Summary:

- Salesforce’s Q2 FY2025 report revealed an era of transformation and strategic urgency – especially when it comes to AI and efficiency.

- CRM’s non-GAAP operating income increased 15.5% to $3.14 billion, and its non-GAAP operating margin increased 210 basis points to 33.7%.

- The company’s strategic moves, including acquisitions and organic development of internal products, indicate that Salesforce is well-prepared to compete with any rival.

- Salesforce is now more attractively valued than ever when looking at its key valuation multiples. CRM’s fair value today would be $337.80/share, suggesting a potential growth opportunity of about 16%.

- I decided to maintain my “Buy” rating today.

John M. Chase

Intro & Thesis

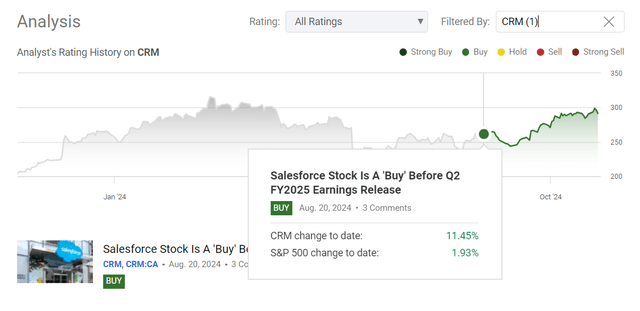

I initiated coverage of Salesforce, Inc. (NYSE:CRM) in August 2024 with a ‘Buy’ recommendation on the stock before it reports for its fiscal Q2 FY2025. At the time, I assumed that despite some obvious challenges, CRM’s strategic acquisitions and AI technology developments could drive growth and help the firm exceed market expectations. As history has shown, my bullish call was correct and CRM outperformed the broad market significantly for this short period of time:

Seeking Alpha, my coverage of CRM Seeking Alpha, CRM, notes added

After the fiscal Q2 report, I was only reinforced in my thesis. Moreover, despite the recent growth, I believe that CRM stock has only become cheaper, no matter what skeptics say, while the tailwind for further business expansion has not diminished. In this regard, I am reiterating my “Buy” rating today.

Why Do I Think So?

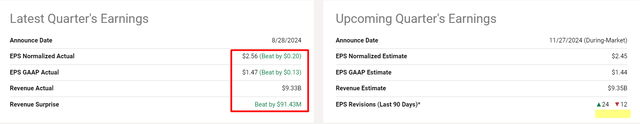

From what I see, Salesforce’s Q2 FY2025 report revealed an era of transformation and strategic urgency – especially when it comes to AI and efficiency. CRM generated ~$9.33 billion in revenue – up 8% YoY or 9% YoY in constant currency, beating the consensus expectations. This top-line growth, while a little less than the 11% that we saw last year, was fueled by strong performances across the Service Cloud and multi-cloud deals, accounting for almost 80% of new business. The Service Cloud had a 10% YoY growth and Marketing and Commerce 6% YoY growth. I think this discrepancy reflects Salesforce’s continued move toward AI and data solutions, which are becoming increasingly the core of its business model, which I find beneficial in the longer term.

The company’s remaining performance obligation (RPO), which represents future revenues, rose 15% to $53.5 billion and the current RPO ((cRPO)) climbed by 10% to $26.5 billion – this expansion is slower than previous quarters due to the wider macroeconomic conditions and dovish customer behavior, but in spite of that, CRM’s continued focus on multi-cloud solutions and AI-powered innovations have kept sales pipeline healthy.

I also like the firm’s cost control during the quarter. The non-GAAP operating income increased 15.5% to $3.14 billion and its non-GAAP operating margin increased 210 basis points to 33.7%. As the executives explained during the earnings call, this growth is due to “continued reorganization efforts and a sharp focus on cost management as part of a broad industry shift toward profitability in the face of declining revenues.” So as a result, the company’s non-GAAP diluted EPS rose 21% YoY to $2.56, also beating the consensus figure – a further testament to its sound financial control, in my view.

One of the most prominent announcements of the second quarter was the release of Agentforce, a platform for creating customizable generative AI agents. This platform was scheduled to be generally available in October this year and would represent an enormous advancement in Salesforce’s AI capabilities, as per management’s commentary. I think with Salesforce’s extensive data cloud and AI platforms, Agentforce should enable customers to automate and enhance their experiences across various verticals, bringing more growth to CRM’s RPO. The promise of the platform was evident in their pilot programs with Wiley and OpenTable, which saw increases in both customer satisfaction and operational efficiency. Wiley, for example, increased case resolution by 50%, and OpenTable was able to scale customer service more efficiently.

Salesforce AI not only brings in innovation but also a strategic business imperative: The firm has found that many of its customers face difficulties attempting DIY AI solutions, which tend to yield suboptimal results. With its fully integrated AI platform, CRM aims to offer high-performance AI without the need for advanced model training to its customers. It will likely result in high productivity enhancements and business efficiency improvements for Salesforce’s clients and could make the firm the dominant AI-powered enterprise software provider.

Based on what I see in sell-side analysts’ notes (Argus Research and Morningstar Premium, proprietary sources), they generally have a favorable outlook for Salesforce, particularly given its aggressive AI and data-driven approach. The company’s deep enterprise customer base and high-tech leadership are perceived as the company’s strong points, enabling it to take a significant portion of the burgeoning AI market. However, there are worries about AI disruption and competition, with competitors such as ServiceNow (NOW) also exploring generative AI.

I think Salesforce’s primary commercial strength is its integrated CRM platform which integrates multiple offerings such as sales, service, marketing, and commerce in 1 place. This hybrid approach gives clients a 360-degree customer experience, creating highly individualized and intelligent customer experiences. Also, its industry-specific offerings and the company’s ability to harness its deep data cloud are also considered competitive advantages.

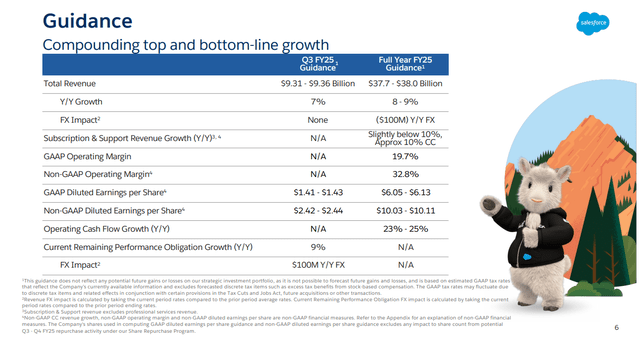

They were indeed struggling to sustain growth in the face of macro uncertainty and evolving customer needs: Deal cycles are extending, and spending is more closely monitored than ever before, especially in Salesforce’s biggest end market (the United States). But Salesforce’s management still forecasts a solid FY2025 revenue growth of 8-9% (higher than before) and a non-GAAP operating margin of 32.8%, a 230 basis point improvement from FY2024. The company also expects a 22.5% increase in non-GAAP EPS thanks to the strategic investments in AI and data cloud technology:

The company’s outlook predicts that the total available market (TAM) will grow at 13% CAGR to $290 billion by 2026. Since CRM is focusing on large customers as its key growth channel, leveraging a land-and-expand approach should help it generate incremental revenues from its installed base, in my opinion. Also, Salesforce’s partnerships and acquisitions, including with MuleSoft, Tableau, and Slack, should help fuel this expansion by growing its platform and global footprint.

Coming back to CRM’s financials, I’d like to note its great financial strength and strong cash flow generation capacity. As of Q2 data, the company possessed ~$12.6 billion in cash and convertible securities, which gave CRM great latitude for strategic investments and acquisitions. They held ~$8.4 billion in long-term debt while having a debt rating of ‘A+/Stable’ according to S&P, representing a solid and investment-grade profile.

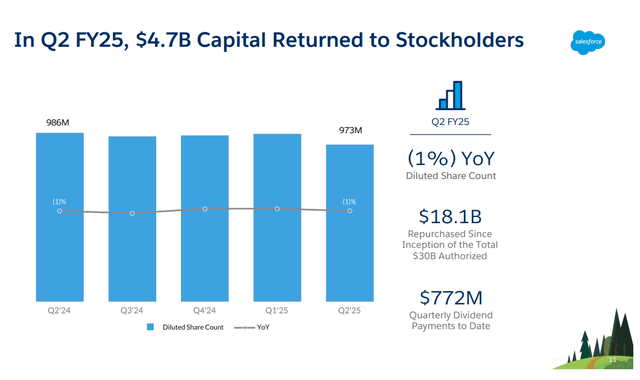

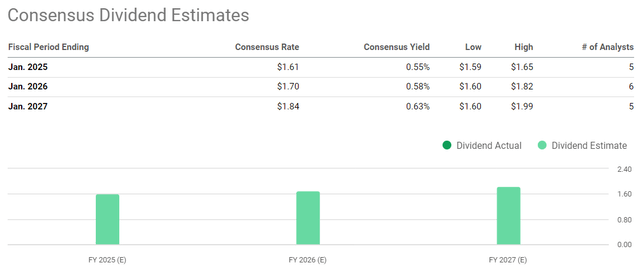

Salesforce’s free cash flow demonstrates its capability to create significant cash post-capital expenditures with $755 million FCF for Q2 FY2025, which is up 20% year-over-year. The firm has also been returning capital through share buybacks and dividends, with $4.3 billion in share buybacks and nearly $400 million in dividends paid in the quarter.

Salesforce began paying its first quarterly cash dividend ($0.40 per share) in February, and Wall Street consensus forecasts a dividend of $1.61 for FY2025 as a whole and $1.70 for FY2026:

Seeking Alpha, CRM’s dividend estimates

So when adding to the above small dividend yield of 0.55% the part of buybacks, we get a total shareholder’s return of about 4%, according to my calculations – that’s a great yield for a growth stock, in my opinion, which may speak of existing undervaluation.

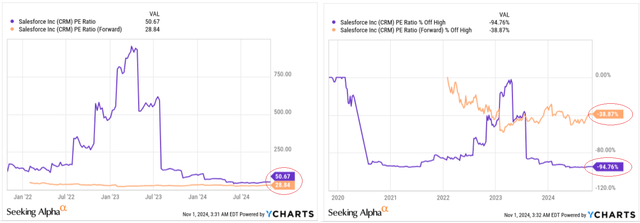

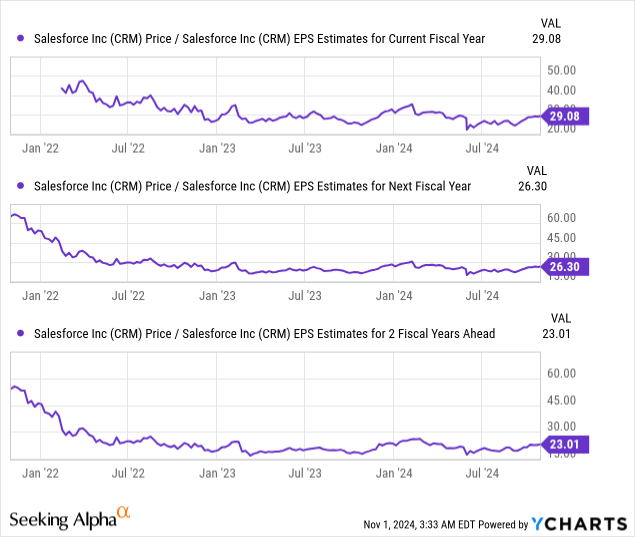

Since I touched upon CRM’s valuation, let me show you that the stock is now actually the cheapest it’s ever been: The forwarding P/E of now 28.8x, according to YCharts data, has managed to fall off its peak by almost 39% (since 2022). So the multiple contraction takes place amid rising margins and absolute EPS figures.

In addition, we see that the multiple contraction process is projected to keep going well into calendar 2025 and 2026, with P/E eventually reaching 23x:

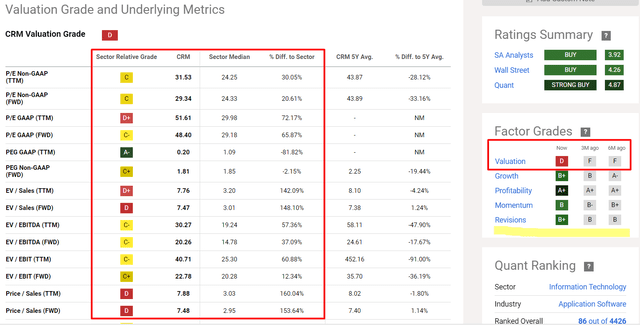

According to Seeking Alpha data, Salesforce’s key valuation multiples are still trading at substantial premiums, but on the other hand, compared to 3 months ago, the stock’s valuation has become significantly more attractive. Meanwhile, analysts’ earnings forecasts for Salesforce have only improved:

Seeking Alpha, CRM’s Valuation grade, notes added

I believe that if the company exceeds current EPS forecasts by ~5% for the fiscal FY2026 and the stock continues to trade at its current P/E multiple, its fair value today would be $337.80/share. This suggests a potential growth opportunity of about 16%.

So based on all of the above, I decided to reiterate my “Buy” rating after CRM’s Q2 earnings.

Where Can I Be Wrong?

The risk factors I noted last time didn’t go anywhere. While I’m quite confident about the future of Salesforce, there are a few things that could make my bullish stance wrong.

First of all, as I briefly mentioned above, the end market where CRM operates seems to be highly competitive and dynamically evolving. So Salesforce has to constantly innovate its products as it faces stiff competition not just from ServiceNow, but also from companies like Amazon’s (AMZN) AWS, SAP, Oracle (ORCL), Microsoft’s (MSFT) Azure, IBM (IBM), and some smaller, sometimes more agile competitors.

Another problem I see is Salesforce’s high valuation, which reflects the company’s success as a growth company, but also makes it vulnerable to market changes. In my above calculations, I assumed that the current multiple may hold if the firm keeps beating projections. But as the CRM stock still trades at relatively high multiples, even a small financial underperformance can lead to a significant drop in the market cap. So my calculations of its fair value may be out of touch with reality.

Also, data privacy is now of great importance to both Salesforce’s reputation and customer confidence – releasing customer data without consent poses a significant risk to the company’s image and requires stricter privacy policies in America or even abroad.

The Bottom Line

Despite the risks I described above, I can say with confidence that the results for the second quarter of fiscal 2025, which the company presented at the end of August, have strengthened my conviction that my initial bullish rating was correct. It is not just a matter of having predicted the behavior of the stock; the stock’s appreciation over the last quarter has a solid fundamental basis. The end market in which Salesforce operates offers numerous opportunities despite its competitiveness. The company’s strategic moves, including acquisitions and organic development of internal products, indicate that Salesforce is well-prepared to compete with any rival. Furthermore, in my observation, the company is now more attractively valued than ever when looking at its key valuation multiples. Growth has slowed somewhat, but margins continue to increase and management is confident that this trend will continue. I have therefore decided to maintain my “Buy” rating today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CRM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!