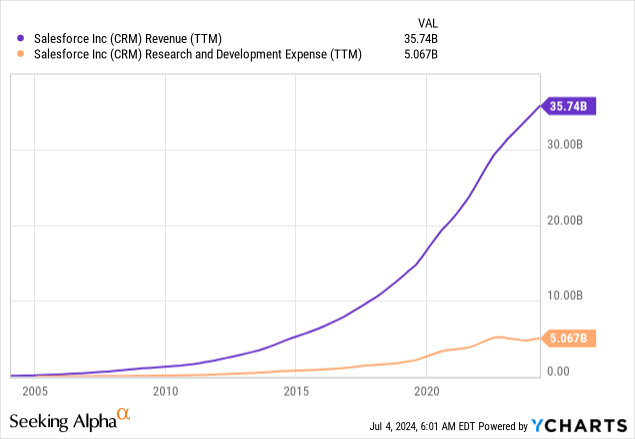

For example, in 2018 Salesforce acquired MuleSoft in a $6.5 billion deal. In 2019 CRM acquired Tableau for $15.7 billion in one of the largest deals in the company’s history. Another massive acquisition took place in 2020 when the company acquired Slack in a $27.7 billion deal. I think that financial performance of CRM over the last five years is the best evidence indicating that these acquisitions were quite successful. Despite the inherently risky nature of growth through acquisitions, it looks like CRM’s top managers are masters in M&A.

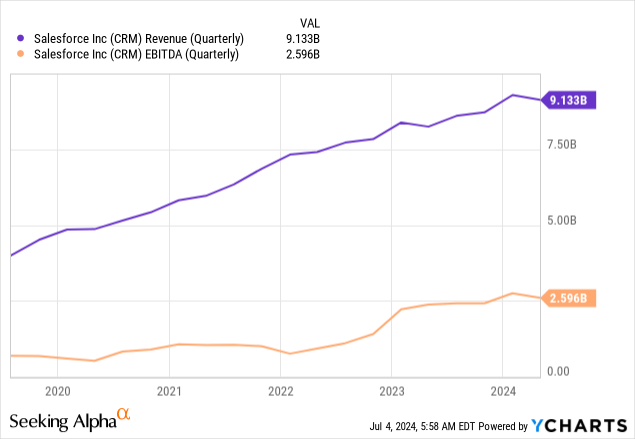

CRM also does not forget about generating innovation internally. The R&D spending is increasing together with revenue growth, and the TTM spending on R&D surpassed $5 billion in recent quarters. According to Forbes, Salesforce.com is the most innovative company in the world. Fortune’s list of America’s most innovative companies says that CRM is the fifth most innovative company, which is also a high spot.

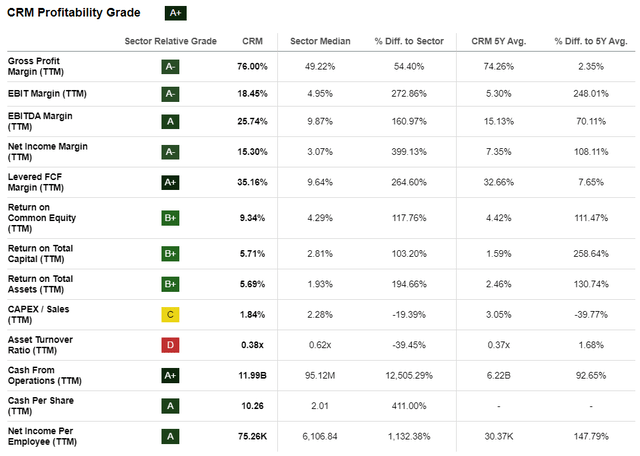

Constant dedication to differentiate through innovation allowed CRM to build a suite, or an ecosystem of cutting-edge services. Delivering unique value proposition to its customers allows CRM to charge premium prices for its services. As a result, CRM boasts stellar profitability, much higher compared to the industry.

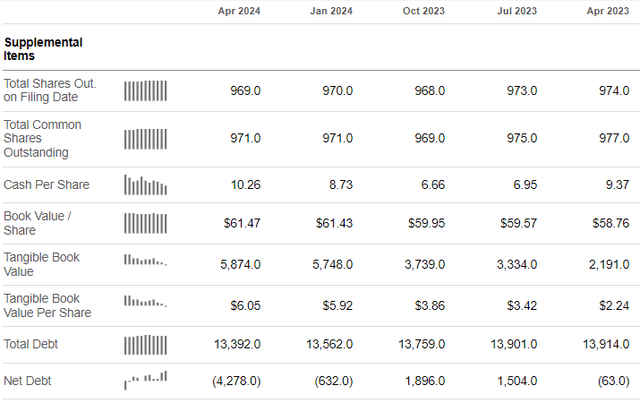

In the earlier part of my analysis, I underlined that CRM invests a lot in innovation and acquisitions. The management is strong in allocating financial resources as it not only invests in innovation, but also spends billions on stock buybacks and pays dividends. However, the dividend yield is very low and below 1%. CRM’s balance sheet remains very strong after its massive investments, buybacks, and dividends. Leverage is low and cash balance is impressive. The fascinating fact here is that the balance sheet is clean even after several massive acquisitions in the last five years.

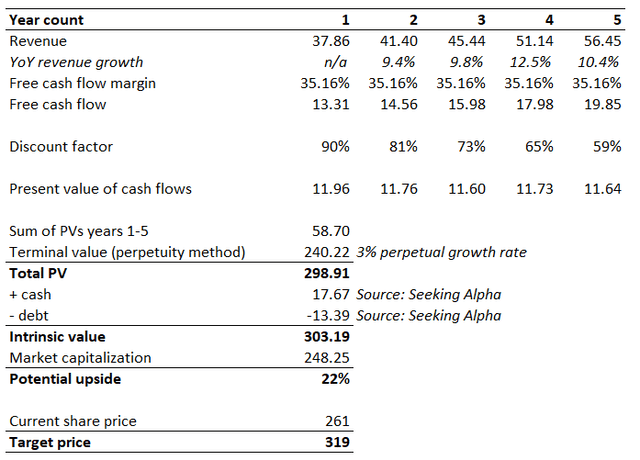

Intrinsic value calculation

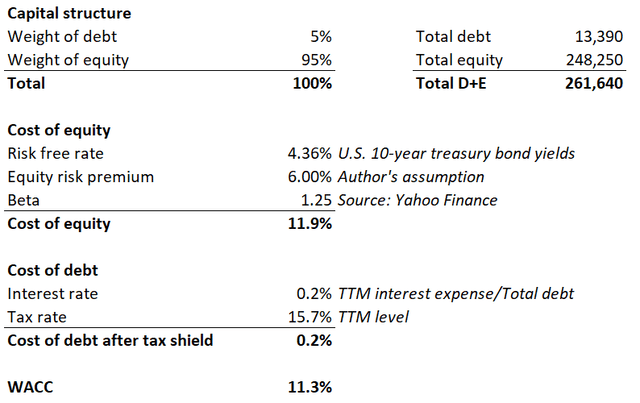

Discount rate is a vital assumption for the discounted cash flow (DCF) model. Therefore, I start with calculating the weighted average cost of capital (WACC) using the capital-asset pricing model (CAPM). Below working outlines my WACC calculations. CRM’s WACC is 11.3%.

Consensus estimates appear conservative as they observe a low double-digit revenue CAGR for the next five years. A 35.16% TTM levered FCF margin is already aggressive, and projecting expansion might be an overestimation. Therefore, I expect this FCF margin level to be stable. The perpetual growth rate is also very conservative at 3%.

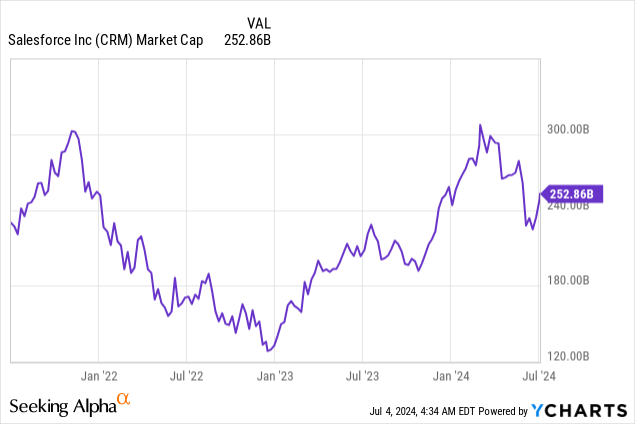

The net effect of Adding cash and deducting total debt does not significantly affect CRM’s $303 billion intrinsic value. This amount is 22% higher than CRM’s market capitalization, which means there is a compelling potential upside. I think that the valuation is extremely attractive for a leading and innovative company like CRM. With a 22% potential upside, the target price recommended by DT Invest is $319.

What can go wrong with my thesis?

CRM’s market cap was close to its $300 billion intrinsic value just a few months ago. However, there was a big selloff from investors after below-than-expected revenue in the latest fiscal quarter. The market’s disappointment was very strong and resulted in a 20% one-day share price dip. Thus, in case CRM delivers disappointing quarterly performance on August 21 there might be another wave of investors running into safer stocks.

CRM stores a lot of sensitive information of its customers, which increases risks of data breaches. Any leakage of sensitive information can damage the company’s reputation, and even lead to legal disputes with customers. As cybercrimes become more sophisticated every year, it means that CRM’s cybersecurity systems and vendors must develop and evolve constantly.

Despite CRM is an undisputed leader in the industry, the competition looks quite dangerous. on the pie chart shared in the core part of my analysis it is shown that competitors include prominent companies like Adobe (ADBE), Oracle (ORCL), Microsoft (MSFT), and European giant SAP (SAP).

Summary

CRM dominates a growing industry and its strategy of heavy reliance on innovation and differentiation will likely help it preserve its leadership. Capital allocation is exceptional as the balance sheet is clean even after several multi-billion acquisitions of the last five years. A 22% discount to CRM’s intrinsic value for the company that dominates in its industry is nothing but a gift.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.